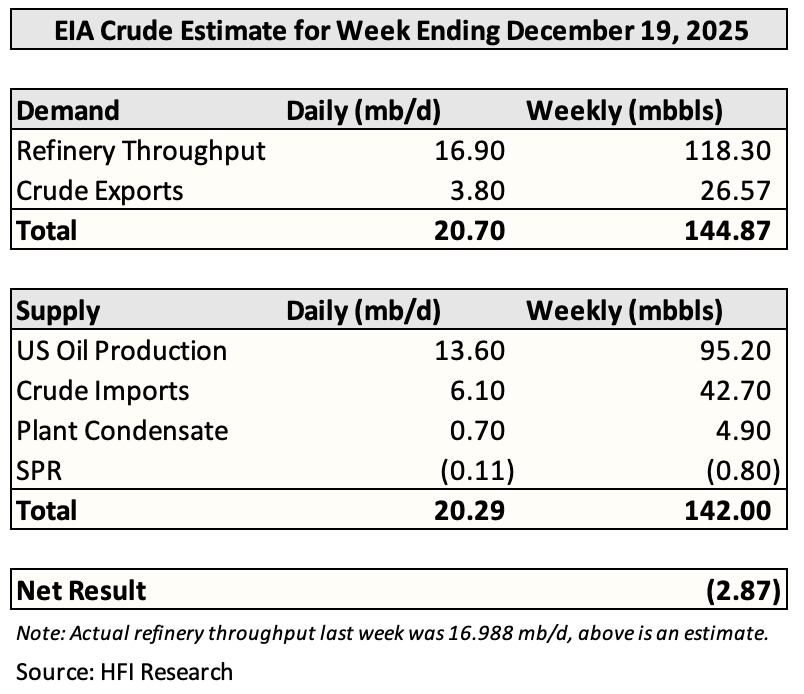

For the week ending Dec 19, we have a crude draw of 2.87 million bbls. This is in line with the 5-year average draw of ~2.9 million bbls.

This crude draw coupled with our preliminary forecast for next week will push US commercial crude storage near multi-year lows. This is in sharp contrast to our earlier forecast for a range of ~440 to ~460 million bbls.

The main variables that contributed to this are:

Higher-than-expected refinery throughput.

Lower-than-expected crude imports.

The low crude imports were surprising considering how elevated global oil-on-water is, but as we noted in our other OMFs, the surplus is entirely from Russia and Iran, so the unsanctioned crude side remains “tight”.

