Editor’s Note: This article was first published to paid subscribers on Nov 15. The thesis for CC 0.00%↑remains intact.

By: Jon Costello

Chemours (CC) was formed on July 1, 2015, as a spinoff of DuPont’s (DD) more cyclical businesses. Chemours operates in three businesses: Thermal & Specialized Solutions (TSS), Titanium Technologies (TT), and Advanced Performance Materials (APM). In 2024, the company generated $5.8 billion in sales and $786 million in Adjusted EBITDA. This year, it is on track to earn approximately $750 in Adjusted EBITDA. It has an enterprise value of $5.6 billion.

Chemours Overview

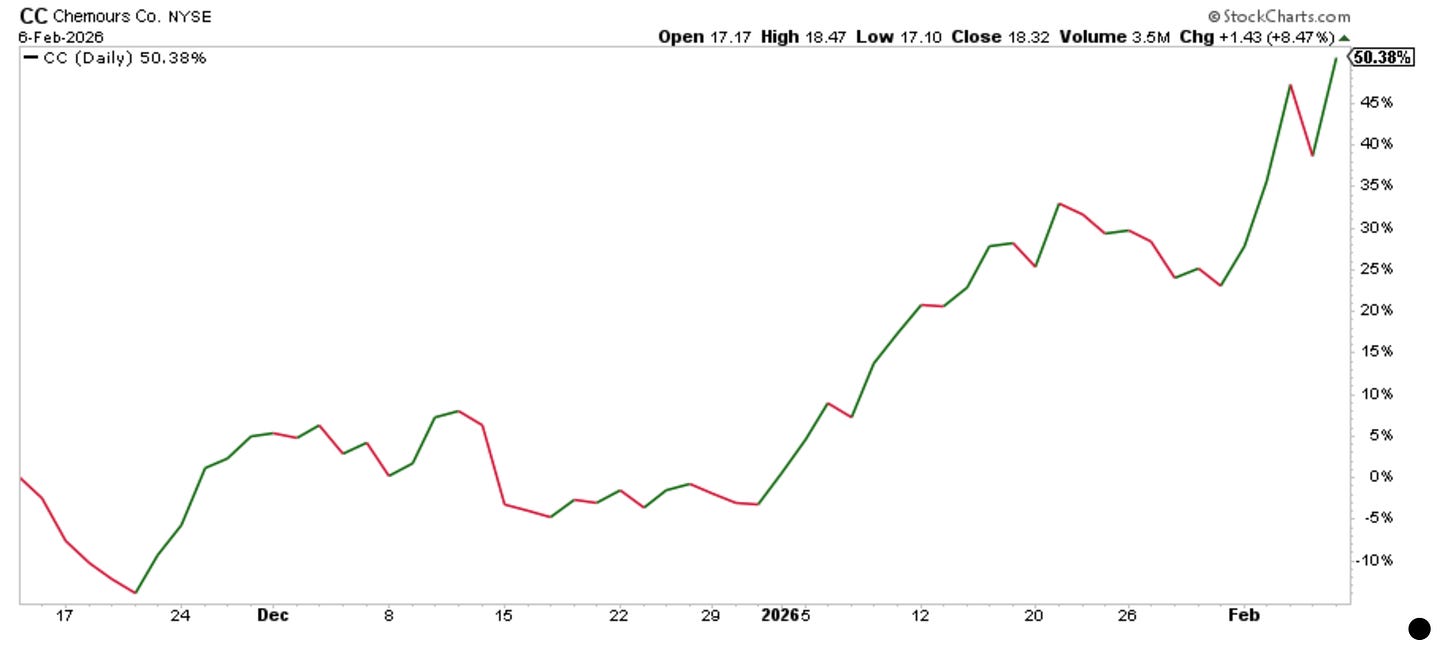

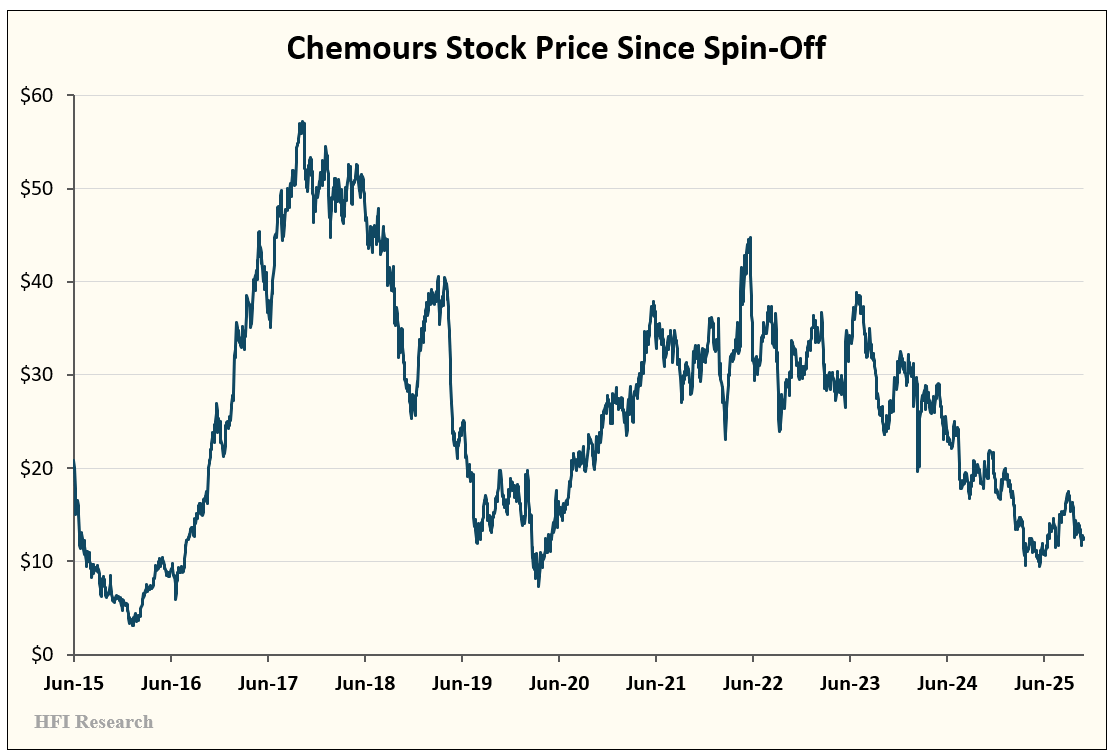

Chemours shares have been on a steady decline since 2023, as shown below. The shares are currently priced at a discounted valuation characteristic of a cyclical trough.

