Pierre Andurand, nicknamed the oil trading god (after Andy Hall retired), is famous in the hedge fund world for his keen and often accurate forecast of the oil market fundamentals. So for many close followers of the oil market, when Andurand talks, we all listen.

After a rough 2023 where oil prices were stuck in rangebound territory, Andurand's commodity fund has recovered nicely climbing up ~22% for the year, while his enhanced fund is up ~63% for the year. (See article for details.)

More notably, Andurand is calling for a mixed outlook on the oil market going forward while pivoting to a more bullish outlook for copper and cocoa. I am certain his firm has other bets that he has not disclosed, but the "mixed" outlook on the oil market is getting a lot of attention.

In particular, the letter obtained by Bloomberg notes the supply uncertainty his team is seeing.

We will reengage in the oil markets once we obtain greater clarity on the supply side.

From our view, we agree in most part with Andurand's team's assessment of the oil market. While we wouldn't call it mixed, we believe oil prices are rangebound at best into year-end.

Mixed? Or just rangebound?

In April, we wrote an article titled, "This Is How I See The Oil Market Playing Out For The Rest Of 2024." We concluded by saying:

I see a rangebound oil price environment for the rest of 2024 with WTI ranging between $85 to $95. I see Saudi unwinding its voluntary production cut starting in June. It will unwind slowly to not disrupt fundamentals. I see the US releasing ~30 million bbls of SPR starting in August and into October, just before the US elections. And I see US oil production peaking, which should give oil bulls ammunition going into 2025. The degree of US oil production outperformance/underperformance will play a pivotal role in the narrative going into 2025.

But most importantly, the oil market will be dictated by the healthiness of global oil demand, which could be gauged through the healthiness of global refining margins.

As a result, global refining margins will continue to be the leading indicator for crude prices and for prices to reach the next structurally higher range, refining margins need to move higher.

Fast forwarding to today and with the latest fundamental updates, this is what I'm seeing:

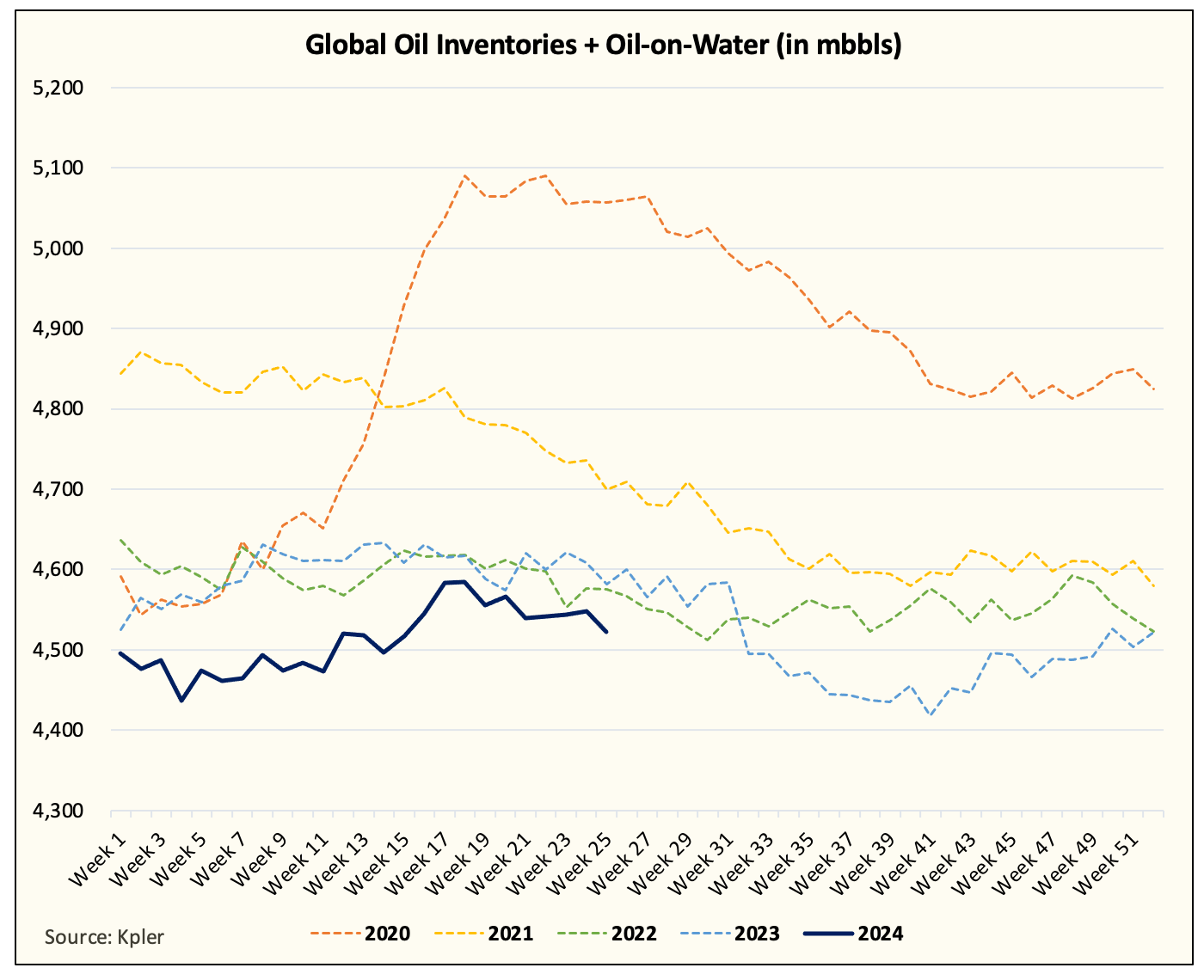

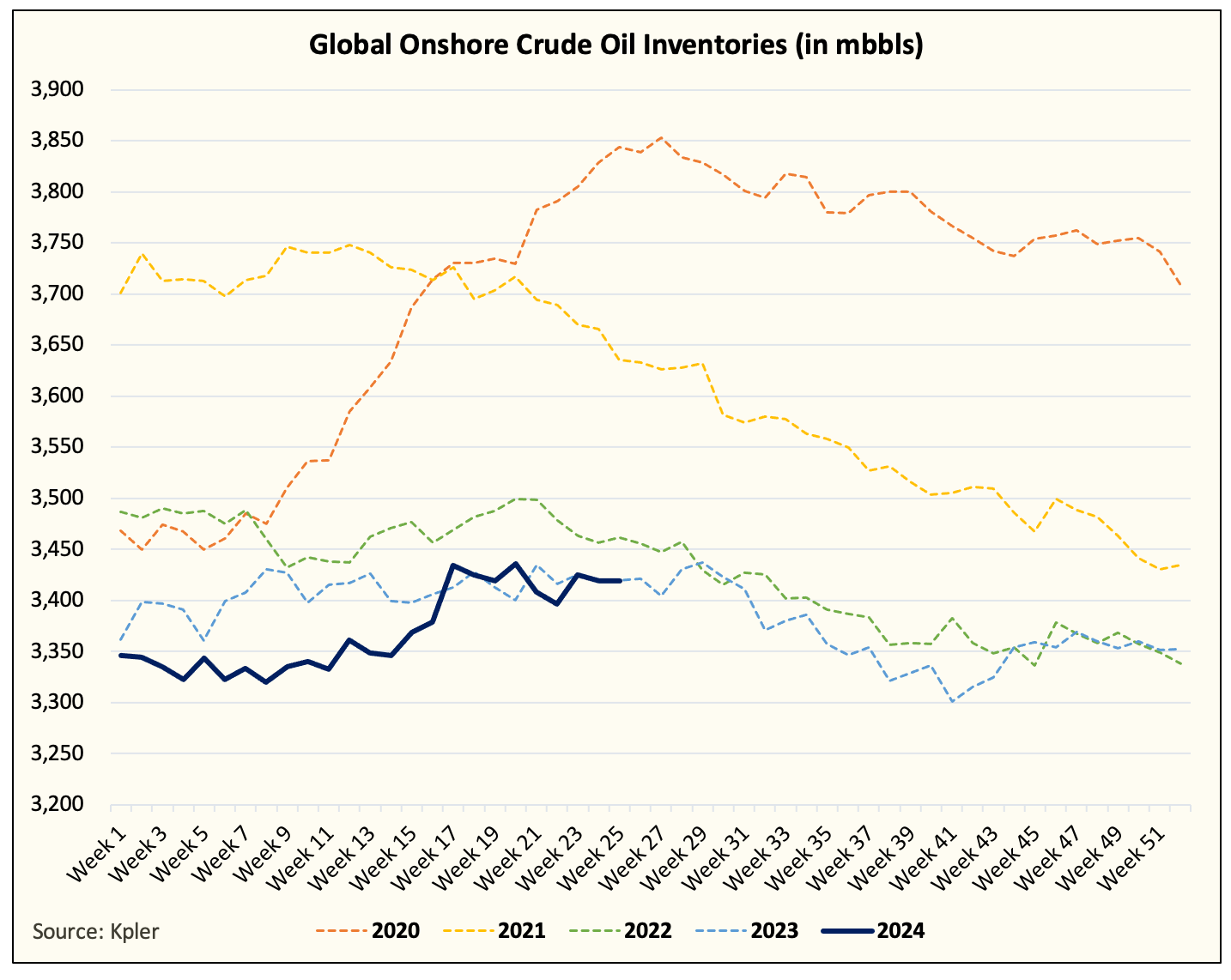

Q1 global oil inventory balances surprised to the bull side, but Q2 balances are heavily skewed to the bear side.

