Note: This article was first published to paying subscribers on April 24.

EIA oil storage report was fairly bullish today with the crude draw of 6.4 million bbls outpacing our forecast of -4.33 million bbls. More importantly in these weekly reports, we watch just how accurate we are at estimating US crude production. And so far, things are looking good.

Looking at our real-time US oil production data, we saw a brief spike in implied US oil production in March. Considering that the weather fully normalized in the 2nd half of February and into March, US shale oil producers likely brought back production to full capacity by early March and sold off stored-up inventory. This likely caused a dislocation in our modified adjustment, which showed a false bump higher in production.

Why do we say that it was temporary? Well, if you look at the latest reading, the implied US oil production figure is back down to ~13 million b/d.

Another good way for readers to gauge just how accurate we are on US oil production is by looking at our US weekly crude storage estimate figure vs the EIA. If our draw is smaller than what EIA reports, then it implies a lower US oil production figure than we estimated. If our draw is larger than what EIA reports, then it implies a higher US oil production figure. In essence, anytime the EIA comes in more bearish than our estimate, it implies a higher production figure, and vice versa.

Alarming Trend...

At some point over the next 18 months, oil analysts will have to change US shale oil into US shale NGL oil. Oil weighting in US shale oil producers is dropping at an alarming rate as Permian players become gassier and gassier. This is not a surprise to anyone who's tracked some of the best producers in the Permian. Diamondback Energy is a great example of this with oil weighting dropping from 74% in 2017 to 59% in 2023. The trend going forward will be a further decline in oil weighting, while both the NGL and natural gas components increase.

So why is this alarming?

Well, the US natural gas market remains bloated and with the recent pipeline maintenance we saw in Texas, West Texas gas prices on the spot market dropped to an eye-popping -$5/MMBtu intraday.

Capacity expansion is expected to continue in the Permian basin until 2030, but during periods of maintenance, we will see spot gas prices go negative especially when the underlying market is bearish. In our view, with more and more producers showing higher associated gas production and lower oil mix, this will increasingly be a problem into the end of 2024.

More importantly, however, is that as the Permian gets gassier, the possibility of production peaking is even greater than people think.