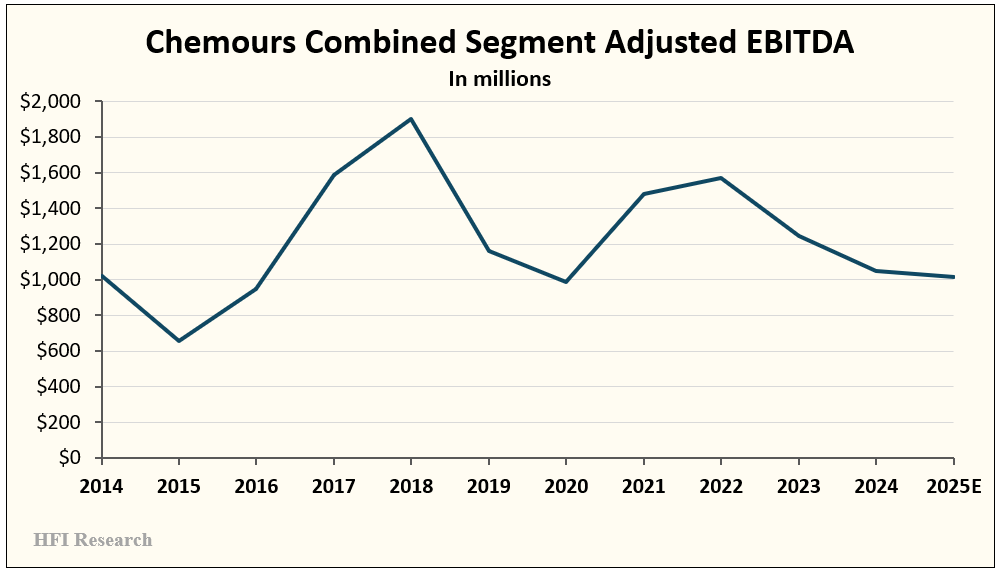

The selloff has coincided with the decline in Adjusted EBITDA. This year’s estimated $750 million is down nearly half from $1.4 billion generated in 2021.

