One Big Trade

All eyes on China

Since the Chinese stimulus announcements, the global market is best characterized as one big trade. On Sept 30 when we published our WCTW, "This Feels Pretty Serious." I laid out the 3 key signals that we need to watch moving forward. They are:

Fiscal transfers to households.

Lifting property prices.

Improve private business sentiment.

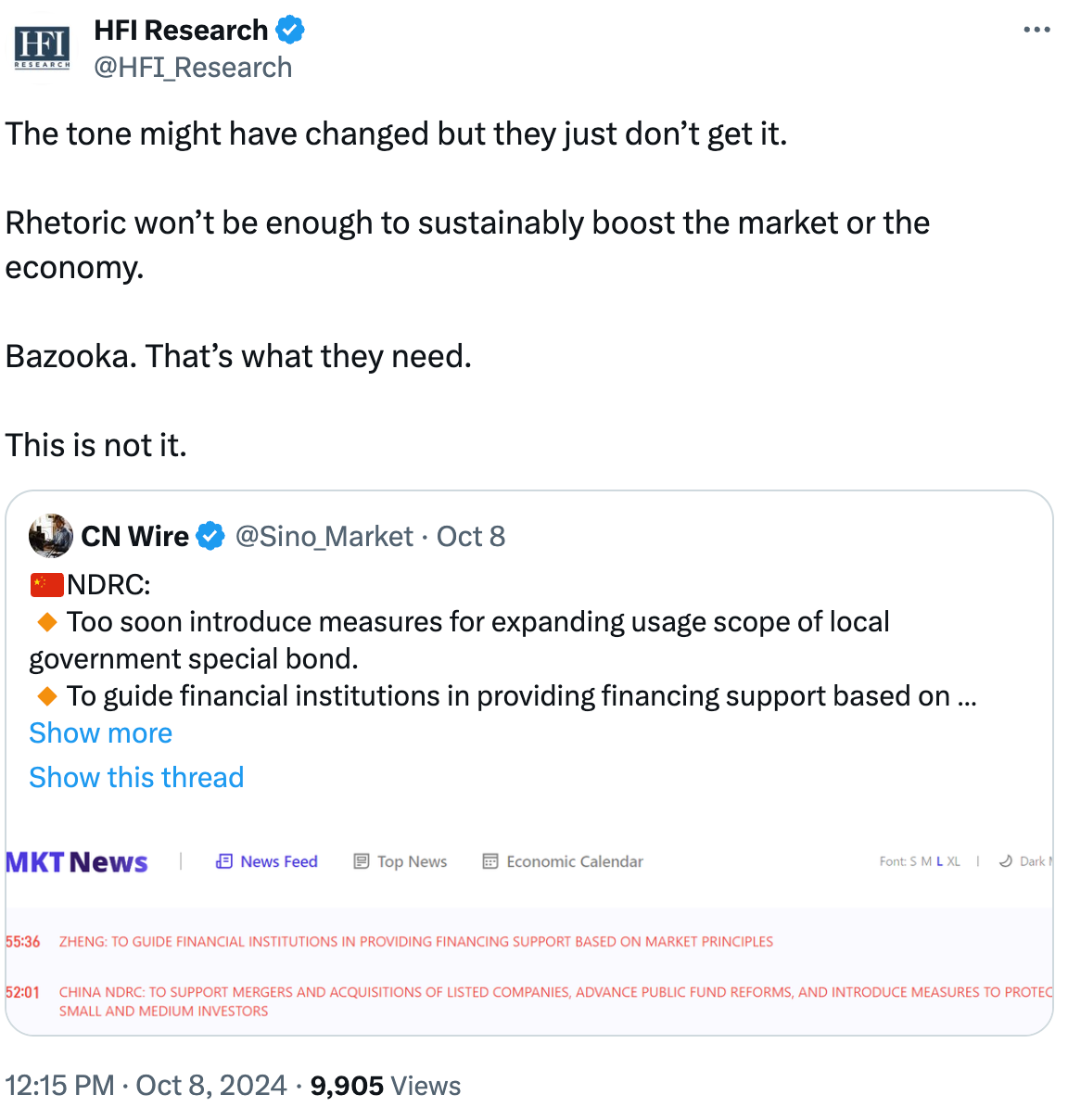

Just this week, the announcement on Tuesday following a week-long holiday in China was nothing but disappointment. And as I said in my tweet immediately following the release, they just don't understand the magnitude of what it takes.

This is it for China. If policymakers don't understand the seriousness of the situation, then a 2nd chance might require even more stimulus than the opportunity today.

And for global markets, what China does next has very important ramifications for how certain sectors perform (value vs growth), how commodities perform, and how currency markets will react. If China enacts serious fiscal stimulus, then there will also be ramifications on inflation expectations for the world and what the Federal Reserve has to do to respond to that.

It's one big trade now, and whether you like it or not, China's next policy decision will have rippling effects across global economies.