By: Jon Costello

Last week, we updated our E&P spreadsheet (the link is only available for paying subscribers) to reflect cash flow generation at $70 and $75 per barrel WTI. We found that E&Ps currently discount WTI in the mid-$70s per barrel. Prices above that level would cause E&P free cash flow to surge higher. Free cash flow would be returned to shareholders, and E&P stocks would trade well above current levels.

Recent news flow in the oil market suggests that higher oil prices are imminent, as data consistently points to a more constructive supply/demand balance than what is implied in consensus expectations.

We expect the positive news to continue. Investors should consider buying E&P stocks now before a shift in the fundamental outlook and investor sentiment sends their prices significantly higher.

The IEA’s Bearish Bias Strikes Again

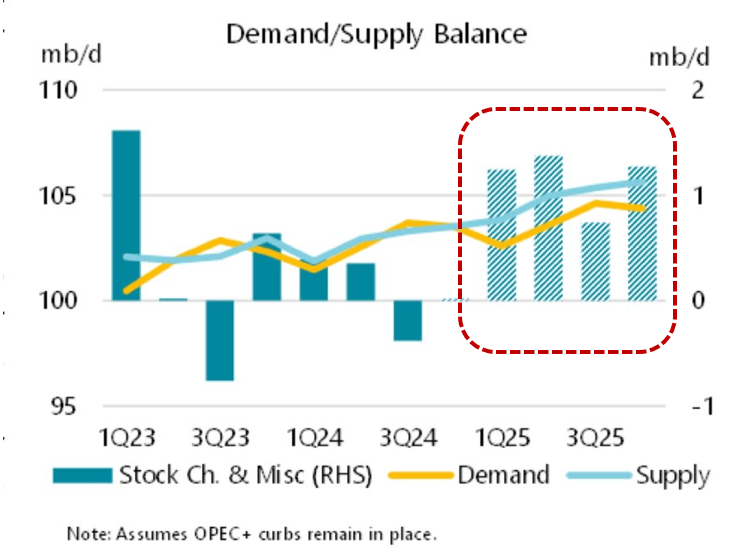

For months, oil prices have been held down by the consensus narrative that 2025 oil market balances will be too loose for comfort. The narrative is captured in the IEA’s November 2024 Oil Market Report, published last Thursday, which forecasts an ugly 1.1 million barrel per day oversupply for 2025.

The oversupply is depicted in the following chart. This is what currently spooks the market.

Source: IEA

The IEA is the oil market’s de facto benchmark for the consensus outlook, particularly with regard to supply, so we understand investors’ reluctance to buy E&Ps in the face of such massive projected inventory builds.

Oil prices have moved lower in anticipation of these builds. In fact, prices have undershot levels implied by inventories to a degree rarely seen over recent years, as shown below.

Source: Lefert Clement, X, Nov. 15, 2024. Red-dotted square added by author.

The WTI price is discounting more than 100 million barrels of inventory builds, equivalent to an annual build of 274,000 bbl/d.

The mega-builds forecasted by the IEA are set to begin in January and remain in effect throughout all of next year. By year-end, they imply that 300 to 400 million barrels of excess oil supply will have to be worked down before fundamentals justify a WTI price above $80 per barrel.

Reality Will Play Out Differently

Barring a deep global recession and/or OPEC’s abdication from market management, the IEA's forecasts strike us as ridiculous. By our estimates, the IEA’s oversupply is inflated by more than half.

Wilson discussed the problems with the IEA’s 2025 forecast in an update published last Thursday. He concluded that the agency included at least 300,000 bbl/d of excess OPEC+ supply growth and an additional 250,000 bbl/d of overstated U.S. production. Adjusting the forecasted oversupply for these factors brings the projected oversupply down by half to 550,000 bbl/d.

In the days since Wilson’s update, additional data have come to light that cast further doubt on the IEA’s 2025 supply forecast.

"Missing Barrels" Point to Larger-than-Expected Inventory Draws

In the IEA’s November report, its paper supply/demand balance for the third quarter of this year implied a global oil inventory build of approximately 400,000 bbl/d.

However, data on observed physical oil inventories indicate that draws occurred at a far greater rate. This trend is evident in satellite inventory data from Kpler, but it’s also apparent in the IEA’s own published figures.

The agency reported a 1.2 million bbl/d draw in observable inventories in the third quarter, three times its 400,000 bbl/d modeled draw. The difference between the inventory changes implied by the paper balances and the changes observed in physical global inventories are referred to as “missing barrels.”

The current missing barrel tally for the third quarter of 2024 is depicted in the chart below.

Source: Bloomberg, Nov. 19, 2024.

This underestimation of demand and/or overestimation of supply that blew out the missing barrel tally in the third quarter repeats a pattern of overly bearish balances published by IEA throughout all of 2024.

