(Public) Emotions Run Wild As Oil Bulls Question Their Existence

Note: This article was first published to subscribers on Dec 1.

Ok, fine. The article title is probably an over-exaggeration, but it sure got your attention. In all seriousness, I'm seeing a lot of people question whether or not the OPEC+ cut thing is a good thing, then I see panic over the reported US oil production figures, and I can't type fast enough to calm some of those fears. So to be efficient, I will break this article into multiple parts.

US oil production

Supply & demand balance

OPEC+ production cut

Where the hell are we headed?

US oil production

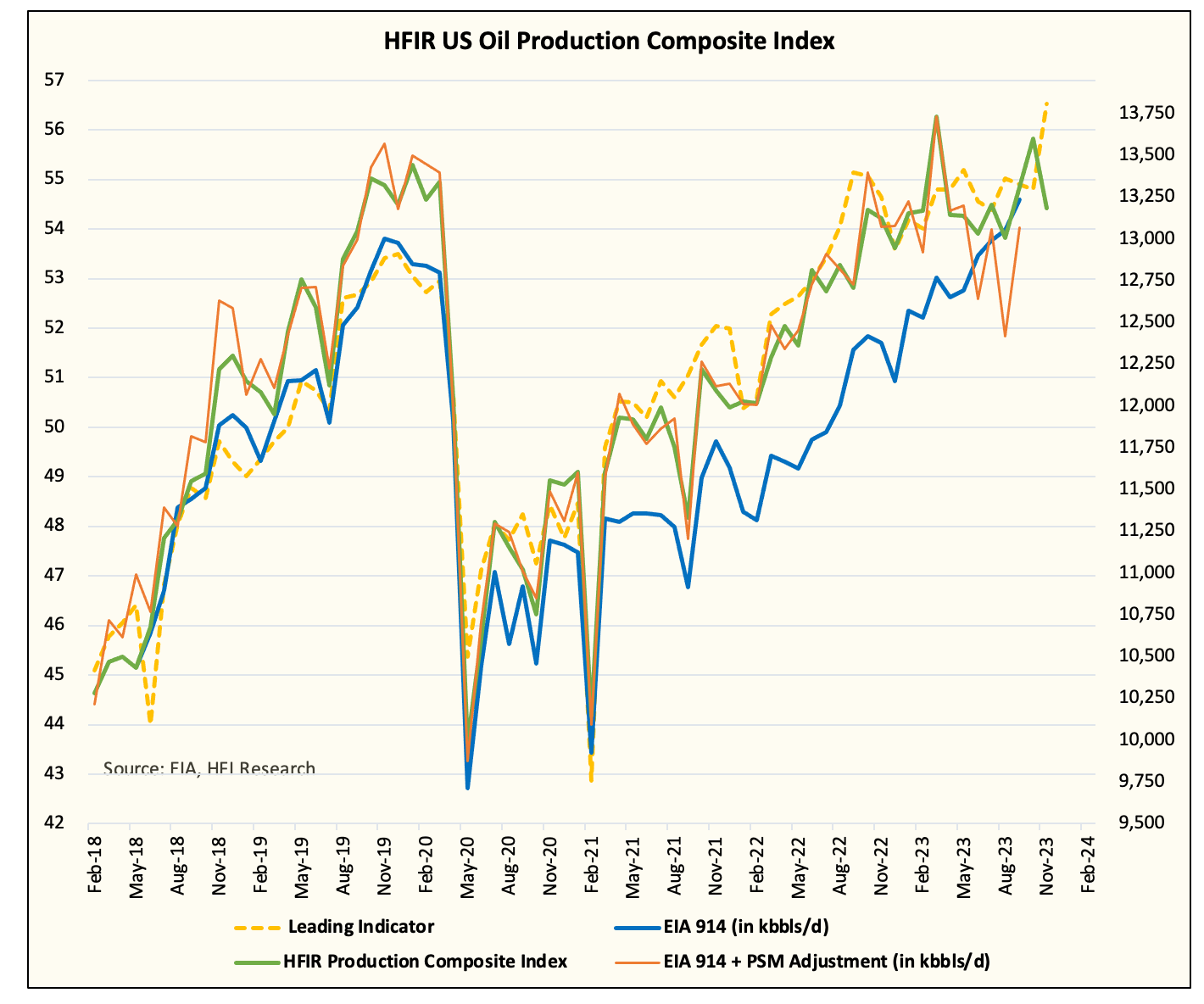

This is the easiest one to cover because we've been doing it for way too long. EIA's monthly oil production figure came out and to everyone's surprise, it's another month of growth. September US oil production was reported at 13.236 million b/d. But it's always the things in the finer details that you have to pay attention to. The adjustment factor, which has always been a consistent positive since the US shale revolution began, came in yet again at a negative. At -168k b/d, implied US oil production for September was 13.068 million b/d. Transfers to crude oil supply came in at ~725k b/d or consistent around the ~650 to ~750k b/d range. (For more info on transfers to crude oil supply, please read our US oil production-specific article.)

So was US oil production really 13.236 million b/d? No, it was 13.068 million b/d. EIA was successful in segmenting out the adjustment factor, but what it wasn't successful in (just yet) is differentiating what's crude production and what's not. As we wrote in our OMF, this will be resolved in March 2024 in EIA's phase 3 (of tackling the adjustment).