OPEC+ voluntary cut reduction is coming in Q4 vs Q3.

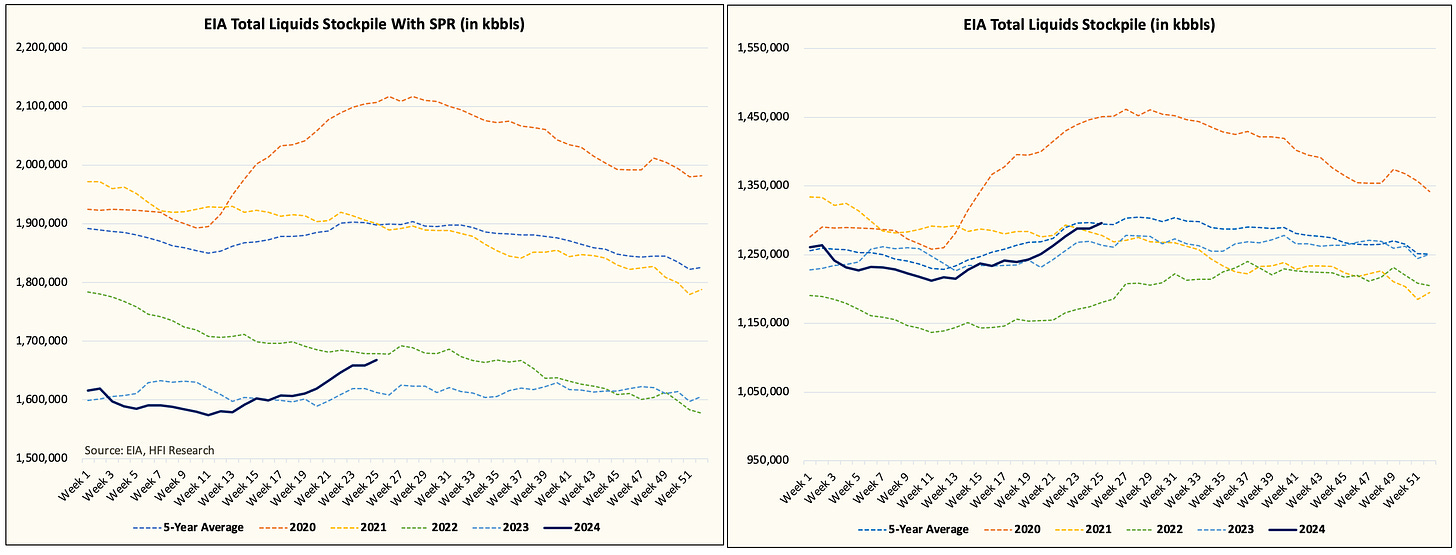

US SPR release is still very likely even if WTI stays at $80/bbl, which would put a headwind on prices going into year-end.