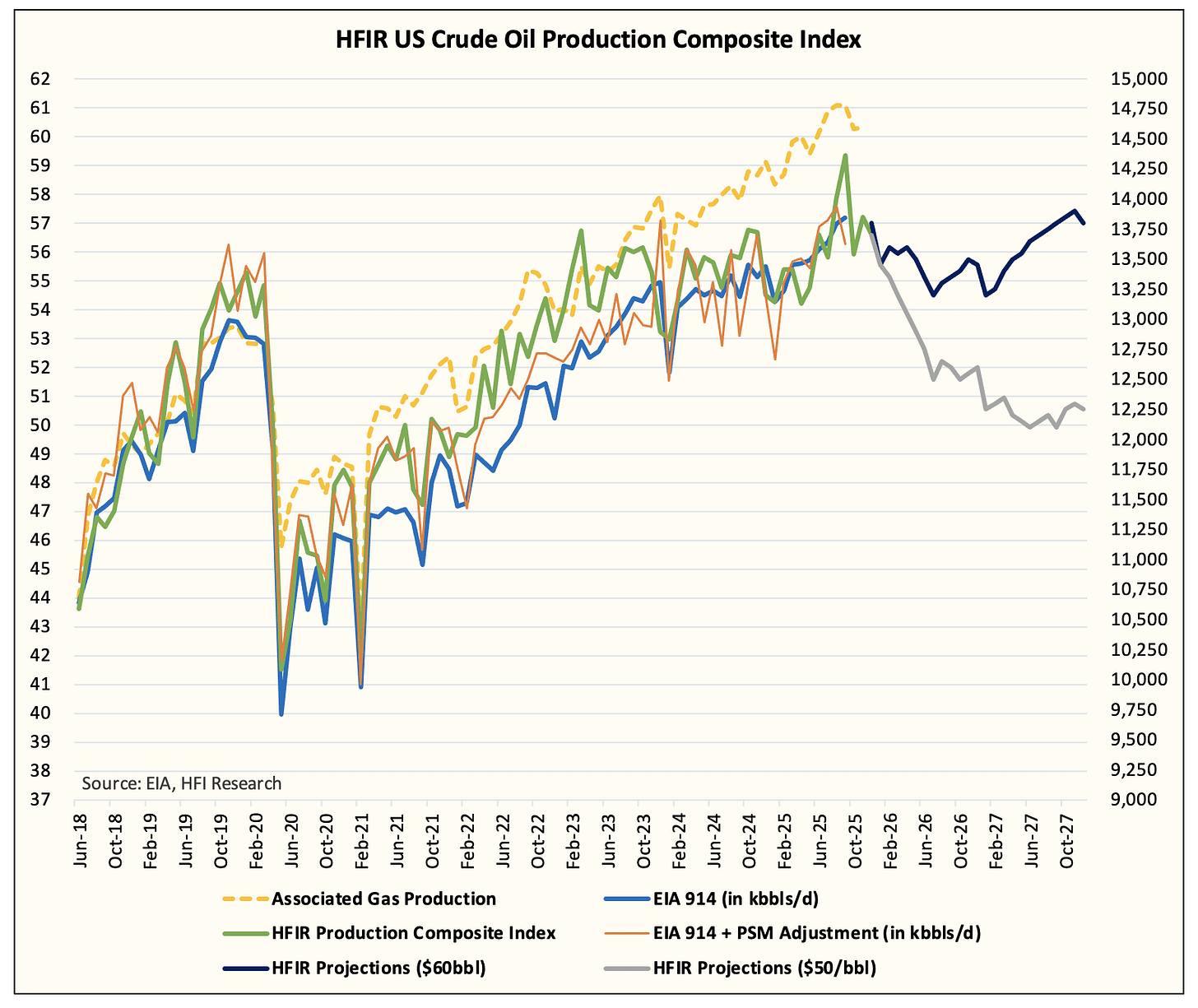

On the production side, if EIA confirms the small crude draw, US crude oil production will average close to ~13.6 million b/d for December.

Following the brief ramp-up we saw in August to November, we think US crude oil production is set to fall going into 2026.

