I honestly don't remember the last time oil and energy stocks rallied this consistently for this long. Now keep in mind that it has only been rallying since mid-March, so I may be a tad bit dramatic on that, but nonetheless, the latest rally feels almost surreal.

The sad part, however, is that WTI and Brent are likely at the top end of the rangebound price action we see. There are a few key reasons as to why we believe this, but the most important one is the weakness in refining margins we are seeing across the globe. The most important one is Asia where Singapore refining margins are close to hitting the 5-year average.

For readers aware of our oil market analysis, we are very straightforward when it comes to the oil market. For 2024, we believe refining margins are the leading indicators for flat crude prices. If refining margins are up + higher backwardation in crude, this implies that the rally will continue. This cycle will continue until 1) refining margins peak and 2) crude timespreads peak. At this point, we will know where the "top" of the range is. Crude will consolidate around this level or pull back until the signals reverse. This cycle will rinse and repeat this year until we are at a structurally higher price range.

Our view is that WTI can average between $85 to $95 this year. Our WTI average price scenario is $87.50 and reflected in our E&P valuation sheets.

So like all processes, our signals are showing that the oil market is peaking in the near term. The market is finding out just where the peak of the range is, so now it needs to find the bottom.

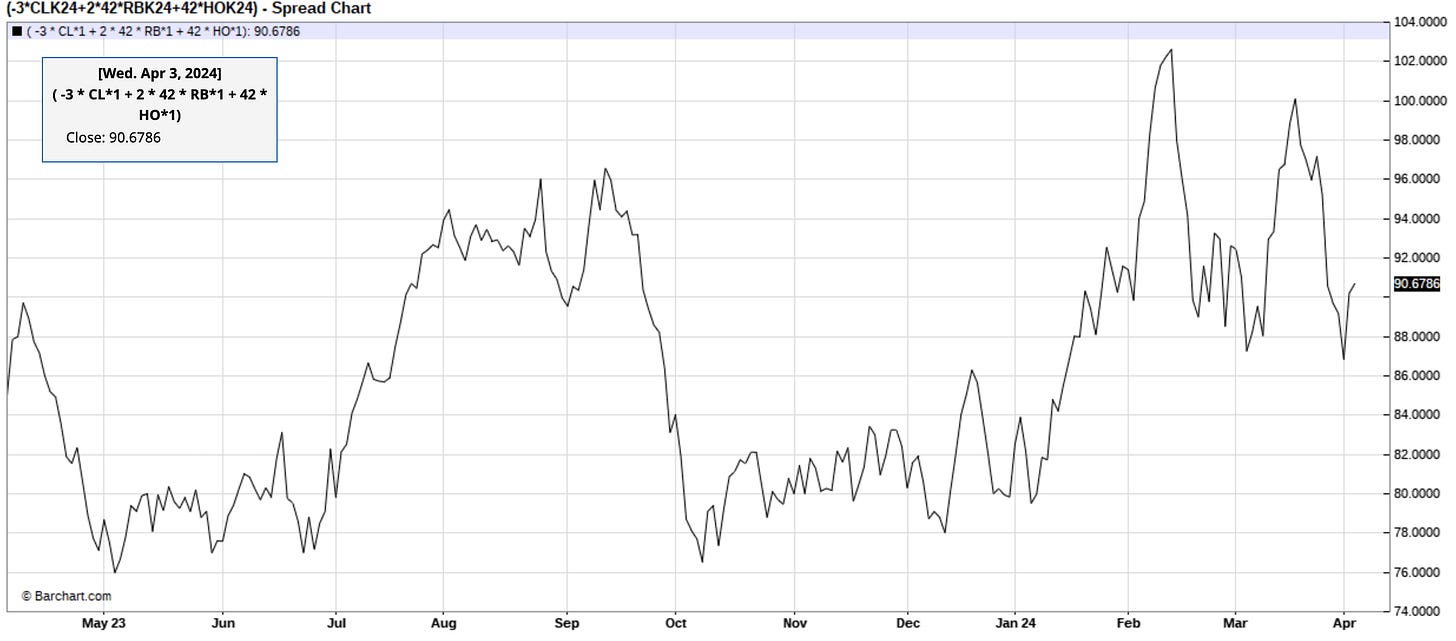

Crack Spreads

Note: Please divide the figure above by 3 to arrive at the 3-2-1 crack spread. Here is the link to track it for yourself.

Timespreads

Now it's not all doom and gloom. We are not expecting a drop back into the $60s, so let's take a step back and think through what's going to happen now.