By: Wilson and Jon

Summary

New Stratus Energy (NSE) is the most levered equity stub to higher oil prices in the public market today. Following its deal announcement today with Sinopec to develop Ecuador's Sacha (block 60) oilfield, we believe that the potential upside far outweighs the risks associated with this name.

Using $65/bbl WTI, we estimate that the EBITDA in 2025 will be roughly C$600 million with 2026 figures showing an EBITDA of C$718 million. At today's stock price of C$0.50, it trades at an EV/EBITDA of 1.5x.

We believe from debt paydown alone, NSE has the potential to reach a price target close to C$2.66 per share or a return of 432%.

As we will explain in this article, the potential upside could be even greater using a higher oil price assumption given the levered capital structure of NSE.

Deal

On Feb 10, a day after the first round of the Ecuador Presidential Election was held, we wrote an update piece noting that the stock price reaction following the run-off in the election was unwarranted. As we explained in the article:

The close race is leading some investors to believe that a deal won't be announced and it will be dragged post the April (final round) election.

But I think this logic is flawed. Because of the tight race, Noboa will want to increase his chance of winning by announcing initiatives in advance. His campaign has been hallmarked by a fight against organized crime, and there have been very few initiatives to bolster the economy or employment. A $1.5 billion payment from Sinopec and New Stratus would be held as a political win and garner more support.

Fast forwarding to today, NSE announced the deal with the following terms:

20-year term, through which it will receive a percent of production calculated on a sliding-scale basis by reference to the prevailing Oriente Blend oil price. At $65 per barrel WTI, the consortium is set to receive 82% of the Sacha field’s production. The remainder will flow to the Ecuadorian government.

Sinopec (60%) and NSE (40%) will make a $1.5 billion signing bonus to Ecuador.

Sinopec and NSE have agreed to invest $1.7 billion into the Sacha oilfield development. The capex is expected to be funded through cash flow from operations.

The capex is expected to boost the recovery rate of the Sacha field from 23% to ~30%.

The capex investment is expected to boost Sacha's production from ~74k boe/d today to ~105k boe/d by 2029.

In order to obtain the $600 million in financing (C$864 million), NSE has signed a $480 million deal with an off-taker at a cost of SOFR + 9.5%. We have heard that the off-taker is Shell, one of the largest oil trading firms.

As for the remainder of the proceeds ($120 million or C$172.8 million), NSE has announced a private placement totaling C$114 million at an issuance price of C$0.50. This increases the shares outstanding by 228 million bringing its total shares outstanding to 361 million.

As for the remainder of the financing ($40.83 million or C$58.8 million), we expect it to be financed by debt.

Here is what the new capital structure looks like:

Detailed Breakdown of the Financials

The Sacha field is producing approximately 73,700 boe/d. Assuming a WTI price of $65.00, the consortium would be entitled to 82% of the Sacha field’s production or 60,434 boe/d. NSE owns a 40% interest in the consortium, so its share of the consortium’s production would be 24,174 boe/d.

