Weather models showed a substantial increase in heating degree days this weekend. Since the Friday close, ECMWF-EPS has gained ~48 HDDs, and the next 15-days are projected to be colder-than-normal. On a heating demand basis, we estimate close to ~220 Bcf of natural gas demand was added (conservative). If you include the potential production freeze-off, we could be looking at close to 250-260 Bcf of storage delta.

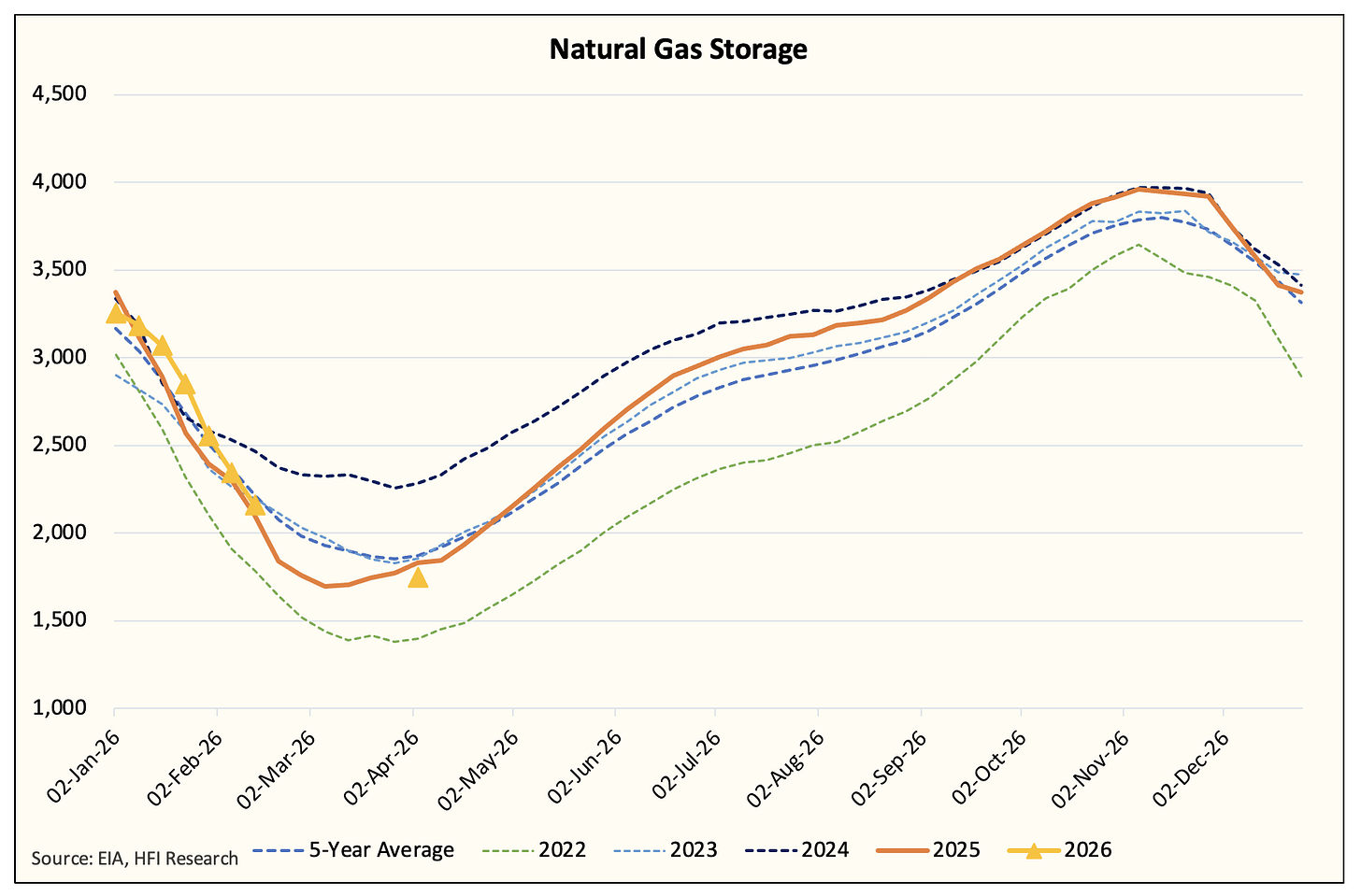

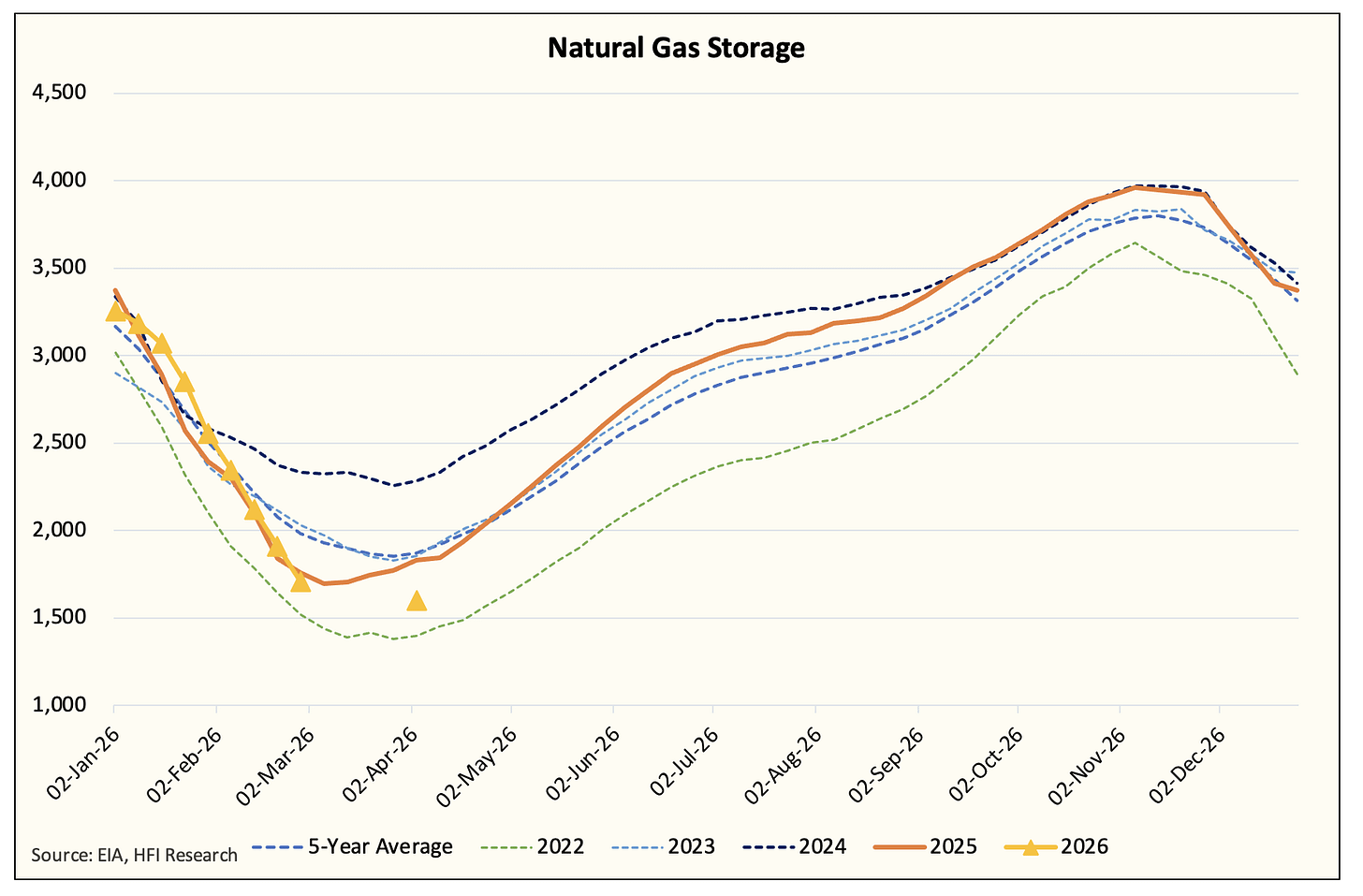

We originally projected EOS at 1.95 Tcf, but the latest update puts us at 1.75 Tcf.

The latest heating demand increase also puts natural gas back to the 5-year average by the middle of February. This is a major change from the previous forecast.

What does the weather look like?

