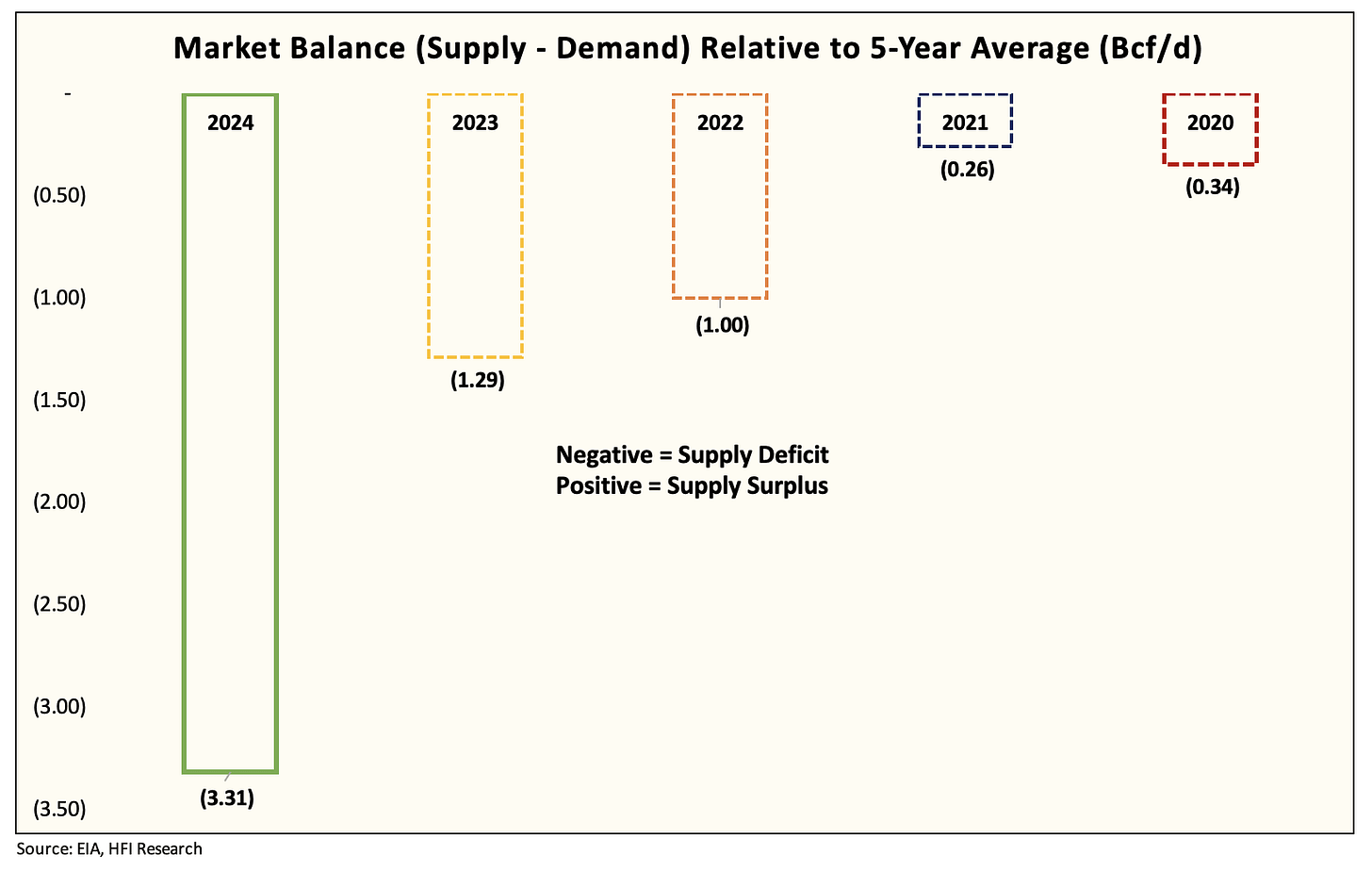

As we go into the heart of the summer cooling demand season, this is undoubtedly one of the tighter natural gas markets we've seen in years.

