(Public) Geopolitical Tensions Back In Focus, But Trump's Hatred For High Oil Prices Runs Deep

Editor’s Note: This article was first published to HFI Research paying subscribers on June 12, 2025. Since then, the geopolitical chaos has played out, and we have unloaded our UCO position along with a meaningful portion of our energy stock portfolio. This article should help explain the framework for understanding the oil market.

Here we go again. Geopolitical tensions are back in play, which has prompted a lot of tourists to think that World War 3 is on the horizon. And while some argue that there's nothing the US can do this time to stop Israel from attacking Iran, history suggests otherwise.

Instead of speculating on whether an attack will or will not happen, we need to focus on the things we know:

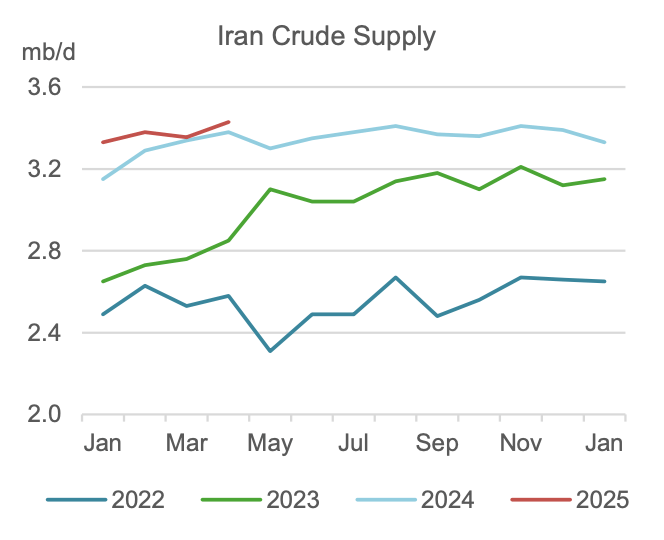

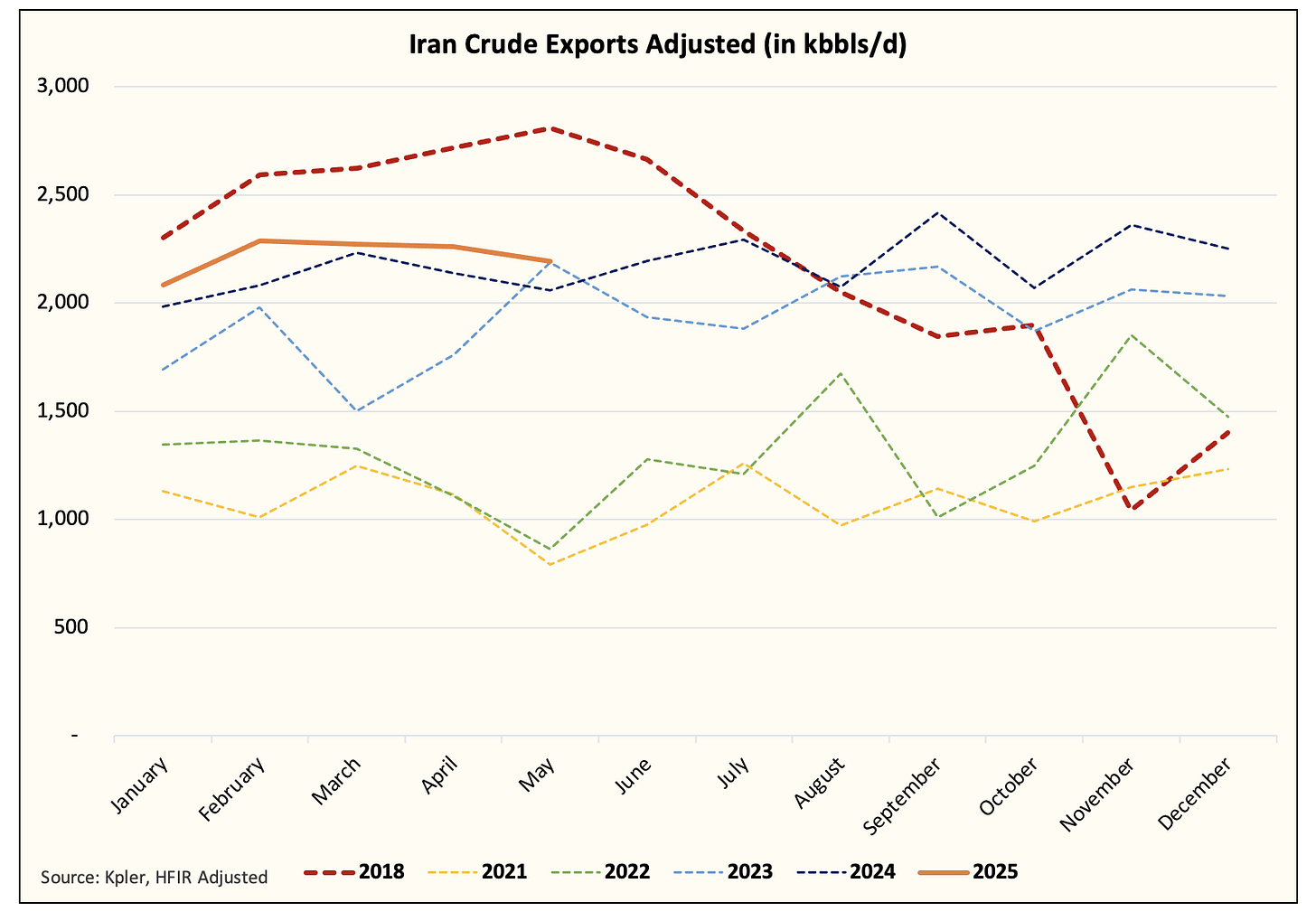

Iranian crude oil production is near a multi-year high.

Iranian crude exports (adjusted for Malaysia) average around ~2.2 million b/d.