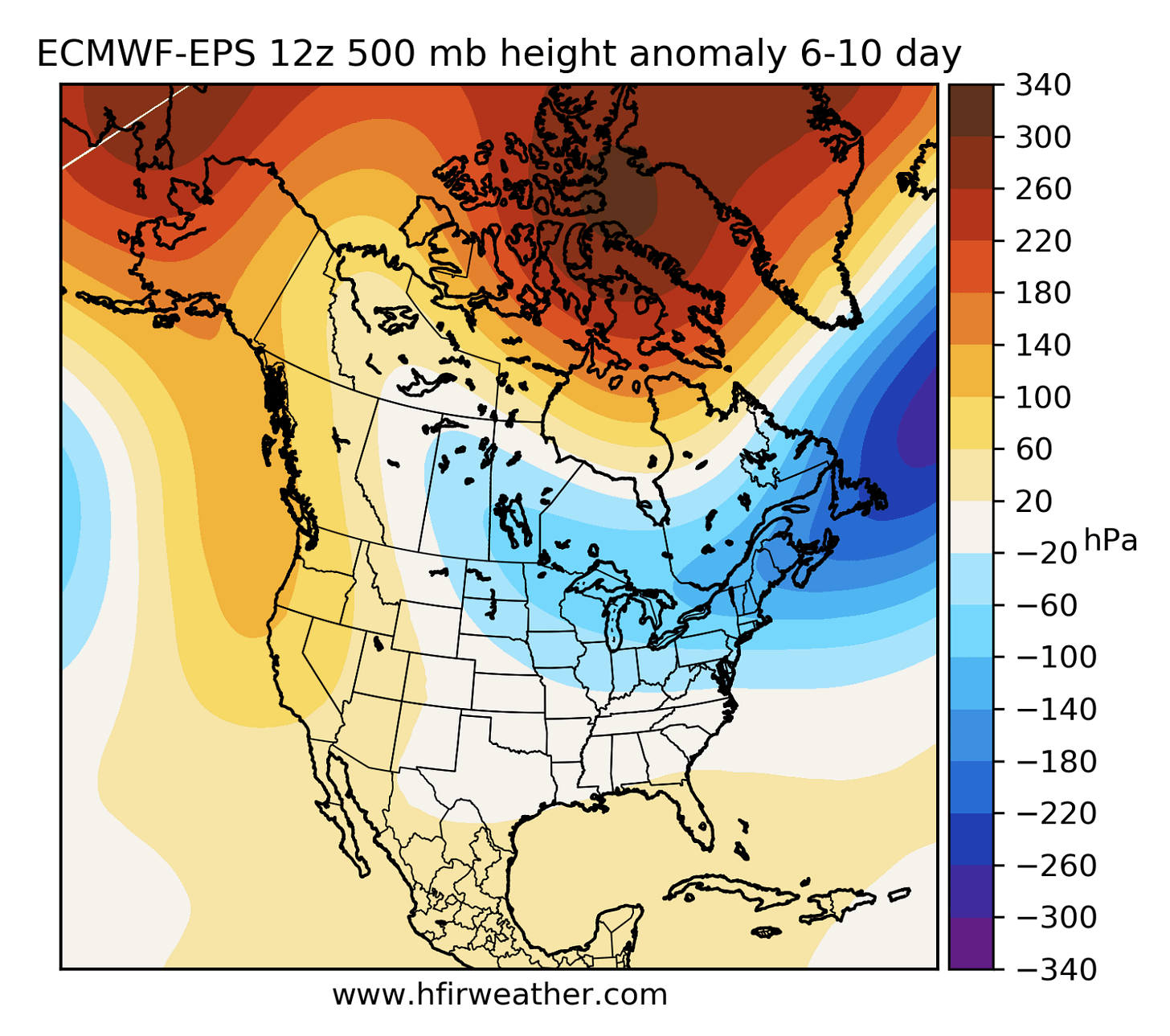

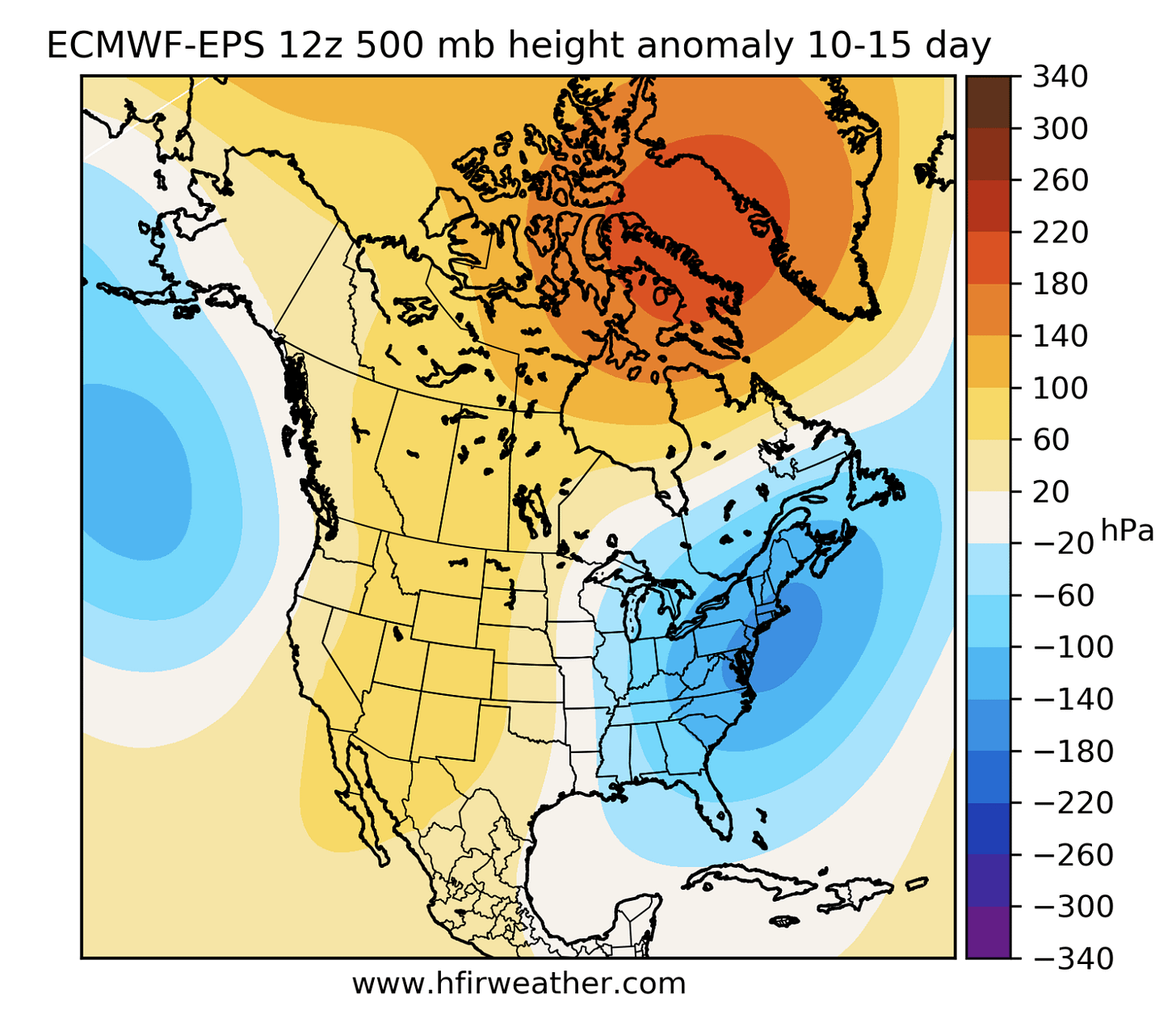

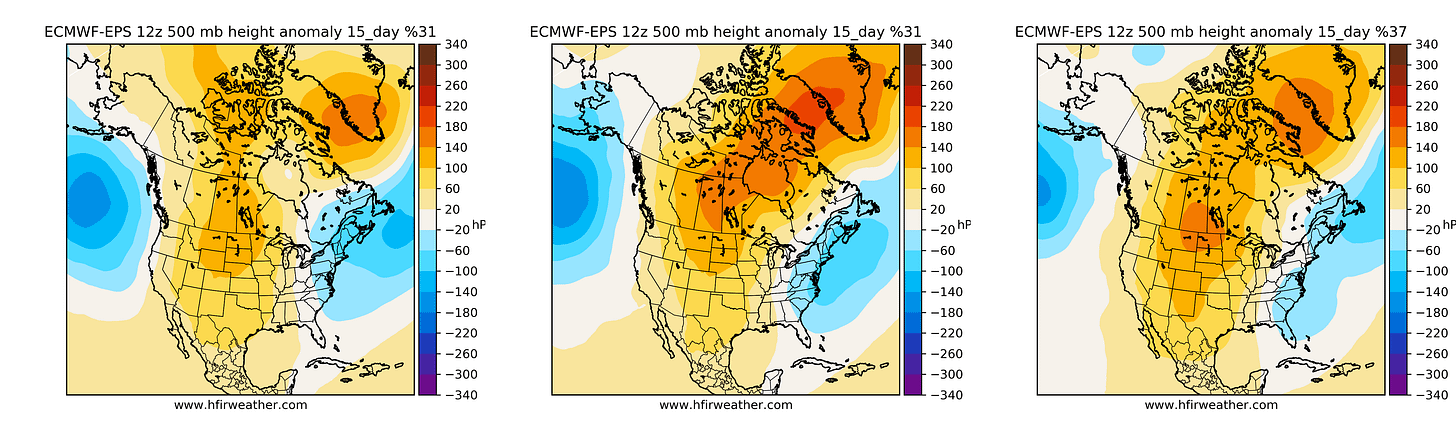

