(Public) What Will A Trump Presidential Victory Do To The Oil Market?

With the US election just 3-weeks away, it's time to pick a winner. Our view is that Trump will win the election.

Editor’s Note: Trump has won the presidential election. This is our WCTW from Oct 21 detailing what a Trump presidency will do to the oil market. The post is in its original form, so please excuse the old market data in it.

According to ElectionBettingOdds.com, Trump is currently favored at 58.3%.

Source: ElectionBettingOdds.com

And according to Nate Silver, Trump is only slightly favored.

While Nate Silver's data shows a 50/50 chance Trump wins, he explained that if Trump wins Pennsylvania, he has a 93% chance of winning the election.

As a result, we think the odds are heavily in favor of a Trump win, which means we need to start thinking about how this will impact both the oil and natural gas market.

For the oil market, we see several key policies that will impact global supply & demand balances:

Trump will reinforce sanctions on Iran leading to a loss of ~1.2 million b/d of production.

Trump will encourage OPEC+ to increase production by the amount Iran loses.

The Trump ceiling (OPEC+ ceiling).

Trump will encourage US producers to produce more, but government policies will be extremely limited.

Trump will end subsidies for electric vehicles, which will slow EV growth.

Trump may end up making a deal with China that supports global growth (big question mark for now).

In total, we expect Trump's policies related to the oil market to be neutral to slightly bullish.

On the natural gas front, these are the most meaningful ones:

Less government subsidies on renewable projects would increase power burn demand needs from natural gas.

Reversal of Biden administration policies on LNG export ban.

Drill baby drill, but this will be limited by market factors more than government policies.

In total, we expect Trump's policies related to the natural gas market to be net bullish.

Oil Market Policies

Two of the most significant Trump policies would be:

Iranian Sanctions

Saudi Relationship

Source: IEA

Unlike 2018 when Trump had to reinstate sanctions, this time around, the process would be rather seamless. The moment Trump wins the election, the sanctions would be enforced on Iranian crude exports (all going to China), which would result in a decrease of 1.2 million b/d. We expect Iran's crude production to fall from ~3.4 million b/d today to ~2.2 million b/d.

The "reported" drop in oil production will not match the reality due to the dark fleets. With China being the largest buyer of Iranian crude, we expect Iran's real production loss to be around ~800k b/d.

The first sign of this will be a jump in Iran's floating storage. Many of the top tanker data providers are tracking this, so that's your first signal that sanctions are being enforced again. Afterward, we expect Iran's oil production to drop to match the decrease in crude exports.

In aggregate, the oil market will react bullishly to this news, but we think OPEC+ can easily step into the void to fill the gap. Given the lesson learned in the 2018/2019 saga, we think OPEC+ will be smarter this time and only increase production to match the "realistic" drop in Iranian production.

However, while the Biden administration showed a lot more stealth when it came to dealing with the oil market, Trump will frequently use Twitter to express his disdain for high oil prices. And because of his relationship with the Saudis, there will be an invisible ceiling to oil prices during Trump's administration. Every time oil prices reach $90-$95/bbl Brent, Trump will cry out on Twitter, and the Saudis will respond. For energy investors, this is a reality you will have to grapple with despite the near-term bullish impact from enforcing Iranian sanctions.