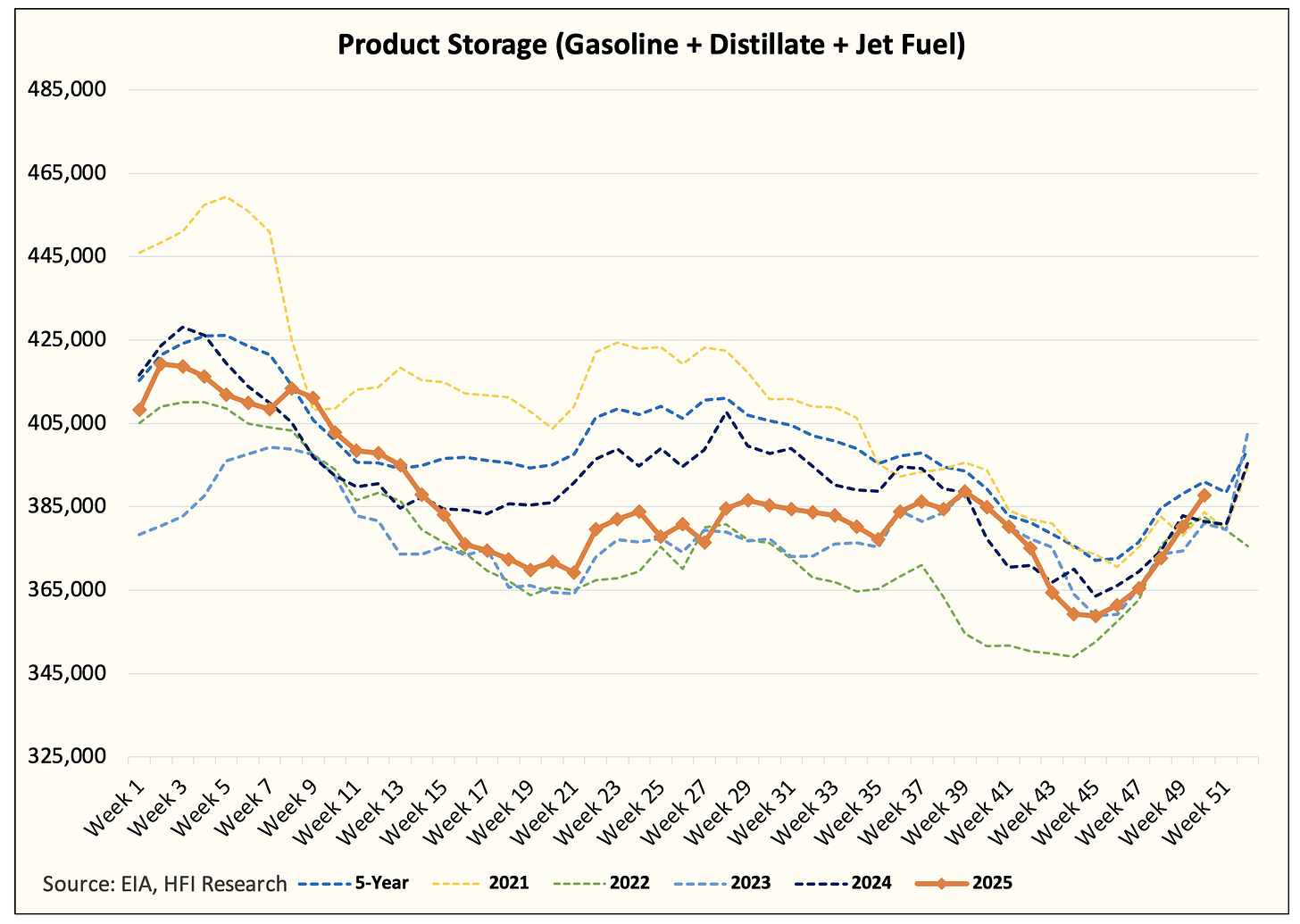

On the product side, readers should expect material builds. For end-of-year tax reasons, refineries typically stockpile product and keep crude storage low. API reported only +1.1 million bbls for gasoline and +0.7 million bbls for distillate.

If EIA confirms the small builds, product storage will be in line with previous averages.