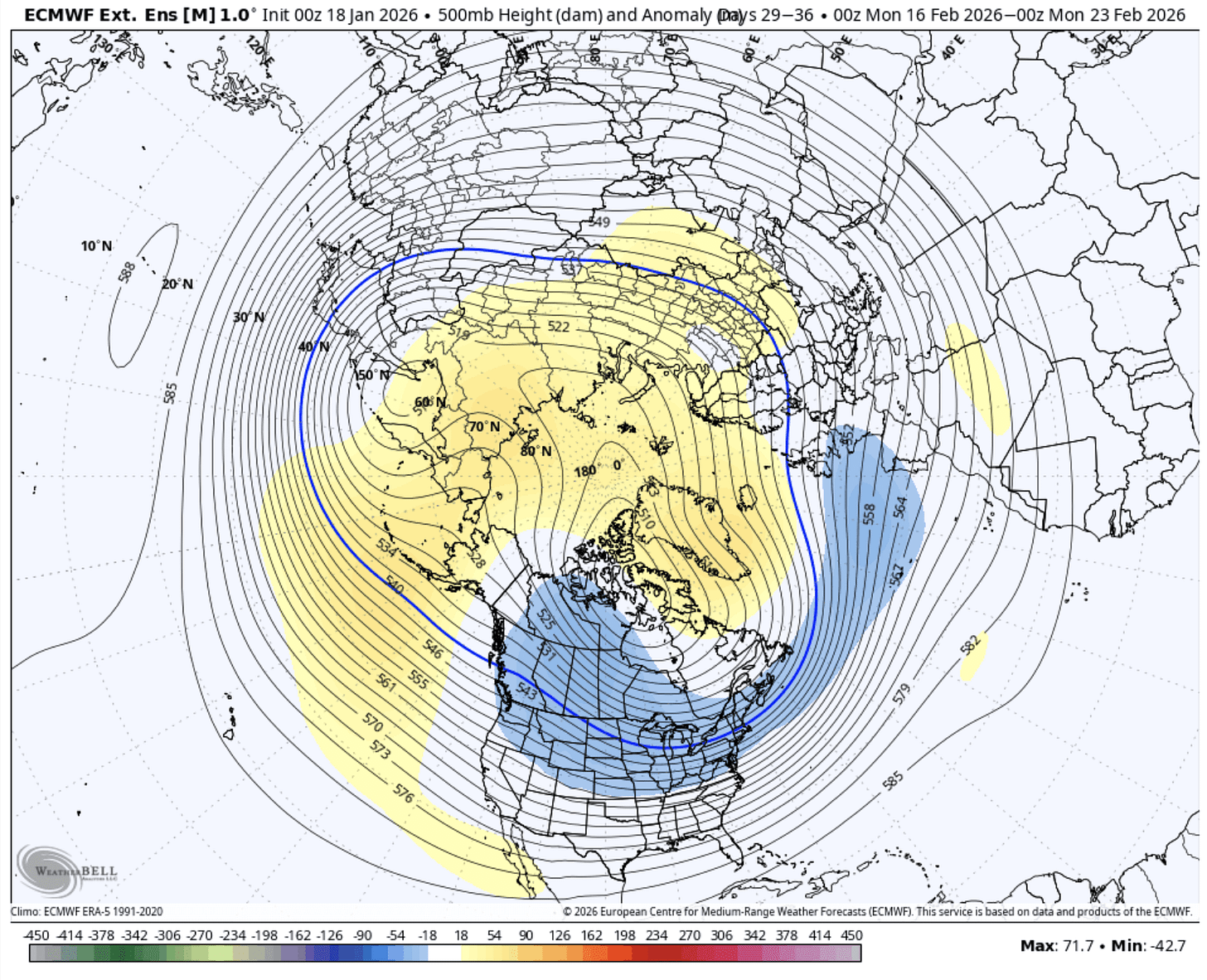

In the Jan 18 ECMWF-EPS 12z update, this is what the weather maps looked like:

