(Public) Sable Offshore Will Run Out Of Money By January

Federal support? There's nothing coming.

Sable Offshore should be nominated the “drama stock of 2025” for the never-ending entertaining twists and turns this name provides. For both bulls and bears, the good news is that the name won’t exist much longer given the precarious cash situation the company is in, despite raising $225 million net in its latest capital raise.

In this article, we will explain to you the following:

The pipeline route is like dead, really dead.

The OS&T (offshore) route is unrealistic, impractical, and impossible to achieve within the timeframe the company is proposing.

The available support options from the Federal government are extremely limited, and extremely unlikely to materialize.

After we walk you through all of this, you will see why we think it will be impossible for Sable to raise additional financing.

Pipeline is Dead

Sable’s pipeline route is dead. In order for the pipeline to restart, the following events will need to take place.

Sable would need to win the court case in Kern County. The company is forcing the court to specify whether or not SB 237 (CDP for restart) applies to Sable’s pipeline. Sable’s argument in this case contends that the Pipeline and Hazardous Materials Safety Administration (PHMSA) only defines active and abandoned. There is no definition for “idle,” and as a result, Sable’s pipeline has been active this entire time and was never idled. If Sable does not win this, then the SB 237 deadline of Jan 1, 2026 kicks in, which will force the company to get a coastal development permit.

Sable would need to appeal Judge Anderle’s ruling on Oct 15, 2025, where he denied the writ. The CCC currently has a cease and desist (CDO) order, a restoration order (RO), and an $18 million fine. Sable would have to win the appeal.

Santa Barbara County denied the Exxon permit transfer on November 4, 2025. Even if Sable wins both the Kern County (SB 237) case and Anderle’s CCC case, it would still need SB approval for the permit transfer. If not, SB can issue a cease and desist order on the Las Flores facility.

If Sable, somehow, wins the SB 237 case, the Anderle CCC case, and the SB county permit approval, it would still need to do all of the anomaly repairs in the coastal sections. After which, Sable would need to resubmit the final restart plan to California’s State Fire Marshal (OSFM). The OSFM would have to approve the pipeline for restart.

After all this is said and done, Sable would have to submit the restart plan to Judge Geck, where it would need to survive 10 court days.

If any of the routes above fail, the pipeline route dies. And even if it wins the SB 237 and CCC case in the appeals court, they will be tied up in litigation. The counterparties would sue again, and court delays will guarantee that none of this would start before January 1, 2026.

Pipeline Hail Mary

In Sable’s latest 8-K filing, it notified the Pipeline and Hazardous Materials Safety Administration (PHMSA) that the “pipeline connecting the Santa Ynez Unit to the Pentland Station terminal in Kern County, CA constitutes an interstate pipeline facility under the Pipeline Safety Act.”

Just in case readers are not fully aware of this, following the Refugio oil spill in 2015, the consent decree signed by PHMSA transferred oversight to the California Office State Fire Marshal.

Could PHMSA change the designation from intrastate to interstate?

Sure, but good luck getting that through court. The consent decree would make it nearly impossible 1) for PHMSA to change it back and 2) for any court to accept the change.

As a result, this is a dead-on-arrival strategy.

Offshore Route Is Bad

In order to successfully pivot the company to the offshore storage and treating vessel (OS&T) route, we estimate that Sable would need the following:

$3 to $3.7 billion of financing.

48 months.

NEPA

Before we start discussing the permits needed, it’s important to understand that the Santa Barbara County air permit (one of the many items) is a key gating mechanism. As a result, the only way the company can avoid having the air permit issue is if it parks the OS&T 25 nautical miles outside of the coastal zone. This will trigger the National Environmental Policy Act (NEPA).

The Department of Energy (DOE) requires NEPA to give a federal loan guarantee, and the Bureau of Ocean Energy Management (BOEM) will require NEPA for the permit.

Under President Trump, the expedited NEPA process could take 30 days, but such a process would likely be challenged in court. Realistically, the NEPA process could take up to 12 months, assuming legal challenges pile up.

BOEM Permit

On the leaked investor call, Jim Flores, CEO of Sable Offshore, alleged that the “permit” will come before Thanksgiving. Now that it’s Dec 1, it was obvious that it was logistically impossible to have a BOEM permit in place.