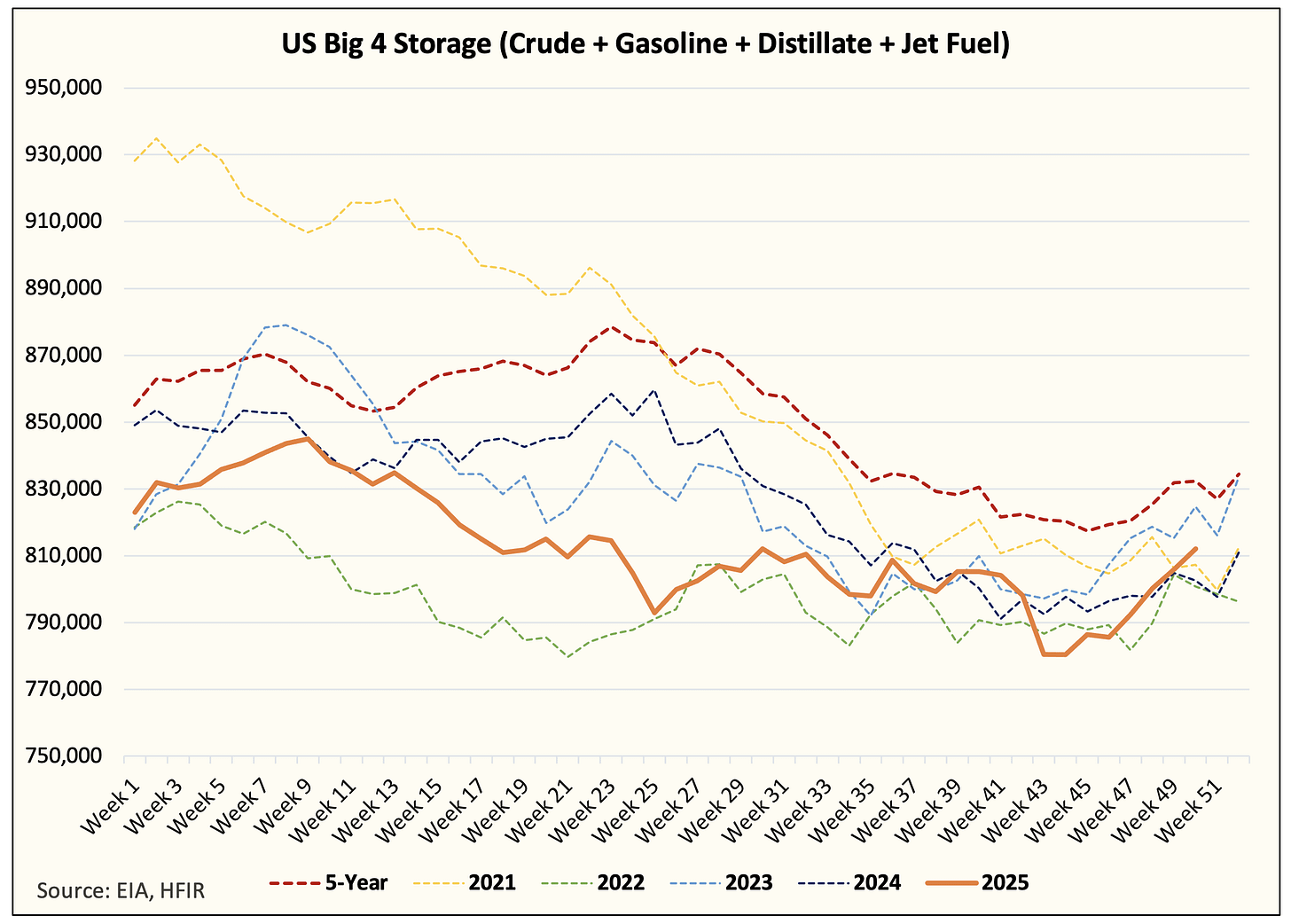

Finally, the US total liquids stockpile is where you will see the bulk of the surplus in the oil market balance:

Now compare that with the big 4 inventory balance (crude, distillate, jet fuel, and gasoline):

And you can quickly see that the surplus the market is pointing to is largely in NGLs and other liquids. Note: At least from the US oil inventory perspective.

In aggregate, US commercial crude storage is expected to finish near the multi-year lows despite the consensus estimates calling for a massive surplus in Q4 2025. This is one of the few times in the oil market history where the surplus elsewhere did not translate to visible US inventory builds, yet.