ECMWF-EPS TDD Chart

1-5 Day

6-10 Day

10-15 Day

15-Day Cluster

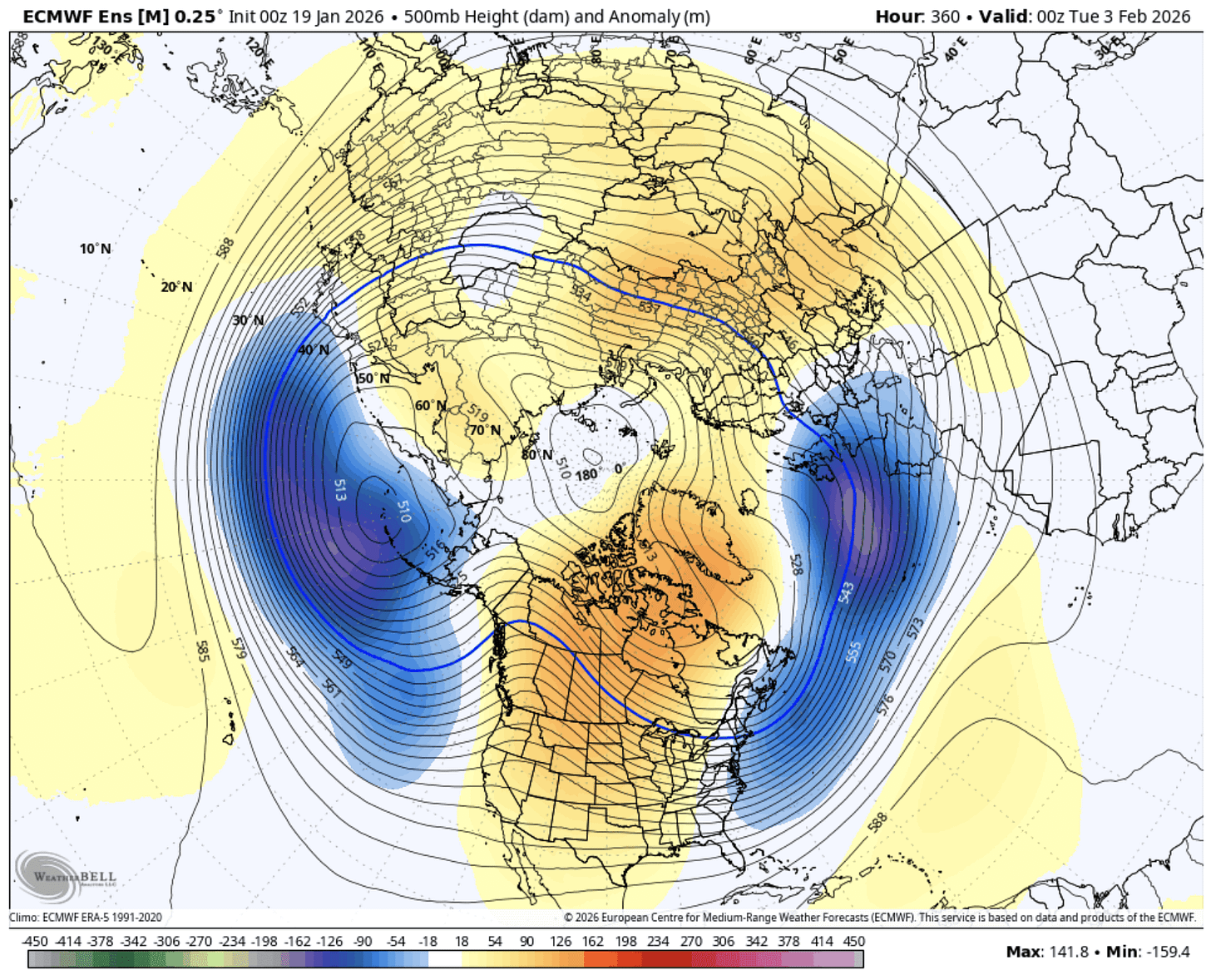

Now what you will notice in the above charts is the massive ridging pattern stretching from Alaska to Greenland. As we explained in past natural gas reports, this is the bull signal you want to see during winter gas trading. The models are projecting that the bull pattern dissipates, but we think model variability continues to “underwhelm” the real bull scenario.

