Editor’s Note: This article was first published to subscribers on August 29.

Anytime the topic of an oil structural supply deficit comes up, this is how I feel.

So it's no surprise that when Exxon released its long-term outlook yesterday, it was like porn for the oil bulls. In the outlook, this chart especially stood out.

Oil

Natural Gas

While it is true that oil and gas companies need to continuously invest every year to replace existing declining oil and gas production, the above charts feel a bit unreal. The chart implies that we need new fields in order to sustain production over ~100 million b/d (which is very true).

And while I am very bullish on oil in the long term, there also needs to be a sense of realism here when we look at this chart. Someone at Exxon basically took existing oil and gas fields, applied an arbitrary decline rate (~4% in this case), and Excel dragged it.

What this chart likely doesn't reflect is each company's ability to expand existing inventory. It is broadly correct for larger oilfield projects that require a multi-year planning process, but for the short-term cycle barrels like shale, this is not a good illustration.

But on the topic of US shale, I think there's a greater point to be made here that wasn't covered in Exxon's outlook.

US Shale's Peak?

Back in 2019, Rystad Energy published a piece forecasting how much US shale will eventually grow to.

In the forecast, Rystad expected Lower 48 oil production to hit ~13.5 million b/d by 2024 and ~14 million b/d by 2025.

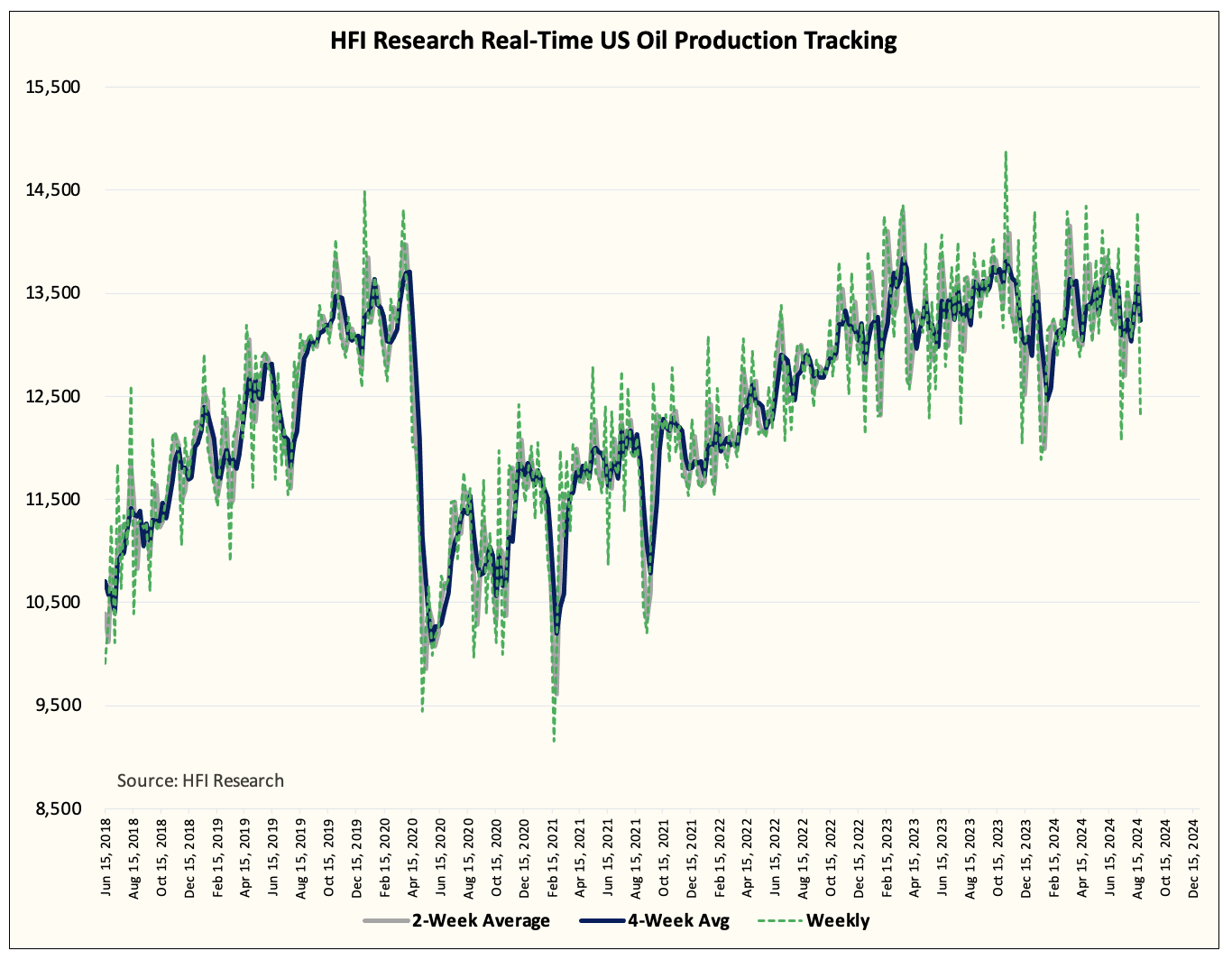

Fast forwarding to today, their modeling wasn't entirely off, but the delta is starting to grow. If we include Alaska's production into the mix, US oil production is totaling ~13.04 million b/d. Lower 48 production component is about ~12.6 million b/d, so relative to Rystad's model, Lower 48 oil production has underperformed ~1 million b/d.

By the end of 2025, we think Rystad's model will be off by ~1.1 million b/d (13.2 million b/d versus 14.3), and by 2027 to 2030, the model will be off by ~1.3 million b/d (13.2 million b/d versus 14.5 million b/d).

Now in fairness to Rystad, there was no way to predict COVID back in September 2019, so they could have been correct about the eventual peak in US shale production. But what's evident about their modeling and reality today is that the US shale peak is on the horizon.

If we are correct that peak US oil production (total) is around ~13.6 to ~13.8 million b/d, then non-OPEC growth in the years ahead will disappear.

And looking at Exxon's supply growth estimate chart, you can see that a bulk of the capacity increase in the years ahead will have to come from the Middle East. By Exxon's estimate, the Middle East will have to increase liquids supply by ~12 to ~13 million b/d to meet the growing demand. And even under that scenario, it looks like it won't be enough.

In essence, what Exxon is saying is what the oil bulls have been saying for years, without new capital investment and discoveries, a structural oil supply deficit is coming. If global oil demand simply remains around ~100 million b/d for the foreseeable future, the existing declines in oil fields will require companies to continuously invest to meet future demand needs.

This goes back to the meme image I posted at the start of the article, that's been the central bull thesis for anyone bullish on oil. And it feels like an eternity. I am tired, exhausted, and mentally drained. The uphill climb feels eternal and the torture never seems to go away.

But at some point, reality is reality. Oil fields decline, capex is needed to boost oil production, and new discoveries are needed to replace existing oil fields. If oil demand remains resilient at around 100 million b/d for the foreseeable future, then the current capex from companies is insufficient to meet future demand.

That's just the reality, and no matter how crazy I feel at times, I go back to the central thesis. While it's always easy to tell yourself to keep it simple, in reality, it's probably the hardest thing to do.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Great article. The reality, after being invested since 2018/9 in energy, is this is not a buy/hold sector but one where you need to be opportunistic and take advantage of the volatility, particularly given the geopolitical nuances which come with this commodity.