US oil production has not decreased to ~12.8 million b/d by June and is instead averaging around ~13.1 million b/d. This opens the possibility of a move to ~13.45 million b/d by year-end, and ~13.8 million b/d as the peak.

Global refining margins have decreased signaling weaker than expected demand (globally). As a result, the structurally higher level of $85 to $95 is unattainable without higher refining margins.

From a trader's perspective, it doesn't make sense to go long crude here considering that 1) you need refining margins to move higher for there to be more upside, 2) global oil balances are not that bullish with visible inventory builds happening, and 3) ample spare capacity from Saudi coupled with the possibility of an SPR release in August.

These obvious headwinds should detract anyone from contemplating a long position in crude futures. So understandably, we agree with Andurand's team's view that the outlook for crude is mixed.

And speaking of supplies, this is what we are seeing with US oil production.

Our real-time data shows US oil production at the same level as Q4 2023. There's been very little change since then. Following the freeze-off we saw in January, US oil production has recovered fully. But given the underlying strength we are seeing in US oil production, we think US oil production will finish year-end around ~13.45 to ~13.55 million b/d. This will represent an exit-to-exit increase of ~350k b/d to ~450k b/d. (We are using ~13.1 million b/d as the baseline, EIA 914 + adjustment.)

For 2025, we have another increase to ~13.8 to ~13.9 million b/d. By this point, we see US oil production peaking. But from now to that point, US oil production should add ~700k b/d to ~800k b/d to global oil market balances.

On the demand side, the outlook is mixed. IEA is calling for lackluster demand growth, while consistently revising up 2023 global oil demand. On a y-o-y basis, it appears that the growth is shrinking, but on an absolute level, the figure remains the same. We think global oil demand growth has weakened since 2022, but not at the same level of severity. Even amidst the current slowdown we are seeing, we have 2024 growing closer to ~1.4 million b/d, which should more than absorb the supply increases we see for this year.

The issue for the oil bulls is that with Q2 balances pivoting so bearishly, unless fundamental balances change swiftly, even the call for a rangebound oil market environment could be at risk.

We are, however, confident that balances should skew to the downside, and global oil inventories will draw. But for now, the bears are winning that side of the argument as most of the draws we have observed in the past few weeks are coming from oil on water.

Onshore

EIA US Total Liquids

What's the move?

For oil traders:

Trade the oil price range ($77 to $85). Anytime futures positioning gets skewed to either direction, take the opposite side of the bet.

Watch refining margins, if it's moving up, then crude has the potential to get a bid. If it's moving down, then crude is heading lower.

The physical market will take a backseat to the financial side unless either 1) global oil inventories are meaningfully declining or 2) vice versa.

For energy investors:

We think buying energy stocks that trade at high teen free cash flow yields makes sense considering the rangebound oil market environment we see into year-end.

While there's no obvious catalyst on the horizon for both 1) oil to move higher and 2) energy stocks to meaningfully re-rate, we do like the value we see in many of the names.

We recommend energy investors to tactically position themselves to give themselves the ability to trade in and out of names. Because of the rangebound oil price environment, you can take advantage of overly enthusiastic market participants, and vice versa.

Our Move

For us, we are repositioned back into energy stocks (in full). We issued trade alerts last week detailing our purchases of MEG and CVE.

While we are fully positioned, if oil market balances do not improve over the next few weeks, we will be back into holding a meaningful position in cash. We should not be dismissive of the bear argument and the current builds we are seeing in global oil inventories is a major concern.

As always, we will keep you up to date with the latest data. For now, we are holding still, but observing the incoming data closely.

Analyst's Disclosure: I/we have a beneficial long position in the shares of MEG.TO, CVE either through stock ownership, options, or other derivatives.

Thanks for the balanced viewpoint.