At 13.068 million b/d, US oil production has already exceeded what we expected at the start of the year (~12.9 million b/d). And looking at our real-time US oil production tracker, we have ~13.2 million b/d for November.

For readers, what you should readily expect is either EIA show a higher US oil production figure (higher than 13.2 million b/d) and show a similar negative adjustment figure, or EIA could show ~13.2 million b/d and show an adjustment coming in at zero. Either way, total supplies don't change.

Now is US oil production surprising to the upside? Yes, but to the point that warrants OPEC+ to announce another ~696k b/d cut? No, not at all (more on this later).

Our forecast shows US oil production will gradually fall in H1 2024. Our estimate shows US oil production falling back to ~12.8 to ~12.9 million b/d before growing to ~13.4 to ~13.5 million b/d by the end of 2024. After that we see production growth hitting ~13.7 million b/d in late 2025 before completely stalling out. We are ~500k b/d away from the permanent plateau.

So while US oil production on a marginal basis impacts global supply & demand, it is not the reason OPEC+ needs to cut again.

Supply & Demand Balance

Now looking at supply & demand balances, what exactly went wrong that required the extra production cut from OPEC+?

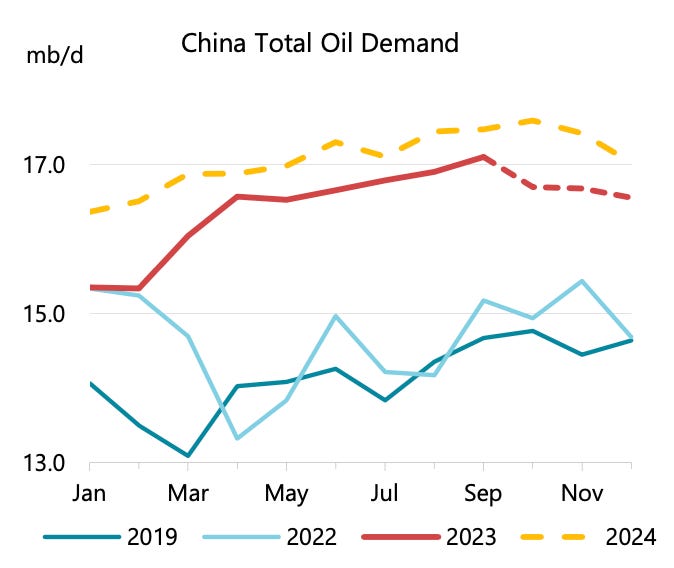

First, global oil demand growth is not as good as people think. IEA, notorious for its underestimation of global oil demand, may finally be overestimating global oil demand this year. IEA expected global oil demand to climb ~2.4 million b/d this year, but as we explained in our WCTW, "Swing Buyer vs Swing Producer." China's oil demand, which is expected to increase by 1.778 million b/d or nearly ~74% of global oil demand growth this year, is ~400k b/d overstated.

