On August 27, we published our WCTW titled, "It's Time To Get Extremely Bullish Natural Gas (Long-Term)." There have been some meaningful changes since then and I want to cover everything in this article update.

Long-Term Projection Remains On Track

Just 3-months ago when we published our extremely bullish natural gas call, people ridiculed us. Henry Hub at the time traded at $2/MMBtu and it appeared all hope was lost on natural gas. But as we argued at the time, there's a very important thesis in natural gas that will not change no matter what happens going forward:

Natural gas storage capacity relative to the incoming increase in structural demand will create extremes in natural gas prices.

With the market testing the lower bound this year, it now knows that if it pushes prices down to $2/MMBtu, producers will willingly shut-in production.

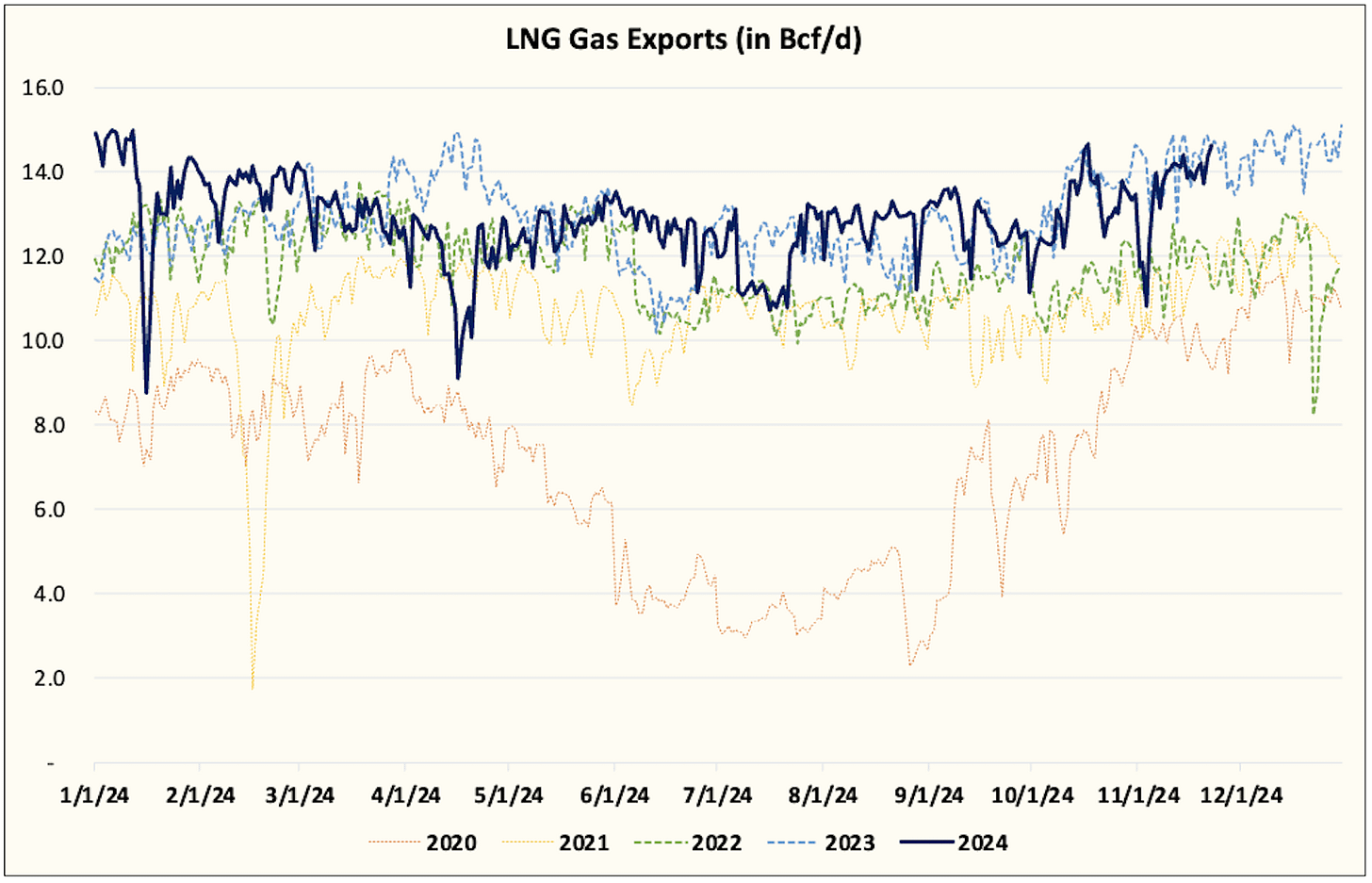

Similarly, we also have an idea of where LNG gas exports shut in.

Most LNG projects get built in the US based on take or pay contracts. For LNG exports to shut in, it would have to be dependent on global LNG prices. Natural gas prices in the US + liquification fee (usually $3/MMBtu) + transportation cost would have to be meaningfully higher than global LNG prices to shut-in exports. You can see the drop in 2020 LNG exports as an example.

But if global LNG prices are strong (like 2022), then there's ample room for Henry Hub to rally without any worry over price shut-in.

With that said, there are 3 key parts to the bull thesis for natural gas:

Increase in structural demand (LNG + Mexico gas exports).

Power burn from AI.

Production growth not keeping pace.