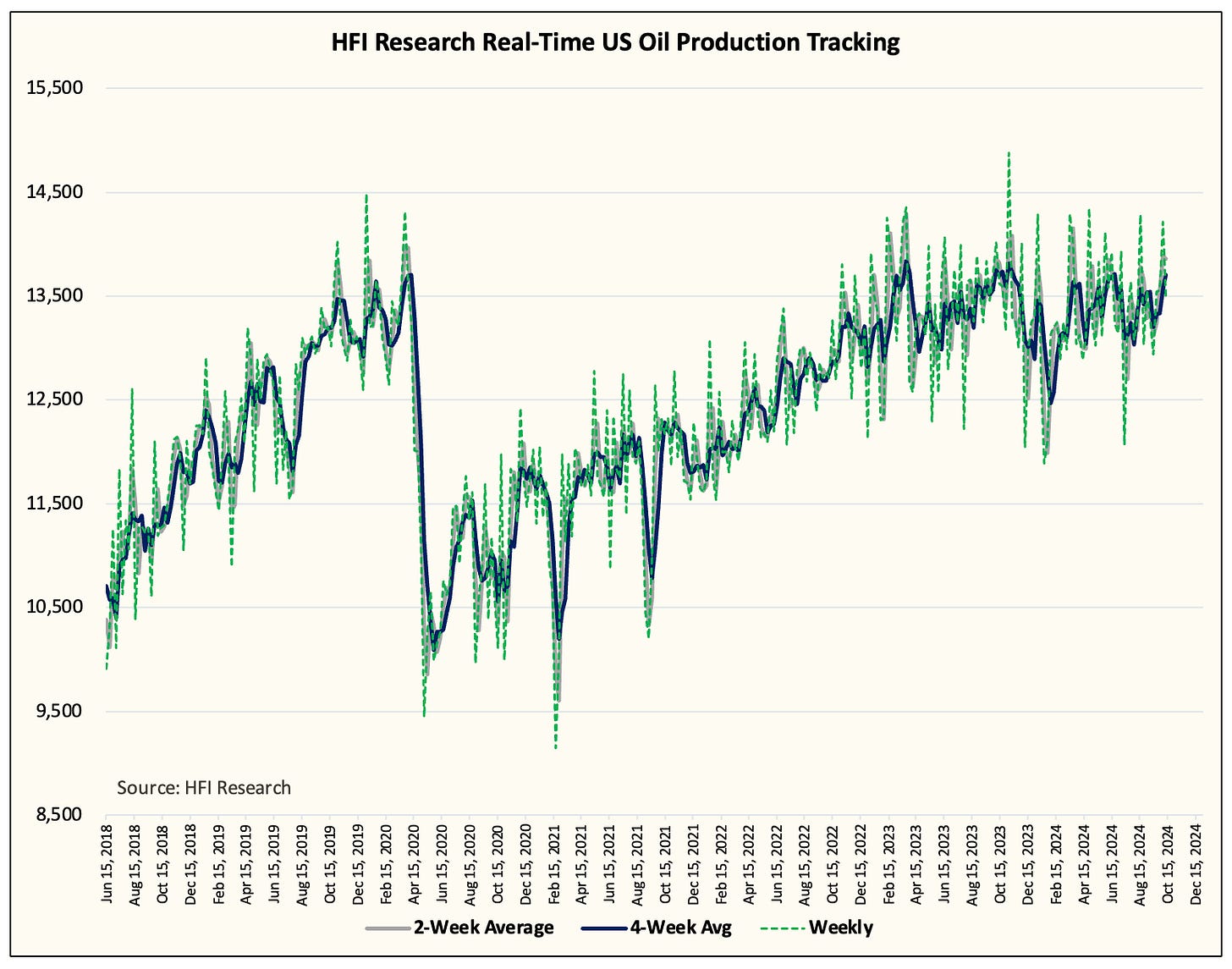

On the other end, Trump's domestic policy of "drill baby drill" will have almost no impact on US oil production. There are many reasons, but the most important one is that the US government has no policies in hand that will make producers produce more.

In addition, US oil production velocity has already meaningfully decelerated, so unless the US government can resolve the issue of depleting tier 1 inventory, then producers will remain tight with spending and growth will be muted.

