Physical Market Needs To Do The Heavy Lifting If Oil Is To Get Out Of Its Slump

Macro fears vs physical reality, that's the oil market in a nutshell today. Macro concerns about 1) the banking crisis, 2) Fed tightening, and 3) the global growth slowdown will continue to weigh on investor sentiment and allocation into oil and energy stocks. There's really no sugarcoating the headwinds we are facing, but rather than stating the obvious, what needs to change this perception? What are the catalysts going forward?

Our view is straightforward. The physical oil market will have to tighten to the point where the financial market can no longer ignore this.

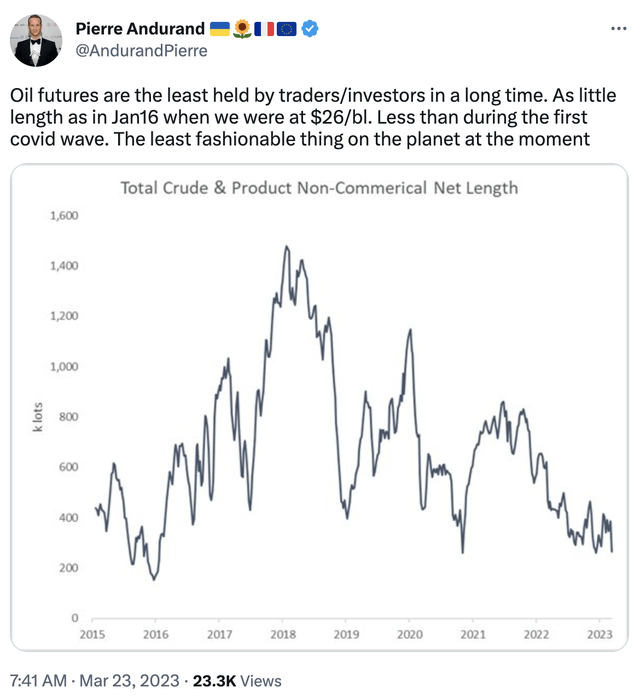

As Pierre Andurand pointed out today in a tweet, this is one of the lowest net length positions on record.

And traders and investors are right to keep ignoring oil as an asset class. Starting in mid-2022, we had 1) Fed tightening, 2) China COVID lockdowns, and 3) global coordinated SPR release on the heels of Russian supply loss that never materialized.

What's to motivate investors and traders to want to get back into oil especially given all the visible headwinds apparent today? Nothing.

But in our experience, it's precisely moments like this that you can develop an edge over the market. Apathy on its own isn't enough to want to persuade investors from wanting to allocate. There should be sound fundamentals to back those views, and in the case of oil, it appears it's just driven primarily by perception.