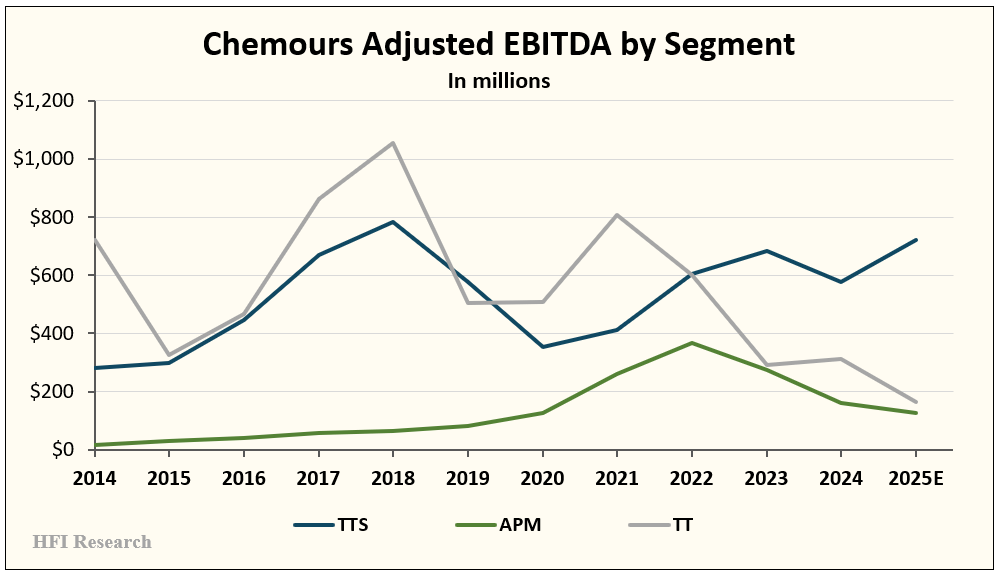

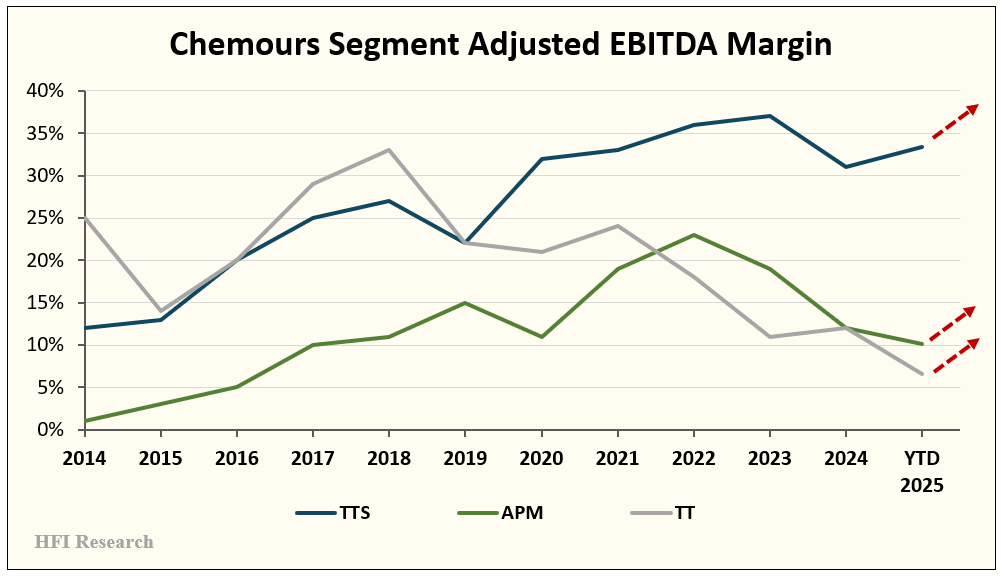

The decline was driven by the ongoing three-and-a-half-year downturn in Chemours’ two cyclical operating segments. These segments have been hit by weak domestic housing and construction markets, Chinese overcapacity, and, most recently, tariffs. The three segments’ annual Adjusted EBITDA contribution since 2014 is shown in the chart below.

When combined, Chemours’ cyclicality is evident.

Given the strong likelihood of a recovery in Chemours’ fundamentals over the next three years and the significant upside potential in its shares amid such a recovery, the time is right for aggressive investors to consider Chemours’ stock for long-term purchase.

Long-term investors in the company must be familiar with its operating segments, their EBITDA generation potential, and their challenges.

Thermal & Specialized Solutions (TSS)

This segment represents Chemours’ refrigerants and thermal-management portfolio. Its core brands are Opteon refrigerants and foam blowing agents, as well as legacy Freon hydrofluorocarbon (HFC) and chlorofluorocarbon (CFC) products. TTS’s end markets are air-conditioning and refrigeration for automobiles and buildings, foam insulation for buildings, and aerosol propellants for niche applications.

The TSS segment is currently Chemours’ profit engine, with strong margins that I believe are both insulated from cyclical forces and are sustainable. The segment’s demand drivers are climate change regulations coming into effect, air conditioning replacement cycles, and new construction.

This segment is a leading beneficiary of a movement by governments to force a refrigerant technology transition away from HFCs and to refrigerants with low global warming potential. In the U.S., the AIM Act is phasing down the production and consumption of HFCs. The leading replacement has been hydrofluoroolefins (HFOs), and Chemours, along with Honeywell (HON), holds a patented duopoly with its Opteon HFO product.