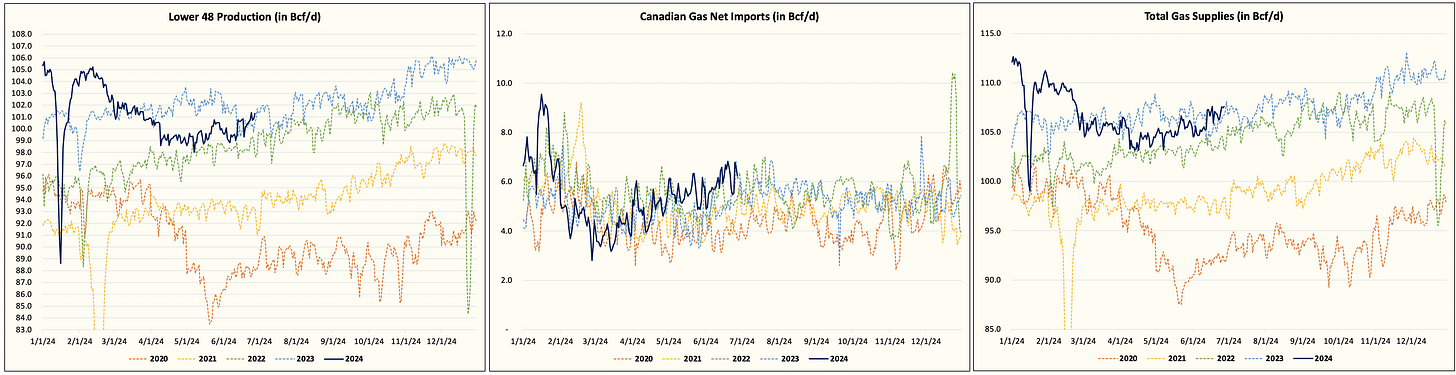

On a forward-looking basis, we see this year's gas balances being ~3.31 Bcf/d to the deficit. This is largely fueled by:

