(Public) Global Oil-On-Water Never Was And Never Will Be A Leading Indicator For The Oil Market

People familiar with our writing should be aware that we are not oil bulls, at least not at present. In fact, we are 35% net short in our portfolio (our last update).

With this context out of the way, global oil-on-water has never been and never will be a leading indicator for oil prices.

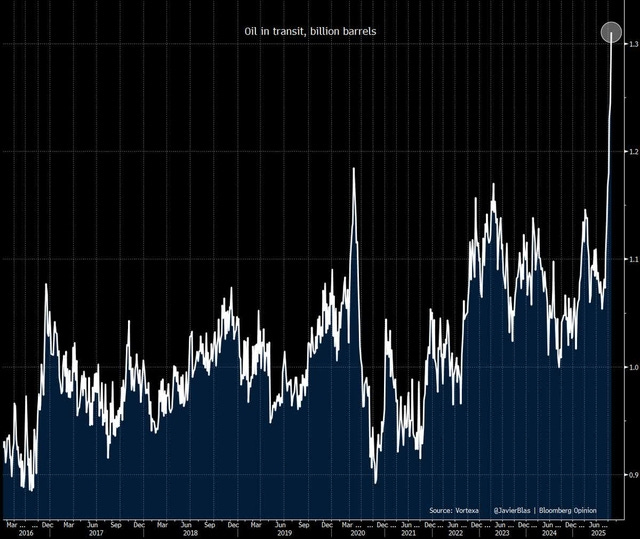

Why am I saying that? Because of this chart that’s circulating on X.

Source: Bloomberg, Javier Blas

Here are the reasons why:

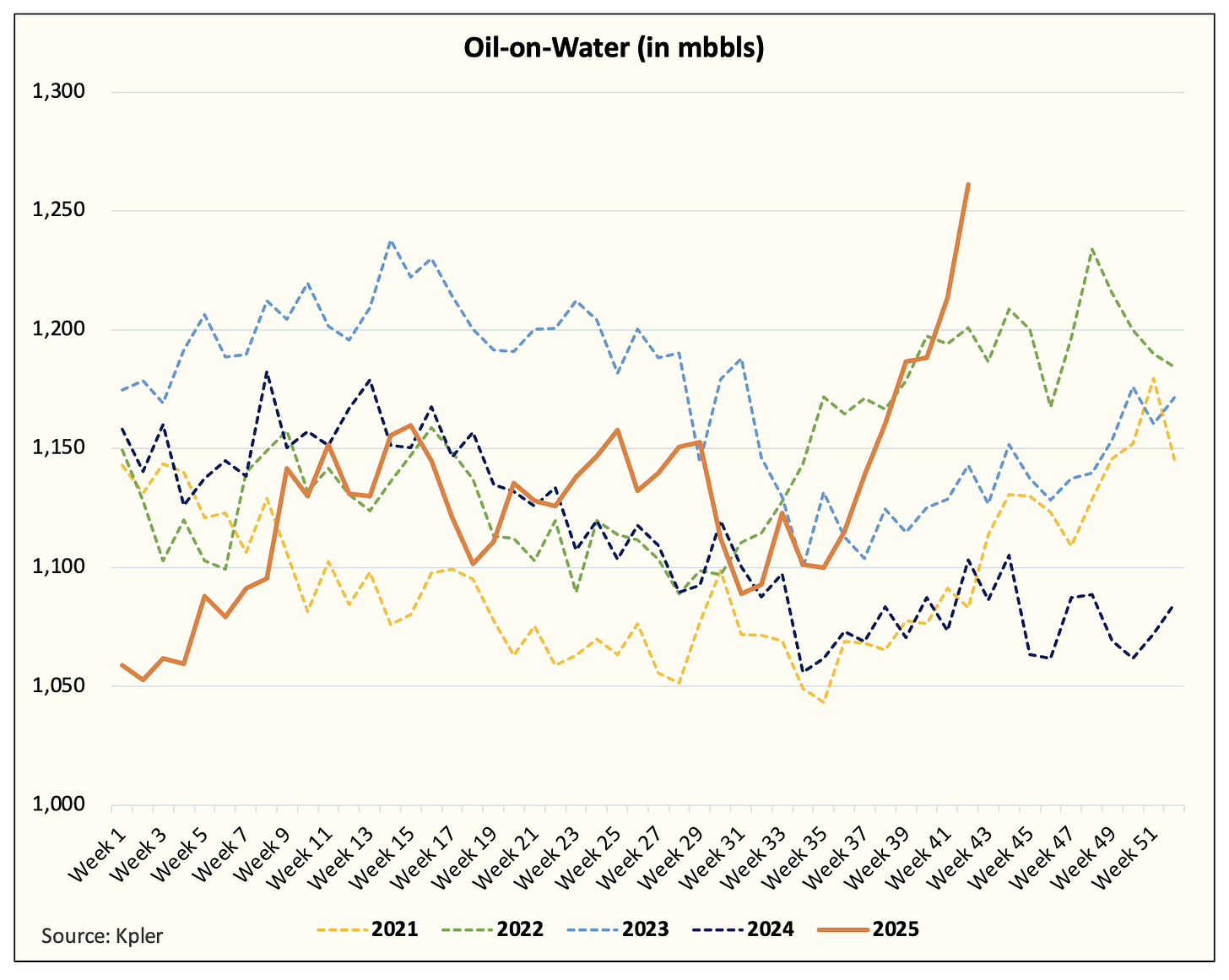

Data quality is a serious problem. Oil-on-water typically gets revised retroactively without any warning. How so? That chart you see from Vortexa? Well, Kpler is showing something similar, but the magnitude is nowhere near the level of increase.

Why?

Because the data is subject to change even years in advance. This is because you need to understand how the data is derived.

Tanker tracking companies use algos to guess how much crude is in each tanker. There’s no hard evidence to show how much crude is being loaded on each tanker. This is especially true of real-time data. The most recent data is subject to the most changes, and without concrete evidence of a persistent increase, it’s hard to determine the magnitude of the change relative to before.

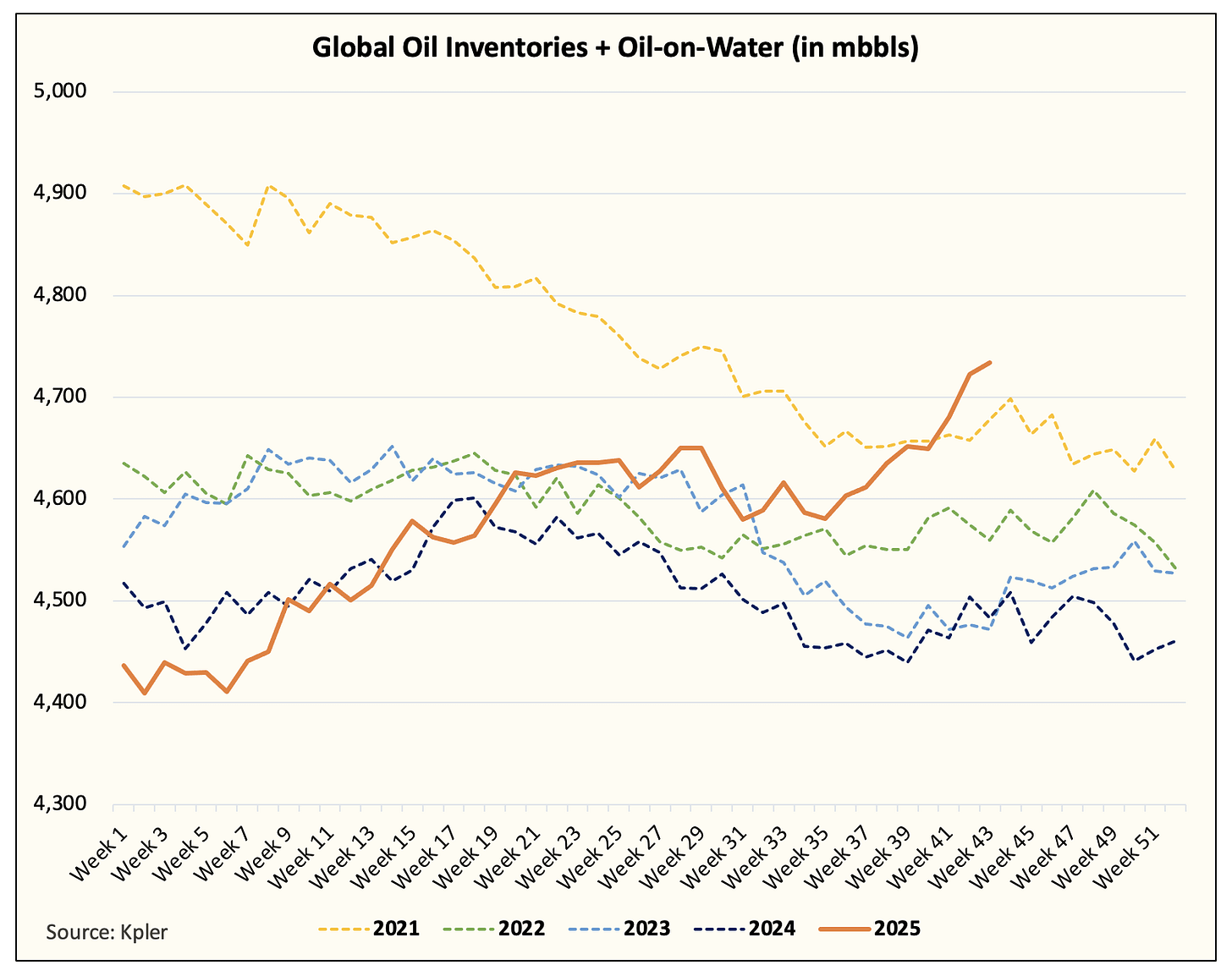

Oil-on-water on its own doesn’t provide context. There could be shipping delays, timing issues, etc, that cause a temporary bump on oil-on-water, while global onshore crude inventories fall. In this case, global oil inventories are building, but the size of the builds is nowhere near what the chart appears to be illustrating.

With that said, nothing we are saying here suggests that global oil inventories won’t build. They are, and the pace of the builds is likely to accelerate into year-end.

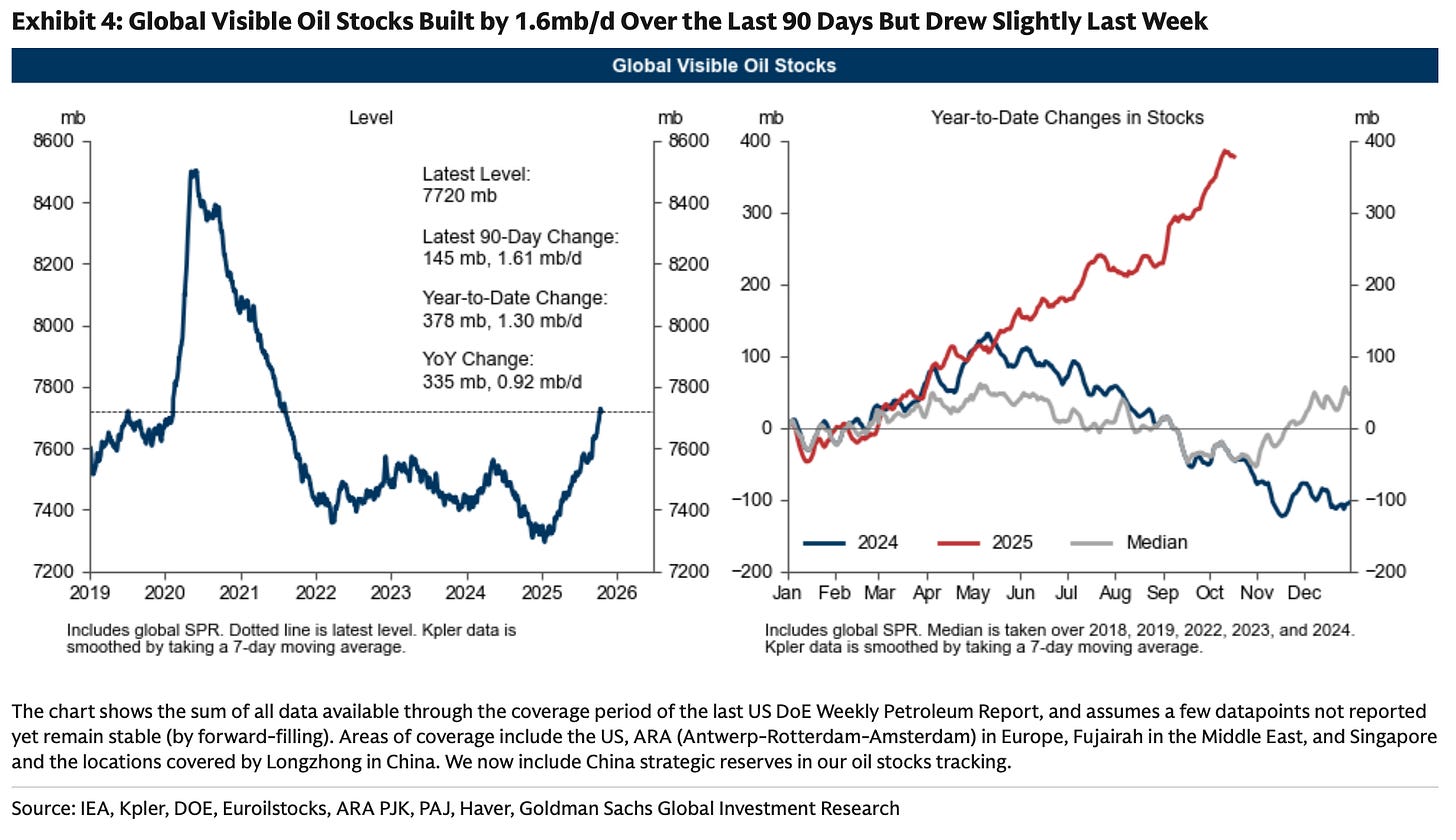

In Goldman’s latest update, you can see that global visible oil inventories were on pace to build over ~1.6 million b/d over the last 90 days. Add on top the issue that our real-time US crude oil production data is still well above ~13.8 million b/d, and you have an oil market that’s headed for a temporary glut.

