By: Jon Costello

The selloff in natural gas names has provided an opportunity to add to our income holdings. This morning, we published a trading alert that we bought 7,050 of Mach Natural Resources LP (MNR) units for the HFIR Energy Income Portfolio at $10.83 per unit. We plan to add to our position if the units fall further from here.

MNR Review & Update

Mach is an oil and natural gas E&P consolidator that acquires producing, cash-flowing acreage at a discount, operates it efficiently, and returns a large portion of cash flow to unitholders through distributions. It aims to grow its operations by purchasing assets below PDP PV-10 with a focus on increasing distribution capacity per unit.

The company’s strategy is focused on keeping leverage low. It targets net debt at less than 1.0-times Adjusted EBITDA. It aims to maintain a reinvestment rate below 50% of operating cash flow, reduce production decline rates, and keep operating costs low. Its strategy has effectively supported large and increasing unitholder distributions. Currently, its distribution is the highest among E&Ps.

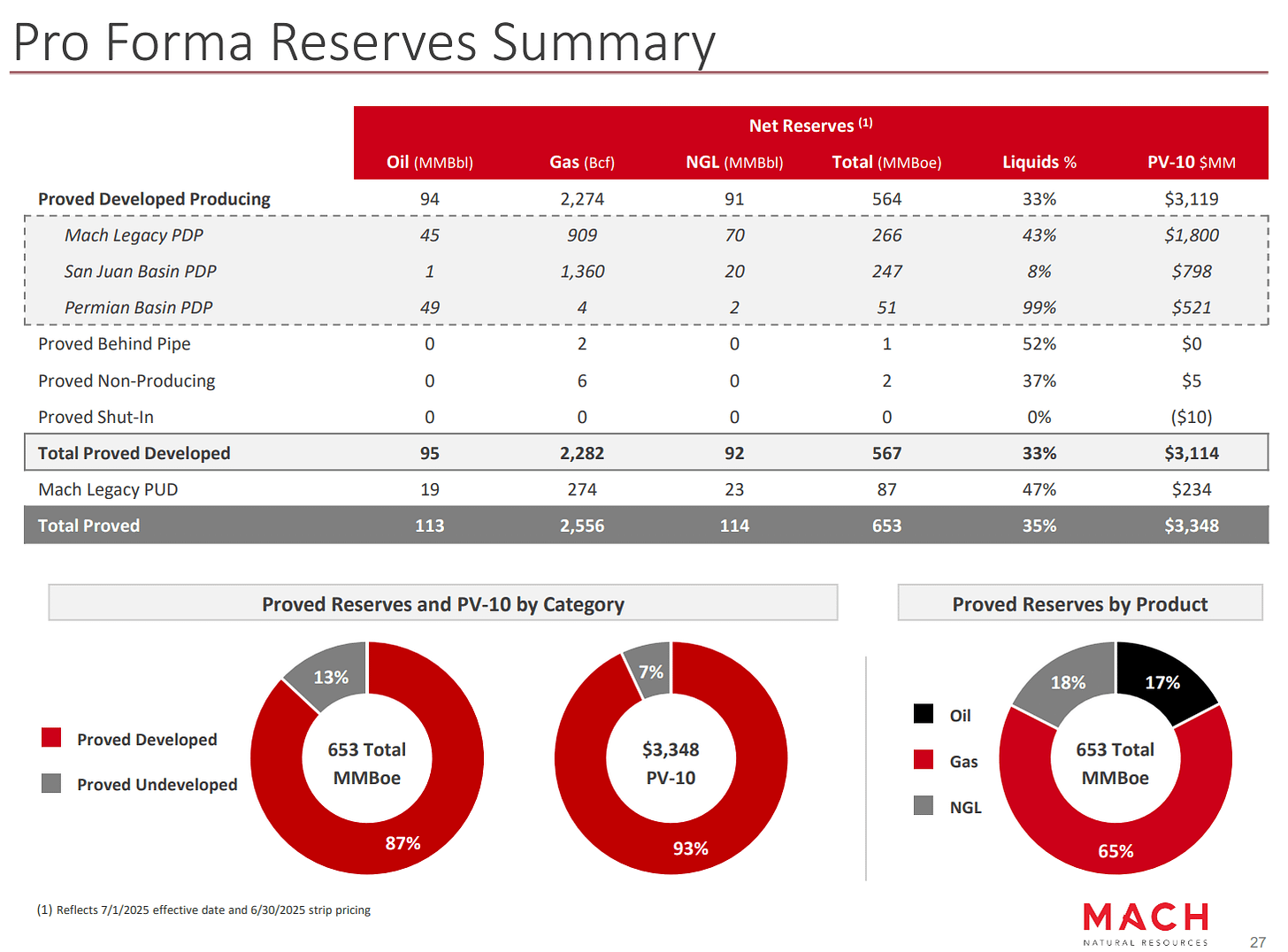

Mach projects 2026 production of 151,000 boe/d, with a 71%/29% split between natural gas and liquids. Proved reserves total 653 million boe, of which 87% is PDP with a PV-10 value of $3.3 billion. Its reserves are summarized below.

Source: Mach Natural Resources December Investor Presentation.

Mach has an enterprise value of $2.9 billion with its units trading at $10.83. The discount to PDP calculated using commodity prices we believe are below mid-cycle levels, offers a significant margin of safety at the current unit price. Such a margin of safety is difficult to find among Mach’s North American E&P peers.

The margin of safety in Mach units, the temporary nature of the selloff, and the units’ upside potential make for an attractive opportunity. Long-term investors should consider buying the units below $12.00.

Why Mach Units are Undervalued

The first reason for Mach’s undervaluation is that MLPs remain out of favor. MLP units are heavily owned by individual investors who often lack the staying power of larger institutions that focus on C-corporations. Most MLPs are of the midstream variety, and these equities consistently trade at a discount to their C-corporation peers.

