OPEC+ surprised the oil market over the weekend with an announcement to pause the +137k b/d increase for Q1 2026. The pause comes amidst the consensus’s build for massive oil inventory builds. OPEC+ is still slated to increase production quota by ~137k b/d in December.

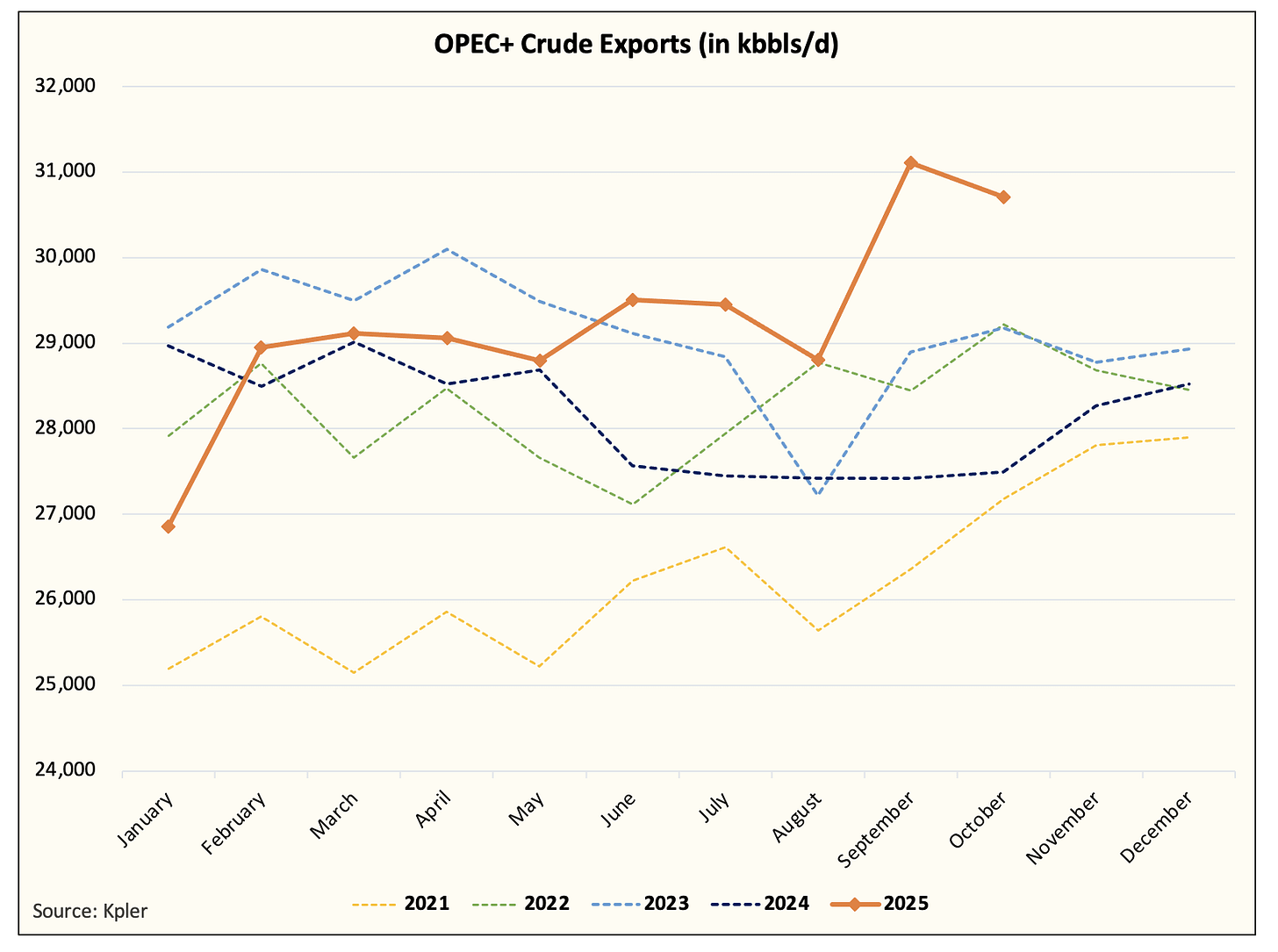

The production pause won’t help. Total production increase over Q1 would have added only ~24.66 million bbls if it were fully realized. With OPEC+ crude exports already at multi-year highs, the delta is negligible at best.

