Like clockwork, oil prices are down again on Friday. Shorting oil on Thursday's close seems to have been a rather profitable strategy for the past few months. I, for one, am getting very tired of this. Oil inventory reports in real-time continue to trend bullish, and even the physical oil market is starting to heal. Yet, oil prices continue to trend lower. Frustration is aplenty, when will this all change?

Inventory

EIA's oil storage report was bullish yesterday, and bullish developments were seen in product storage.

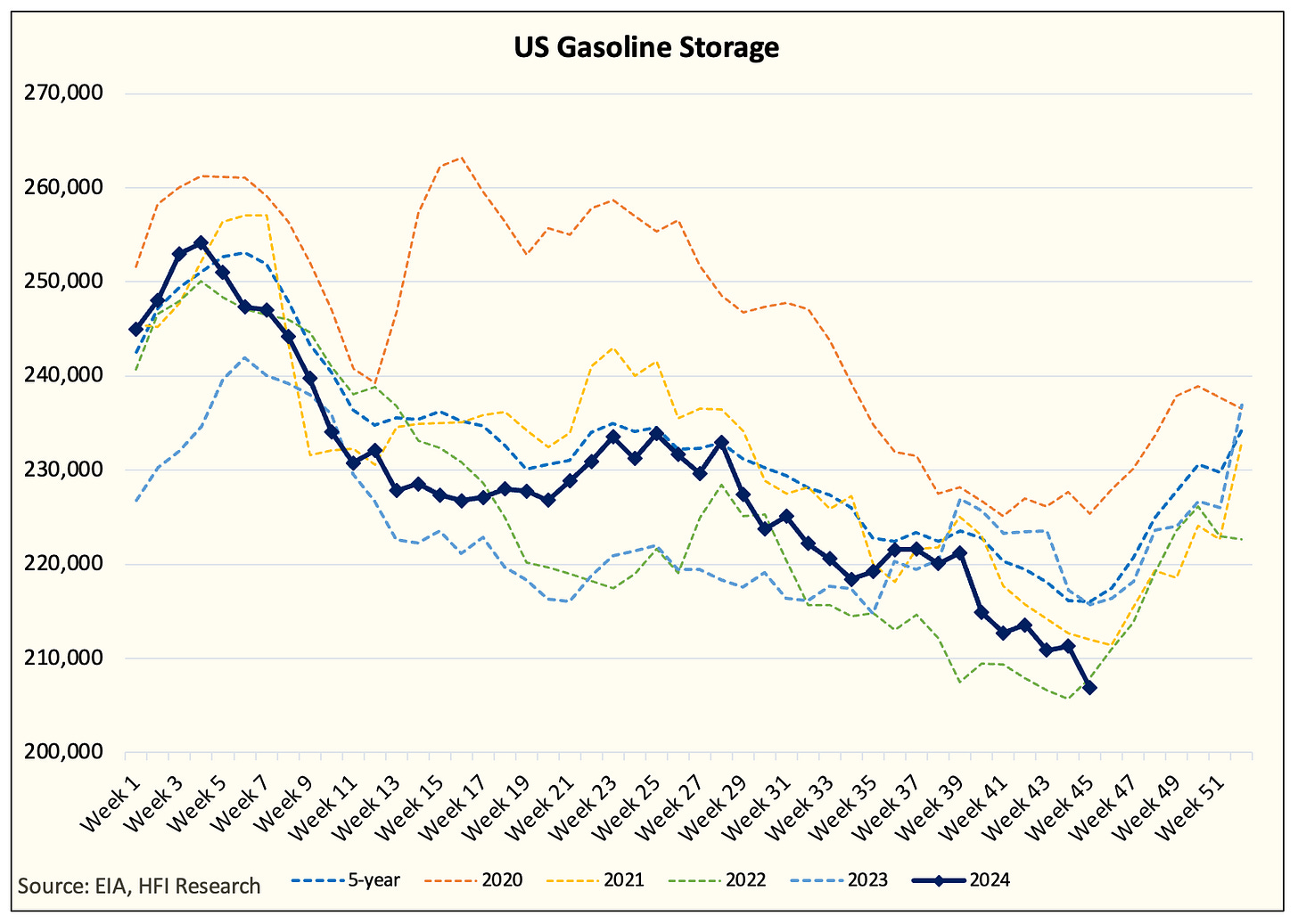

Despite US refinery throughput hitting ~16.509 million b/d, US gasoline storage is at a new low for this time of the year. The bullish counterseasonal draw has prompted refining margins to start moving higher.

In addition, total liquids continue to trend lower and counter to what the IEA's balance forecasts (no inventory draw).

What's particularly interesting about the trend I'm seeing in total liquids is that this is one of the steeper inventory draws we've seen since 2022. Throughout 2023, US total liquids stopped decreasing in H2 2023.