The MLP discount relative to C-corps is the biggest disadvantage for public companies that adopt the structure. However, this tends to be offset by the higher distributions paid by most MLPs.

Despite the equity price discount, longtime readers appreciate my fondness for midstream MLPs. The structure offers several advantages. For instance, MLP distributions are treated as a return of capital, so taxes are deferred and usually lower than those of C-corps. MLPs don’t pay corporate income tax, so they generally have more distributable cash flow than C-corps.

The MLP discount also creates opportunities for accretive unit repurchases. Mach hasn’t repurchased any units since its October 2023 reorganization, but it could make accretive repurchases if it chose to do so.

The downside of the MLP structure historically has been aggressive governance practices that favor the partnership’s sponsor over its common unitholders. This issue has been largely remedied in recent years through various governance reforms. Still, an investor in an MLP should be comfortable with the partnership’s management and board of directors, which exercise significant control over the limited partnership.

E&Ps MLPs are treated with added skepticism by investors because they’re seen as income vehicles but entail greater commodity price and depletion risk than midstream MLPs. However, Mach’s low-decline asset base, sensible acquisition program, and conservative operating and financial structure mitigate much of the risk.

A second factor holding down Mach’s unit price is low oil prices and a recent selloff in natural gas prices. We believe both are temporary. As such, we view the units’ weakness as a good opportunity to initiate a position. As commodity prices recover, Mach’s cash flow per unit will rise, leading to larger quarterly distributions and a higher unit price.

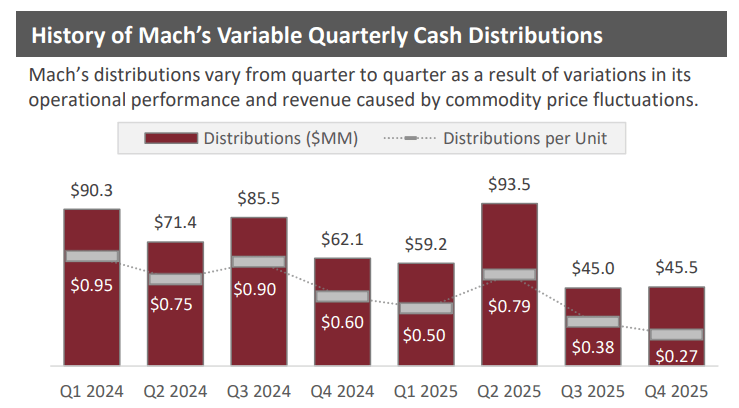

Third, Mach’s units are also out of favor due to the company’s policy of paying variable distributions, which fluctuate widely. For example, the distribution was $0.79 per unit in the first quarter of 2025 and fell to $0.29 per unit in the third quarter.

