(Public) The Ugly Truth About US Oil Production And Why You Should Pay Attention

EIA published US oil production figures for November yesterday and yay, another record high in US oil production (~13.308 million b/d). But not so fast, the adjustment factor came in at -315k b/d. This means that the real effective US oil production figure for November was 12.993 million b/d.

Source: EIA

What the heck is the adjustment?

The adjustment is a balancing item. Here is EIA's explanation of it:

Source: EIA

And this is the more detailed explanation of the adjustment:

Source: EIA

In essence, what's known to the EIA every month are the following variables with certainty:

Storage level

Refinery throughput

Crude imports and exports (customs data)

And now, the new transfers to crude oil.

While US oil production has always been survey-based, it is very difficult to grasp the full nature of US oil production with US shale being so dominated by NGLs. This is why at the start of 2023, EIA wanted to implement a new process to attempt to eliminate the adjustment factor. Before they introduced "transfers to crude oil supply or A.K.A. blending", the adjustment was constantly positive.

Source: EIA

But ever since June 2023, the adjustment in the monthly reports has turned sharply to the downside. There are two reasons why this is the case:

EIA found out that blending permanently made the adjustment factor high. They estimate that due to increasing US crude exports, blending ranges from ~500k b/d to ~700k b/d. The higher US crude exports are, the higher the blending value or AKA transfers to crude oil supply.

EIA also attributed, wrongly (as we will explain), that they have been underestimating US oil production. So they have increased US oil production estimates for the sake of increasing it in an effort to eliminate the adjustment.

The end result? The adjustment factor turned from a constantly positive figure to a constantly negative one.

Ugly Truth

EIA did the right thing in trying to figure out why the adjustment factor was constantly positive. But the problem it made was that it over-corrected the production side. Looking at our US oil production matrix, you can see that Q4 2022 US oil production was likely understated at 12.315 million b/d.

If we use the methodology of adding production to adjustment (this is before transfers to crude oil supply were introduced), we get an average of 13.183 million b/d. This means that US oil production exiting 2022 was closer to ~12.5 to ~12.6 million b/d. This put the underestimation between ~200k b/d to ~300k b/d.

Why is this an issue?

Well, the underestimation created several issues.

By underestimating US oil production into year-end 2022, it automatically overstates the growth we saw between year-end 2023 and 2022. For example, headline figures will have you think that US oil production grew ~1 million b/d (13.3 - 12.3).

In an attempt to correct the underestimation, EIA is overestimating the headline US oil production figure. So now the perception amongst the oil community is that US shale is going to eat into OPEC+'s market share.

The reality is far uglier...

What's the real growth in US oil production from Nov 2023 to Nov 2022? It was 400k b/d to 500k b/d. (12.993 - 12.5 or 12.6)

And to make matters worse, US oil production has not been able to keep up with the pace of growth we are seeing in associated gas production.

