Our Natural Gas Market Signals Turn Bullish For The First Time In A Long Time

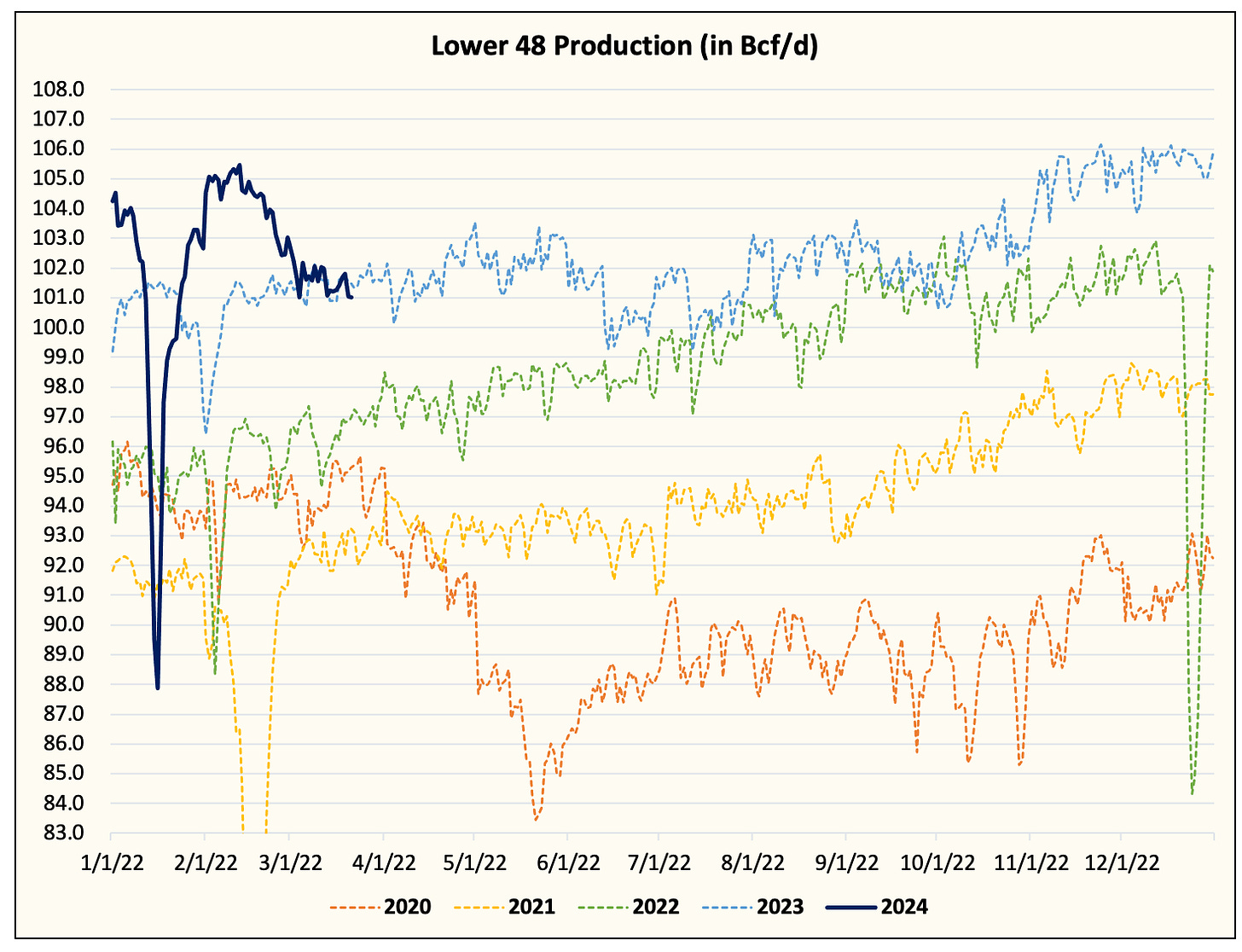

Natural gas bulls should be thankful this winter is finally coming to an end. The warmer-than-normal weather never went away and with heating demand finishing near historic lows, and Lower 48 gas production entering the 2023/2024 winter at an all-time high, it's a miracle we aren't worse off in storage.

Interestingly enough, the market, rightfully so, has punished natural gas prices to the point of potentially correcting the bearish path it's on.

Our natural gas market signal has turned bullish for the first time in a very long time. Frequent readers of our reports will note that we have been bearish on natural gas since the latter part of 2022, so it's refreshing to see this flip to the bull side.

On the fundamental side, storage is expected to remain bearish, which in turn has led the physical market to be very bearish. Spot prices are still hanging around $1.5/MMBtu, and with no demand catalyst on the horizon (aside from Freeport), there's nothing that's going to materially move prices up in the near term.

Looking at our storage projections, we have -1 Bcf for this week's report. This is compared to the -47 Bcf for the 5-year average and -72 Bcf last year. Despite how bearish winter was for 2022/2023, we at least head a colder than normal March. We don't even have that this year!

Storage, as a result, is expected to finish withdrawal season close to ~2.3 Tcf, which presents a major hurdle for the natural gas market to overcome. We've already discussed the implied balance math in previous NGFs, but in essence, if Lower 48 gas production holds between ~101 to ~102 Bcf/d, there's a path to normality.

Thankfully, low prices are curing low prices. Lower 48 gas production has remained around ~101 Bcf/d. The market has successfully pushed prices to the level to force production shut-ins, and we don't see the need to push prices even lower to prompt a larger response.