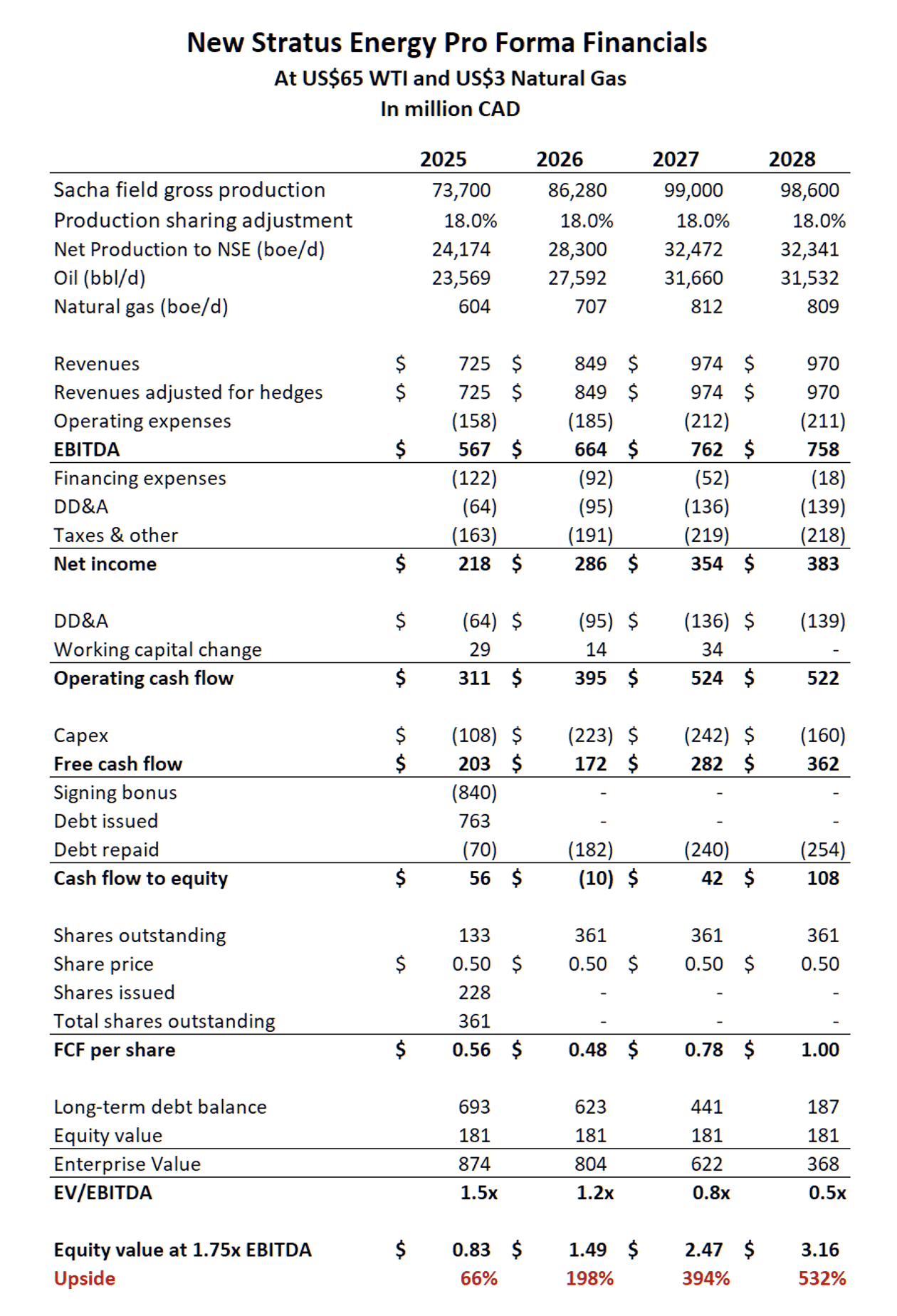

The table below shows our pro forma financial estimates for NSE after the deal. It assumes a WTI price of $65 and that 2024 net production is 24,174 boe/d. Over subsequent years, production increases according to the consortium’s estimates of Sacha’s gross production growth. We adjust cash flow to account for NSE’s hedging policy, which uses hedges to protect the capex requirements over the next year. We assume NSE hedges next year’s production at $65 per barrel WTI.

The upside we estimate in NSE shares is very meaningful.

As you will notice, a small increase in the trading multiple from 1.5x to 1.75x has a meaningful impact on the share price performance (+66% or C$0.83).

The levered nature of the equity becomes that much more apparent using a higher WTI pricing assumption.

Note: The production agreement stipulates that if oil prices are higher, the government share increases. In the case of $75/bbl WTI, the proportion of Ecuador's government share is 19%.

At $85 WTI, the upside is almost too obvious.

Note: The production agreement stipulates that if oil prices are higher, the government share increases. In the case of $85/bbl WTI, the proportion of Ecuador's government share is 20% (capped).

The resulting financial sensitivity exercise demonstrates just how levered the NSE equity stub really is. And since the off-taker financing terms mandate a yearly amortized payment, all the early-year free cash flows will go toward debt repayment with equity holders getting all of the free cash flow after 2028.

Catalysts

There are several catalysts on the horizon—both positive and negative—that will impact NSE shares. The following catalysts are set to occur over the coming months:

Until NSE closes its equity offering, the number of shares outstanding will remain unknown. Investors will be concerned about the ultimate amount of stock issued and at what price. We believe the equity offering will be a positive catalyst for the shares if the company raises around our expected C$114 million at C$0.50. The offering will increase the share count by 228 million.

The Ecuadorian runoff election is scheduled for April 13. If sitting president Daniel Noboa wins, NSE’s standing vis-à-vis the government is not likely to change. The company can focus on executing without political interference for years.

However, if Luisa Gonzalez wins the runoff, it will introduce a new set of risks for NSE, which we discuss below. While we believe the deal is unlikely to be scuttled, the optics of Noboa losing to a socialist will probably send NSE shares lower.

NSE is scheduled to release earnings in late April. We expect it to report solid progress on mobilizing rigs in the Sacha field to drill wells that will add to production in the near term. Any report of progress can be a positive catalyst for the stock.

Other positive catalysts will occur as the company executes. We expect the shares to reach from debt reduction and production growth.

Geopolitical Risks

At the end of the day, an oil equity stub with this much upside only exists because of the geopolitical risks involved with owning the name. As we will explain below, we think the risks are not as great as you may think. The geopolitics for the dummy 101 version is that with Sinopec as a 60% partner in this venture, Ecuador's history with China indicates that no matter the ruling party, there won't be any "rug-pulls" that occur.

Here's a brief overview of the history of Ecuador's politics with the energy sector.

Ecuador has a fraught history with regard to domestic oil producers. Rafael Correa, Ecuador’s socialist president from 2007 to 2017, oversaw the rapid growth of the country’s oil production. The production growth funded lavish government expenditures that boosted GDP per capita and grew Ecuador’s middle class.

However, after the oil market turned down in 2014, Correa changed his tune. He turned against the oil industry, railing against domestic producers and threatening to expropriate domestic oilfields under foreign control.