Source: EIA, HFIR

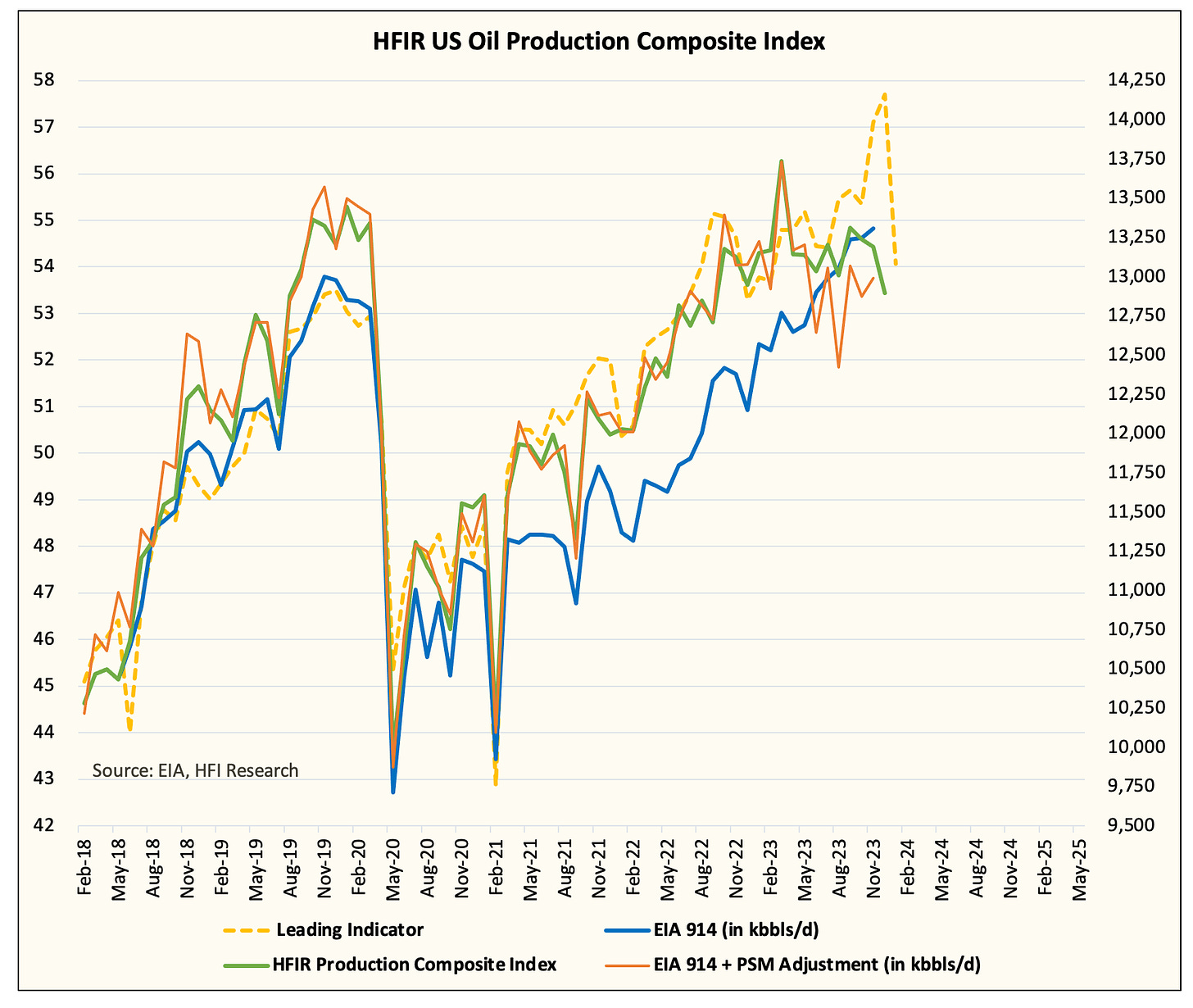

If we had taken our leading indicator (associated gas production) at face value, then we should have seen a corresponding increase in US oil production. For example, EIA would have reported ~13.3 million b/d as a headline figure with a positive 300k b/d in adjustment.

Instead, it was the opposite outcome, and as a result, this signals to us that the end of US shale is near.

Pounding the table here...

For December, our US oil production tracker shows ~12.896 million b/d. This is actually below what we had expected at the start of 2023. At ~12.896 million b/d, Q4 y-o-y growth would be ~371k b/d (12.921 - 12.55).

There are several conclusions you can arrive at using this data:

US oil production growth is far lower than what headline figures are showing: +1 million b/d vs +371k b/d.

IEA, OPEC, and EIA are wrong in using US oil production at ~13.3 million b/d as a baseline for Q4 2023. This means that their balance for the rest of 2024 is off. (Note: All oil analysts use the previous year's Q4 as a starting point for Q1 to Q4 balances in the following year. As a result, getting Q4 wrong means you got the entire next year wrong.)

Because of the material difference in both growth assumption and base figures, 2024 balances will be skewed to the bull side.

For readers, the most important takeaway from our article is the massive disparity in growth. The fact that headline figures show +1 million b/d versus our real implied +371k b/d should be alarming, and that's why we are pounding the table here.

Expectations going forward...

There's a lot to unwrap here, but this article would be meaningless if we didn't explain what that means going forward. So here's what we see:

Q1 2024 US oil production should meaningfully surprise to the downside. Previously, we expected an average of 12.8 to 12.9 million b/d, but with December production already averaging ~12.9 million b/d, we see the average closer to ~12.7 to ~12.8 million b/d.

This also materially lowers our projections for year-end 2024 down from 13.6 million b/d to 13.2 million b/d. For the rest of 2024, we think EIA will report flat headline production figures. We do expect US shale to still grow this year.

Associated gas production will completely decouple from US shale oil production. Over the entirety of 2024, we should see associated gas production remaining elevated, while oil production lags.

Capex guidance out of US shale oil producers will increasingly point to a flat growth projection. The growth is almost entirely gone.

By 2025, peak US shale will have arrived with the majority of the growth evaporating. With associated gas production still outpacing crude oil production growth, US oil production will have peaked between 13.2 to 13.5 million b/d.

As for the oil market, if demand growth continues at just a measly ~1 million b/d post-2025, the burden will have to fall on OPEC+ to fulfill most of that gap. Canada, Guyana, and Brazil will be unable to fill that gap. Once US shale is tapped, that's when the real oil supercycle begins.

So we hope this article helped explain the ugly truth we are seeing in US oil production. The headline growth is not what it seems, and sadly, we don't think a lot of people follow the data closely enough to know what's really going on.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Could you please explain what this adjustment is, I mean the reality behind this figure: is it coming from liquid extraction out of any HC flow? is it just a mathematical substraction? is it aggregated?

You have been mentioning this adjustment for months and I still do not get the full understanding of what it is exactly and what that means.

A couple of definitions (Leading indicator, HFIR production composite index, EIA 914, PSM adjustment etc...) would not hurt really, and a couple of simple equations too. We need to understand in EIA methodology what is data collection, what is inferred and what is plugged. Thank you