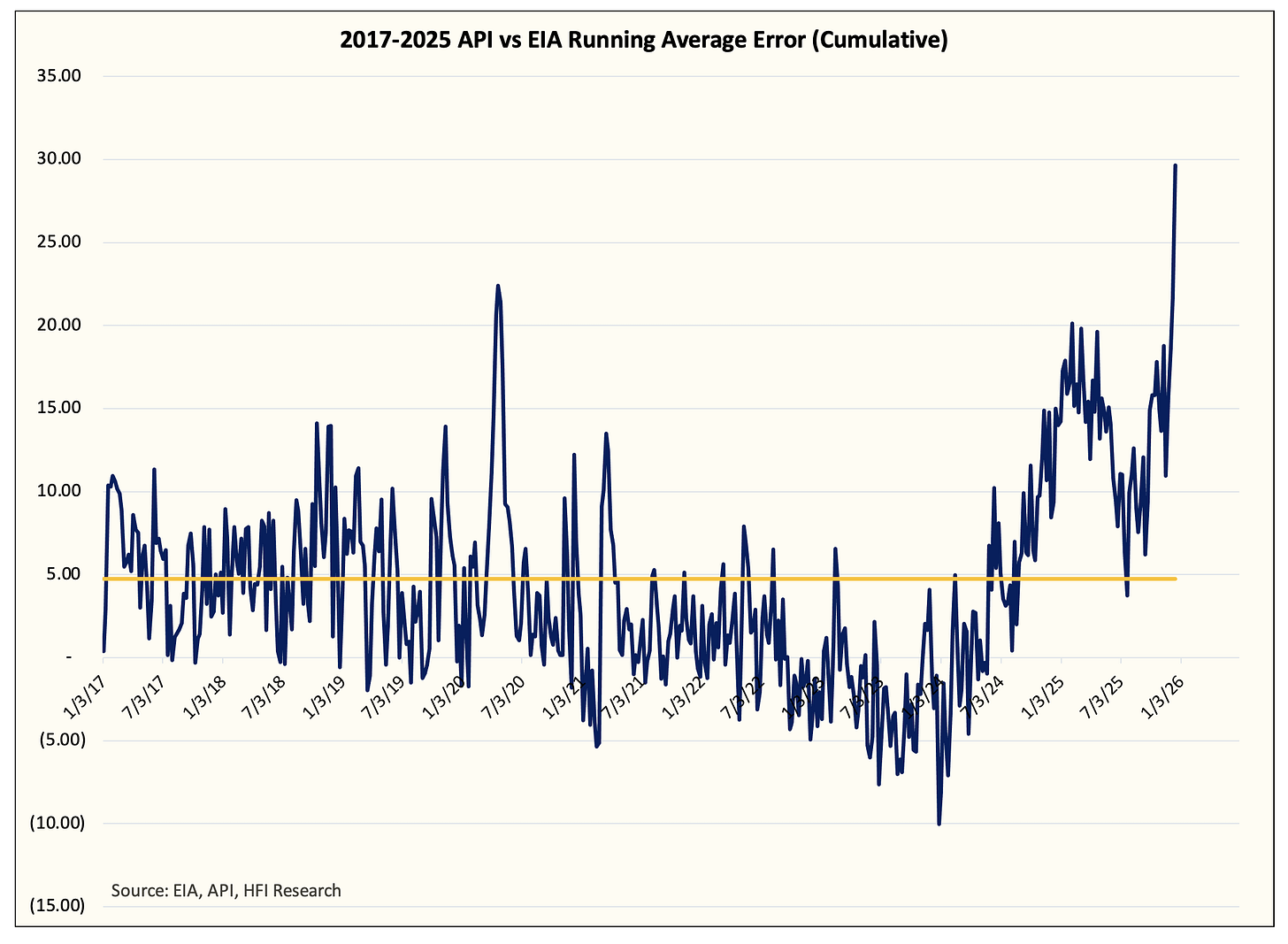

API vs EIA

Following API’s crazy -9+ million bbl crude draw figure last week (EIA reported -1.274 million bbls), API vs EIA running error has blown out to +29 million bbls. As a result, API’s crude storage estimate (+2.4 million bbls) is expected to be more bearish than EIA.

By our estimate, EIA should report near -2.5 to -3 million bbls or in line with our estimate.