Physical Oil Market

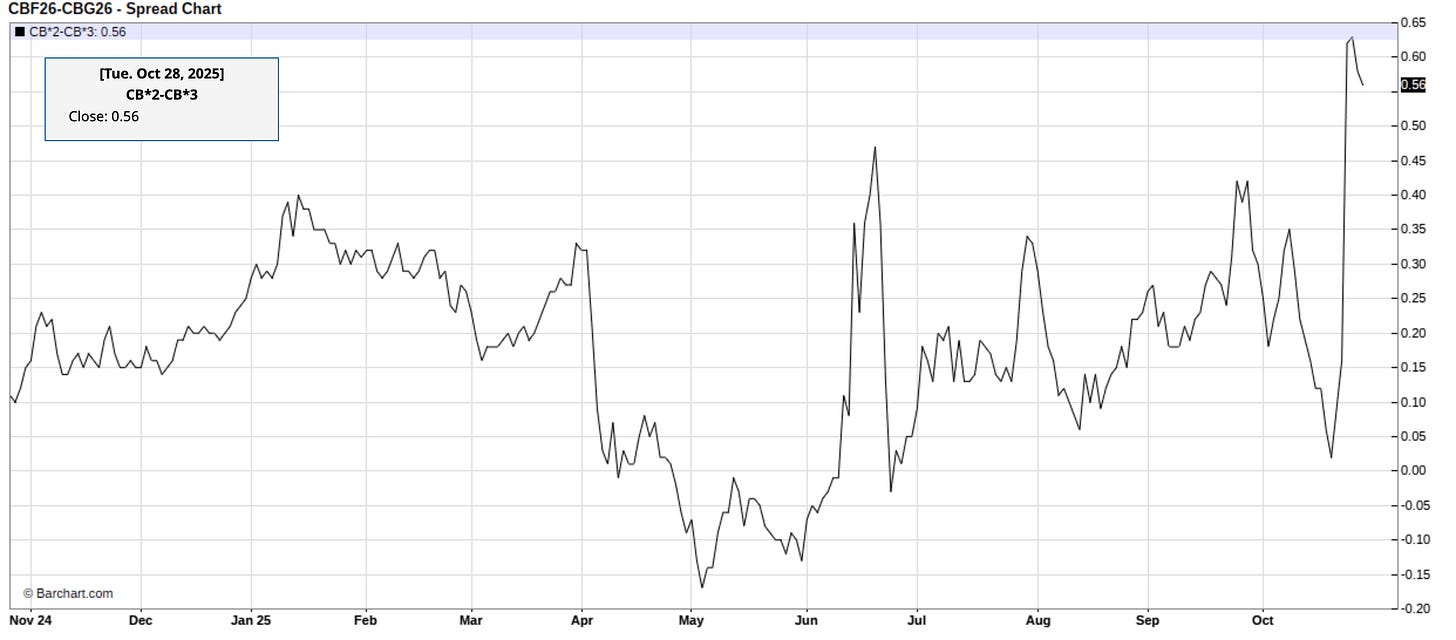

Instead of focusing on something like oil-on-water, which is subject to frequent changes, we urge readers to keep watching timespreads.

The Brent 2-3 timespread was about to fall into contango last week before Trump’s Russian sanction announcement jolted the market higher.

But the fact that the market was slowly drifting towards contango tells you everything you need to know about the state of the oil market. There is oversupply coming, but if that oil-on-water chart’s parabolic rise was real in magnitude, we would have seen much steeper contango. So the fact that the market is telling you it’s not should give you the signal you need.

As the sanction impacts playout in the market, readers should be aware of the following:

Sanctions don’t work, especially if they don’t target China. Russian oil companies will find ways around it, just like the Iranians have. If that means longer transit time and cheaper crude for China, then so be it.

Tanker stocks will benefit from the higher crude export flows we are seeing out of OPEC+. If Russian sanctions require more ship-to-ship transfers, then tanker rates should continue to benefit.

In essence, follow crude timespreads. If they start to weaken back into a contango despite the sanction announcements, then you know global oil market balance is weak, and lower oil prices are coming.

Conclusion

Oil-on-water has never been and never will be a leading indicator. The data is subject to a lot of retroactive revisions that make it almost unusable. The same could be said of satellite onshore crude oil inventories. The issue with these third-party provider data is that they are only useful in offering a snapshot of where the market is at (i.e., the general trend). They are not useful in determining the specifics.

In this case, the parabolic increase is likely an exaggeration, but the reality is that global oil market balances in Q4 are headed for a surplus. Readers should be skeptical of the size of the increase, but be aware that builds are coming.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.