Our Latest View On Natural Gas For The Year

Low prices will cure low prices... eventually. The problem for investors is the opportunity costs associated with being in natural gas names versus other energy subsectors like oilfield servicing, Canadian heavy oil, and offshore drillers to just list a few.

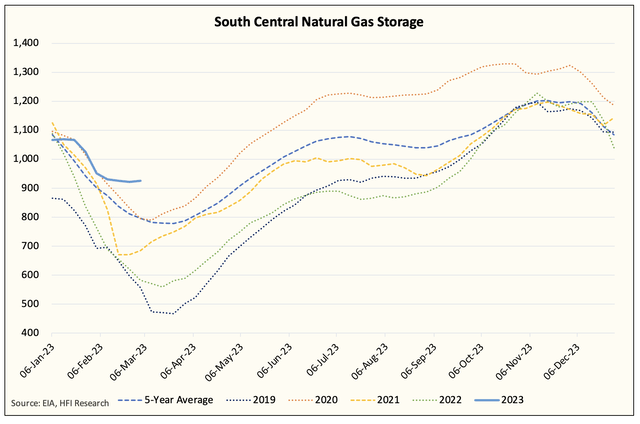

The problem that will materially plague US natural gas prices this year is displayed perfectly in the chart below:

South Central gas storage is sitting at 925 Bcf or close to 125 Bcf higher than the 5-year average. This will serve as a meaningful headwind for natural gas prices during the injection season. Until we see South Central gas storage fall below the 5-year average, you can kiss the possibility that traders frantically buy up gas goodbye.

Elevated gas storage combined with strong production growth will continue to weigh on prices and keep prices capped.