On Oct 9, 2025, Sable issued an 8-K noting that it “updated” its Development and Production Plan for the Santa Ynez Unit (DPP). The company said that it believes the existing permit is still “active”.

The statement is factually inaccurate.

In recent sellside commentary, Sable’s management team has been telling analysts that the Commerce Department can override the 1984 deferred CZMA override decision. Below is the file from 1984 on why the Commerce Department deferred/rejected the override.

This time around, Sable appears confident that Howard Lutnick, Commerce Secretary, will be able to override a decision deferred from 41 years ago. Never mind the fact that the existing 1982 permit is completely out of date and inadequate for the production guidance the company is touting (60k boe/d production).

Don’t believe me? Look at the transcript of the Monday public conference call following the Hunterbrook article:

To make matters worse, if you go through the 1984 rejection, it specifically notes that if the onshore route isn’t available, the Commerce Department would revisit. In 1985, the CCC allowed the onshore pipeline through, and Exxon eventually abandoned the OS&T.

So to think that the Commerce Department would override something that has already taken place and to do it on the old 1982 permit is just hilarious and ridiculous.

What’s a viable path?

Outside of the fantasy scenario the company is touting to sell-side analysts, there’s a valid way Sable can obtain a BOEM permit. For Sable to successfully pivot to the OS&T route, it would need to park the OS&T 25 miles outside of the coast. The reason this is important to understand is that the Santa Barbara County will issue the needed air permit, and the only way to bypass this is by doing the above strategy.

But this strategy brings other issues.

The hefty cost associated with the buildout.

The timeline it takes for the buildout to take place.

It’s no longer a minor update on the existing permit, but a complete overhaul.

As a result, BOEM’s review process will take time as it will require the following:

Air permit (EPA OCS above 25 nautical miles): This will also trigger its own CZMA review (6 months, below for more info). It will require the Commerce Secretary's override.

NEPA (above).

National Pollutant Discharge Elimination System (NPDES) authorization.

Oil Spill Financial Responsibility (OSFR) and Certificate of Financial Responsibility (COFR).

Oil Spill Response Plan (OSRP), Vessel Response Plan (VRP), and Facility Response Plan (FRP).

BSEE safety systems approval (Subpart H), pipeline approvals (Subpart J), and construction/installation notices.

Coastal Zone Management Act (CZMA): This gives a coastal state a binding say (federal consistency) over federal actions. The California Coastal Commission (CCC) is the state reviewer. The CZMA process takes 6 months, and given Sable’s history with the CCC, they will likely reject the plan. This is the part that will be sent to the Commerce Secretary, where the company thinks Howard Lutnick will override on the premise of “national security.”

BOEM Permit Timeline - 12-18 months, minimum.

Construction to Production Start (24 months, minimum)

Let’s assume that Sable is successful thus far and receives the BOEM permit after many legal battles with the environmental groups. The BOEM permit in hand took 12-18 months following all of the above requirements. This is when Sable will (if) receive federal funding support to START the buildout of the OS&T and the subsea tie-back needed to connect the offshore platforms to the OS&T.

Reasoning why it needs the permit? The company cannot risk spending on OS&T (at the risk of not obtaining the permit), and it cannot legally start work on the subsea tie-back until the permit is in hand.

The OS&T buildout alone will take 18-24 months.

The subsea tie-back will take 12-18 months.

In conclusion, there’s no scenario Sable will be able to sell oil by Q4 2026. At a minimum, we won’t see any oil sales until late 2029.

Federal Support, But How?

Without a BOEM permit, Sable cannot obtain a Federal financing guarantee.

Without NEPA, it can’t get equity or financing assistance from the Department of War (Department of Defense).

Sable is asking the Department of the Interior for an “expedited” permit, but the only thing that can be expedited is NEPA. There’s no other mechanism that the DOI can expedite. It cannot expedite the air permit. It cannot expedite the CZMA. As a result, DOI is extremely limited.

The Commerce Department can give an override on the CZMA under the pretense of National Security, but Sable would need to first go through a CZMA, which takes 6 months!

The only support Sable can receive from the Feds is verbal, but that’s about it. Can President Trump tweet about Sable and help it? Sure, but what’s in it for him?