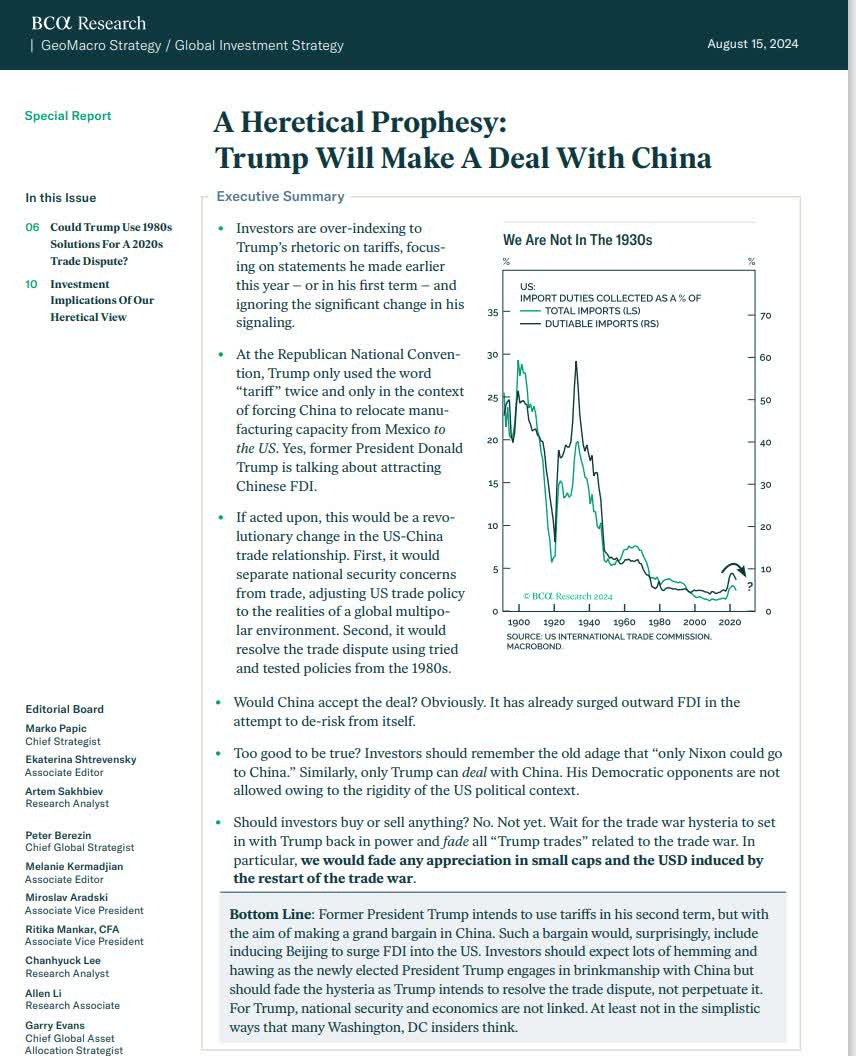

On the macro front, Trump's first term was very bearish on global oil demand as the trade war between the US and China resulted in a slowdown in global oil demand growth in 2019.

But BCA Research's Mark Papic seems to think differently. In a piece he wrote titled, "A Heretical Prophesy: Trump Will Make A Deal With China." He said:

Mark believes that Trump will use the rhetoric to eventually get a deal done. While we don't have any special insights on this, his report seems to make a lot of sense. I guess you can put this in the "too hard" pile for now.

In aggregate, a Trump victory will be neutral to slightly bullish for the oil market. Enforcement of Iranian sanctions would take barrels off the market, while the cozy relationships with the Saudis will see the production replaced, and an effective ceiling put on the oil market. Investors should expect years of rangebound oil prices, which would be bullish for equities.

Stock Picker's Market

With our view that the oil market will oscillate between $70 to $90 for the next few years, the energy sector becomes a stock picker's market. We think investors should continue to focus on the following attributes:

Long reserve life

Low maintenance capital

High free cash flow yield

Low debt

Share buyback capital allocation (only if the reserve life is long)

To make life simple, we continue to urge readers to own oilsand companies like Strathcona, MEG, Suncor, and Athabasca. We think these names will continue to outperform the sector as investors realize that longevity in the asset base is the name of the game. This is especially the case when investors see that the Permian is getting gassier and gassier.

Analyst's Disclosure: I/we have a beneficial long position in the shares of SCR.TO, MEG.TO, ATH.TO, SU either through stock ownership, options, or other derivatives.