Seriously, What's Next?

Since the end of 2022, our messaging has been consistent: survive Q1. Sadly, we are barely surviving. WTI has fallen below the critical $69-$71 support range today putting it at arm's length to the next support level of $61 to $63. The reality is that the macro situation right now with the possibility of Credit Suisse failing is so uncertain that no one in their right mind wants to go long an economically sensitive commodity like oil.

Said in another way, if you were an oil trader today, and we asked you what's the risk/reward for going long, you can only point to 1) the physical market being tight and 2) the supply deficit on the horizon. But those are not catalysts to want to go long TODAY, and that's the important differentiator here.

Inversely, if we asked you what the risk/reward is for going short. You could point to OPEC+ possibly cutting more production as a tail risk, but broadly speaking, the risk/reward is skewed to the downside.

This mindset coupled with skewed positioning and negative delta gamma hedging has flushed oil down to where it is today. Never mind the fact that the various demand signals we look at are actually pointing higher, perception is the reality today, and perception is awful and could worsen.

That's the grim reality facing us today, but in times of turmoil, we need to go back to what got us here in the first place. What do fundamentals look like? What do the fundamentals of our companies look like? Are we positioned correctly?

Rather than fixating on the unknown, we need to first understand the situation that we are in and whether or not this situation will improve.

So let's put aside Credit Suisse for a second here. Let's just look purely at oil market fundamentals.

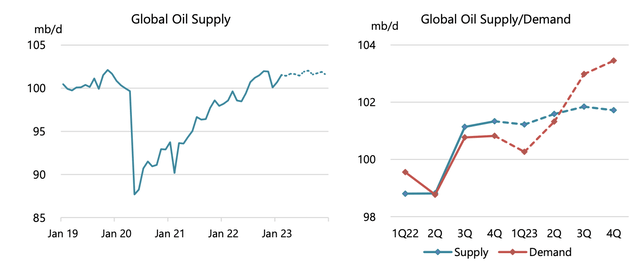

In the chart below, this is the latest global supply & demand outlook from IEA.

Source: IEA

What should be clear and obvious from this chart is that the supply side of the global oil market balance is known. More likely than not, global oil supplies may surprise the downside given the recent oil rout. Oil companies have the tendency to weigh their capex to the second half of the year, so if prices remain low into May, for example, then there's better than a 50% chance that upstream capex will be slashed.

Looking at our model, if WTI remains around $65 to $70, US shale oil production could surprise to the downside by ~200k b/d bringing year-end exit to ~12.7 million b/d. This would represent a growth of just ~350k b/d exit-to-exit (assuming Dec is 12.4 because of freeze-off impact).

IEA is currently assuming +1.1 million b/d from US, so this figure is likely skewed to the downside as a result.

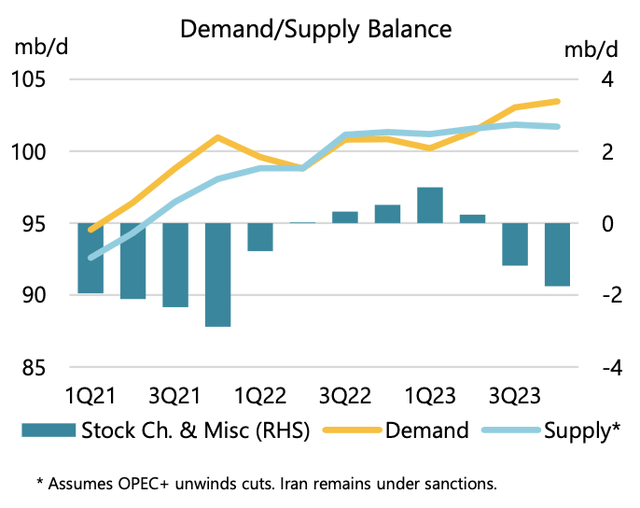

Source: IEA

Note, however, that IEA has Russia declining by ~700k b/d. Given what we wrote about Russia yesterday, we should just assume this loss does not materialize.

In turn, the offsetting variables we see in this table above are 1) Brazil (likely too high) and 2) the US (likely too high). Assuming these two variables offset ~500k b/d of the ~700k b/d assumption, we are left with a net surplus balance of 200k b/d.

Source: IEA

Now circling this calculation back to IEA's assumptions for this year, you can see that H2 2023 will still show inventory draws.

In essence, we know it's not supplies, so the only remaining variable is global oil demand.

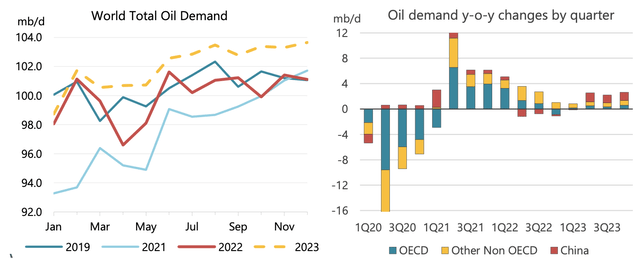

Source: IEA

And looking at global oil demand, you can see that we are already on pace to be well above 2022 and 2019 thanks to China's reopening. Economic data out of China has so far been encouraging, so the reopening trade is real. The question now is whether or not any of the things happening in macro land will have a contagion on the rest of the world and impact oil demand.

Unfortunately, we don't know. Our biased opinion is that the banking issues are contained and unlike the global financial crisis we saw in 2008/2009. Larger banks are much better capitalized with better risk ratios, but you don't know what you don't know. The issues happening at Credit Suisse have been long in the making, so none of this was a "surprise" to the market like Silicon Valley Bank was.

But I think the bigger unknown here is that we don't know what we don't know. The market is now showing a 50/50 probability that the Fed will even hike interest rates next week, and they are now starting to price in a 100 basis point rate cut by the end of this year. Clearly, the Fed f***ed around and we are finding out the consequences.

So what's next? I don't know. Is the banking situation contained? Logically, I think it is. But is there something else we don't know that's lurking? Possibly, and that's what makes asking this question so hard.

But if we take a step back and just entertain the idea that oil prices remain low and global oil demand muddles along. What happens next?

I can say with a high degree of confidence that given the global supply situation is constrained for the foreseeable future (post-2023), the moment demand recovers, oil prices will spike.

And the degree of the spike will be contingent on how much surplus oil inventories we build in the meantime.

So is it a matter of time? Yes. Is there a lot of uncertainty along this path? Yes.

But that's the direction we are headed because supplies are going to be constrained. That's just the nature of the beast (commodities but in particular oil).

So what am I doing with my portfolio? Absolutely nothing. I'm not buying but I'm not selling either. During times of turmoil, it's best to just sit still and think. That's the path I'm choosing.