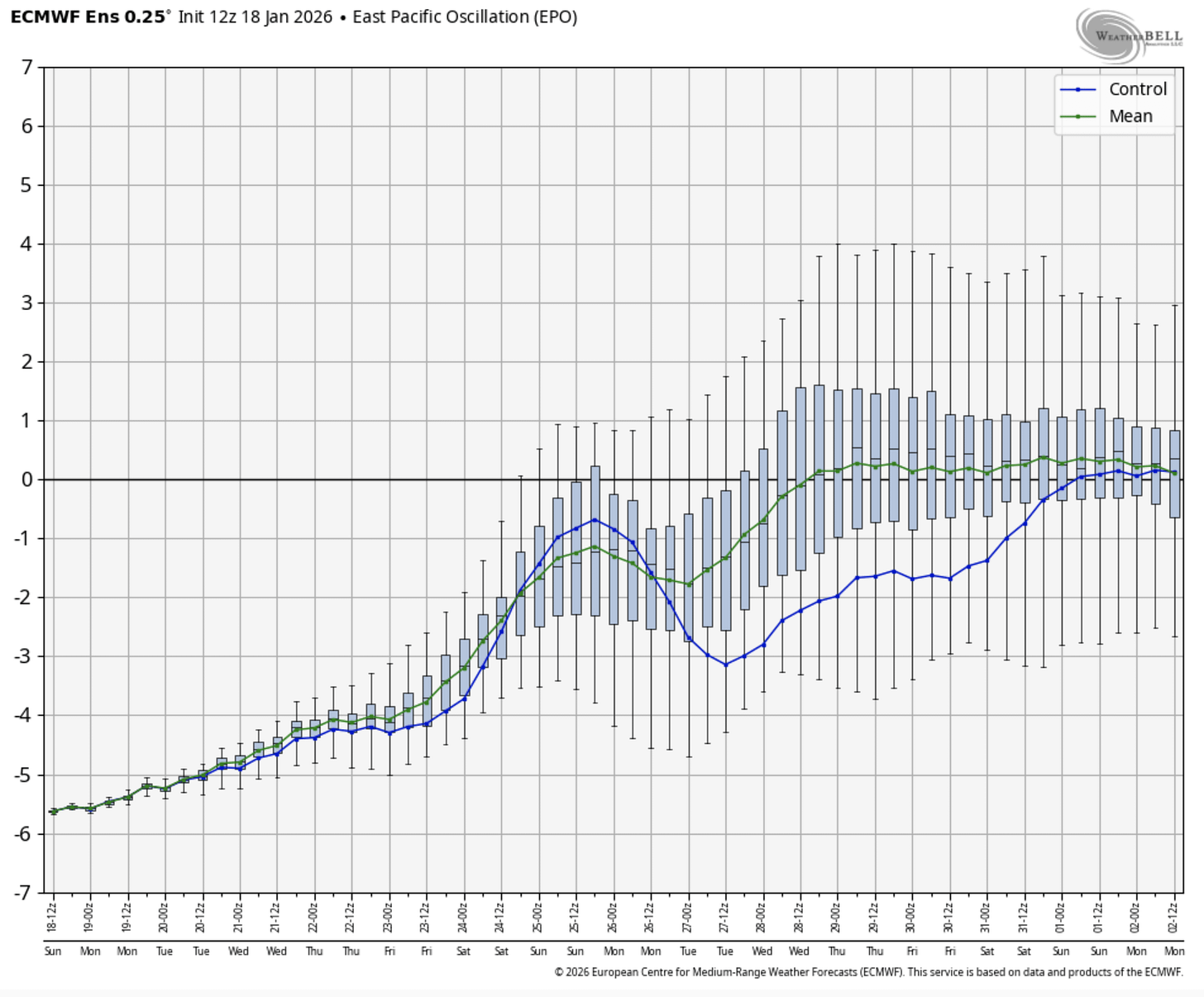

For example, the Eastern Pacific Oscillation or EPO continues to show a 50/50 outlook for the teleconnection signal. As we explained in our last natural gas article, a negative EPO equates to a bullish outlook, while a positive EPO equates to a bearish outlook.

Since it’s the weather models we are talking about here, the variability is notable given the sudden reversal higher from the current “intense” ridging we see.

Here’s a good example of a snapshot of when the Alaska ridge disappears:

Source: Weatherbell.com

We have several issues with this forecast. First, it appears this sudden change in the Alaska ridge is more related to weather model variability as opposed to pattern confidence. As many people in the natural gas trading business will know, weather models tend to “trend,” and given