(Public) Don't Be Distracted By Year-End Data, Look Ahead

Year-end EIA weekly oil storage reports are about as useful as asking a fruit for life advice. Refineries typically game the storage system for tax purposes, so at the end of every year, product storage typically builds, while crude storage declines. EIA's reported crude draw of ~5.5 million bbls was lower than what we had expected, but we attribute part of this to normal year-end seasonality.

Crude

Product

By our estimate, the modified adjustment flipped from -48k b/d last week to +102k b/d this week. Implied US oil production for the last week of December was ~13.3 million b/d, but the 4-week average was ~13.05 million b/d.

When EIA reports monthly US oil production in February 2024, we expect EIA to show ~13.25 million b/d with -200k b/d of adjustment. Transfers to crude oil supply will average ~694k b/d.

But don't be distracted by year-end data, look ahead...

It's easy to lose track of the important stuff in oil. Weekly data is all fun and exciting, but it is historical data, so it doesn't give you any insights into the future. In this case, especially, year-end data is not useful at all.

For us, one of the key signals going forward will be the velocity of change in supply and the change in storage. On the supply front, we fully expect OPEC+ to deliver on their promise of reducing production.

While total OPEC+ crude exports were up slightly m-o-m in December, most of this is attributed to a recovery in Russian crude exports due to normalizing weather.

We expect Russia to average ~4.75 million b/d in Q1 2024.

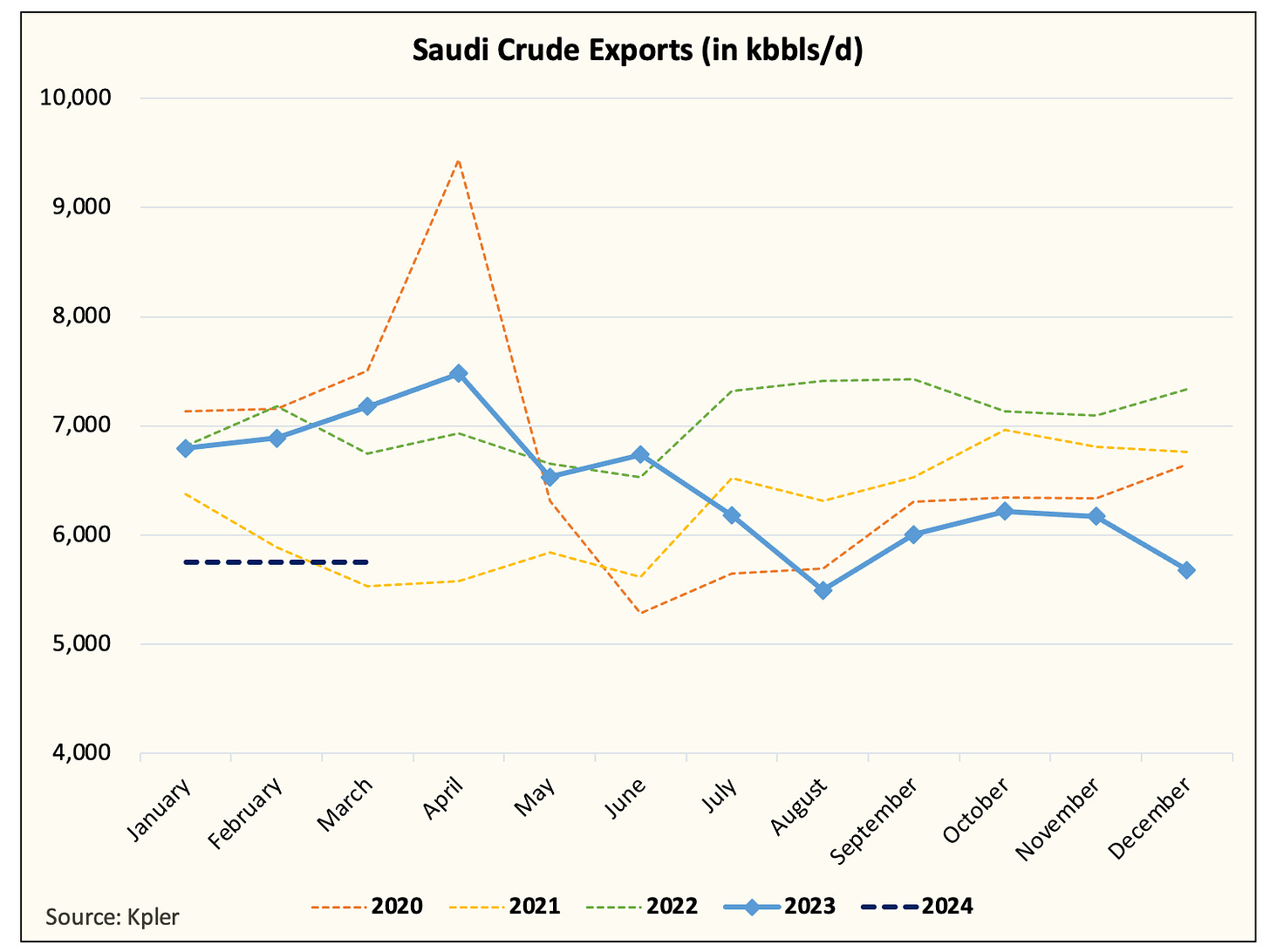

Looking at the rest of OPEC+, Saudis led the way by plummeting crude exports down to ~5.671 million b/d. For the rest of Q1, we see an average of ~5.8 million b/d. If the Saudis export at this level, it would represent a decrease of ~1.2 million b/d y-o-y.

While the US did meaningfully increase crude exports in 2023, it would not be able to increase to the extent of the Saudi cut. As a result, this cut will eat right into global oil balances.

In addition, we expect US oil production to decline in Q1 2024. This will help aid US crude storage balances, which are the most visible to the rest of the world.

Our preliminary crude storage figure shows a positive start to 2024 with an estimated draw of ~6 million bbls, so if Q1 shows a small crude draw in aggregate, it will bode well for balances for the rest of the year.

For context, Q1 2023 saw US crude storage build ~49 million bbls. It will be important for us to prevent something similar from happening. (Side note: The first week of 2023 saw ~19 million bbl build in US crude storage.)

Once the market sees that supplies in aggregate are lower, then it will be up to demand to boost prices higher. We will need to rely on continued strength in refining margins. In essence, if demand cooperates and supplies decrease as we expect, crude should be comfortably back in the $80s.

Focus

For those of you who read our reports daily, it might often feel like we are constantly repeating the same thing over and over again. But that's the discipline we need in order to stay focused on the task at hand. It's very easy to get distracted by the various geopolitical risks or supply outages that you forget the broader fundamental direction going forward.

Looking ahead, we laid out everything that needs to happen for prices to move higher. Supplies are headed lower, so demand needs to pull its weight. And if it does, then prices are going higher.