Consider that in January, the agency projected builds on the order of 1 million bbl/d in each of the final three quarters of 2024. Its January 2024 forecast is shown in the following chart.

Source: IEA, January 2024 Oil Market Report, Jan. 18, 2024. Red-dotted square added by author.

As we now know, the inventory builds that were expected to begin in April never materialized. This is a huge miss for the agency that has gone essentially unnoticed.

A similar miss for the fourth quarter that brings forth more missing barrels is likely. If the IEA’s numbers are off as much as we expect, incoming fundamental data will continue to track more bullishly than consensus expectations based on IEA paper balances.

A key implication of these inventory dynamics is that the larger-than-expected supply deficit now underway will carry over into the 2025 supply/demand balance. It will therefore reduce the magnitude of any anticipated oversupply for that year.

This deficit carryover could reduce the inventory builds expected by consensus by as much as 500,000 bbl/d, eliminating the majority of the IEA's forecasted builds for 2025. It could shift the outlook for E&P stocks from ultra-bearish to outright bullish, particularly from today’s depressed price levels.

Brazil Disappoints, Again

Brazil is a major swing factor in the IEA's 2025 supply outlook, accounting for a quarter of next year's anticipated oversupply.

The IEA currently expects Brazil’s production to grow from approximately 3.25 million boe/d as of September 2024 to nearly 4 million boe/d by the end of 2025, representing more than 700,000 boe/d of expected growth over that timeframe.

However, yesterday news circulated that poured cold water on the IEA’s Brazil production forecast. Petrobras (PBR), Brazil’s national oil company, pushed back the extent and timing of its planned production increase over the next few years. PBR accounts for approximately 86% of Brazil's production and nearly all its production growth. Lower growth out of PBR translates into lower growth from Brazil.

PBR’s new five-year capital plan calls for production to increase from 2.8 billion boe/d today to 3.2 million boe/d by 2029. The 300,000 boe/d represents nearly all of Brazil’s growth over that timeframe.

The news illustrates the stark difference between the IEA's forecast and reality. Whereas the IEA is expecting Brazil’s oil production to increase by 700,000 boe/d of growth over the next fifteen months, PBR is calling for just 300,000 boe/d of growth over the next five years.

PBR’s growth will come from its new deepwater “pre-salt” offshore projects. All the while, its other production from “post-salt” offshore and shallow water/onshore reservoirs will decline at a rate of 10% per year. Such a high decline rate on a large production base increases the risk that production growth misses expectations if PBR fails to execute.

Poor execution would be in keeping with PBR’s long-term track record. With the exception of 2023, PBR has routinely failed to meet the market’s—and its own—annual production growth expectations due to higher-than-expected decline rates on legacy post-salt production, delayed startup of pre-salt projects, and overly optimistic internal growth forecasts that get cut and pasted each year into the IEA’s projections.

These issues caused the IEA to lower its 2024 growth forecast for Brazi several times this year. It had initially pegged Brazil's growth at 300,000 boe/d after the country's surprise outperformance in 2023. Every few months, however, it revised its estimates lower. It now expects Brazil to post flat production in 2024.

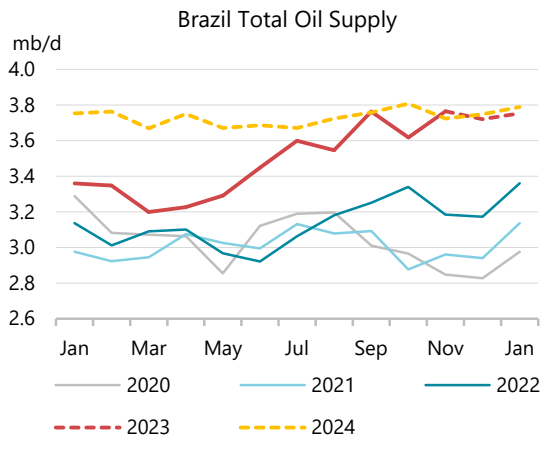

The IEA's overestimation of Brazil's growth can be seen in the following charts. The yellow-dotted line in the first chart below shows the IEA's 2024 Brazil production forecast made in its January 2024 Oil Market Report. Production was expected to average approximately 3.7 million boe/d for the year.

Source: IEA, January 2024 Oil Market Report, Jan. 18, 2024.