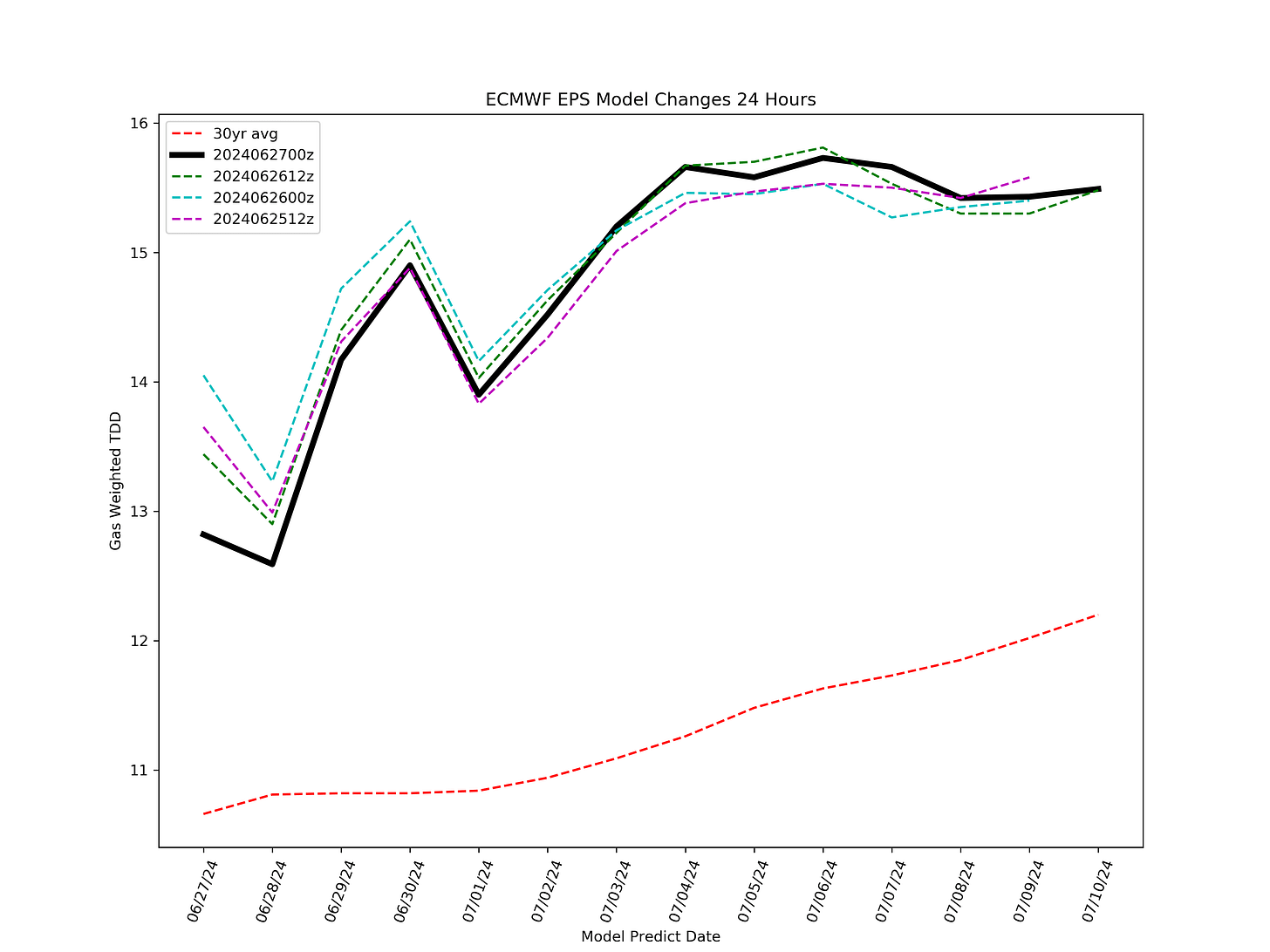

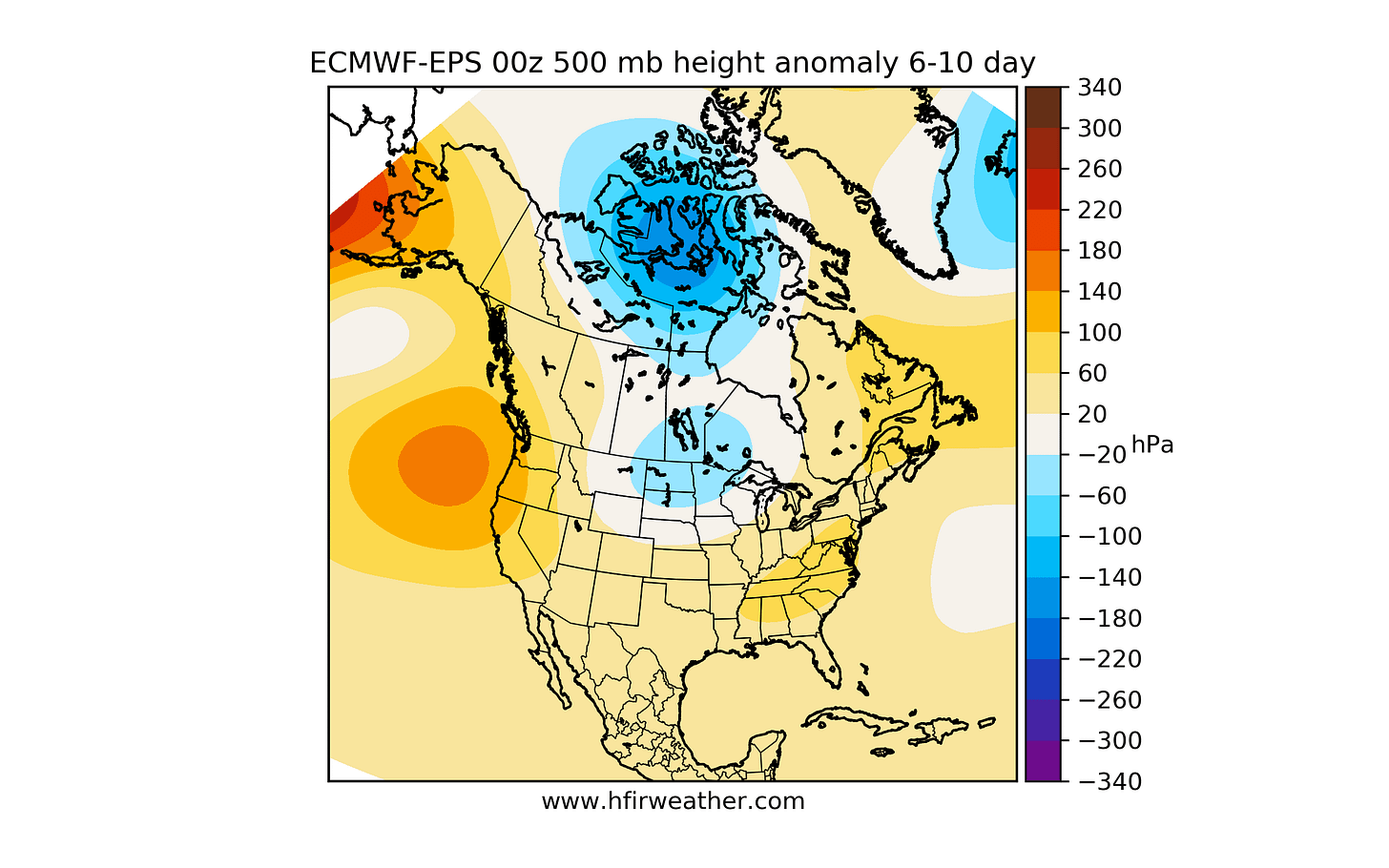