Whether the US and Iran agree to a nuclear deal or not will have no impact on the global oil market fundamentals. Iran has been producing near maximum capacity and selling oil near maximum capacity. This means that any geopolitical conflicts that increase the probability of supply disruptions are asymmetrically skewed to the downside (i.e., supply loss).

The third point is the most important to understand when analyzing the oil market. Given that Iran is already doing everything it can to sell oil to the market, any increase in conflict increases the probability of supply disruptions, which increases the price of oil.

It doesn't matter if it actually results in a supply loss or not; it's just the remote possibility of a significant supply loss that will keep oil prices elevated... for now.

The Contradiction

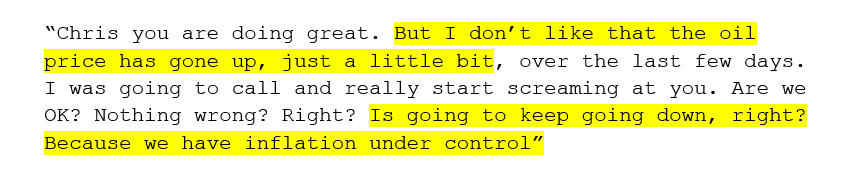

But as geopolitical conflicts fuel oil prices higher, another variable comes into play: Trump's hatred for high oil prices.