the strong evidence of “intense” ridging we are seeing in the 1-5 day range (higher confidence forecast range), it is better than 50/50 that it continues to trend that way.

In layman’s terms, what I’m saying is that the models are likely underestimating how much cold we eventually get (or not pricing in the increase in natural gas properly). Unfortunately for those trading natural gas, it implies that you just have to take on the weather model variability risk to see real upside. Models should, in theory, keep trending colder.

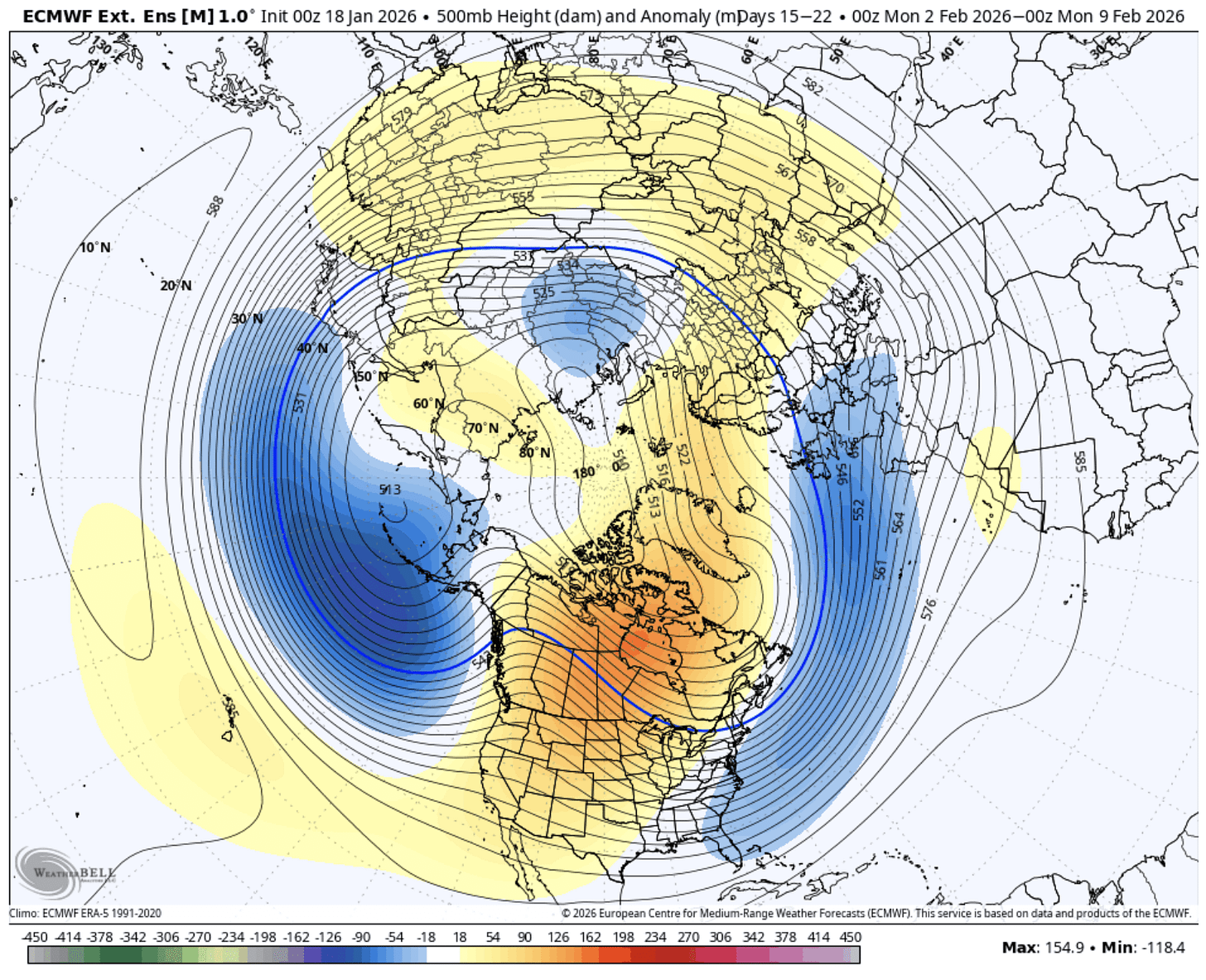

In addition to this weekend’s bullish development, another bullish development took place that should warrant even higher natural gas prices. The 15-day outlook (latest update) shows the Alaska ridge returning and colder-than-normal weather persisting in the East.