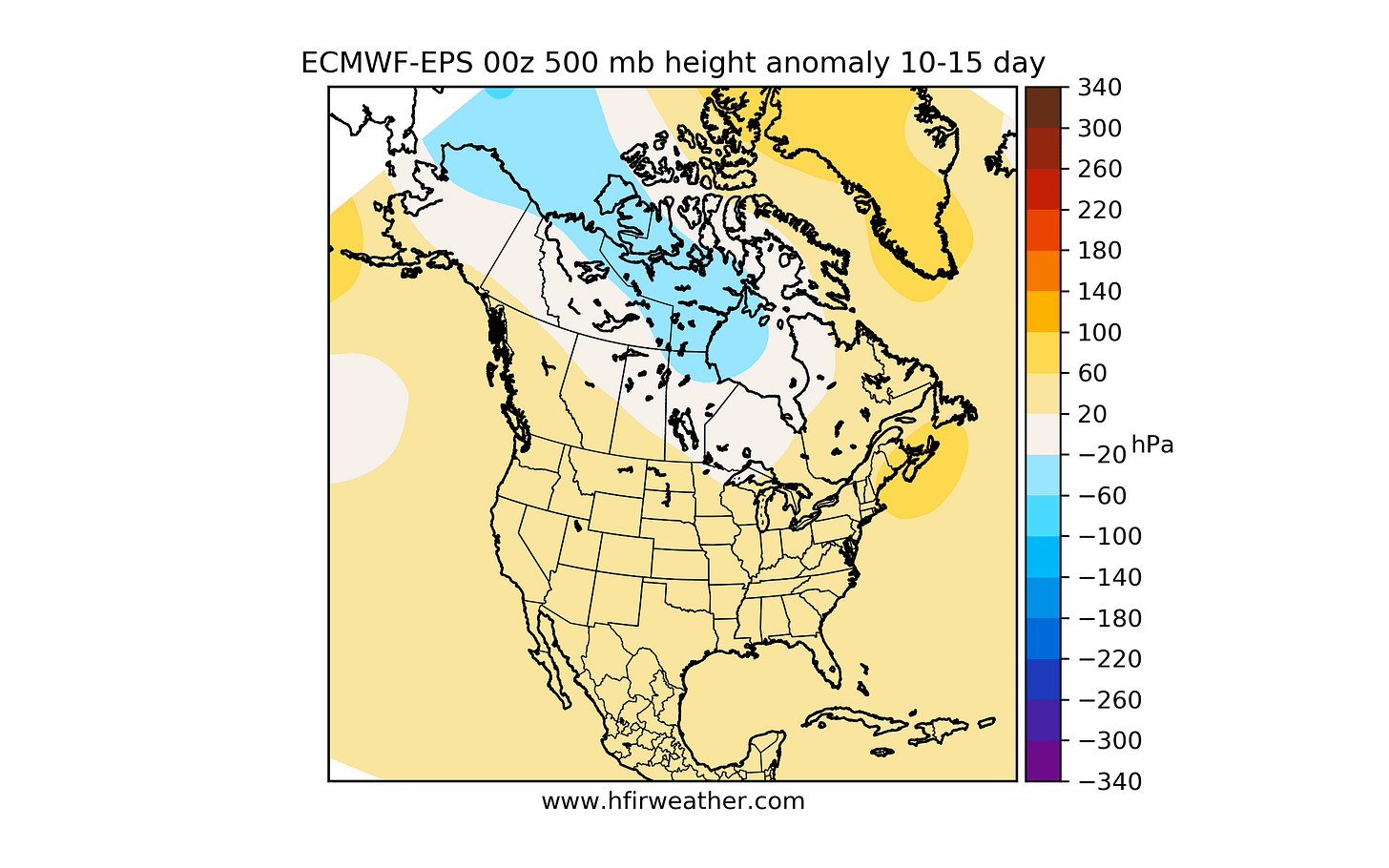