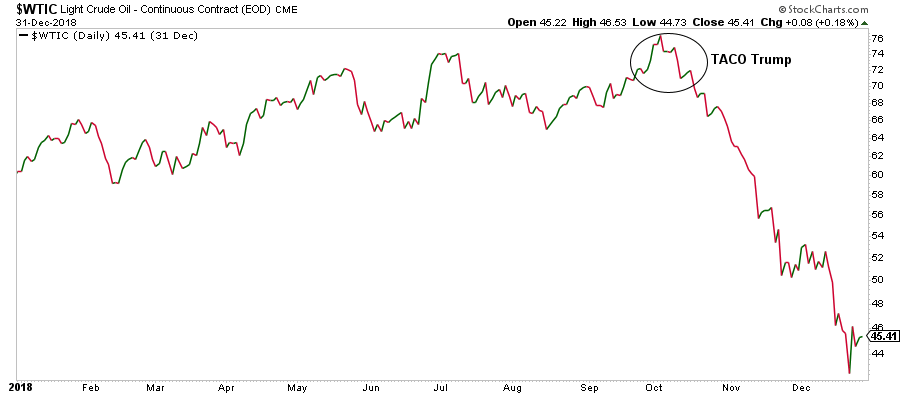

Many of the energy specialists may recall the 2018 to 2019 debacle. Trump gave waivers just days before the Iranian sanctions were supposed to be enforced. He looked at Brent surpassing $80/bbl and decided he would issue waivers to prevent prices from climbing higher, which subsequently resulted in prices crashing straight down after.

Just today, Trump made a notable comment to Energy Secretary Chris Wright about higher oil prices. Here's what he said:

Source: Javier Blas

These remarks came after Chris Wright publicly stated that he did not think US crude oil production would head lower in 2026.

The fact is that all of this is just a giant contradiction.

Similar to the complete misunderstanding of trade, Trump has an inherent bias towards lower oil prices that can't be explained by logic. Facts don't matter in this case, and it doesn't matter that US shale producers need at least $70/bbl to keep production flat. All that matters is what he perceives to be a "low enough" oil price environment, and the messaging will continue to be bearish.

What is that price, you ask?

It's around $40 to $45/bbl WTI.

How do you get this figure? All you have to do is look at his comments on oil back in 2018 and 2019 to figure that range out. Dr. Anas Alhajji has documented this in detail in the past, and we suggest you read his reports for more color.

And because of Trump's deep hatred for higher oil prices, the geopolitical turmoil between Israel and Iran becomes harder to analyze. As I stated earlier in the article, any possibility of supply disruption will keep oil prices elevated, while a de-escalation would push prices back down.

