(Public) Hemisphere Energy - One Of Our Favorite Names

By: Jon Costello

Note: Dollar references in this article are to Canadian dollars unless specified otherwise.

Hemisphere Energy (HME:CA) is a small gem among Canadian E&P. As one of the few remaining junior Canadian oil producers, it generates unusually high cash returns for shareholders. Its superior economics stem from its use of polymer floods as an enhanced recovery technique. These polymer floods increase the amount of oil recovered for the least amount of capital. They reduce ongoing operating and capital costs and maximize free cash flow generation.

With its stock currently at depressed levels, HME’s high free cash flow yield and free cash flow growth at higher oil prices make it one of the most attractive long-term buys in our entire energy sector coverage universe.

Polymer Floods Drive Superior Economics

HME’s polymer flooded wells are characterized by low production decline rates. They enable the company to keep production flat at relatively low cost. HME’s decline rates compare favorably with those of most other E&Ps, as shown in the following graphic.

Source: Hemisphere Energy Feb. 2024 Investor Presentation.

HME is able to use polymer floods because it operates in high-quality reservoirs. It owns 100% of its operated acreage in the Upper Mannville F&G pools. The polymer floods generate minimal associated natural gas, so HME’s production mix benefits from being 99% heavy crude oil.

The company drills low-cost horizontal wells, which typically cost approximately $1 million. By contrast, the typical hydraulically fractured shale well typically costs more than $6 million.

HME’s wells produce small volumes—anywhere from 60 to 100 barrels of oil per day—for a few years. Then, to increase output, the company injects polymers into the wells to displace heavy crude and push it toward the surface. The process causes the wells to decline by 0% to 5% annually. In fact, some of HME’s wells produce more oil after undergoing polymer flood than they did when they first began producing. Consider that conventional vertical wells decline on average by more than double that rate, while hydraulically fractured shale wells decline by as much as 70% in their first year of production.

The low decline rates enable the company to sustain production for relatively little capital investment. For example, management estimates HME’s existing 12.2 million barrels of proved reserves can be produced for $29 million, lower on a per-barrel basis than nearly every other E&P we’re aware of. The result is a high return on capital and huge free cash flow that can be allocated to shareholders through dividends and share repurchases.

These economics provide HME with a low-cost production base that confers a sustainable competitive advantage. It can thrive at low oil prices that would cause most other E&Ps to throttle back their production.

Abundant Cash Flow

HME’s favorable economics allow it to generate massive amounts of free cash flow. Low operating costs result in a high operating netback, totaling $52 per barrel at US$80 per barrel WTI. The cash flow increases with higher oil prices, as shown in the table below.

We estimate that HME generates free cash flow down to US$54 per barrel WTI without hedges. Our estimates include the entirety of HME’s 2024 capital budget. Due to its low decline rate, if oil prices remain depressed, it can halt the drilling of new wells and maintain production around current levels, minimizing financial risk for shareholders during inevitable oil-market downturns.

HME’s free cash flow has been allocated well by management. HME has paid an annual base dividend of $0.10 since the second quarter of 2022. The dividend generates a 7.1% yield on the current $1.40 stock price. HME has also routinely repurchased shares over the past two years. Its capital allocation over recent quarters is shown below.

HME paid its first special dividend on November 1, 2023. It paid out $3.2 million of the $5.2 million of cash it held at the end of the third quarter.

Clearly, the company’s robust cash flow generation limits risks while increasing income and capital appreciation return prospects.

HME’s Stock is Cheap

HME’s shares should trade at a premium multiple in light of its powerful economic model. However, they actually trade at a significant discount to intrinsic value and free cash flow generation prospects.

At US$80 per barrel WTI, we estimate HME generates an 18.0% free cash flow yield on its $1.40 stock price, a significantly higher yield than other companies in our coverage universe. At US$80 per barrel WTI, free cash flow amounts to $0.25 per share, well in excess of its $0.10 annual dividend.

Free cash flow in 2024 will be greater than 2023 due to higher production, which management expects to average 3,400 boe/d. However, this will be partly offset by higher cash taxes and additional capex allocated toward exploration and associated development.

At higher oil prices, HME will generate cash flow well in excess of its dividend. We expect excess cash flow to be returned to shareholders through dividends and repurchases. The following table illustrates the potential for additional dividends and share repurchases at higher oil prices.

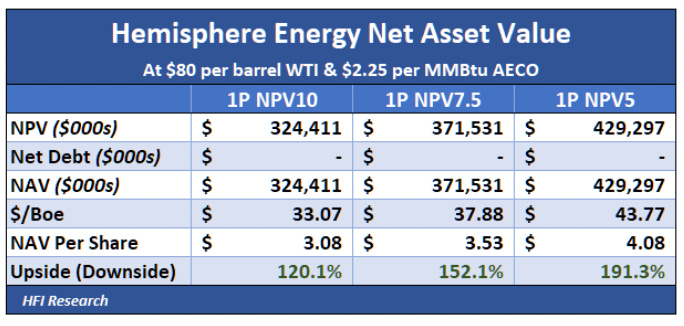

Using HME’s proved reserves discounted at 10%, we estimate its net asset value at US$80 per barrel WTI and $2.25 per MMBtu AECO to be $3.08 per share, implying 120.1% upside from the current price of $1.40.

If we value the proved reserves using US$70 per barrel WTI instead, HME’s net asset value is $2.49 per share, implying 78.1% upside. At US$90 per barrel WTI, net asset value grows to $3.67 per share, implying 162% upside.

Management has guided to flat production on legacy acreage after 2024. Consequently, HME’s free cash flow generation will depend on continued operational execution and oil prices. Its dividend is covered by free cash flow down to US$64.50 per barrel WTI, so at anything above that level, shareholders will benefit from the distribution of free cash flow.

An Upside Kicker

HME’s reserve life at its estimated 2024 production rate extends for ten years, according to its 2022 reserve report. However, management is looking to find and develop new acreage in which it can use its polymer flood enhanced recovery techniques.

As of year-end 2022, HME held 6,248 developed acres out of its total leased acreage of 28,847 acres, implying significant potential for additional discoveries, extensions, and development.

Over the past few months, the company spent $1.5 million leasing new undeveloped land in Saskatchewan. This acreage is separate from the acreage figures cited above. Management believes the land has significant oil in place and that HME’s polymer flood techniques could recover substantial quantities. HME has a pilot project planned for 2024 to gauge the prospectivity of the new acreage. The spending is accounted for in management’s capex guidance.

Any material and economic discovery would extend HME’s reserve life and increase the company’s net asset value, which would likely result in greater value per share for its shareholders.

Risks to Our Bullish Outlook

HME is prone to the usual risks that apply to E&Ps, such as losses stemming from a sustained bout of low oil prices. But its low-cost status puts it at substantially lower risk than virtually any other E&P we know of.

The foremost risk for HME shareholders stems from management using the company’s abundant cash flow to acquire a property or company with inferior economics. Doing so could increase its operating costs and/or capital intensity per barrel, which would reduce free cash flow returns for shareholders. If the company took on debt, it would be required to hedge some of its production, which could reduce free cash flow and limit the upside in the shares.

Other risks include lapses in management’s execution or its inability to find new acreage on which it can perform polymer flood techniques.

Fortunately, management is incentivized to act in shareholders’ interest due to its 15% ownership of HME’s common shares. This incentive reduces the risk of dumb capital allocation decisions.

Conclusion

We consider the risk/reward proposition offered by HME shares to be more attractive than any other E&P at this time. Shareholders are cautioned to accumulate shares slowly to prevent running up the share price. If our longer-term expectation for higher oil prices plays out, investors who can buy and hold HME shares from current levels will be rewarded for many years.

Analyst's Disclosure: I/we have a beneficial long position in the shares of HME:CA either through stock ownership, options, or other derivatives.