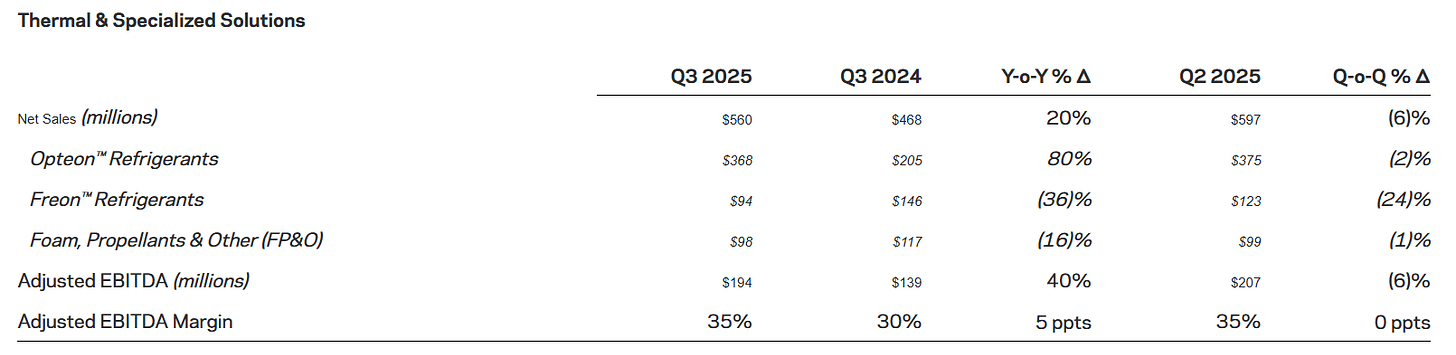

In the third quarter, TTS generated $560 million in sales, a 20% year-over-year increase. The increase was driven by 8% higher volumes and 11% higher prices. The Adjusted EBITDA margin came in at a historically healthy 35%. An 80% increase in Opteon sales drove the performance. Sales of the product now account for more than 75% of TSS segment sales. The impact of Opteon’s growth is illustrated in the table below, which depicts TTS’s third-quarter results.

Source: Chemours’ Q3 2025 Earnings Press Release, Nov. 6, 2025.

Clearly, Opteon’s growth is more than offsetting the shrinkage in Chemours’ legacy Freon and foam volumes, as expected.

Titanium Technologies (TT)

Chemours’ Titanium Technologies segment houses its Ti-Pure titanium dioxide pigment business. Titanium dioxide is a whitening agent and opacifier in paints, cosmetics, and other goods. Chemours is the second-largest producer of titanium dioxide in the global market, which is dominated by four firms. This segment is extremely cyclical, and its downcycle has been responsible for crushing Chemours’ Adjusted EBITDA. However, I believe the titanium dioxide market is near its cyclical trough, as explained in a previous article available here. As the cycle turns upward, it will drive most of Chemours’ Adjusted EBITDA recovery over the coming years.

The TT segment’s demand drivers include pigment demand from the paints and coatings, plastic, paper, automotive, architectural, and construction industries.

In the third quarter, TT generated sales of $612 million but only $25 million in Adjusted EBITDA, representing a 4% margin, due to an 8% decline in global titanium dioxide prices and a 2% decline in the segment’s sales volumes.

Advanced Performance Materials (APM)

This segment is Chemours’ high-end fluoromaterials portfolio. Its main products are Teflon fluoropolymers and coatings, Viton fluoroelastomers, Krytox specialty lubricants, and Nafion ion-exchange membranes.

Its products are used in semiconductors and advanced electronics, automotive applications, and energy transition applications such as hydrogen electrolysis and fuel cells.

APM is less cyclical and enjoys sustained higher margins. However, it is Chemours’ smallest Adjusted EBITDA contributor and is currently being negatively impacted by sluggish industrial end-user demand.

In the third quarter, the segment generated $311 million of sales and $14 million of Adjusted EBITDA. Volumes were down 15% year-over-year.

Investment Thesis

Chemours is a basic long-term capital-cycle play. Its investment thesis is comprised of three main parts, discussed in turn below.

Part 1: HFO Demand Growth

The first part of Chemours’ investment thesis pertains to its TSS segment. The U.S. is undergoing a large-scale transition from HFCs to HFOs. HVAC regulations began requiring the use of HFOs on January 1, 2025. Light automobiles are also already mandated to use HFOs. Medium and heavy-duty automobiles are required to switch by 2028, and industrial HFO uses are being phased in through 2028.

The switch to HFOs will boost TTS Adjusted EBITDA for years. Chemours’ HFOs are priced multiple times higher than its legacy Freon product. For example, auto makers pay $75 to $80 per kilogram of HFO versus $15 to $35 per kilogram of the legacy product. Royal Refrigerants, an online retailer, lists a 25-pound tank of Opteon for automotive use at $890, or $35.60 per pound. It lists a 30-pound tank of automotive Freon at $338, or $11.27 per pound. The improved pricing on HFO translates into more than a 20% increase in Adjusted EBITDA margin for the TTS segment.

As HFOs are more widely adopted and/or as macro demand for the product increases, Chemours will benefit from the additional Adjusted EBITDA. Chemours should be able to grow its TSS revenue at a high single-digit percentage rate. The segment’s Adjusted EBITDA is likely to grow at a rate more than twice that.