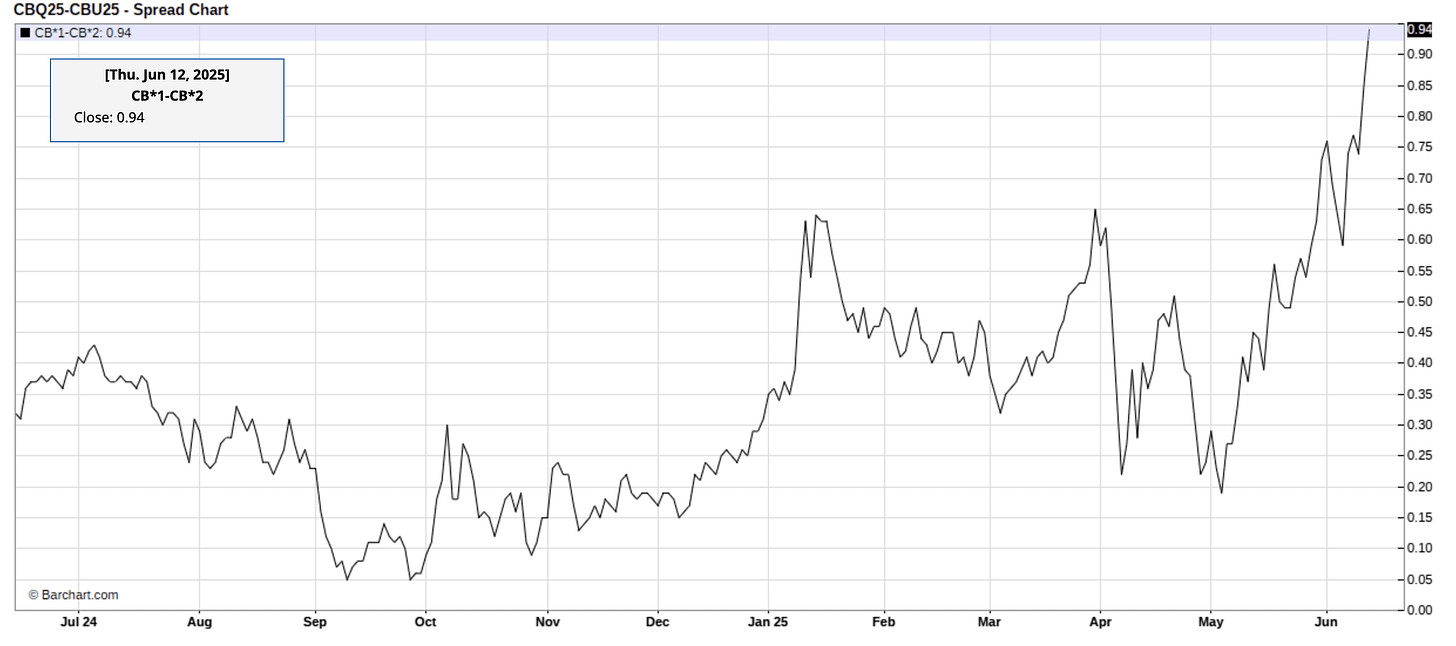

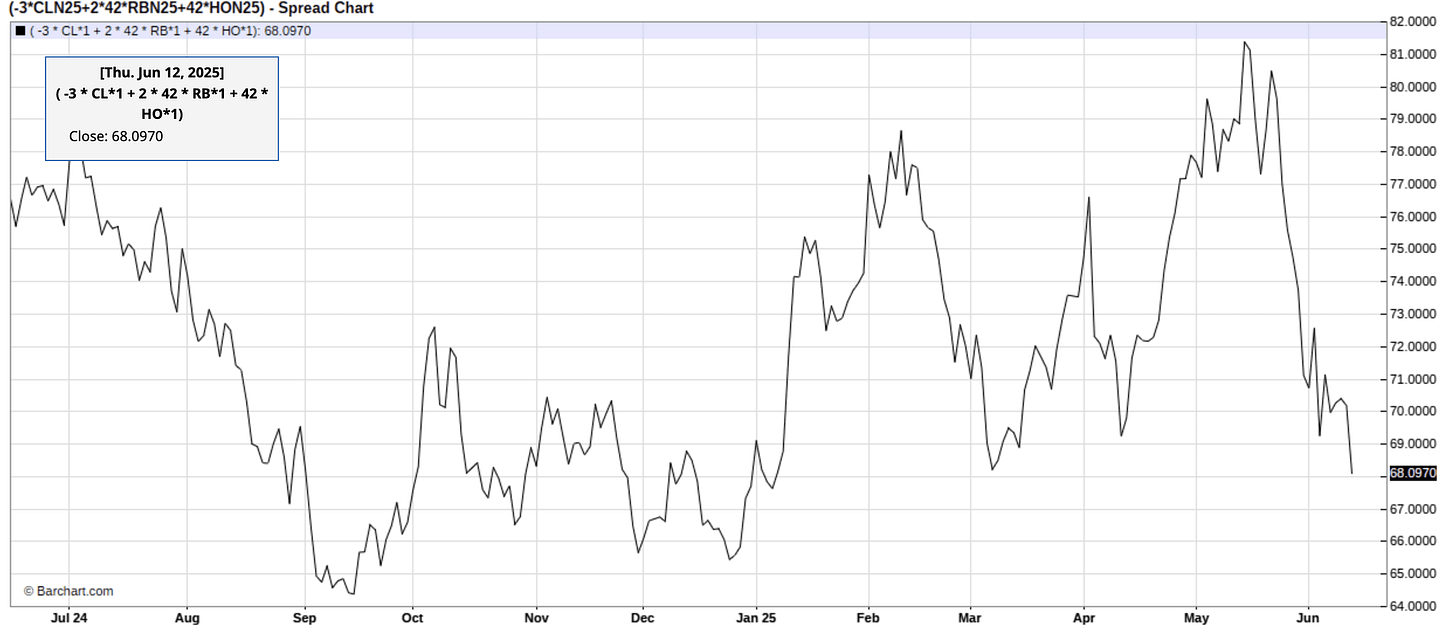

Now, if we look at the physical oil market signals, we can clearly see that the market is pricing in the potential of a supply disruption in crude.

But the drop in refining margins is an early indication that the recent rally is unsustainable.

This means that any sign of de-escalation and WTI will be back into the low to mid-$60s.

My Take

In April 2024, we had a similar situation unfold between Israel and Iran. The biggest difference this time around is that Israel is demanding to strike Iran's nuclear facilities. In my view, this will materially escalate tensions, and this is something Trump will want to avoid at all costs.

This is why we are seeing diplomatic measures taking place with this Sunday's meeting. But if you look at all of this from Iran's angle, you can't help but wonder how this unfolds in favor of de-escalation.

Israel is preparing to attack Iran's nuclear facilities, and the US is saying that if you don't agree to our terms, Israel will attack. How does that sit well with the Iranians?

I don't know, but this certainly doesn't feel like the same situation we've seen from the past. Now couple that with OPEC+ already increasing production ahead of this and it makes you think the US is preparing for the worst case scenario: escalation.

On one hand, we know with certainty that Trump hates high oil prices, but on the other, we know Iran is already producing at max. The asymmetric payoff here is that if things worsen, the probability of supply loss greatly outweighs the probability of no change.

So, how high could oil prices go in the event of further escalation?

My view is that it can move to $75 to $80 Brent.

And to hold that level, we would need to see a meaningful decrease in Iranian crude supplies. I don't think that as a high probability event, as I think the US will dissuade Israel from attacking Iranian oil facilities.

As a result, my guess is that oil prices will pop initially before moving lower. This will allow us to unload more energy equities and our long UCO position.