Increase US crude oil production by ~40k boe/d by the end of 2029, when US crude oil production is already at an all-time high of 13.844 million boe/d?

Realistically, nothing. This is not an easy win for Trump.

As a result, Federal support is not coming.

Sable Is Out Of Money

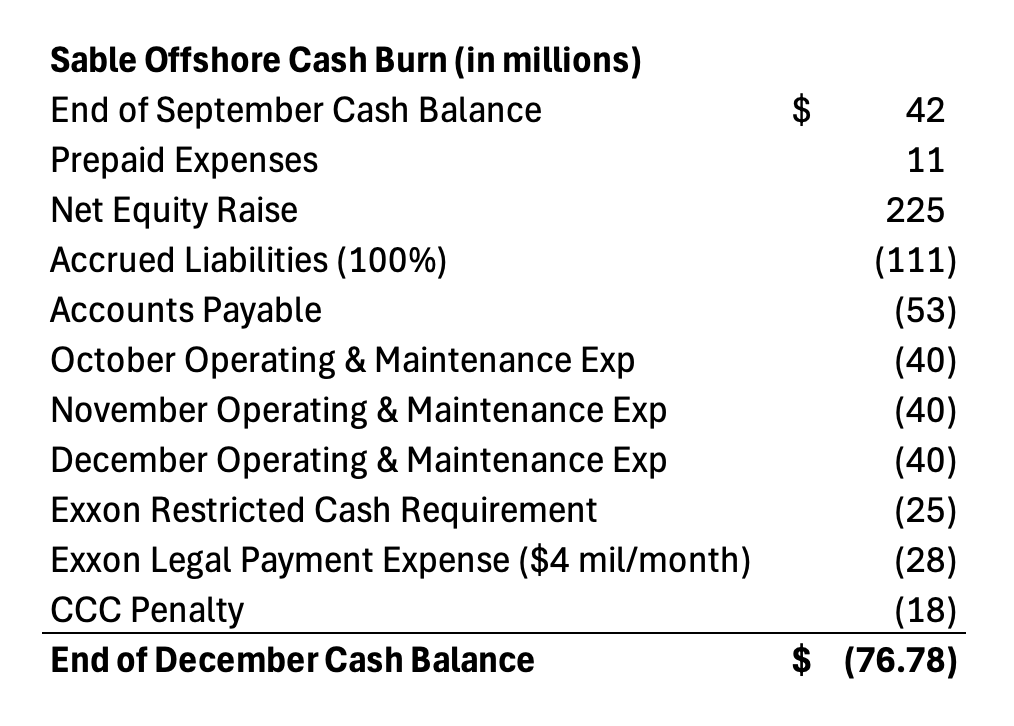

At the end of Q3, Sable had $41.6 million in cash and cash equivalents with ~$53 million in accounts payable. In November, Sable managed to issue 45.45 million shares at $5.5 for gross proceeds of $250 million, $225 million net.

In the table below, we break down our assumptions for Sable’s cash balance by the end of December 2025:

Burn Rate

In our model, we assume an operating and maintenance expense of $50 million per month. This is the cash burn this year so far:

Q1 2025: -$136.3 million, $45.4 million/month

Q2 2025: -$265.2 million, $88.4 million/month

Q3 2025: -$177.4 million, $59.1 million/month

In Sable’s latest Q3 filing, it notes the following:

Operations and maintenance expenses are expected to remain elevated for the remainder of 2025.

As a result, we think our assumption of $50 million per month is on the conservative side.

Exxon - $28 million legal payment and $25 million in restricted cash

In addition to the disclosure about elevated operations and maintenance expenses, Sable also disclosed the following in its latest quarterly earnings:

On October 14, 2025, the Company entered into the Fifth Amendment to the Sable-EM Purchase Agreement, pursuant to which the Company agreed to purchase a performance bond in the amount of $350.0 million in favor of EM as the sole beneficiary as plug and abandonment financial security, which is due three days prior to the Senior Secured Term Loan maturity (see further discussion of maturity date and Second Debt Amendment at Note 6 — Debt). In accordance with the Sable-EM Purchase Agreement, EM has the ability to request a performance bond increase to $500.0 million in favor of EM.

