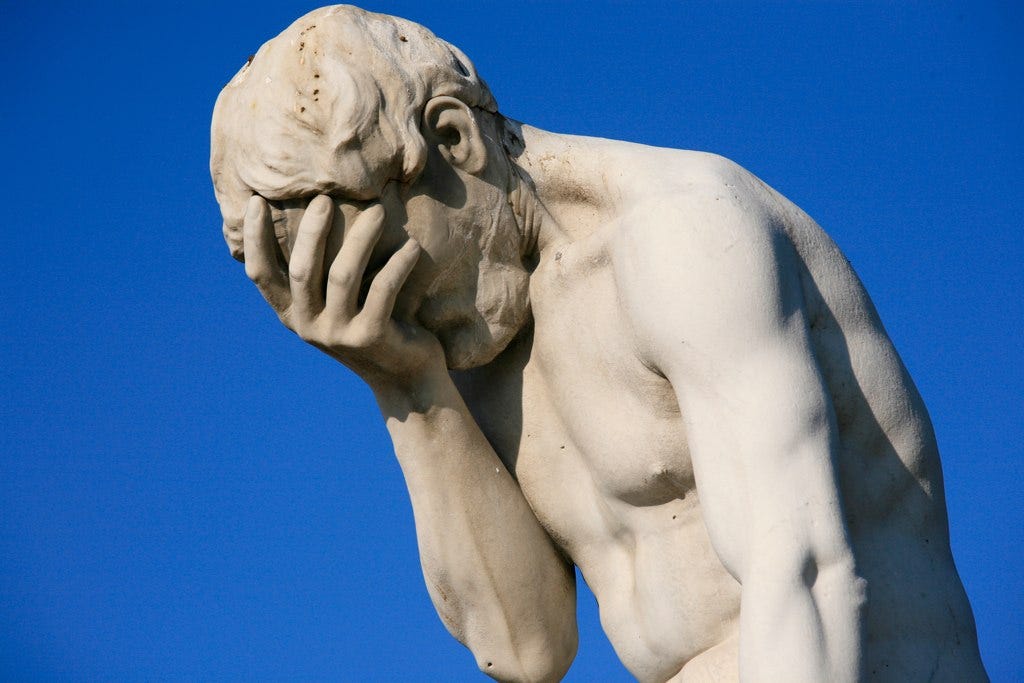

Seriously, Can We Just Get This Over With?

Rangebound oil prices aren't doing speculators any favors. But investors can focus on buying quality names.

I don't know if oil prices being rangebound is the best outcome for the oil market. I'll explain why.

From a bystander's perspective (someone willing to allocate capital to oil), both the bull and bear arguments are compelling. The bears for the time being are winning the debate. We have:

Weak global oil demand.

High OPEC+ spare capacity.

Consensus expectation of strong non-OPEC supply growth.

These three factors are contributing to the bears feeling more confident than ever. And I think there's a strong mismatch with what I'm seeing in the oil market today. The mismatch is in timing and the bears are arguing for a price drop into the $50s followed by a severe supply response, which would ultimately push prices back higher.

As for the oil bulls, the arguments are also straightforward. We have:

Low global oil storage.

Decelerating non-OPEC growth.

OPEC+ policy to help support balances.

Low demand today should result in higher demand growth in the future.

And who can forget, the geopolitical risk between Israel and Iran.

However, outside of the geopolitical event between Israel and Iran, oil bulls are waiting for 1) oil demand to recover and 2) for OPEC+ to guide the market on what it will do with its production policy. From a betting perspective, this is not an asymmetric opportunity, so what should you do?