Saudi Voluntary Cut Will Last Into Year-End

Summary

We expect the Saudi voluntary cuts to last into year-end.

Main reasoning for this argument is that the physical oil market is still not tight enough to justify increasing production.

On a timing basis, by the time the oil market feels the full impact of the voluntary cuts, we will already be in a November extension.

In addition, as oil prices rise, China will release SPR, which will dampen oil's upside. This will further incentivize the Saudis to extend the cuts.

Since the Saudi voluntary cut announcement, we've been writing to readers that we believe the voluntary cut will last until year-end. With July ending soon, readers should expect another extension into September.

For the oil bulls, the Saudi voluntary cut could be considered bullish and bearish. On the bull side, the ~1 million b/d cut is material and given the crude export figures we are seeing so far, it's real.

On the other end, the bears could argue that the lack of demand is prompting the Saudis to cut so much.

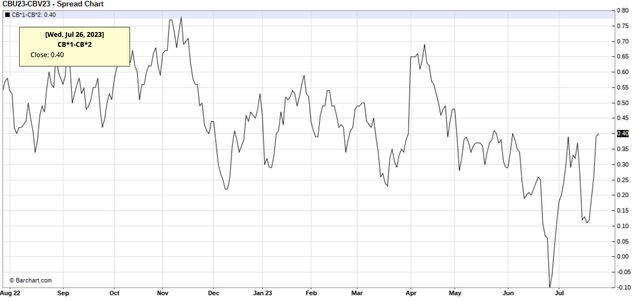

For now, the bears have the upper hand via the weaker-than-expected timespreads we are still seeing.

Looking at the Brent 1-2 timepsread, we are back in backwardation, but it's far below the level we saw from last year. On the physical oil trading side, we are already trading September barrels, which makes the argument more concerning. Why isn't the physical market tighter even amidst the voluntary cuts?

A good explanation of this came from a trader we spoke to recently. He pointed out that the physical market is having to deal with sanctioned and unsanctioned barrels. Official Chinese customs data came out today that it imported over ~1.5 million b/d from Malaysia (please refer to our Iran is back article on why this is important). As we wrote previously, this is basically all of the sanctioned barrels, and with these barrels trading at a discount, this is making the price discovery aspect of trading difficult.

Couple that with pockets of weakness in the oil market, and the physical market remains much looser than we like.

But not all bad things are bad things. Because of the weak physical oil market today, we believe the timing will force the Saudis to have to extend the voluntary production cut until year-end.

For the oil market, the visibility of the Saudi cuts is only extending to the end of August. But for the market to feel the full force of the Saudi cuts (logistical timeline of tankers), the physical side won't see it until mid-September. Given this being the timeline, Saudis will have to announce an extension into the end of October in early September.

And since the impact won't be felt until mid-September, there's a very high likelihood that in early October, Saudis will have to announce another extension into the end of November. By then, the oil market should have materially tightened, and we are already into a December extension.

Implications

The lack of tightness in the physical oil market today may turn out to be a blessing in disguise. As oil speculators remain complacent about what the Saudis want, this is inadvertently forcing them to cut more than they really need to. Global oil demand seasonally rises into year-end, so with the cuts we are seeing from Saudi and Russia, global onshore inventories will drain.

And if we are right about the Saudis extending cuts into year-end, then it's more likely that we will overtighten the physical market. If so, then we could see China stepping into the fray by releasing SPR (i.e. less physical buying). And if China preemptively acts, then we could see Saudi, once again, extend cuts into early 2024. Remember that in our 2024 outlook, Q1 inventories are flat, so this could possibly push the voluntary cut to the end of Q1.

All of these implications are premature, but I think these are high-probability scenarios in the making. Oil, thankfully, is a physical commodity. If demand outstrips supply, prices will rise, no matter what the speculators want.