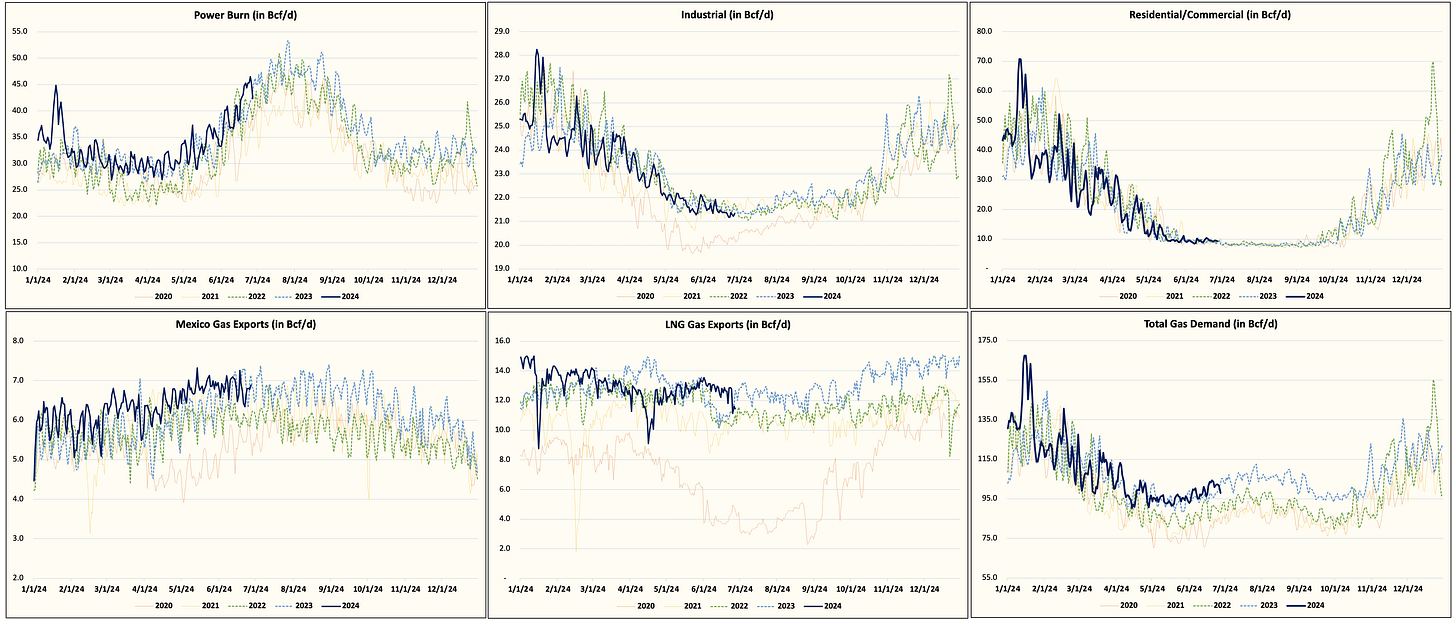

Warmer than normal weather.