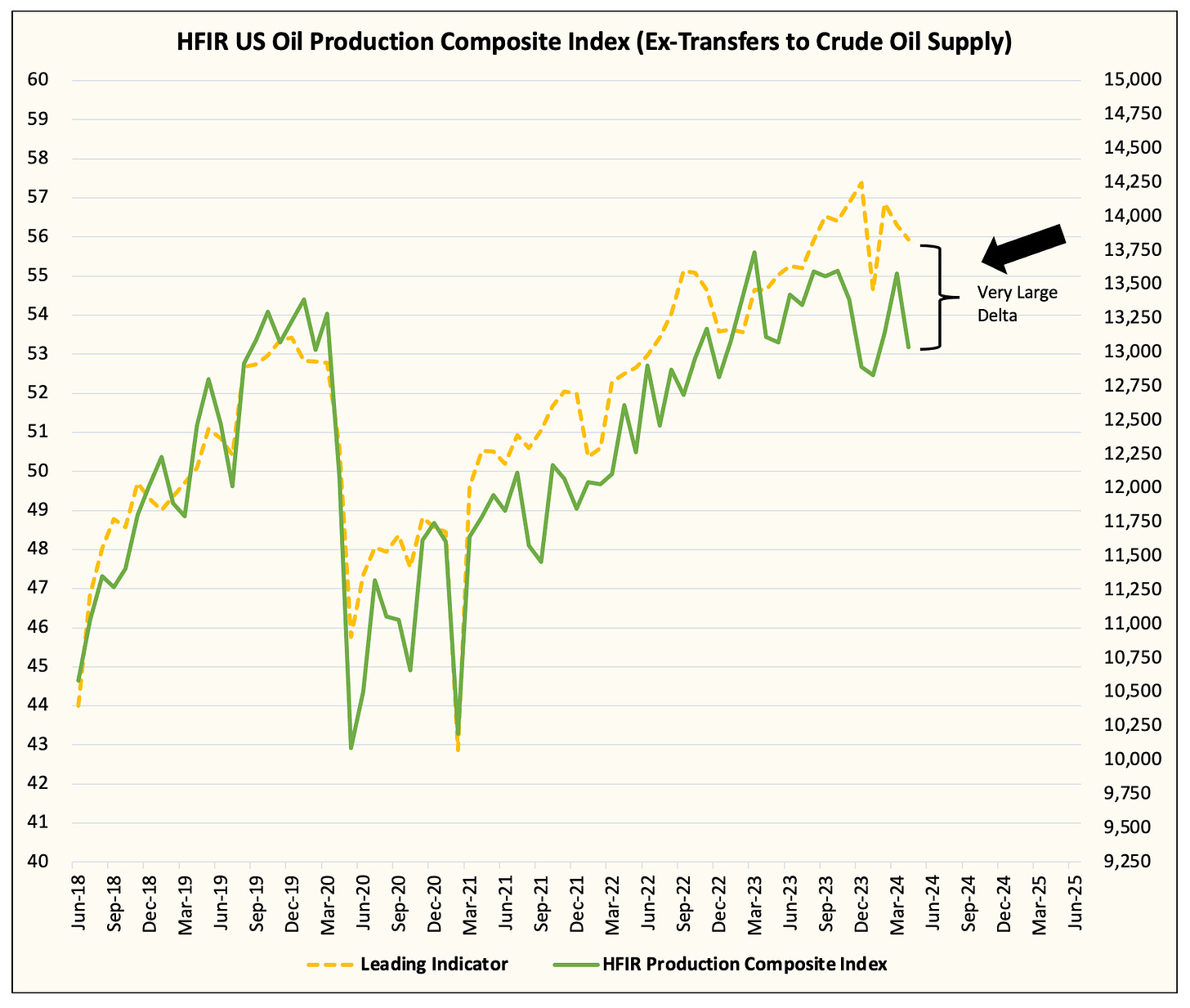

Our leading indicator in our real-time US oil production tracker has been to use associated gas production from the shale oil basins. In this case, you can see that following COVID-19, US oil production has severely lagged associated gas production.

But while the total volume lagged, the overall trajectory was close to the growth we saw in associated gas production. This was until Q4 2023 when we noticed a big disconnect between real US oil production and reported associated gas production.

As you can see, associated gas production roofed to an all-time high, while implied US oil production remains stuck around ~13 million b/d. Following the cold blast in January, associated gas production only declined slightly, while US oil production failed to regain any traction.

By our estimate, US oil production will fall further in the coming weeks hitting ~12.8 million b/d by June before rebounding into year-end. And as any veteran oil analysts know, when you start seeing overall gas production outpace oil production, you know the basin is closer to the end than the beginning. This is an alarming trend and something everyone needs to pay attention to.

Path Forward

The world is not ready for what's to come if US shale oil production peaks. The Permian basin single-handedly rescued the world from a structural oil supply deficit, so the moment the Permian peaks, so too does non-OPEC supply growth. From 2025 to 2030, the theme will be centered around the lack of production growth outside of OPEC, and what happens to global oil demand at $XXX oil price. We are entering a new paradigm and this alarming trend is not gaining enough attention.

In the meantime, oil analysts simply believe that capital discipline is resulting in slower US oil production, but we see something much worse. While we don't expect the Permian to go into a freefall anytime soon, the lack of growth in itself will be sufficient for oil prices to roof.

As I step back and look at the signals we are using, we can validate this thesis easily by tracking 1) associated gas production and 2) our real-time US oil production figures.

As a reader, you should rest assured that we have your back on this topic. As I wrote in my MEMO, "The long-term is made up of short-term events". This thesis is precisely that and the hard work we put into analyzing US oil production over the years will bear fruit.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.