Source: IEA

India, which is marginally growing this year vs 2022, is also not growing enough to move the needle. Other countries in the non-OECD do not provide enough visibility to accurately gauge demand.

Source: IEA

As for OECD, 2023 demand was no better than 2022, so this leaves another black eye on the demand picture.

Source: IEA

In aggregate, demand growth this year was closer to ~1.5 to ~1.7 million b/d versus IEA's ~2.4 million b/d.

Now you couple that with IEA's estimate of non-OPEC+ production growth of ~1.7 million b/d (crude + NGL) and Iran pushing higher production by ~600k b/d, you get a scenario where the oil market would be in oversupply if it wasn't for the Saudi's voluntary production cut.

And if you look at total observable oil inventories, you can see that it is flat y-o-y.

In conclusion, this is what happened:

Demand is ~700k b/d to ~900k b/d below what IEA is estimating.

Supply-side surprises from Iran (+600k b/d), US (+250k b/d), and Brazil (+100k b/d) have pushed the total supply side higher by 950k b/d.

To offset the supply side surprise, Saudi's 1 million b/d voluntary cut does the job, but the demand side surprise will require others to step in.

OPEC+ Production Cut

Saudi worked its magic yet again. Thanks to Z4 Energy Research on Twitter, here's the compiled table for the Q1 voluntary cuts.

Source: Z4 Energy Research

As you can see, Iraq, UAE, and Kuwait will contribute a total cut of ~521k b/d. This is in line with what we expected in our OPEC+ article. As for the other producers, we think Oman will be good for the ~42k b/d it committed. Algeria's ~51k b/d is questionable alongside Kazakhstan's ~82k b/d. Russia has further committed to another ~200k b/d cut on fuel oil exports, but we would question the compliance rate on that.

In aggregate, I think the market should effectively price in Saudi, UAE, Kuwait, and Oman. This leaves it with an effective cut of 1.34 million b/d.

Now I'm not saying Russia or the others won't cut, but the compliance rate won't be 100% like the 4 producers we mentioned previously. So the market has every right to be skittish about those.

Assuming some level of cheating, we think an effective cut of ~1.5 million b/d makes sense, and if this is achieved, Q1 2024 balances should flip into a small deficit. This will also be dependent on weather, which will play a big role in heating demand.

Where the hell are we headed?

Rewinding to the title of this article, oil bulls seem to be questioning their very own existence. How can this be an oil bull market if OPEC+ has to keep cutting?

The question is a valid one, and I point you to demand. In any sustained oil bull market, demand has to be a key driver. While lagging supply is an important variable, growing demand is far more important. The outlook for 2024 will essentially be boiled down to one simple question again, what does demand look like?

And for the moment, the answer is not a comfortable one. Europe is already in recession, and elevated interest rates combined with a slowing US economy means that recession is coming near as well. While China is now starting to stimulate its economy and copper prices are showing signs of life, it's still too early to say that demand could surprise to the upside. The end result is that no one knows what demand will look like, and so in turn, the uncertainty is pushing a lot of people away from investing in energy stocks.

But in terms of oil market balance, we see 2024 as a constructive one. US oil production, while it did surprise to the upside this year, is expected to stall in 2024 with moderate growth. Non-OPEC growth is expected to slow to ~700k b/d, and there won't be another Iran to jump in with a +600k b/d surprise. For OPEC+, H2 2024 will provide ample room to unwind the voluntary cuts they have committed to. We see the Saudis unwinding the cut completely by the end of 2024 assuming at least 1.1 million b/d of demand growth.

In aggregate, we see a pathway forward. Oil price volatility should remain subdued (relative to historical standards). We see WTI averaging in the $80s throughout 2024 and Brent in the mid-$80s. We don't see a scenario just yet where oil prices eclipse the $90s for a sustained period of time and make a move to $100. Only if demand surprises to the upside will we see prices spike, but even in that scenario, China will flex its muscles as the swing buyer.

As a result, readers should expect a rangebound market. For energy equities, stable prices in the $80s will present a great time to keep paying down debt and reward shareholders (dividends & share buybacks). We think you should remain invested and add to your favorite names on weakness.

So no, you shouldn't question your existence, and focus on what you can focus on.