6-10 Day

10-15 Day

Lower natural gas production level vs the start of the year.

An all-time high (incoming) power burn demand.

These three variables will go a long way in eliminating a significant portion of the surplus we are seeing in natural gas storage.

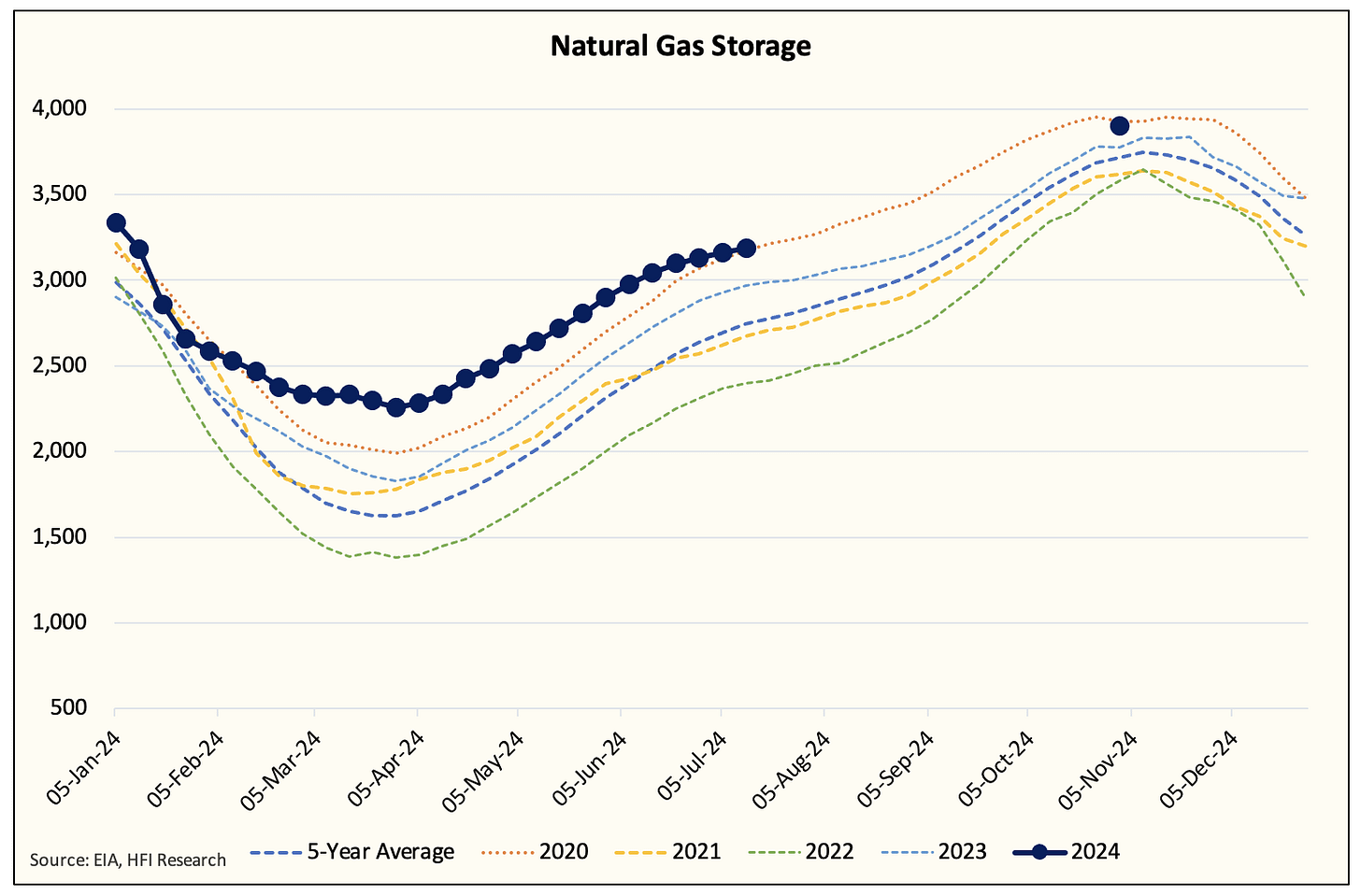

And looking at our projection, we see natural gas storage reaching 2020 level by late July.