On October 14, 2025, the Company entered into a Letter Agreement Regarding Restart Production (the “Letter Agreement”) and the County of Santa Barbara’s Field Development Plan, with an effective date of June 1, 2025, whereby the Company agreed to provide EM additional consideration for lack of operatorship transfer. The Company will reimburse EM for costs associated with the Sable Offshore et al. v. County of Santa Barbara et al. litigation regarding operator permit transfer, and will compensate EM $4.0 million per month during the term of the agreement for operator related services. The term concludes at the earlier of (i) the completion of the transfer of operator or (ii) termination of the agreement by EM. Refer to Note 8 — Commitments and Contingencies for details regarding this County Permit Transfer Matter.

On item 1, the performance bond won’t be due until three days prior to the loan maturity. This will not be a cash drag item, but it will impose additional financing requirements if Sable is able to restart through the OS&T route.

On item 2, Sable agreed to compensate Exxon $4 million per month with an effective date of June 1, 2025. By the end of November, Sable will have needed to pay $24 million to Exxon and an additional $4 million in December. Since this agreement was made on October 14, it did not need to be disclosed in the financial statements. But this is a real cash expense, and by the end of December, Sable needs to pay Exxon $28 million.

Lastly, the new amended credit agreement requires Sable to hold $25 million in restricted cash. This needs to be subtracted from the cash balance.

CCC Fine

Judge Anderle has already ruled against Sable on October 15. The final clean-up is on Dec 3 where the CCC will ask Judge Anderle to dismiss the case. Sable, on the other hand, is asking Judge Anderle to make a ruling on discovery. Given Anderle’s ruling on Oct 15, it is extremely unlikely he will rule in favor of Sable.

According to the CCC fine of $18 million, Sable was supposed to pay that in early October. Given the ongoing legal case, CCC has not enforced the fine just yet. After Dec 3, it will likely enforce it. If Sable does not pay, CCC can put a lien on the assets.

Negative Cash Balance

By the end of December, Sable’s cash and cash equivalents will be negative. The company could prolong its death a few weeks, but the accounts payable will stack up, and another $4 million to Exxon will be due in January. Meanwhile, Sable’s legal bills are stacking up, and even using Sable’s $25 million per month burn rate to start 2026, it won’t have enough money to survive January.

Without another round of dilution, Sable will not even survive to see its Hail Mary attempts in the Federal government payoff.

Death Spiral 2.0

Following the Hunterbrook article, Sable’s stock price immediately went into a death spiral. The leaked audio call suggested that Sable needed to raise additional financing in Q4 prior to getting Federal support. Just the thought of an additional capital raise sent investors into a panic, and the stock spiraled down from $12 to $5 per share. Now that the company has raised $225 million to satisfy the Exxon loan extension requirement, many investors are not fully aware of just how dire the cash situation is.

In fact, we are speculating here that many of the PIPE investors were not fully aware of how dire the cash situation was. Dec 3 is the last date Sable said it would register the PIPE shares. Once those become registered, investors who felt that they were lied to on the deal will look to exit in a hurry creating the Death Spiral 2.0.

With no Federal Support on the horizon and no viable path to restarting oil sales via pipeline, the company will effectively run out of cash by January. Once the equity market realizes that, the reflexive feedback loop will feed on itself making it impossible to raise equity.

Conclusion

Sable Offshore will run out of money by January. Whatever tactic the company tries to throw at the market today will fall short because the reality is what it is. Any avenues for Federal support require the bare minimum, NEPA and BOEM permits, both of which the company does not have.

Some of the more audacious tactics like asking the Commerce Department to override a 1984 rejection are just borderline laughable.

Whatever the case, we explained our logic in this article:

Why the pipeline can’t restart.

The OS&T strategy will take 4 years and $3+ billion.

No imminent Federal Support is coming.

Why Sable will run out of cash by January.

All of this leads to one inevitable outcome: the equity becomes worthless.

Analyst’s Disclosure: We are long SOC puts.