Source: Weatherbell.com

Now if you align this latest outlook with the ECMWF-EPS weekly, you can quickly see that the bullish weather pattern is expected to persist into late February.

15-22 Day

Source: Weatherbell.com

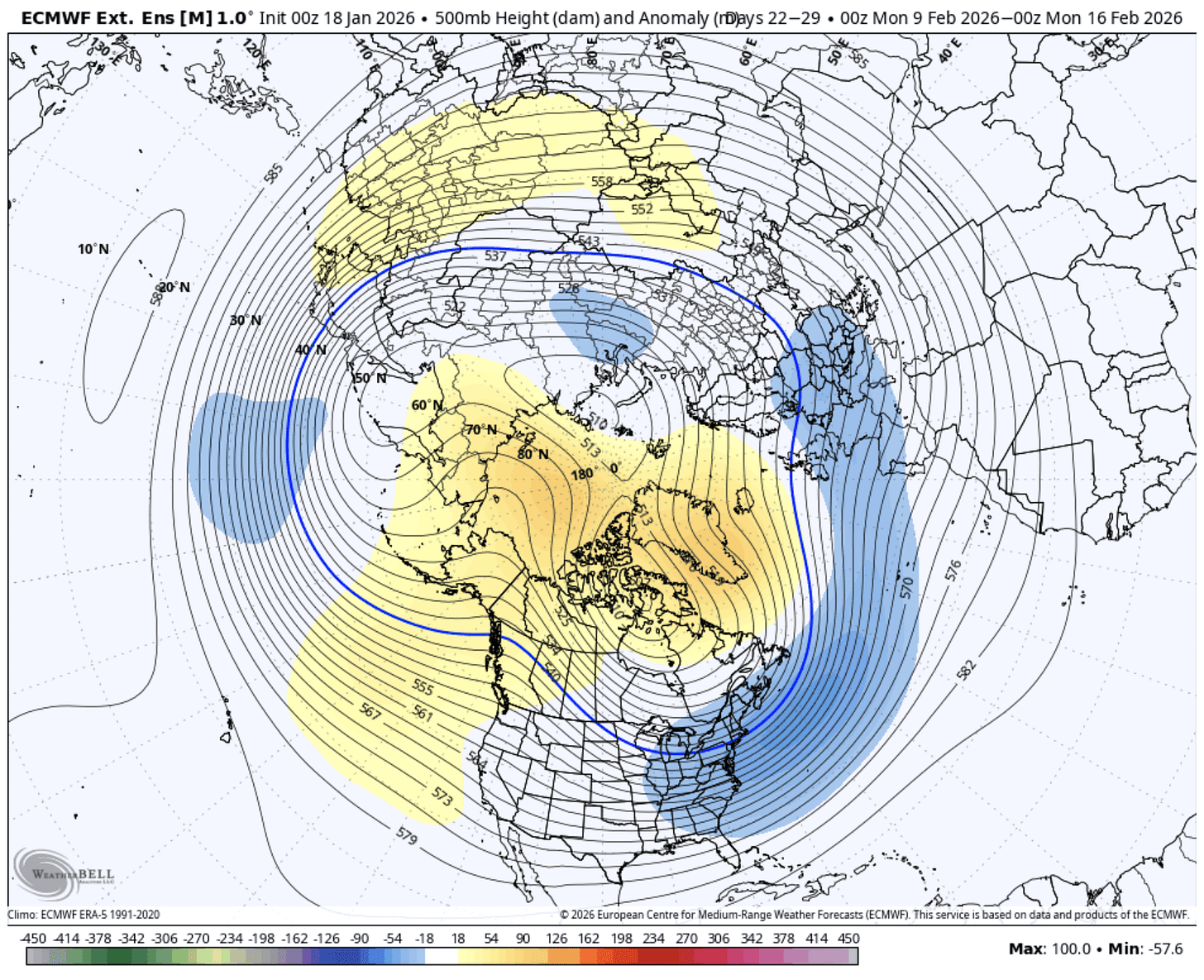

22-29 Day

Source: Weatherbell.com

29-36 Day

Source: Weatherbell.com

It’s hard to believe, but such a weather forecast would push natural gas prices well above $4.5/MMBtu. Let’s discuss the fundamental implications arising from this.

Fundamentals

Sustained cold is the most bullish outcome for the natural gas market during winter gas trading. Normally, we would see a bout of cold, and then the models would trend warmer, but in this case, this looks like a durable cold for longer.

Our natural gas storage model is being conservative at the moment, but if we assume colder-than-normal weather into the end of February, this is what storage would look like:

The above scenario does not require a major polar vortex or an extreme weather event. All this scenario requires is for us to avoid warmer-than-normal temperatures, which is certainly doable. In the event of another extreme weather event, you will see us break the 2022 lows.