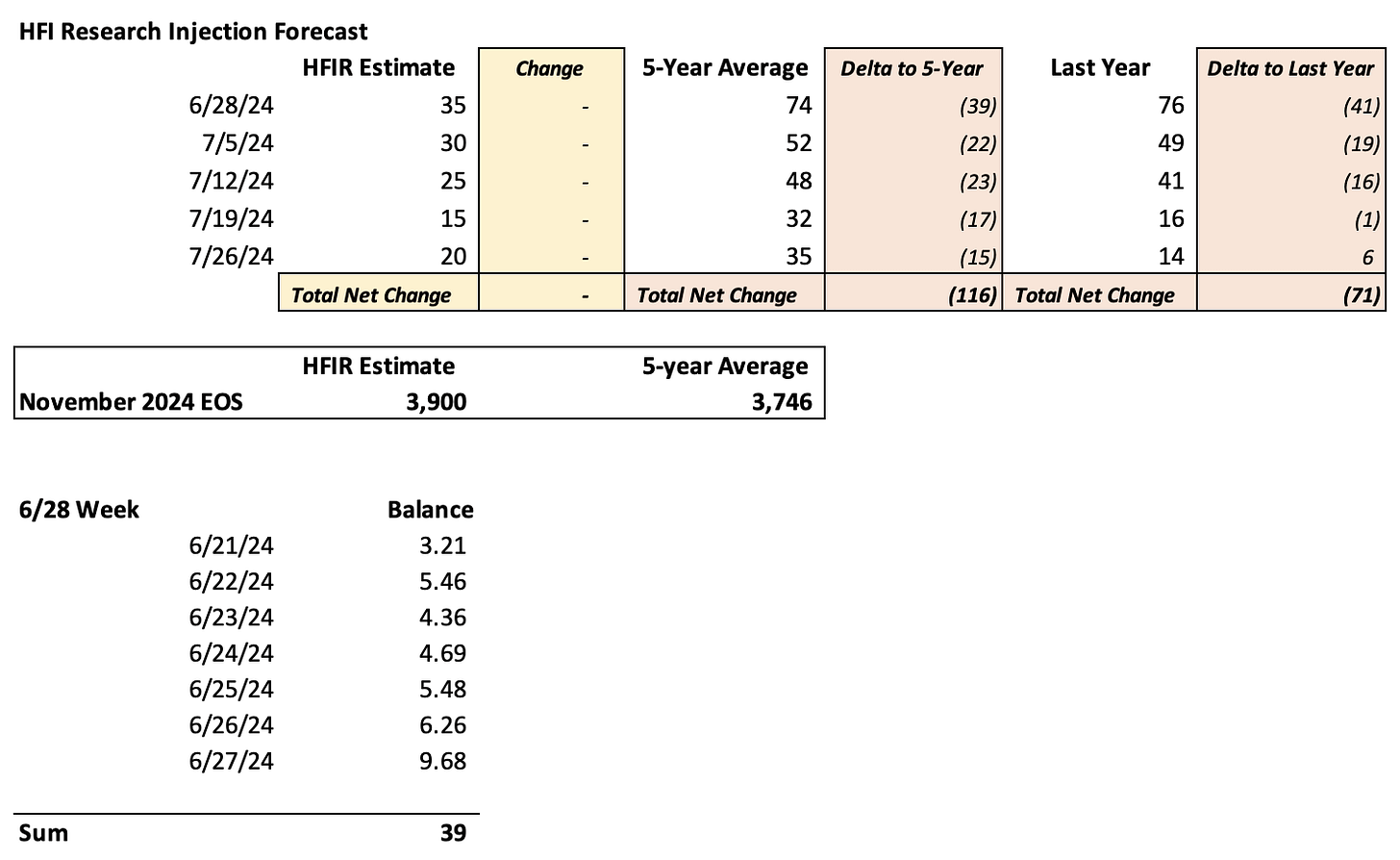

Over the next 5 reports, we see natural gas storage injection lower by ~116 Bcf relative to the 5-year average.

All of this is good news for the bulls, except for one big caveat...