In our NGF reports as of late, we pointed to the tightening market fundamentals we were seeing for natural gas. Lower production coupled with structurally higher demand this year will result in a gradual recovery in the market. Until, of course, Freeport had "issues" again and LNG feedgas is down meaningfully. The drop in LNG feedgas has sent the US gas market, once again, back into a surplus.

While the drop is not expected to last for a long time, it does present a sizable headwind for the US gas market. For our natural gas balance for the next 5 reports, we see a +65 Bcf injection total versus the 5-year average.

At a time when natural gas storage is already bloated, this is going to really damage sentiment and the recovery process.

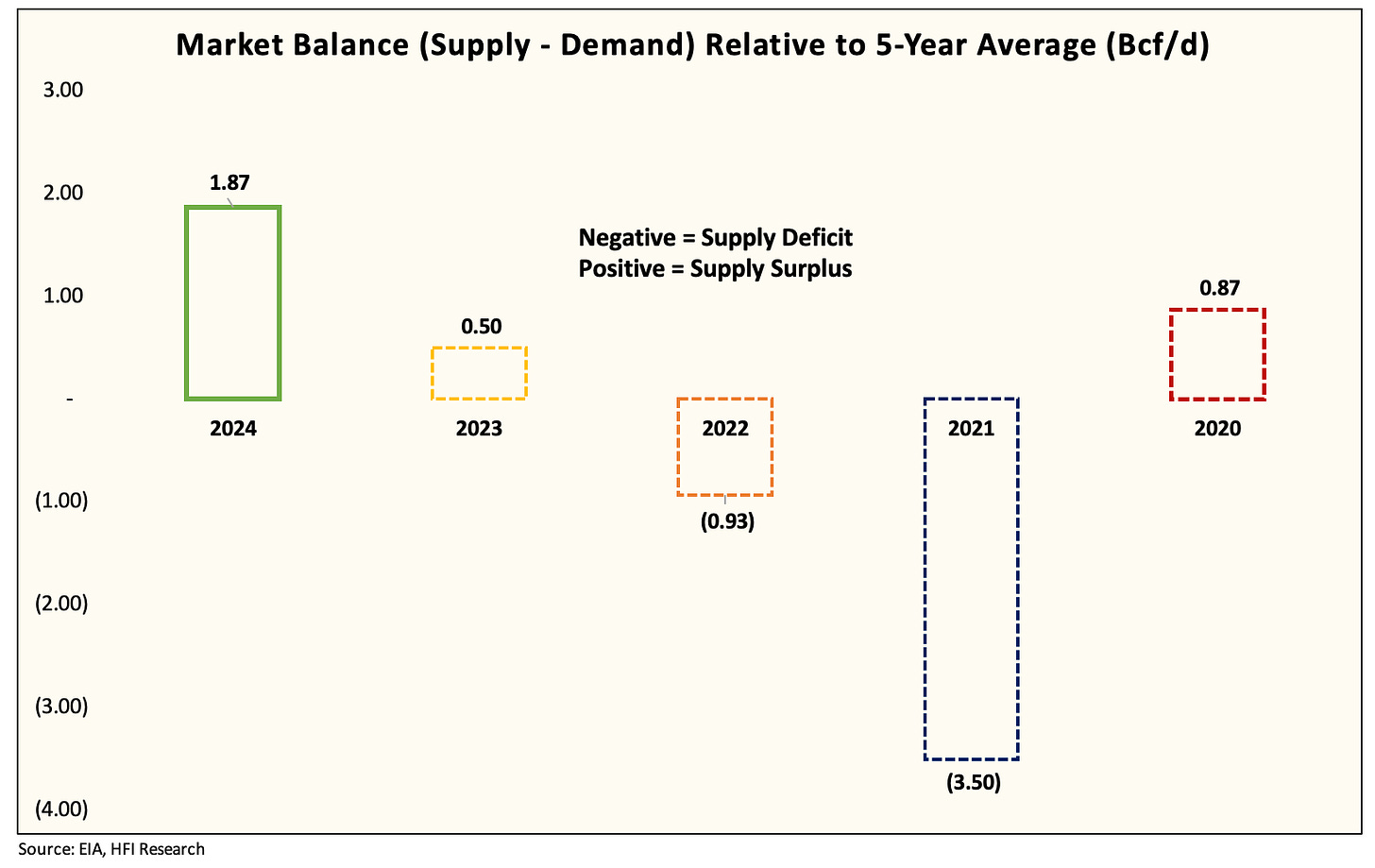

We estimate that because of the LNG feedgas drop, the US gas market is now +1.87 Bcf/d in surplus.

This is a dramatic change from last week's implied balance of -1.4 Bcf/d deficit.

On the supply side, we are seeing very weak supply figures.

Lower 48 gas production is averaging between ~99 to ~100 Bcf/d with the latest data showing a drop to just below ~99 Bcf/d. Canadian gas net imports are in-line with historical averages, but today's price pop appears to be related to a pipeline outage in Canada, which could impact net imports. Total gas supplies are near 2022 levels and down materially y-o-y.

Producer discipline is starting to show, but the sizable drop in LNG feedgas (-5 Bcf/d y-o-y) is far outweighing any supply decreases we are seeing.

On the demand front, despite strong power burn demand, we are entering the weakest demand period of the year. Without any visible catalysts (aside from LNG returning), the natural gas market will have to force production lower still to balance the market.

Even at ~99 Bcf/d, the lower LNG feedgas has pushed the market into a surplus, which means price pressure will continue for a while longer.

The real dilemma for investors/traders

But for investors and traders, the real dilemma is in the steep contango in the natural gas futures curve.

While on the surface, natural gas prices today are cheap, readers must be reminded that the futures curve is in steep contango.

Calendar 2025 prices are all above $3/MMBtu, so this does not signal that the market believes the surplus will continue by this time next year.

This is an optimistic assumption because we believe associated gas production growth, regardless of natural gas prices, will continue and overwhelm balances. And since the bulk of the LNG export capacity increase is coming on in late 2025, the market is likely too optimistic that balances will tighten significantly this year to warrant such a high price average.

In our view, the most effective way to bet on higher natural gas prices is to buy high liquids-weighted producers that trade at a discount. For example, a name like Crescent Point Energy will give investors enough gas exposure without worrying about the impending doom that comes if natural gas prices fail to recover.

The issue with buying natural gas only producers is that if the recovery fails for whatever reason (i.e. weather, LNG, overproduction from US shale oil), you will be left holding onto something that is already pricing in a big recovery. Hence why we think it's far better to buy a liquids-rich producer that has gas exposure.

As for traders, the opportunity in natural gas is not obvious to me. Despite low prompt gas prices, it is low for a reason and will continue to remain low. May and June contracts are in the heart of shoulder season, so with no demand catalyst in sight, the upside is capped. And if you are betting on higher natural gas prices this summer, July to September already trade near $2.4/MMBtu, which will further limit any upside potential.

To me, the most obvious trade will be to wait patiently for summer gas prices to drop near $2/MMBtu before contemplating a long position. Until then, we don't see a favorable risk/reward setup.

Conclusion

The recovery process in the US natural gas market will take time. Low natural gas prices are needed in order for the market to balance and despite the steep drop we saw in production, the drop in LNG has canceled that out and more. With storage already bloated, the market cannot afford to handle these intermittent setbacks. It will be paramount for producers to remain disciplined throughout the summer months even if prices start to recover.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.