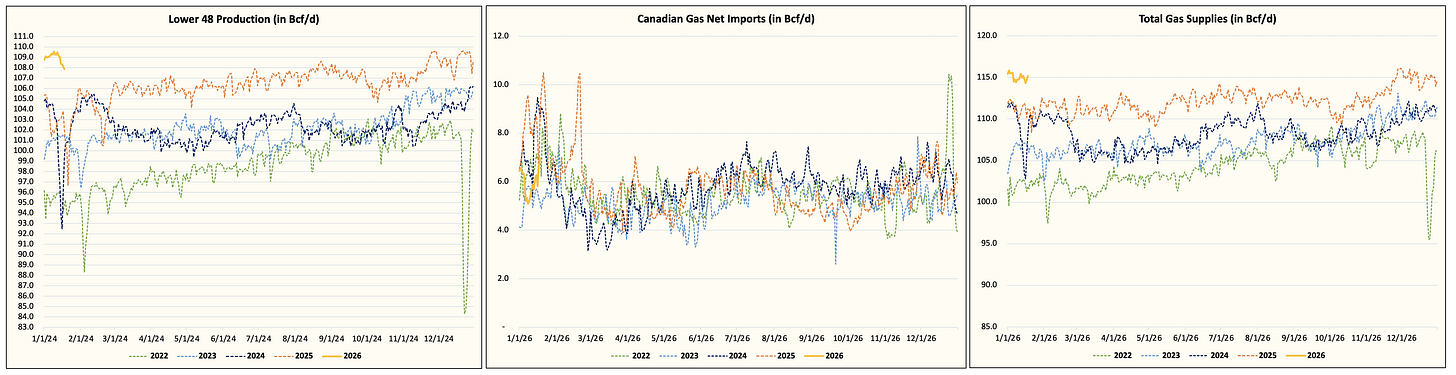

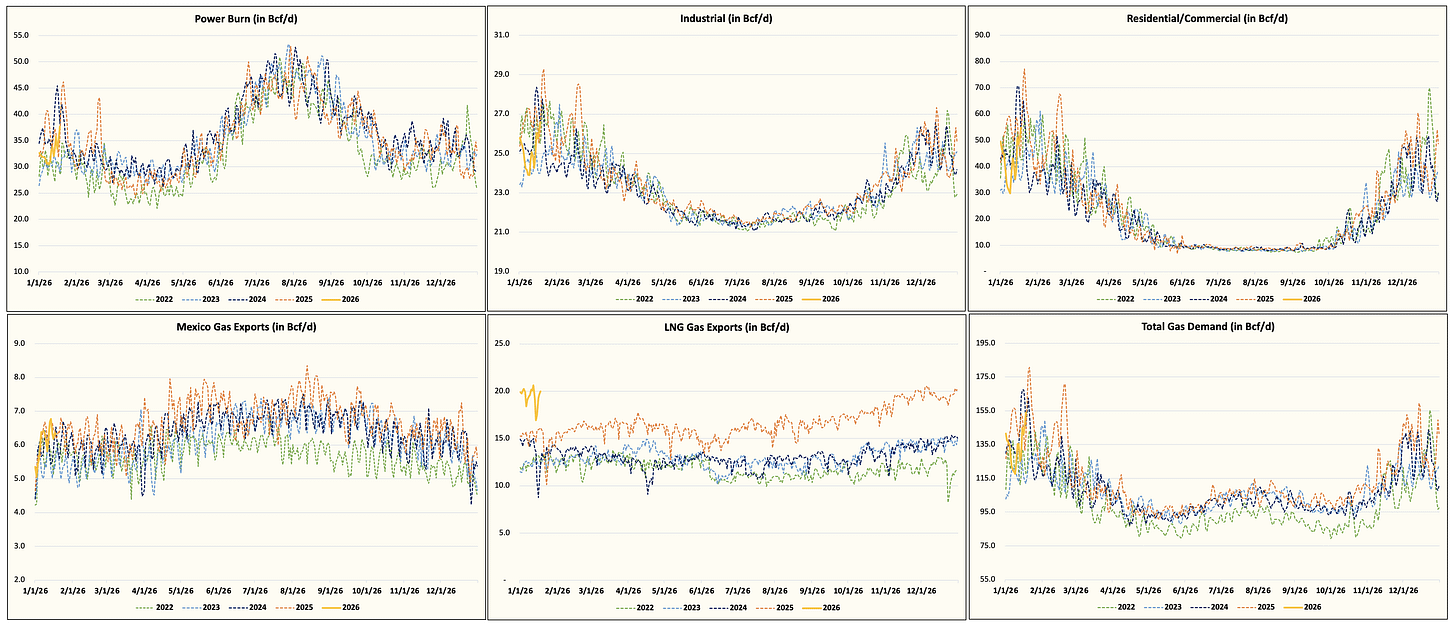

In addition to the increase in heating demand, Lower 48 gas production will experience freeze-offs that will materially impact the supply side.

Canadian net gas imports will jump to fill some of the void, but the freeze-off will be dramatic. We estimate at least ~5 Bcf/d of production going offline with more if the cold is sustained.

And because this cold front won’t impact the South much, LNG exports will still operate near capacity, which will further strain natural gas balances.

From a balance standpoint, a production freeze-off coupled with no meaningful disruption in LNG feedgas will materially tighten the natural gas market. Any supply disruption will eat directly into balances, and traders will price that accordingly.

Conclusion

This weekend saw one of the more dramatic turns of events in terms of heating demand change for the natural gas market. The market underappreciated the risk of colder than normal weather and prices are starting to respond accordingly. Despite the jump higher, we think the market might still be too skeptical of the incoming cold. No one can blame traders for wanting to wait for more certainty after all of the weather volatility earlier this winter. But as we’ve said time and time again, the market was trading as if this winter was over, and it certainly was not. We remain long BOIL.

Paying subscribers received our real-time trade alert to go long BOIL on Jan 15. Please consider becoming a paid subscriber.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BOIL either through stock ownership, options, or other derivatives.