Something Really Strange Is Happening To The Oil Market

Oil prices have been all over the place. As we will detail in this article, there are conflicting signals in the oil market. Both bulls and bears have to pay attention.

Here are the things we will discuss in this OMF:

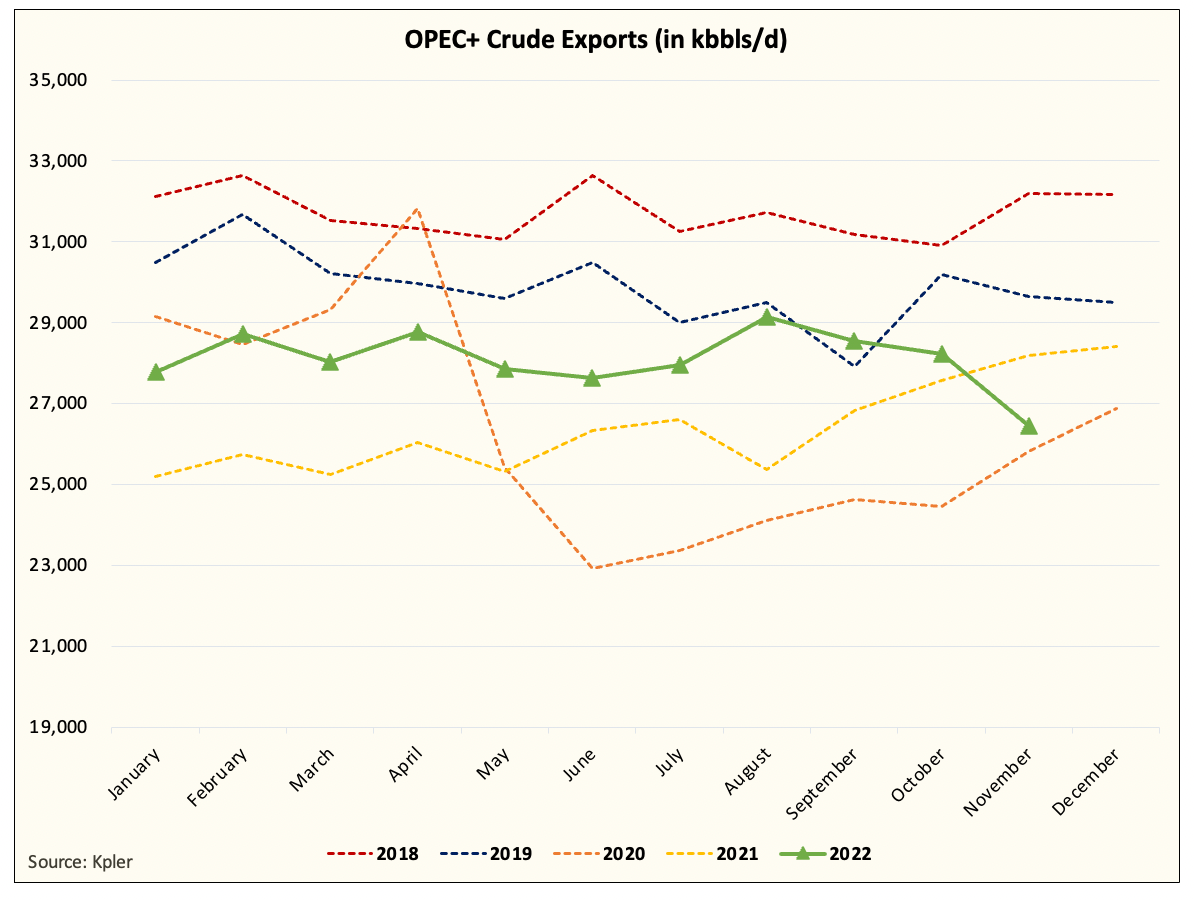

OPEC+ is following through on its production cut with Saudis materially decreasing crude exports month-to-date.

Russian crude exports are up materially month-to-date.

Brent timespreads continue to weaken signaling lackluster physical oil market conditions.

China's crude imports are up materially m-o-m so far in November, but why aren't oil prices reacting stronger?

As you can see from the list, there are conflicting signals everywhere. China's uptick in crude imports should be perceived bullishly, however, why aren't we seeing the physical oil market tighten as a result?

Let's get started.

OPEC+

The production cut is real. You can see in the chart above the dramatic drop-off in OPEC+ exports month-to-date so far. This is led by the Saudis, which have reduced crude exports by ~1 million b/d since September.