Source: Mach Natural Resources December Investor Presentation.

A variable distribution policy is the most intelligent approach for an E&P. We understand that the stock market craves regularity, but as long-term owners, we appreciate that Mach’s policy of paying variable distributions adds a layer of financial flexibility and safety that it wouldn’t have if it committed to paying a regular base distribution. The policy also reflects the fact that Mach is an E&P with highly variable cash flow driven by commodity prices and the need to allocate cash to fund acquisitions.

Fourth, Mach’s units are under pressure because the company’s leverage has increased to 1.3-times Adjusted EBITDA, surpassing the company’s long-term target of 1.0-times. The debt was used to finance the company’s recent transformative acquisitions in the Permian and San Juan basins. Reducing debt will likely take precedence over paying distributions, particularly at low commodity prices, where higher leverage presents greater risk. Unitholders are likely to see significantly lower distributions over the next few quarters, as cash flow available for distributions will decline if commodity prices stay low and free cash flow is allocated to debt reduction.

We aren’t concerned by any of these factors holding down the price of Mach units. They’re all either irrelevant to us as long-term equity owners or temporary in nature. The company is in good hands under its current leadership. Its significant insider ownership further strengthens our confidence. Insiders own 74% of the common units. Note that insiders purchased additional units on the open market in November and December of last year at prices ranging from $11.45 to $12.41.

We intend to hold the units for several years, which we believe is more than enough time to permit a substantial recovery in distributions and the unit price. The fact of the matter is that a lot of “bad” is priced into the units at their current price of $10.83. That price implies the market is overlooking the company’s advantages, its prospects for higher revenues and lower unit costs, and its conservative approach to managing its business. Given the current setup, I suspect any good news on a company or macro level is likely to send the units higher.

Positive Operating Results

Mach is succeeding in its goal of maintaining low operating costs. The company is integrating its recently completed acquisitions and expects its lease operating costs to be approximately $6.90, roughly in line with its pre-acquisition level.

The company was able to cut drilling and completion capital by 18% in its 2026 capital program while maintaining production guidance. The freed-up cash flow from lower capex can be used to pay down debt.

Typically, the stock market would reward such an achievement with a higher stock price, but Mach’s status as an MLP limits analyst and investor coverage, so news can slip through the cracks.

Drilling results have been impressive, demonstrating the quality of Mach’s acreage. The company drilled a two-well pad in the Deep Anadarko that produced over 40 MMcf/d, while the first five wells drilled in the Mancos shale delivered more than 100 MMcf/d of low-decline production. These results illustrate that management can selectively allocate capital into high-return projects when commodity prices justify the investment.

The recent acquisitions will further lower Mach’s production base decline rate. A low decline is a key feature for an E&P income vehicle. For example, one of my favorite Canadian oil-weighted names, Cardinal Energy (CJ:CA), has successfully maintained its large dividend in large part due to its low decline rate. The low decline rate decreases maintenance capital, supports cash flow distribution, and makes Mach’s pledge to reinvest less than 50% of its cash flow more credible.

The company remained true to its pledge to reinvest less than 50% of its cash flow. In the nine months ending September 30, 2025, Mach generated $361.3 million in adjusted operating cash flow and invested $165.6 million in capex, representing a reinvestment rate of 46.5%. Free cash flow was $195.8 million, and unitholder distributions amounted to $197.7 million.

Mach’s recent pivot toward natural gas is another strong point of its operation. We’ve seen other income vehicles among our holdings, such as Black Stone Minerals (BSM), make similar pivots toward natural gas to good effect. If gas fundamentals tighten later this year with the ramp of North American LNG production, the company will be favorably positioned to benefit from higher domestic natural gas prices. Data center growth provides another demand driver for natural gas.