Also notable is that as Chemours’ Freon sales have declined, the company has been left with an inventory oversupply of lower-priced product. This has created a temporary drag on the company’s financial results. That drag is dissipating, which will help improve comparable quarterly results going forward.

I estimate that Adjusted EBITDA margins from Opteon sales are in the low-40s%, which is high for the chemical industry. Adjusted EBITDA will therefore receive a significant boost as sales volumes increase.

Assuming a conservative 5.0% annual sales growth from the TTS segment over the next two years, and that the segment generates a 36% Adjusted EBITDA margin, its EBITDA contribution in 2028 would be $830 million.

Part 2: Titanium Dioxide Recovery

I’ve written that the titanium dioxide market is poised for a cyclical recovery. The TT segment’s Adjusted EBITDA contraction is responsible for the lion’s share of Chemours’ Adjusted EBITDA decline over recent years, so a recovery will likely drive Chemours’ combined Adjusted EBITDA significantly higher.

The TT segment also experienced unexpected downtime due to production outages in the U.S. and Mexico. These outages have been resolved.

The TT segment is working through internal cost reductions that management has billed as structurally reducing costs by $125 million. However, cost savings will likely exceed that amount by a significant margin. Management expects that these initiatives, combined with Chemours’ technological advantages in titanium dioxide production, will make the company one of the lowest-cost producers globally, based on production cost per ton.

Chemours needs only a modest swing in the titanium dioxide cycle to realize a significant boost in the TT segment’s Adjusted EBITDA. Assuming TT revenues revert to a mid-cycle level of $2.5 billion and the company achieves its 10-year average Adjusted EBITDA margin of 20%, the segment will generate $500 million in Adjusted EBITDA. As the cycle inflects higher, Adjusted EBITDA will increase further. In fact, Adjusted EBITDA increases can exceed TT’s historical recovery trends if the segment’s cost-reduction initiatives prove successful.

Part 3: “Other” (An APM Recovery & Data Center Cooling Technology)

A cyclical recovery in Chemours’ APM segment’s end markets will also contribute materially to Chemours’ Adjusted EBITDA recovery over the coming years.

In the third quarter, APM generated $311 million in sales and earned $14 million of Adjusted EBITDA, for a 5% margin. Volumes fell 15% from the previous year. Since 2014, APM’s Adjusted EBITDA margin has averaged 12%, so an improvement in volumes and Adjusted EBITDA stands to add more than $100 million to Adjusted EBITDA annually, for a total normalized segment Adjusted EBITDA contribution of approximately $200 million.

Data center cooling technology is more of a wild card in Chemours’ investment thesis. Nevertheless, it is important because of the significant value it would represent for the company if widely adopted.

For decades, Chemours has demonstrated its ability to innovate, roll out the innovations at scale, and profit as they are commercialized. The company’s newest focal point for innovation is its data center cooling technology.

Chemours has developed a proprietary fluid for two-phase immersion cooling in data centers. Since data center processing speed is directly correlated with heat levels, continued advances in processing will drive increased needs for data centers to dissipate heat. In fact, rising costs for heat reduction will become a major limiting factor on data center growth. Immersion cooling is a promising cooling technology in which data center hardware is submerged in a non-conductive fluid that absorbs heat more efficiently than air.

Chemours is a leader in developing these fluids through its expertise in HFOs. Only it and Honeywell control the patents needed to scale up this immersion cooling technology.

The issue with this technology stems not from its viability, which is proven, but rather from the timing of its implementation. Data centers must be specifically designed to accommodate the technology, so the challenge for a wide-scale rollout will be to partner early with data center owners and developers. At the moment, it appears that a rollout isn’t likely until 2028. As a result, the technology’s economics and long-term potential remain a mystery. Still, Chemours has partnered with digital infrastructure providers and manufacturers to prepare for a rollout.