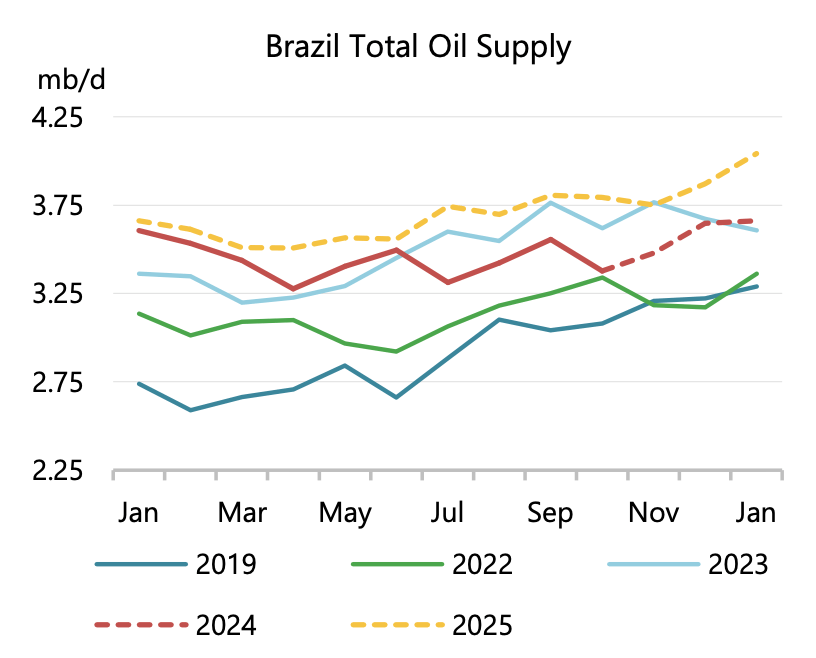

The solid red line in the next chart shows what has actually occurred through September of 2024. Brazil's production was stuck in the 3.3 million boe/d range. Production for the year was flat, while the 2024 exit rate stands nearly 500,000 boe/d below the IEA’s original forecast.

Source: IEA, November 2024 Oil Market Report, Nov. 14, 2024.

I expect PBR's recent extension of its growth timeline to cause the IEA to revise its 2025 Brazil production growth assumption downward. If it does, the agency's forecasted 2025 oversupply will be whittled down further, creating another bullish tailwind for oil prices and E&P stocks.

Iranian Production: Up in the Air

Iran’s production outlook depends on the course of U.S. sanctions and their enforcement under the incoming Trump administration. At this point, Iran’s near-term production outlook is anyone’s guess. However, its production one year from now is more likely to be lower than higher. I’ve already seen reports of large Chinese refiners balking at buying Iranian barrels for delivery in 2025.

Some reputable oil market authorities, such as Energy Aspects, expect big Iranian supply losses. The following chart plots Iran’s actual supply growth under the Biden administration and Energy Aspects’ expectations for what is likely to occur in 2025 under Trump.

Source: Energy Aspects, Nov. 18 2024.

Supply losses of this magnitude, when coupled with the other supply disappointments mentioned above, would tip the oil market into a supply deficit absent compensating supply increases by OPEC+.

Meanwhile, Demand is Improving

Bears often cite the weak demand outlook to explain the persistent oil price weakness. Like supply, however, demand may also be shifting in favor of the bulls. Refining margins, for one, indicate that demand has picked up to a material degree over recent weeks.

Source: Barchart.com

Higher margins give refiners the green light to increase crude oil throughput, thereby drawing crude inventories lower and bolstering crude prices.

Time spreads also imply a healthy demand outlook. The 1.2 million bbl/d inventory build forecasted by the IEA in the first quarter of 2025 is nowhere to be found.

Source: Barchart.com

Higher-than-expected demand may be just what the oil market needs to send WTI back to levels implied by inventories in the $80-to-$85 per barrel range. Needless to say, such conditions would bring about huge gains in E&P stocks from today’s prices.

Conclusion

As more data trickles in, the prevailing bearish narrative for 2025 is becoming less believable. If the supply disappointments come to pass, they could put the oil market into a supply deficit in 2025, similar to what happened in 2024. Oil market management would then rest firmly in the hands of OPEC+. We would expect WTI to trade in the $75 to $90 per barrel range throughout the year, buoyed up and down based on demand factors. Today’s E&P stock prices would represent the bottom of the trading range.

Aggressive investors should consider buying shares in their favorite oil-weighted E&Ps now. Those that do stand to reap the biggest gains as the bullish outlook becomes reflected in higher prices for oil and E&P stocks.

Risk-averse investors may prefer to wait for a discernible sentiment change before loading up on E&P stocks. They should be on the lookout for such a change over the coming weeks so they can buy before it becomes obvious in the broader market. Alternatively, they can simply buy the most conservative names, such as Canadian Natural Resources (CNQ), and eliminate the need to get the timing right.

The oil market's fundamental outlook is clearly brighter than the consensus expects. My next article will discuss some of my favorite E&P stocks to buy as sentiment toward the sector improves over the coming months.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.