Correa awarded the Sacha field to Venezuela’s national oil company, PDVSA. As PDVSA fell apart, ownership of the field passed to Petroecuador. Petroecuador operated the field with little regard for the environment or the health of the people living around the fields it operates. Spills on its producing properties are still a weekly occurrence.

Lenin Moreno replaced Correa in 2017. Even though Moreno was a socialist, he sought to attract foreign oil investment. Unfortunately, the Covid downturn in 2020 caused Ecuador’s oil production to fall. It has remained below 500,000 boe/d ever since.

Moreno’s successor, Guillermo Lasso, became president in 2021. Lasso was right-of-center. He tried to privatize Ecuador’s oil industry to attract foreign investment. Lasso set a goal to produce 540,000 boe/d, but production remained below 500,000 boe/d as corruption scandals prevented him from seeking reelection in 2023.

Lasso’s successor, Daniel Noboa, has been president since 2023. Like his predecessors, he is also attempting to attract foreign capital into Ecuador’s oil sector. His economic plan calls for the industry to invest $42 billion over the next five years to make the infrastructure investments needed to reverse Ecuador’s declining oil production.

Noboa won Ecuador’s presidential election in February by a slim margin, prompting a runoff vote scheduled to be held on April 13. The runoff will raise certain risks for foreign investors in Ecuador, as Noboa’s opponent, Luisa Gonzalez, is an acolyte of former socialist president Correa. Since 2017, Correa has been living in exile in Belgium due to corruption charges. Some Ecuadorians worry that Gonzalez’s election will allow Correa to return to Ecuador and exert influence, whether elected or not.

Geopolitical Risk-Mitigating Factors

Three factors mitigate Ecuador’s political risk.

The first is economic. Whatever happens in the April runoff, Ecuador will remain a poor country. Its oil production accounts for nearly one-third of its GDP. The decline of its oil production from 550,000 boe/d in 2019 to 475,000 boe/d in 2024 has significantly reduced government revenue. Noboa hopes to reverse the slide in production in part by attracting sophisticated foreign operators like Sinopec and NSE.

Petroecuador has demonstrated for years that it’s not up to the task of operating in an economically efficient manner. It clearly lacks the resources to boost Ecuador’s production at all, let alone to levels targeted by politicians. Without foreign expertise and capital like that of Sinopec and NSE needed to boost Ecuador’s oil production, social and political conditions in the country are likely to deteriorate.

If foreign companies can boost Ecuador’s production, revenues derived from oil production will ease the burden of Ecuador’s $5 billion of debt. It will also help Ecuador’s government meet the spending requirements necessary to fight a recent increase in gang violence, as well as severe electricity blackouts.

The $1.5 billion signing bonus paid by the Sacha consortium will go a long way toward helping President Noboa fix Ecuador’s problems. Success is likely to boost his reelection prospects.

The second mitigating factor for risk to NSE shareholders comes in the form of the legal framework used in the agreement between the Sacha consortium and the government.

The Constitution of Ecuador allows the government to delegate to private companies in the oil and natural gas sector. Furthermore, Article 2 of Ecuador’s Hydrocarbon Law allows the government to delegate oil production activities through participation contracts or service contracts under state control. Article 19 directly allows private companies to partner with state-owned enterprises. Article 31 expressly allows Ecuador’s energy minister to grant participation contracts consistent with Article 19.

Private foreign-owned companies like NSE are allowed to partner with a state-owned enterprise as long as the state-owned enterprise owns more than 51% of the partnership. NSE’s partner Sinopec, a Chinese state-owned enterprise that is the country’s largest refiner, owns 60% of the Sacha concession, with NSE owning the remaining 40%.

Article 23 of Ecuador’s Hydrocarbon Law states that the government is allowed to seek foreign expertise if an Ecuadorian state-owned oil producer is not deemed to have the technical and financial resources necessary to serve as a field operator. Petroecuador fails to meet these criteria.

The law is clear that NSE is acting lawfully in partnering with Sinopec. Constitutional and legal support will make it difficult for the Gonzalez administration to modify NSE’s participation contract if she becomes president. The company will also be able to seek redress through arbitration.

The last mitigating factor, and likely the most important one, for NSE shareholders is that their partnership with a Chinese state-owned enterprise makes it less likely that Ecuadorian politicians will interfere with the Sacha consortium from a legal or operational standpoint. Doing so could risk reprisal from the Chinese state, and Ecuador entered into an advance sale of oil contracts with Chinese oil majors (PetroChina, Sinopec, and CNPC) totaling over $19 billion. Any interference with this project would eliminate a vital source of funding for Ecuador.

Conclusion

Following the Sacha deal with Ecuador, NSE is the most levered oil equity stub in the public market. With an upside potential of +432% at $65/bbl WTI, we think the geopolitical concerns are 1) overblown and 2) present an opportunity for investors to get option-like upside.

As we have illustrated in the financial, if oil prices move higher in the future, like we think they will, there's more potential upside for equity holders once the debt is paid down.

Analyst's Disclosure: I/we have a beneficial long position in the shares of NSE.V either through stock ownership, options, or other derivatives.