[Air permit under Clean Air Act] The EPA has delegated authority to administer the Clean Air Act to the Santa Barbara County Air Pollution Control District (SBCAPCD). To get an air permit Sable has to qualify under both the federal requirements and the SBCAPCD Rules which impose stricter requirements. Even worse, the decision of the SBCAPCD is a "discretionary decision" of a California state agency and that triggers a CEQA assessment which considers every environmental issue, not just air quality.

However, if the SBCAPCD says no or starts taking into account considerations irrelevant to air quality (CEQA assessment), the EPA could potentially revoke the delegation of authority it made to the SBCAPCD, consider the application itself and potentially grant the air permit without a CEQA assessment (the EPA is not a California state agency). The second half of Section 55.1 of the Clean Air Act Regulations, which deals with OCS air regulations, states as follows: "In implementing, enforcing and revising this rule and in delegating authority hereunder, the Administrator [of the EPA] will ensure that there is a rational relationship to the attainment and maintenance of Federal and State air quality standards and the requirements of Part C of title I, and ***** that the rule is not used for the purpose of preventing exploration and development of the OCS.******" California expressly bans offshore drilling in state waters and Grok says that they are the only state that has attempted to piggyback a full environmental assessment (CEQA) on the delegation under the Clean Air Act to administer air quality. Gavin Newsom also said, "Dead on arrival." when the Trump administration announced possibly auctioning new leases offshore California, which suggests that California intends to use air permits to block new activity in OCS federal waters. That likely offends the portion of Section 55.1 set out above - using the rule for the purpose of preventing exploration and development.

Assuming the EPA can and does take back authority to administer the Clean Air Act, the EPA would still have to ensure that Sable complies with the local SBCAPCD Rules (in addition to the federal rules), which I think will require the use of BACT on the OS&T (adds to cost but probably manageable), but the SBCAPCD Rules should permit offsets for the idling/closure of the onshore facilities. The SBCAPCD treats the SYU, the LFC processing facilities and the POPCO gas plant as a single stationary source (confirmed by William Sarraf, Engineering Supervisor at SBCAPCD). I think that permits the emission reductions from closing the onshore facilities to be applied against the emission increases from the OS&T, BUT I AM NOT AN EXPERT on the SBCAPCD Rules. The OS&T should be part of the single stationary source as it would be added to the SYU. Flores claimed on the Hunterbrook call that Sable would be within their air permits, which I assumed to mean the onshore offsets will exceed the OS&T increases. Of course, Flores may not have been entirely truthful.

If the decision is left to the SBCAPCD, the process is almost certain to take years and ultimately result in the application being denied because the need for the SBCAPCD to make a "discretionary decision" will trigger a CEQA assessment.

The only hope of getting an air permit if an OS&T is installed at the SYU would appear to be the EPA revoking the delegation of authority to the SBCAPCD. I don't know how long that would take and there would be immediate litigation challenging the decision of the EPA of course.

Is anyone aware of any further impediments to Sable getting an air permit for the OS&T if added to the SYU? Grok thinks that this is the most difficult permit for Sable to get even with very robust federal support and that it may be impossible.

I asked the SBCAPCD Engineering supervisor if there was an existing air permit with respect to the original OS&T that was still valid. He said the following: "In response to your last question about existing permits, Exxon operated an OS&T from1981 to 1994. Santa Barbara County APCD did not receive delegation of the OCS Air Regulations, which provided the authority to permit and regulate sources on the OCS, until 1994. By the time the delegation was granted in 1994, Exxon had already decided to cease OS&T operations and transition to onshore processing of oil. As such, a District permit was never issued for the original OS&T, but a District permit would be required before installation and operation of a new OS&T." So Sable is not grandfathered somehow, or at least the SBCAPCD does not think Sable is.

I welcome any comments on the above. I am not certain of any of it.

[DOE loan guarantee timing] Grok suggested that the DOE could provide a loan guarantee on the basis of a conditional BOEM approval and a Commerce Secretary public statement that he will likely override a CCC objection to adding an OS&T unless the current pipeline solution is allowed by Cali agencies on reasonable terms. The Energy Dominance Financing program under the DOE seems the likeliest avenue for a federal loan guarantee. An October 28 interim final order made changes to regs that get rid of a lot of environmental restrictions and push for energy production. Note that Grok thought a loan guarantee may be possible despite the lack of a Clean Air Permit and I am not so confident of that.