There's a massive disconnect between what OPEC thinks global oil demand is doing and what reality is. For the first time in its existence, the IEA is going to be right about oil demand being weak this year.

OPEC oil demand assumption vs IEA

Now there's an important differentiator here. We've long criticized IEA for its "evasive" oil demand increase methods. One such method they have used in the past is by increasing oil demand from the previous year without changing the year-over-year demand growth. On the surface, oil demand growth year over year will look weak, but on an absolute level, it has increased.

So while it's fair to criticize the IEA for its evasive tactics, what's true this time around is that OPEC is likely far too optimistic about its demand assumptions, and the IEA is probably more right than wrong.

As you can see in the comparison chart above, the difference in demand estimate between IEA and OPEC in 2025 is a staggering 2.1 million b/d. This delta effectively explains why OPEC sees the need to increase its oil production versus IEA's call for a bloated market even if the current cut exists.

Source: IEA

In the years I've followed the oil market, I have never seen such a large disconnect in oil demand estimates for the incoming year. And there are major implications for the oil market and what OPEC has to do next.

OPEC Policy

There are various ways we can gauge global oil demand, and one indicator we've used is global refining margins. But as we explained earlier in the year, the increase in refining capacity over the last 3-years will result in structurally lower refining margins going forward. So while it's not a perfect barometer of global oil demand, it still tells us enough about how overall demand is doing.

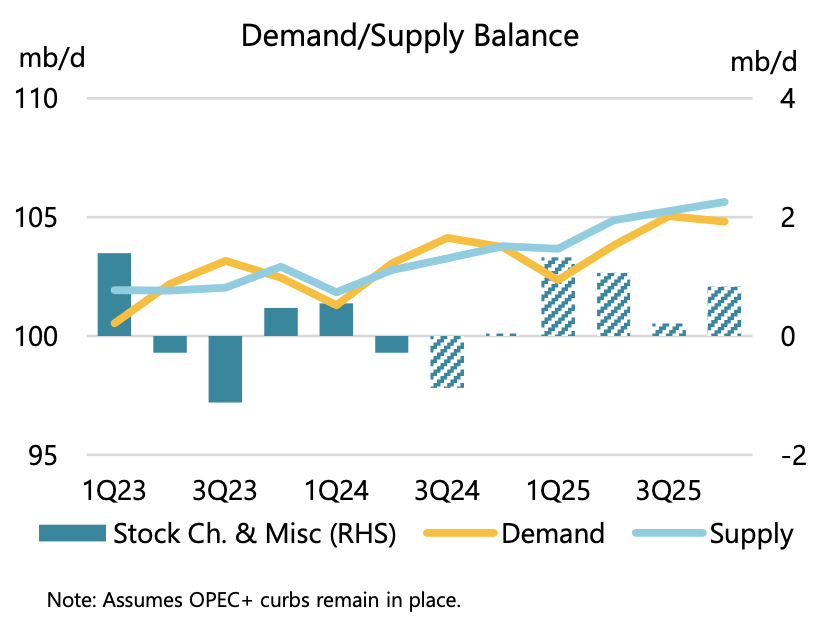

In addition, global oil inventories are another great barometer for just how accurate everyone is on oil demand. Because the supply side is known, the oil demand side is a guestimate. As a result, if global oil inventories are declining faster than expected, then it's very likely that demand is surprising to the upside. In reverse, if global oil inventories are declining slower than expected, then oil demand is likely disappointing to the downside.

Looking at both OECD total and Kpler global oil inventories. We are going to conclude that global oil demand is not matching OPEC's assumption. It is more likely that the IEA is correct about the weak oil demand assumption.

As a result, because of the massive delta we are seeing in OPEC's demand assumption versus reality, we think OPEC will be forced to extend the current production cut into H2 2025.

For transparency purposes, we were calling for OPEC+ to unwind the production cut starting in H2 2024 due to potentially higher-than-expected oil demand. We are absolutely wrong on that call, and global oil demand has so far surprised to the downside. China has been a particular area of weakness with oil demand growth of just ~300k b/d this year versus previously expected +750k b/d. While we think the situation in China is starting to modestly improve, I think it's likely better to be cautious more than anything else.

Rationale

Global oil inventories are currently drawing, but they are not drawing anywhere near the implied deficit the models are showing. As a result, when OPEC convenes for its monthly meeting, it will realize that its demand estimates are far too rosy. This will, in turn, force them to have a discussion centered around whether or not to extend the production cut into year-end.

But there's an interesting dilemma that arises from this. If OPEC+ extends the production cut into year-end, it might as well extend into the end of Q1 as well. Seasonally speaking, global oil demand is at the lowest level in Q1, so by leaving Q1 unchecked, the market will overlook the production cut extension and view it as another bearish event (given the uncertainty on Q1 2025).

One of the reasons why oil prices have failed to rally so far (to the structurally higher level) is because refining margins are weak, but also the fact that people are worried about Q1 2025 balances.

If OPEC+ signals to the market that the production cut will last into Q1 2025, speculators will feel more confident and buy oil. This, in turn, coupled with any geopolitical event in the next few months will send oil prices higher.

Conclusion

OPEC is far too rosy on its oil demand assumption. As a result, we think OPEC+ will extend its current production cut agreement to the end of Q1 2025 (at least). The oil market will be well supported given this fundamental backdrop, and more importantly for the oil bulls, demand needs to improve or any price spike will be temporary at best.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Are you still bullish and long HFIR?

Thanks for the great insight! However, the oil price is truly very depressing, it ignores any bullish news and only follows bearish ones