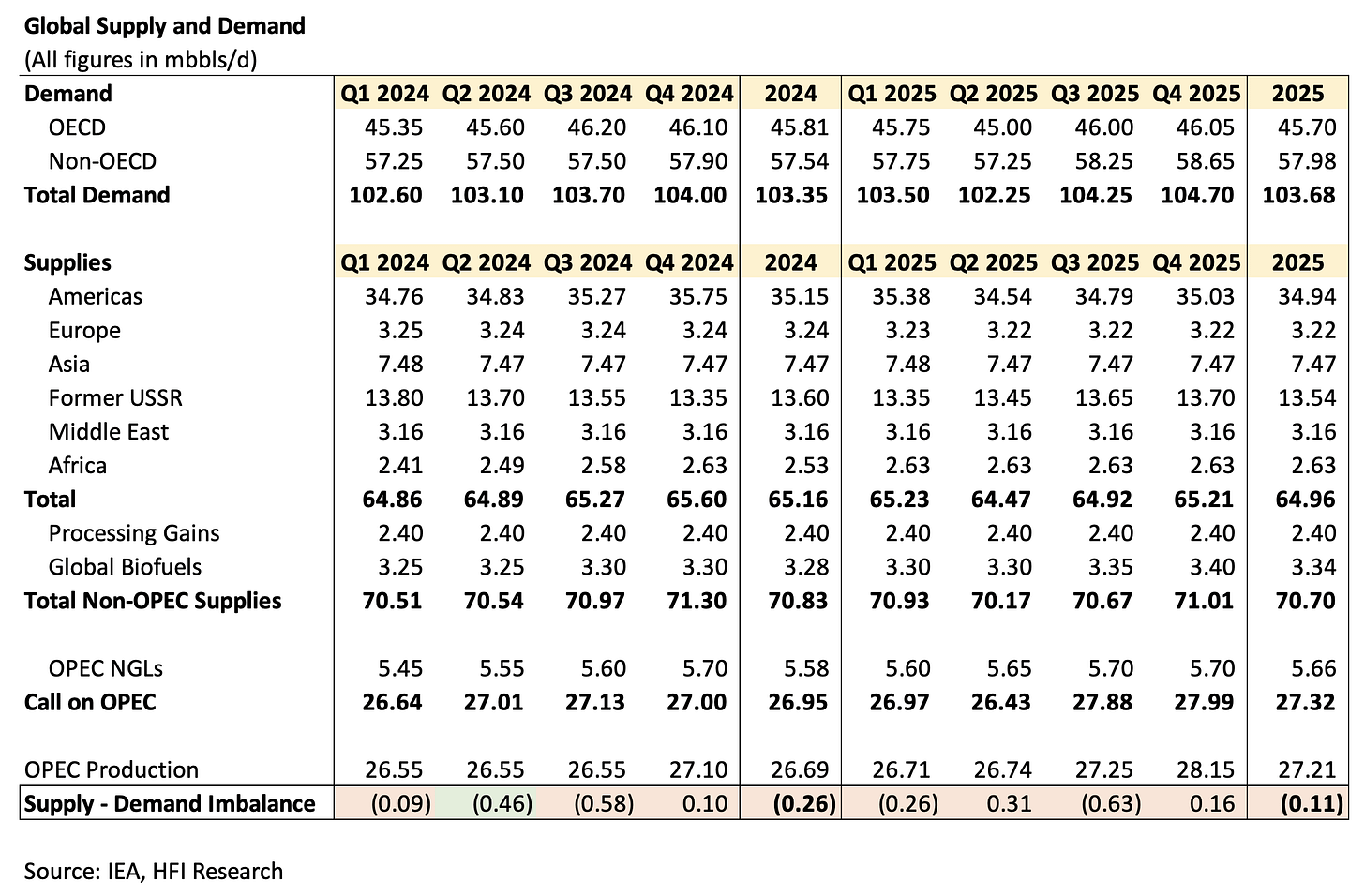

Impact on Global Oil Supply & Demand

The math is the easy part.