Longer-term, even if gas prices struggle to stay above $5.00 per mcf due to an abundance of supply, all the new demand indicates the market is unlikely to experience a repeat of the 2023-2024 downturn. I suspect painful memories of that incident exacerbate the selling of natural gas-weighted equities like Mach amid significant declines in gas prices.

Valuation

Mach’s value ultimately depends on the course of oil and natural gas prices. We’re confident that oil and gas prices will trade at significantly higher average prices over the next few years. Higher commodity prices will lead to increased distributions from Mach, as well as a higher unit price. This outlook makes the units’ prospective total returns particularly attractive at their current price of $10.83.

Mach units are cheap based on virtually any metric.

Enterprise value of $2.9 billion trades at a discount from proved reserve PV-10 of $3.3 billion.

PV-10 is likely to grow as the company continues its successful track record of making accretive acquisitions.

EV/Adjusted EBITDA is roughly 3.8-times.

Mach’s enhanced decline rate, integration synergies, and midstream optimization measures taken after its recent acquisitions will increase cash flow and reserve upside.

Adjusted EBITDA and operating cash flow stand to grow as operating costs per unit decline and commodity prices rise.

Leverage will fall as Adjusted EBITDA increases and debt is paid down.

Distributable cash flow per unit was higher than it appeared at the end of the third quarter due to Mach’s recent acquisitions. The 49.8 million additional units issued in the deal increased the unit count by 42%, but because the deal closed on September 16, Mach had only two weeks of revenue contribution from the new assets. Future quarters will offer a clearer view of the company’s cash-generating capacity.

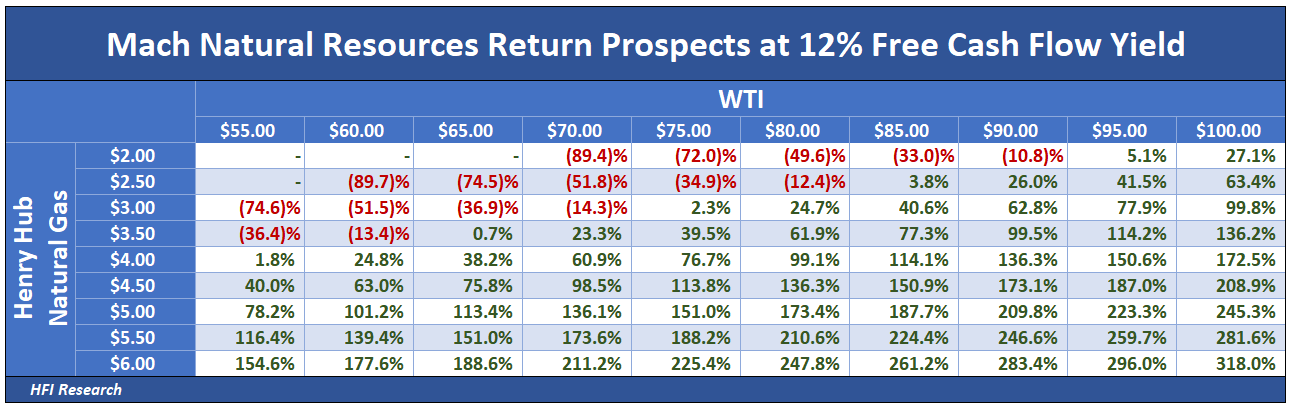

Mach still generates free cash flow at current commodity prices. Using the midpoint of the company’s latest guidance, I estimate free cash flow excluding hedges at $60 per barrel WTI and $3.50 per mcf Henry Hub of approximately $140 million, equivalent to a 10.4% free cash flow yield. Hedges boost that figure modestly. This yield is on par with large midstream MLPs.

At current commodity prices of $57.00 per barrel WTI and $3.41 per mcf Henry Hub, I estimate that Mach units trade at a 7.9% free cash flow yield on an unhedged basis.