I won’t take a stab at rendering an Adjusted EBITDA estimate for Chemours’ data center cooling business due to all the unknowns. Instead, I’ll regard the business as a valuable call option to the company’s intrinsic value. What is clear, however, is that the effort has considerable upside potential for Chemours, with minimal downside.

PFAS Liabilities and Other Risks

The ugly part of Chemours is its “per- and polyfluoroalkyl substances,” or “PFAS” liability. This should be front and center for any investor in the company.

PFAS is a class of chemicals known as “forever chemicals” because they don’t break down easily. DuPont began using PFAS in the production of Teflon in 1946. By the 1960s, DuPont knew the chemical was toxic to animals and accumulated in human blood. DuPont’s West Virginia manufacturing plant discharged PFAS into the air and water in the Ohio River Valley, the source of drinking water for more than 70,000 people.

Chemours was saddled with part of DuPont’s PFAS legal and financial burden when it was spun off from DuPont. As such, it is responsible for shouldering a portion of the remediation and other costs.

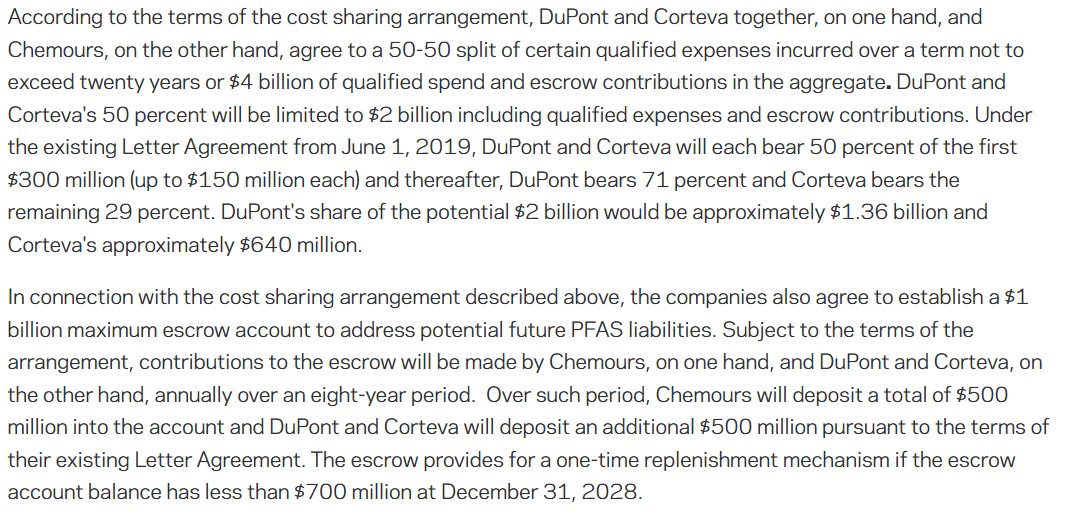

In 2021, Chemours, DuPont, and DuPont’s agriscience spinoff, Corteva (CTVA), entered into a settlement to resolve legal disputes and established a cost-sharing arrangement to support future PFAS liabilities. The terms of the settlement are spelled out in this press release, a key part of which is excerpted below:

Source: Chemours Press Release, Jan. 22, 2021.

The most recent PFAS development occurred in August, when Chemours, DuPont, and Corteva agreed to an $875 million settlement with the State of New Jersey over PFAS and other environmental claims. Chemours will pay 50% of the approximately $500 million present value of the settlement over 25 years.

In a separate case, a federal judge ordered Chemours to stop unlawful PFAS discharges from its Washington Works facility into the Ohio River, highlighting ongoing reputational and compliance risk.

The greatest uncertainty regarding PFAS litigation stems from personal injury and landfill-related claims if regulators pursue waste operators and manufacturers. There is no reliable way to estimate this potential liability at the moment.