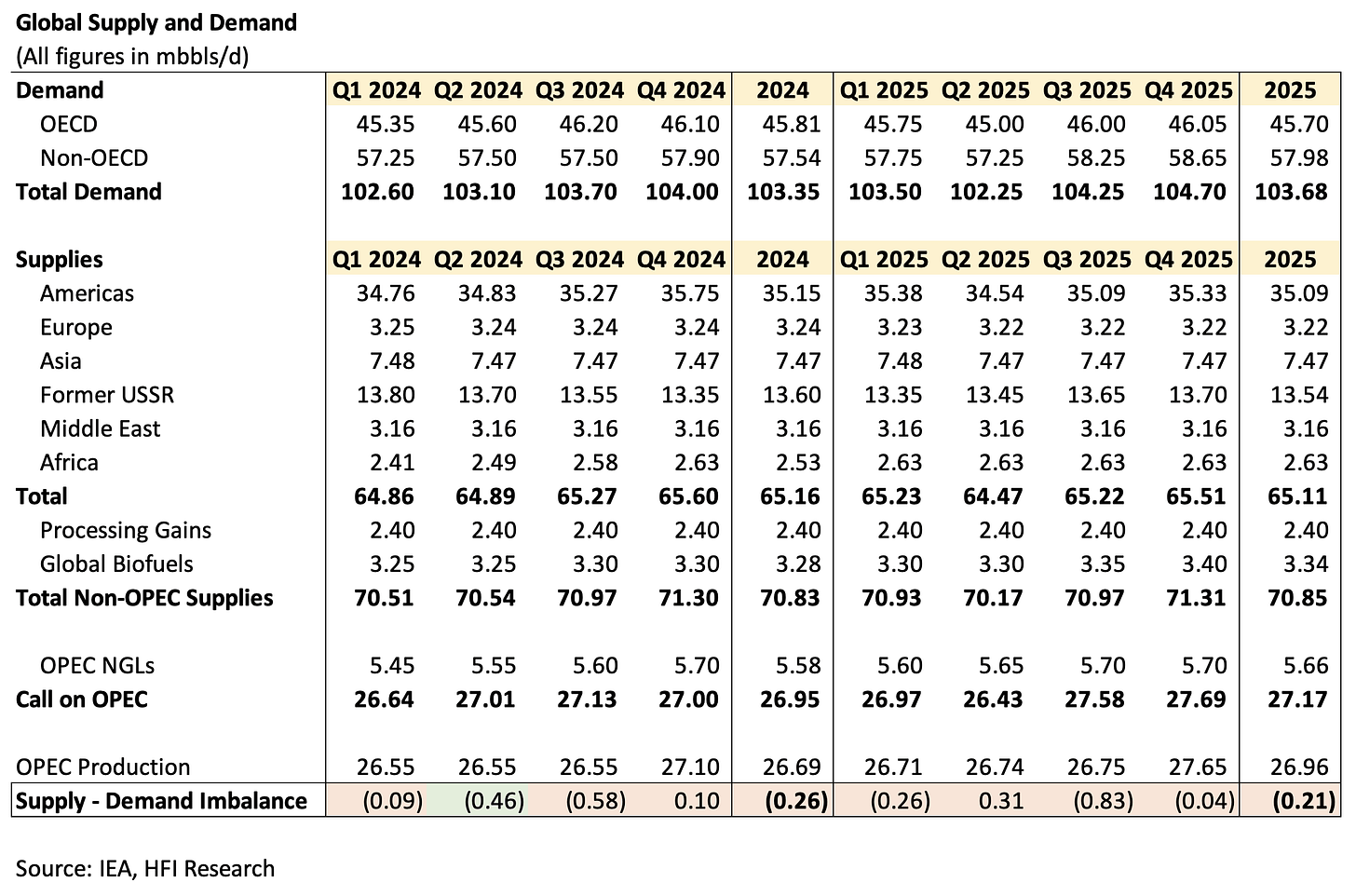

In the event that Iran loses ~1 million b/d, and WTI averages $70/bbl, this is what global oil supply & demand looks like.

Keep in mind that under ~$70/bbl WTI, US crude oil production will remain flat at ~13.1 million b/d.

Scenario 1:

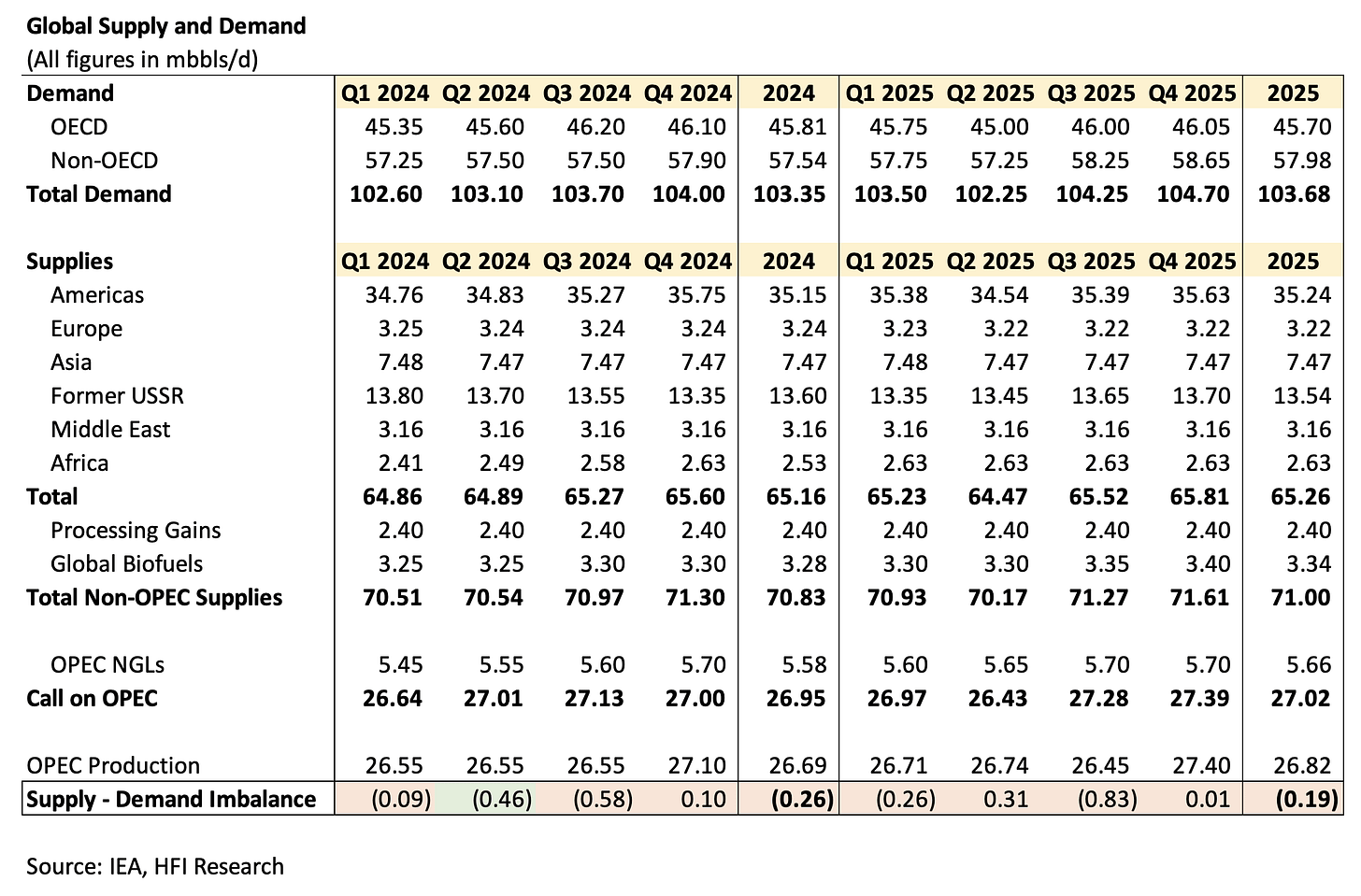

In the event that Iran loses ~1.5 million b/d (back to late 2019 levels), and WTI averages $75/bbl, this is what global supply & demand looks like.

Keep in mind that the Saudis will likely increase production to 10.5 million b/d, and US crude oil production will recover to ~13.35 million b/d.

Scenario 2:

Finally, we could have a scenario where Iran only loses ~0.5 million b/d and WTI averages ~$65/bbl.

This would keep US crude oil production around ~12.85 million b/d.

As you can see, in all 3 scenarios, Q3 balances will be steeply in the deficit, followed by a more muted Q4 balance.

This is why even in the event of further escalation, the upside in oil will be limited, given the 1) uncertainty over demand and 2) Saudi and US response.

Using these scenarios as your framework, you can see why we would opt to reduce our energy holdings exposure if there is an increase in escalation.

Conclusion

Trump's hatred for high oil prices runs deep, so any geopolitical conflicts will likely result in no changes to oil market fundamentals.

In the event of further escalation, we will use the price run-up to reduce our energy holdings and sell off our UCO position.

From a fundamental standpoint, any real supply disruptions will be offset by an increase in Saudi production and the US shale's response to higher prices.

We hope this article gives you a better framework for understanding the incoming geopolitical conflicts between Israel and Iran.