(Public) When Is A Supply Cut Not Really A Supply Cut?

Since starting HFI Research, I've had the fortune of having discussions with some of the greatest money managers and oil traders in the world. Pierre Andurand, a subscriber of ours, was kind enough to share with me his thoughts today on what he thought was pushing oil prices down. He also shared this publicly via his tweet thread.

Source: Pierre Andurand

Now it's important to note that Pierre is referencing total liquids (products + crude), and the fixation of this article will be mainly on crude.

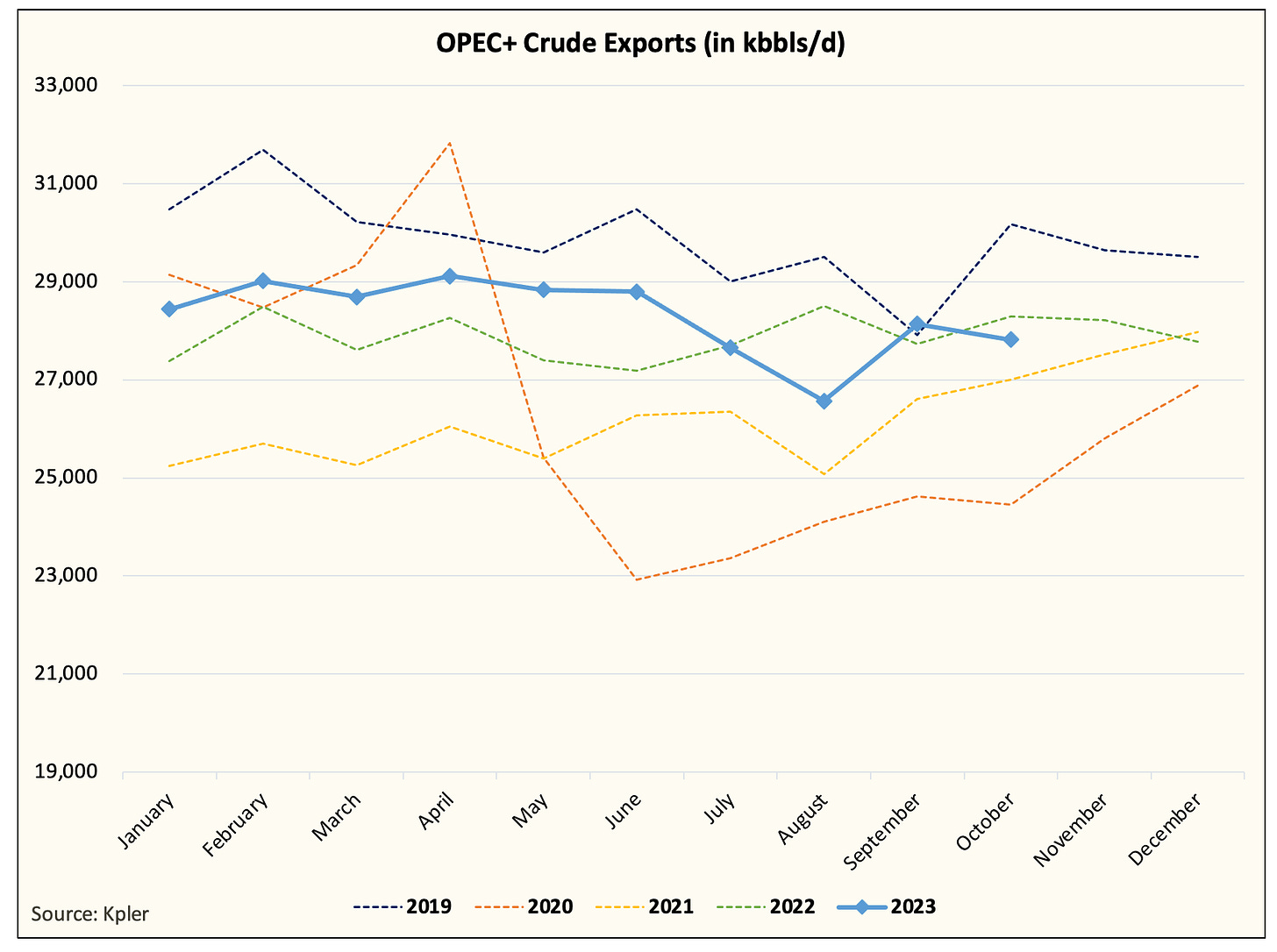

Following my discussion with him, this made me ponder just what the OPEC+ supply breakdown looks like. Here is a chart of OPEC+ crude exports:

Now you will notice that while we are lower from the peak of this year, we are only flat y-o-y despite all of the announced production cuts. So what gives? If there is truly a large ~1.3 million b/d (voluntary cut), then why aren't we seeing it via the lower crude exports?

This is where things get interesting. If you break the exports down, the Saudis are doing exactly what they are saying:

Saudi crude exports are down ~1 million b/d y-o-y and in comparison to the time of the voluntary cut announcement. While it's not at the lows we saw in August, Saudis have been doing the heavy lifting.

So what about everyone else?

Now if you take OPEC+ crude export and exclude the Saudis, it's easy to conclude that "everyone" else is cheating, while the Saudis are doing all the cutting. A price war is coming! Not so fast, you need to break this down a bit more to see just who is contributing to all the delta (i.e. y-o-y growth).

And quickly, you realize that Russia, while publicly committing to cutting exports, is still exporting ~700k b/d higher y-o-y. Now granted, Russian crude exports are down ~300k b/d from the very peak earlier this year, but it is up ~500k b/d from the July/August lows.

If you exclude Saudi and Russia, this is what you get.

Finally, if you exclude Iran, which has been increasing visible crude exports thanks to the lax enforcement from the US, you get the bigger picture.

In essence, it's not that "everyone" else is cheating, it's just that Russian and Iranian crude exports are rising at a time when Saudi crude exports are falling. The net result is no real substantial decrease in the market.

