IEA published its latest 2030 outlook yesterday, and I don't even know where to start. The big headline from the IEA medium-term outlook is that global oil demand will peak by 2030, and oil producers are going to face a surplus as large as ~8 million b/d thanks to Electric Vehicle and the energy transition movement.

Source: IEA

For energy investors, this is the greatest confirmation signal you needed. As a golden rule in energy investing, we've learned that fading the IEA has almost always worked. Who remembers IEA's famous call in March 2022 for Russia to lose ~3 million b/d of oil production following the Ukraine invasion?

We remember, and at the time, we published a piece cautioning those following IEA's prediction. In addition, we also tweeted at the time the following:

Source: HFI Research

With the benefit of hindsight, Russia lost zero barrels, and we ended up being wrong about the 400k b/d to 600k b/d export loss as well.

Nonetheless, the point of this article is to look at the rationale behind IEA's massive surplus estimate. There are some notable bullish figures in these charts as well disguised behind the hideous demand estimates.

Let's get started.

Delusion

Since the birth of the industrial revolution, there's been a close correlation between oil demand growth and GDP growth. As emerging countries become developed countries over time, energy intensity decreases, so the relative pace of growth slows, but the relationship remains intact.

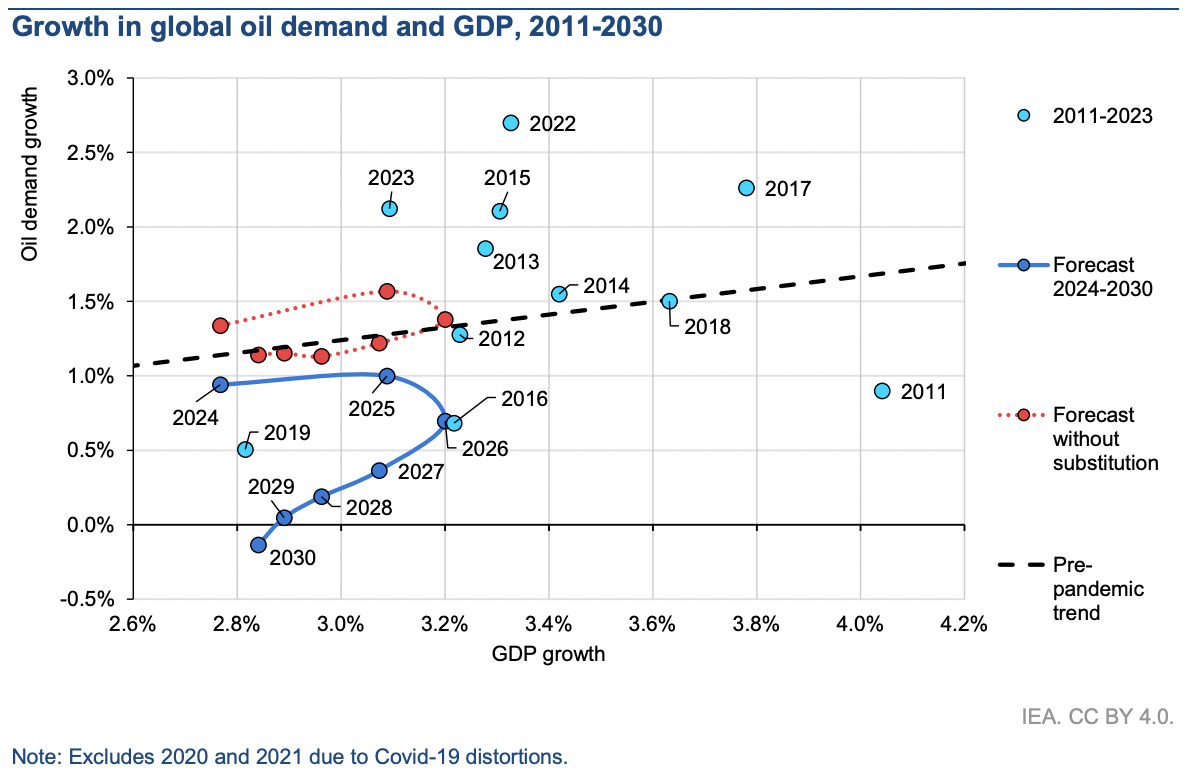

With that said, IEA's latest outlook appears to show a complete disconnect between GDP growth and oil demand growth.

You can see in the above chart from the IEA report the relationship between global oil demand and GDP from 2024 to 2030. Not only is it far from the historical norm, but IEA appears to believe that it will go into the negative. Here is the more detailed growth figures:

You can see that by 2026, the growth stalls to +0.7 million b/d, followed by +0.4 million b/d, +0.2 million b/d, and 0 million b/d.

In aggregate, IEA expects OECD America, Europe, and Asia Oceania to contribute to a demand loss of ~2.7 million b/d.

And almost all of the entirety of the demand loss comes from this chart:

This analysis is so far from reality, you do have to wonder just what is the thinking behind publishing an analysis like this.