Mach unitholders should expect distributions over the next few quarters to decrease from previous quarters. Capex will consume the lion’s share of cash flow, and a significant portion of the remaining free cash flow will be used to reduce debt. Although EBITDA fluctuates with commodity prices, I assume Mach will aim to pay down roughly $250 million in long-term debt to reduce its leverage ratio to its long-term target. While there isn’t urgency to reduce debt, Mach has been run with an emphasis on conservatism and has closely adhered to its foundational operating principles, one of which is to keep Adjusted EBITDA of 1.0-times net debt. I therefore expect it to allocate half of the cash flow to deleveraging, and perhaps more.

The lower distribution could lead to further weakness in the unit price. We are prepared to buy more units if that happens. However, such potential near-term downside—which is by no means certain—is more than offset by the tremendous long-term upside offered by the units at higher commodity prices. This cash flow torque to higher oil and gas prices is why Mach represents a superior investment alternative for long-term income-seeking accounts relative to other MLPs and even most midstream operators at their current prices.

From the current $10.83 unit price, Mach units offer a potential double if WTI trades at $85 per barrel and Henry Hub natural gas trades at $4.00 per mcf. These oil and natural gas prices are in the ballpark with our average price expectations over the coming years as natural gas demand grows globally and non-OPEC crude oil production approaches full capacity after 2027. Of course, returns to Mach unitholders increase significantly as commodity prices increase, as illustrated by the table below.

Risks

The one material negative in Mach’s financial picture over the first three quarters of 2025 was its $90.8 million asset impairment, largely attributable to lower oil prices. However, if oil and natural gas prices are higher than those that prevailed in 2025—as we expect—then the value of the impaired assets should increase substantially relative to the value ascribed under full-cost ceiling accounting. Still, additional asset impairments could pose a risk to unitholders.

The units face other risks. For example, Mach units might trade lower for longer than I expect if a natural gas glut emerges, possibly caused by LNG oversupply. This risk is reduced in 2026 by the company’s hedges, which cover approximately half its expected production for the year. Additionally, I don’t expect a domestic gas glut to be a risk until after 2027, at which point we expect oil prices to be much higher.

Furthermore, all E&Ps share commodity price risk, and Mach’s low-decline asset base and conservative balance sheet position it well relative to peers. Still, sustained low commodity prices could hinder the company’s ability to finance the asset acquisitions needed to extend its reserve life and runway of generating distributable cash flow.

Another risk for Mach unitholders is that the company’s financial prospects depend on management’s discipline. If that discipline wilts, so will the unit price. For instance, if Mach were to acquire assets with meaningfully higher decline rates, or if it fails to realize operational efficiencies from acquired acreage, returns for unitholders could be lower than I expect.

Like all E&Ps, Mach’s assets deplete over time, so extending reserves will be an important part of extending unitholder value and supporting the unit price. If Mach cannot find attractive acquisitions, it may be tempted to acquire less attractive alternatives, which would lower its return prospects.

Also, discipline imposed by leverage could act as a constraint on growth, or even distributions, in a severe bearish scenario. Restrictive covenants and debt agreements can limit distributions if commodity prices fall and borrowing bases tighten.

Despite these risks, we expect Mach to stay disciplined. The company’s leadership is heavily incentivized to act in the best interests of all common unitholders.

Conclusion

Mach’s model of buying PDP at a discount, maintaining a low decline rate, and returning cash flow to unitholders is sound, but faces pressure from low commodity prices and its intention to use cash flow for debt reduction rather than distributions. However, we believe this pressure is temporary. As such, it presents an attractive buying opportunity for long-term investors. Those who believe commodity prices will rise from current levels and who are confident in Mach’s management team, as we are, can secure a bargain price today.

We consider the near-term prospect of lower distributions to be an inconvenience, not an existential risk. After all, the units already discount lower distributions under any reasonable view of mid-cycle commodity prices. We expect higher commodity prices and Mach’s increasing operational scale to drive the units higher over time and make the current valuation look cheap in hindsight.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MNR in the HFIR Natural Gas Portfolio and HFIR Energy Income Portfolio, CJ:CA, BSM either through stock ownership, options, or other derivatives.