When is a supply cut not really a supply cut?

From the market's point of view, there is really no supply cut. Crude exports from OPEC+ are flat y-o-y, and while exports do not equate to production, it does in the eyes of the buyer.

For Russia, elevated seaborne crude exports are likely the result of lower landline crude exports. But again, from the market's point of view, that's not a supply reduction. Other oil experts like Anas Alhajji have pointed out that countries like India are taking Russian crude in, refining it, and exporting it back out to Europe.

But the issue here is that for the Saudis, this is a real cut. The cut is just being absorbed by higher exports from Iran and Russia. So without some meaningful deal that gets the Russians to materially move crude exports lower, the Saudis are giving up market share.

I think in order for the market to take the supply reductions seriously, we need to see Russian crude exports back off. In order for the Saudis to continue with its voluntary production cut of ~1 million b/d, there needs to be greater coordination with the Russians to reduce supplies simultaneously. We all know what happened in March 2020 when the Russians went against the Saudi advice of materially reducing production, and with Putin being stuck in a costly war, Russia does not have the means to go back into an oil price war.

November OPEC+ Meeting

Thankfully, as our analysis suggests, it's only one country the Saudis have to deal with. Iran's higher crude exports are the result of lax sanction enforcement from the US, so there's very little room to maneuver there from OPEC+'s standpoint. But for the Saudis, getting the Russians in line will be the first task on the agenda. It will have to offer them the ultimatum: reduce crude exports meaningfully or face a potential oil price war.

And with where Russia is geopolitically speaking, an oil price war is the most unfavorable outcome possible. So in our view, this inevitably leads to more coordination from the Russians.

Putting this all together, we think the Russians will play ball. If the Saudis have to force their hand, they will.

So is this a supply cut? It is for the Saudis, but not for the Russians.