PFAS is therefore an overhang on Chemours’ stock price, and potentially also on its capital allocation. Its most recent financial statements estimate a PFAS environmental remediation liability of $607 million and an accrued litigation liability of $207 million, for a total liability of $814 million as of September 30. In my analysis, I have assumed an obligation of $1.4 billion, which I believe is conservative.

Another risk to Chemours stems from the lapse of its refrigerant patents. Most of the patents that protect its Opteon business will remain in force into the early 2030s. The company is working on new formulations to extend its protection, but there is no guarantee of success.

Chemours also faces execution risk if it continues to add HFO production capacity as planned and demand fails to pan out as the company expects.

Valuation

The Chemours investment thesis hinges on the company’s Adjusted EBITDA margins inflecting upwards over the coming years, as illustrated in the chart.

The TTS segment margins should increase from additional high-margin HFO sales, while the TT and APM segment Adjusted EBITDA should increase more significantly as their respective cycles turn.

I don’t know when APM and TT’s cycles will turn with any precision, but I’m highly confident that, first, they will turn, and second, that Chemours’ stock will move higher well in advance of the upturn. The return upside from Chemours’ current depressed stock price is simply too large for the shares not to move aggressively upon the first glimmer of a sustained recovery.

Chemours is currently trading at an EV/Adjusted EBITDA valuation of approximately 7.5-times, at the high end of its historical range.

Using the Adjusted EBITDA estimates for 2028 for each operating segment, as discussed in my investment thesis above, I expect Chemours to earn roughly $1.5 billion in Adjusted EBITDA before corporate expenses. Applying a 7.0-times EV/Adjusted EBITDA ratio and assuming $3.5 billion of net long-term debt, a PFAS obligation net present value of $1.4 billion, $250 million of corporate overhead, and 150 million shares outstanding, Chemours shares are worth $27 per share, which implies 125% upside from their current price of $12.

In a bull scenario that assumes robust growth of the TTS segment and cyclical-high Adjusted EBITDA from the APM and TT segments (specifically, TTS’s Adjusted EBITDA reaches $925 million, TT reaches $800 million, and APM reaches $250 million), corporate overhead of $250 million, net long-term debt of $3.5 billion, and a PFAS liability of $1.4 billion, Chemours’ Adjusted EBITDA would be $1.7 billion. At a slightly lower EV/Adjusted EBITDA valuation of 6.0-times to account for a cycle-high discount, Chemours’ stock would be valued at $36, for 200% upside.

In a downside scenario that assumes 2028 Adjusted EBITDA of $1.2 billion, a 6.5-times EV/EBITDA multiple, $3.5 billion in net long-term debt, and a $2.5 billion PFAS obligation, the shares would trade at $14, still above today’s price of $12. The margin of safety between price and value that exists in an adverse scenario is one of the reasons I like the shares below $14.

Chemours investors should also keep in mind that the shares have further upside if the immersion-cooling initiative pans out. For perspective, an additional $200 million of Adjusted EBITDA would increase Chemours’ valuation to $35 per share, and $44 per share in the bull scenario sketched above.

Conclusion

The Chemours thesis has some “hair,” to be sure. Shareholders must gauge the PFAS risk and its impact on the company’s valuation. However, the issue has weighed on Chemours’ market valuation in the past. It continues to do so, and even if it persists, it’s unlikely to prevent the shares from rallying amid a cyclical recovery. Consider, for example, that in the 2017-2018 timeframe, Chemours shares traded above $50 at a 6.5-times EV/EBITDA valuation on $1.4 billion of Adjusted EBITDA.

This time around, I believe a price above $30 is achievable in the next three years, for a compound annual total return of 37% for investors buying today at $12. Such a return should be more than satisfactory for aggressive investors who have the patience to hold through the inevitable volatility in the share price. Given these returns, I believe investors should consider buying Chemours shares today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CC either through stock ownership, options, or other derivatives.