Repeat after me: It's not an OPEC+ cut, it's a Saudi cut.

Ok good. Now that you understand our theory, here's the reality. Saudi can and will fill any supply gap left behind by others. If Iranian crude exports are meaningfully disrupted, Saudis can materially increase crude exports.

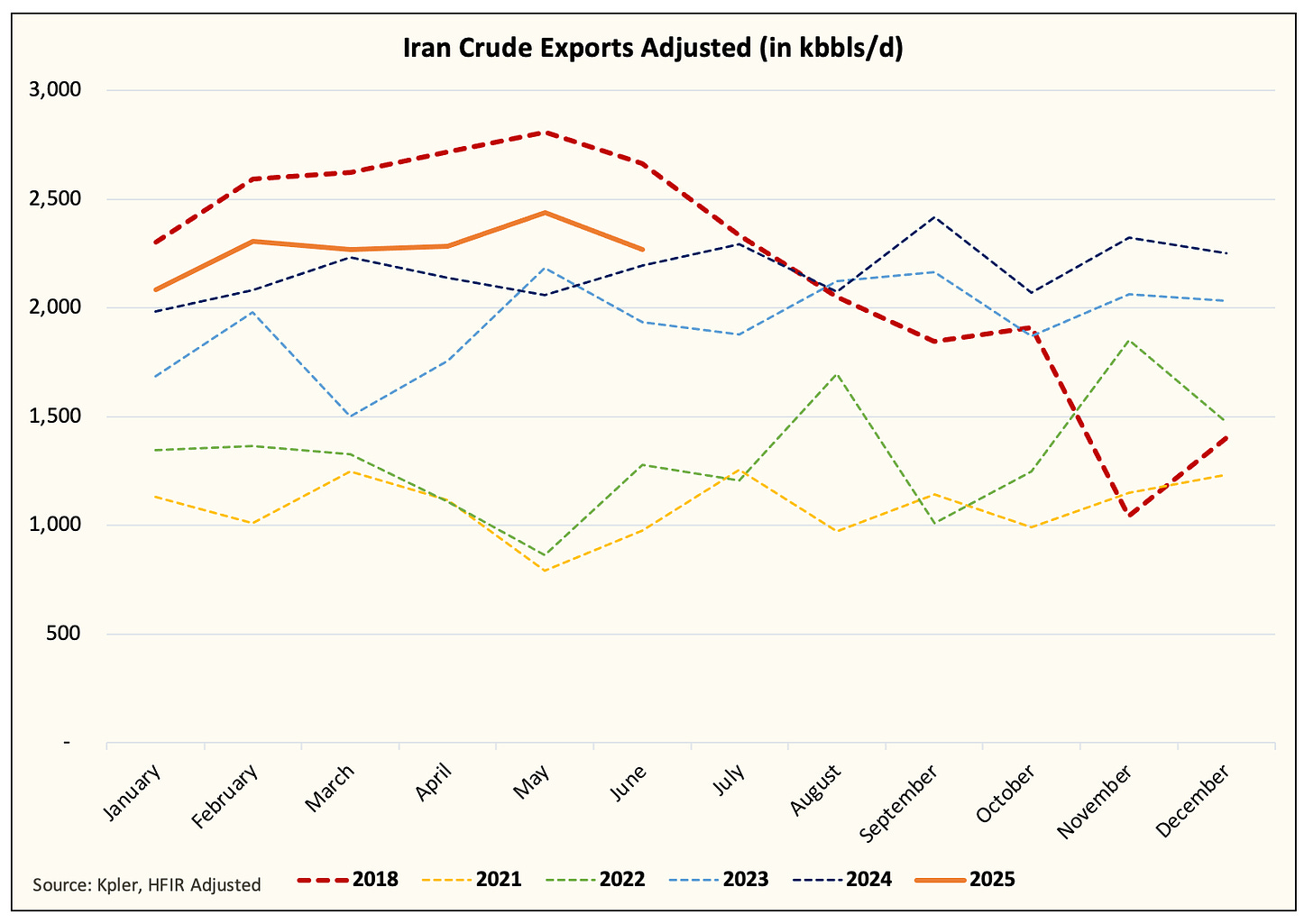

How much? Saudis can average ~9.5 to ~10 million b/d for 3-6 months with ease. This scenario is unlikely given that 1) Iranian crude exports haven't dipped one bit and 2) there are currently no signs that oil assets will be targeted.