The issue is that if OPEC+ really wanted to prevent oil inventory builds in Q1 2026, it shouldn’t have ramped exports so high starting in September. As many oil watchers already know, the export ramp came following the domestic power burn demand season. Gulf Coast Countries like Iraq, Saudi, UAE, and Kuwait use crude oil for power burn, and crude exports usually become more widely available following the cooling demand season.

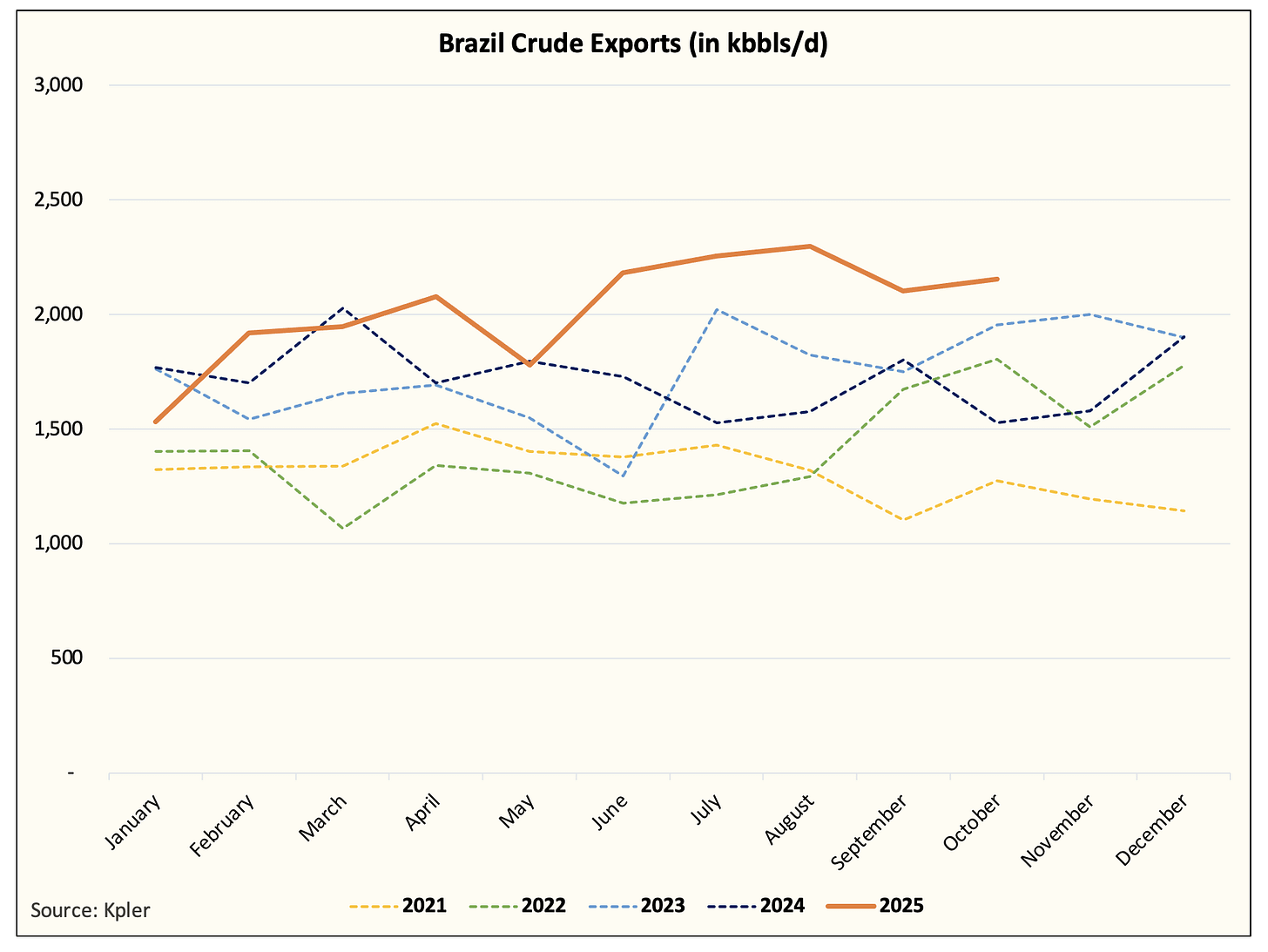

The surge we are seeing on oil-on-water is a large part of the material increase from OPEC+, but also non-OPEC supply sources like the US and Brazil.

But the more troubling thing in the data isn’t that OPEC+ is already ramping near all-time highs; it’s the fact that the crude export surges we’ve seen so far have come at the expense of the Saudis: