Just when Canadian energy investors saw the light at the end of the tunnel (Trudeau resigning), investors got a rude awakening after Alberta's Premier visited Trump at Mar-a-Lago and warned that tariffs were coming and it included oil.

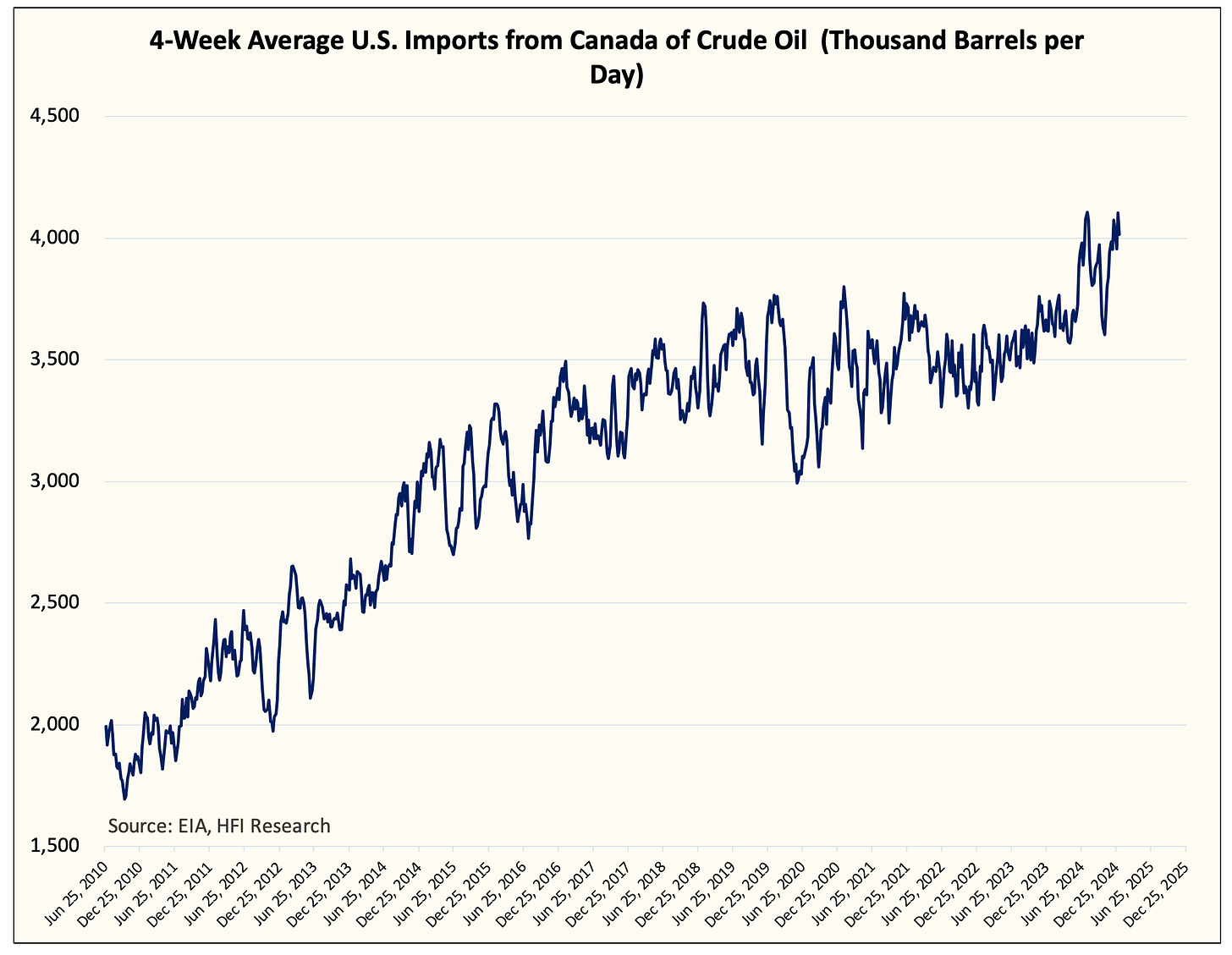

While I firmly believe that the Alberta Premier, Danielle Smith, was playing politics with her commentary, it nonetheless sent a frenzy amongst energy investors and prompted them to start selling first and ask questions later. Never mind the fact that if you look at the most recent US crude import data, US crude imports from Canada are at an all-time high.

The increase in Canadian crude imports won't be easily understood for those who don't follow the oil market closely. For starters, the US shale revolution started around 2010, so why have Canadian crude imports seemingly increased in proportion to the rise in US oil production?

Well, it all starts with crude quality.

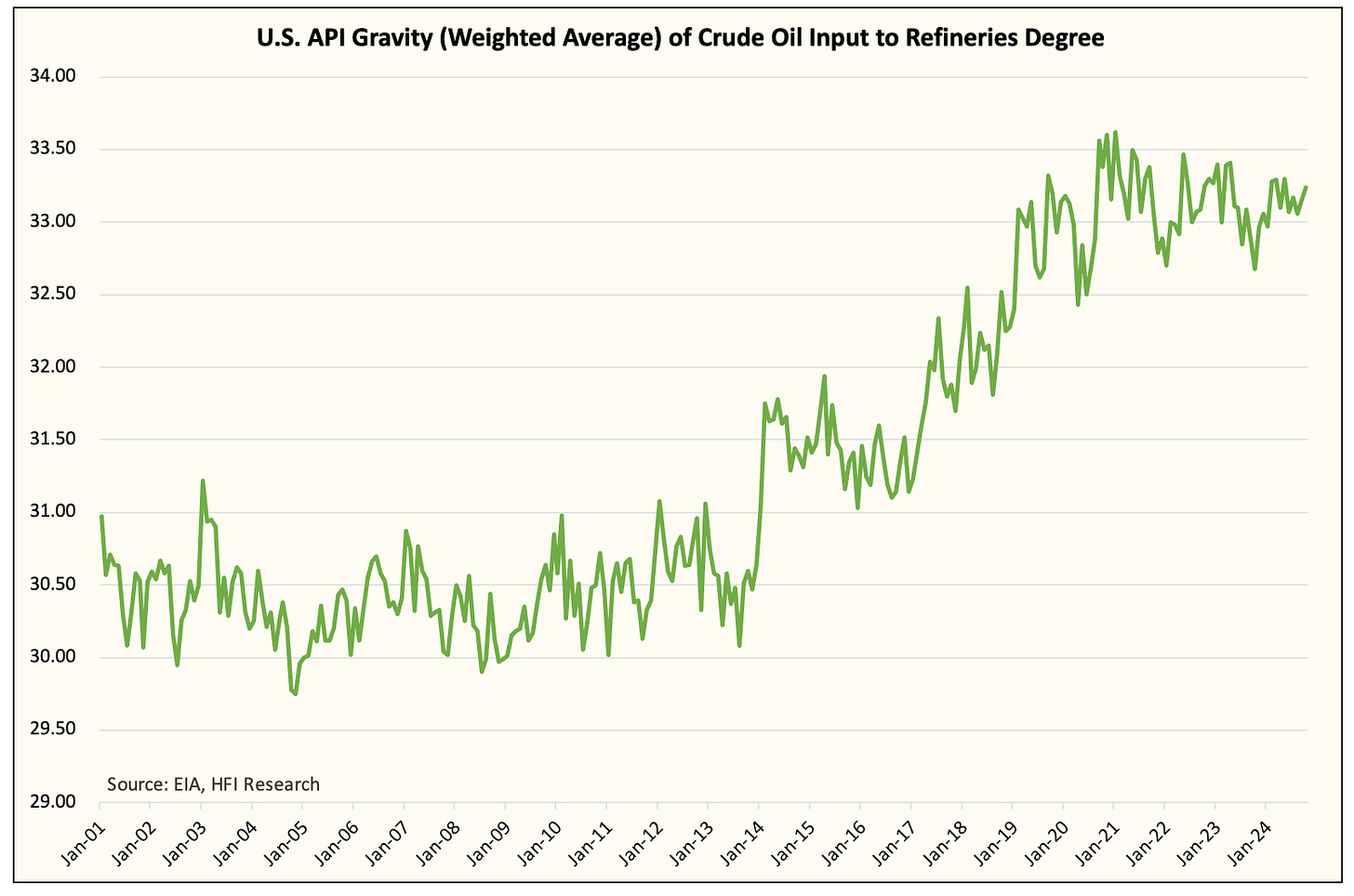

First, it's important to understand that US refineries are geared towards running medium/heavy crude. The average API gravity is currently sitting around ~33 and you can see that following the start of the US shale revolution (2010), the weighted average has increased from ~30.5 to ~33.

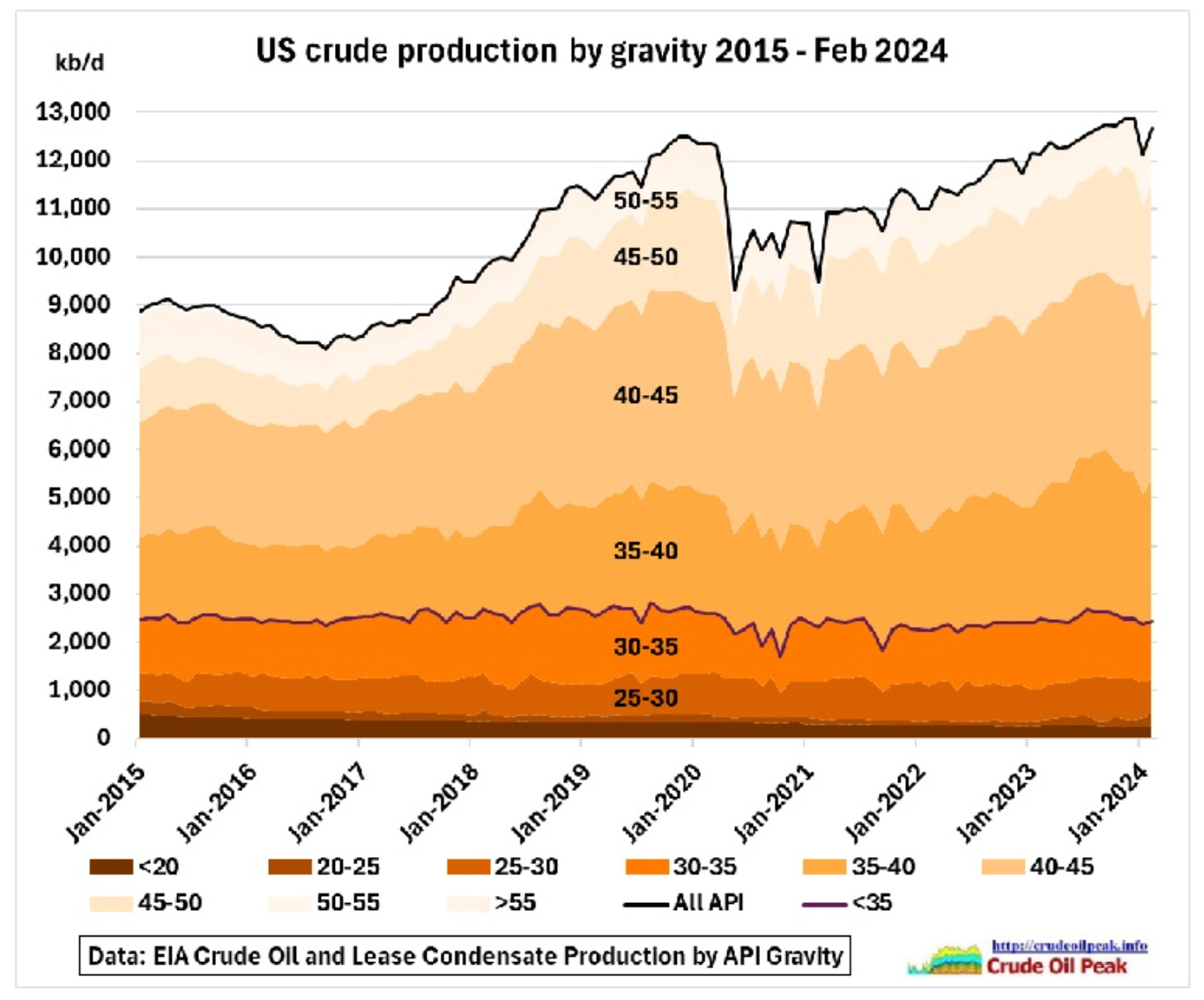

This is because US shale produces very light crude. EIA, unfortunately, no longer updates API gravity for US oil production, but as of the last update, this is the breakdown.

Source: Crudeoilpeak.info

And since early 2024, we know based on individual shale producer data that the crude mix is getting lighter and lighter. So while the 30-35 API gravity and below crude production has remained flat since Jan 2015, the higher API gravity crude continues to increase creating the need for US refineries to import medium/heavy crude to blend the lighter crude.

For this reason alone, the US needs Canadian crude. That's the reason why despite an all-time high US oil production figure of ~13 million b/d, US still needs to import ~6 million b/d with Canada accounting for 2/3 of the import mix.

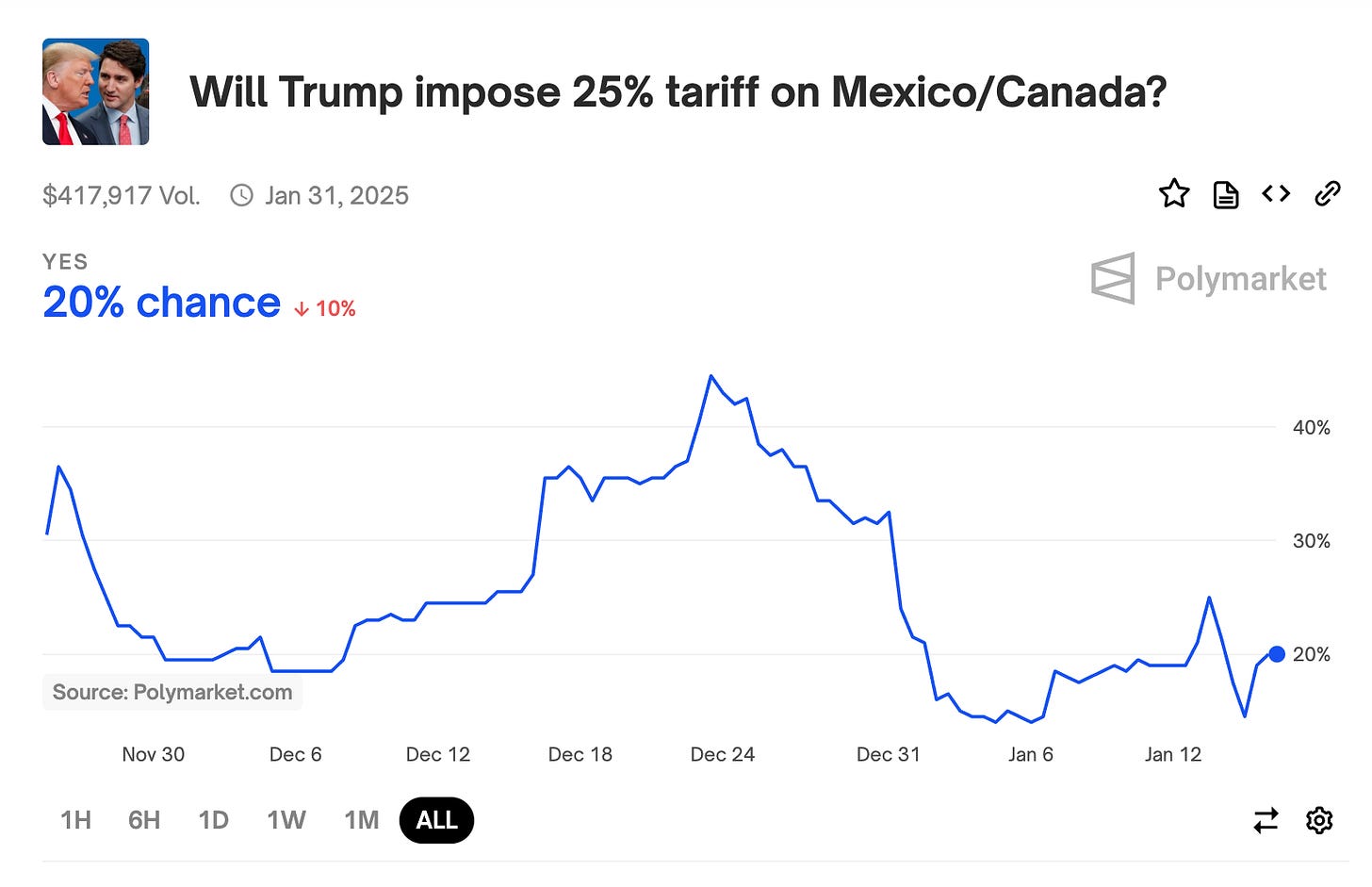

I think aside from the sell-off we saw in Canadian energy stocks, the market doesn't really believe that Trump will impose the 25% tariffs on Mexico/Canada.

Source: Polymarket

If you really do believe that Trump will impose sanctions, then you should bet on that happening on Polymarket. It's currently priced at 20%.

Try and be logical...

The US needs Canadian crude imports. By imposing a 25% tariff on a key crude supplier, the US will inadvertently increase the price of gasoline for many Americans. And we know from Trump's 1st presidency that he is against higher fuel prices. So this policy response seems to be counterintuitive at best, and disastrous at worst.

But akin to the WCTW we noted on Scott Bessent's appointment as Treasury Secretary, I think the tariff strategy is to bring both Canada and Mexico to the negotiation table. By using it as leverage, Trump can extract other means out of the two trading partners. In the case of oil tariffs, this is no different.

But Mr. Market always sell first and ask questions later...

Logic isn't very abundant nowadays. So it's no surprise that energy investors are dumping Canadian energy stocks like they are going out of fashion. Don't mind the fact that US crude imports from Canada are currently sitting at record highs or that US shale is getting gassier in the coming years.

Don't mind the facts, because emotions are running wild, and people just aren't thinking straight these days.

Or perhaps, you can take a step back, think logically, and take advantage of the negative sentiment. For some of us who are fully invested already, all we can do is scream into the void, but for those that have cash on the sidelines, taking advantage of this opportunity seems like a good move.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Most attractive options?

I've bought some MEG as they got whacked the most.

Hey HFI I really like your work from SA it's good to see you monetizing your work. Someone on value degen's chat mentioned today you recommended SCR a couple months ago. If interested I just wrote a detailed write-up on it. Had a meeting with the CFO, It is pretty much one of my highest conviction ideas. One of the best E&P names in North America I have ever come across not to mention the catalysts coming up in 2025 (capital returns and index inclusion).

What is your view? It is trading at half of peers it seems like the right pick in the Canadian Sector.

Management also thinks US shales break-even is near $70 oil - I asked the CFO about this and he had interesting things to say. This was the most surprising part of their investor day presentation, that is not the consensus.

Anyways good luck here!