Iran Crude Exports

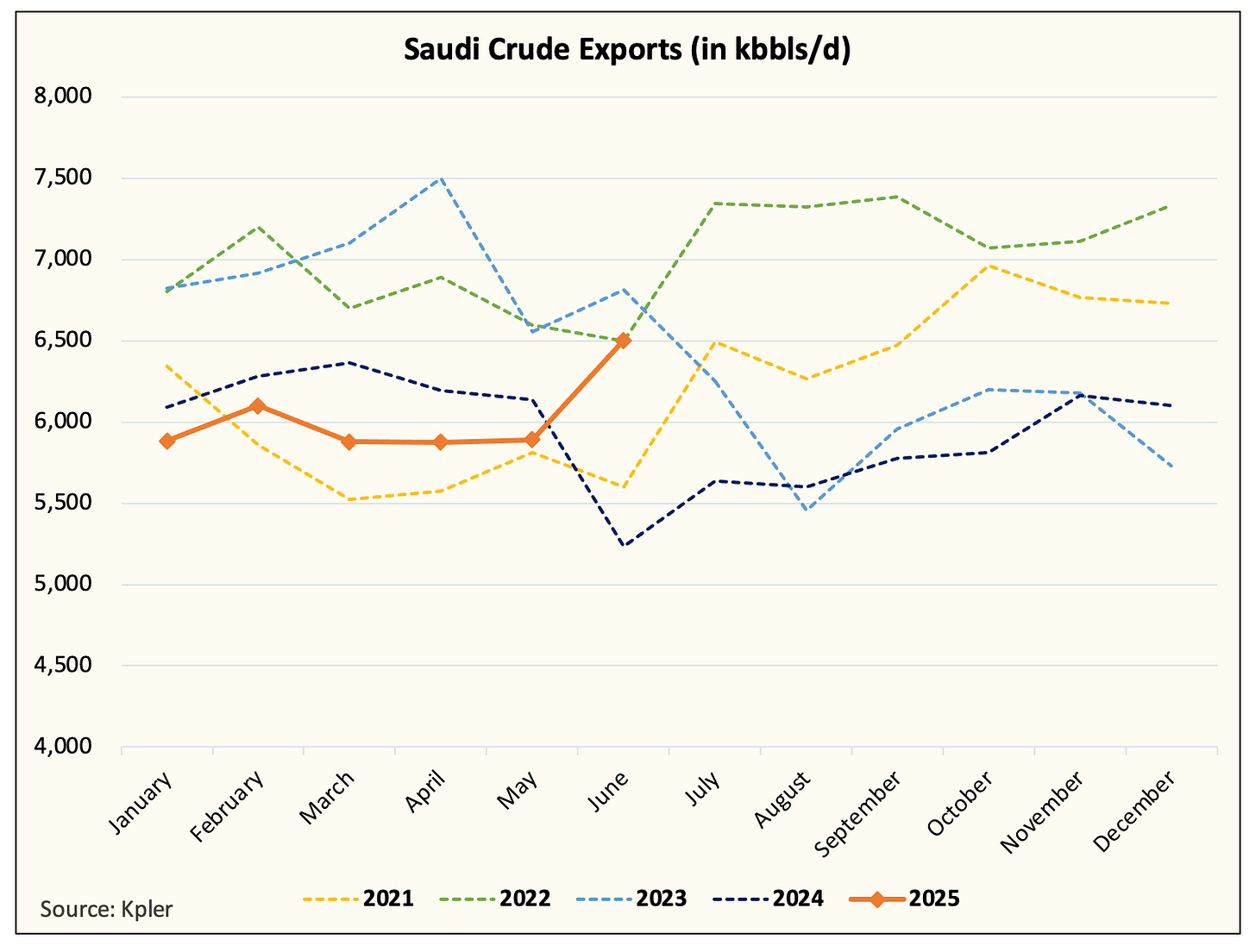

Saudi Crude Exports

The other interesting thing is that we are seeing very strong Saudi crude exports for the first half of June. The final figure won't be as high, but it's an indication that Saudi crude exports will be higher y-o-y this summer.

By our estimate and assuming OPEC+ follows with another two truncated production increases (totaling 822k b/d), Saudi crude exports will reach ~6.5 to ~6.7 million b/d in September and October, with another bump to ~7 million b/d by year-end.

Relative to May exports, Saudi crude exports will increase by ~1 million b/d by year-end. This is a real supply increase and something we think readers need to pay close attention to.

For the rest of OPEC+, the increase will be more muted. So far in June, OPEC+ crude exports have also surged higher.