Let's take Norway as an example as electric vehicle sales as a percentage of vehicle mix last year hit ~90%. This is by far the easiest country to follow to gauge the impact on gasoline and oil demand. And surprise, surprise, Norway's oil demand remains stuck around ~200k b/d with gasoline taking ~60 to ~70k b/d of the mix. While Norway's gasoline consumption has dropped ~10% from 2017, the decrease has not been material.

Even assuming the same electric vehicle penetration rate in the US (~90%), it would displace ~10% of gasoline demand, which equates to ~800k b/d, a far cry from the ~1.5 million b/d assumed.

What's crazy to think about in IEA's demand analysis is that it would require EVs to not only take a dominant market share of total vehicles sold every year (at least 80%+), but it would also require at least 20-25% of the cars on the road to be electric for such a large demand displacement to occur.

Both of these scenarios are so far from reality, once again, you have to wonder what potent narcotics the IEA is consuming to derive an analysis like this.

Sleepwalking the world into a crisis...

IEA was founded on the principle of preventing another energy crisis on the horizon. At least that was the founding mission, the new one appears to be one peddling the energy transition. But as with anything in life, there's a balanced way to doing it. As all policymakers should know, grasping reality is far more important than political motivation, and the idea that global oil demand will peak by 2030 just couldn't be further from the truth. Instead, IEA warned in its report to all oil producers the following:

This report’s projections, based on the latest data, show a major supply surplus emerging this decade, suggesting that oil companies may want to make sure their business strategies and plans are prepared for the changes taking place.

In other words, "Dear oil companies, please don't invest anymore. We don't need your oil."

Not only is the messaging twisted beyond belief, but I especially like the part where IEA Executive Director Fatih Birol emphasized that the projections were based on the "latest data." There's nothing factual about this report, so the irony is that it's biased from the onset.

For those of you who think IEA doesn't have the power to sway oil companies, I sadly have a differing view from you. IEA influences the capital markets, and the capital markets will continue to restrict capital flow to oil companies, which will restrict their abilities to invest in capital. So by promoting the idea that oil demand is peaking, IEA is inadvertently walking the world into an energy crisis.

The very mission it was founded upon will come back to haunt those very words from Fatih Birol. Irony is a hell of a thing, and this one is no different.

But wait, there's more...

If you are willing to overlook the disgusting, twisted, and biased part of the IEA report, you will find nuggets of wisdom within. If IEA had not assumed such a dire demand scenario, you will notice in the supply section that peak oil supplies will happen this decade.

First, US shale oil production is peaking or will peak by the end of this decade.

In the chart above, IEA illustrates the growth in supplies from 2021 to 2024, and 2025-2030. You will note that most countries fall close to zero. For the US, we think IEA's production growth estimate is ~1 million b/d too high. As for the others, we can see an argument to be made (Saudi, Brazil, Guyana, Canada, and the likes).

But for everyone else, the incoming decline is inevitable.

Asia, which is a key region for demand growth, will show declining oil supplies from now to 2030 by ~1 million b/d.

Adding that with the expected demand growth, and the delta will have to be met from OPEC+.

In addition, it was interesting of IEA to point out the annual decline rate in global oil supply.

Note the large yearly decline of ~6.3 million b/d that needs to be replaced. US shale has so far been able to replace other non-OPEC+ supply declines, but once the production growth stalls, the global supply engine also stalls. That's what the oil bulls are essentially betting on.

Demand, where are we headed?

It goes back to this long-term chart:

That red-dotted section is what global oil demand growth looks like without substitution. Assuming a slightly lower relationship versus the past, you would get an annual average growth rate of ~1.3 million b/d.

From 2025 to 2030, that would equate to demand growth of ~7.8 million b/d. This would not only eliminate the entirety of IEA's surplus estimate, but it would likely push the global oil market into a sustainable deficit. On the supply side, we think US shale, Brazil, and others contribute to ~2 million b/d of supply delta. In aggregate, my estimate is a delta of ~9.8 million b/d. Instead of a surplus of +8 million b/d, I see a deficit closer to ~2 million b/d.

Conclusion

IEA's 2030 outlook is about as realistic as the flat earth theorists. Current data does not support IEA's aggressive EV penetration assumption, let alone the dramatic gasoline demand drop. In addition, it is also too aggressive on its supply assumption leading to a false narrative developing in the oil market.

In many ways, I hope oil companies feel frightened and invest less on the back of this IEA oil market report, but the reality is, anyone with a brain could see how idiotic this forecast really is.

While the IEA continues to play games with the global oil market, market participants are far smarter than that, and our analysis is the exact opposite of what the IEA is assuming.

Let's see who is right, but if history is any tell, IEA will likely be very wrong again on this forecast.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Great piece and excellent advice to fade nearly every IEA report. They've entered the Jim Cramer zone.

It’s interesting to observe apparent market reaction to the IEA report. Oil remains well supported. Equities are getting hammered…. Market confusion by those without deep knowledge of the O&G industry is presenting another buying opportunity. Fine with me. E&Ps can keep working down debt and buying back shares. The returns later this decade and into next keep looking juicier and juicier for those with ample reserves