Staying Bullish On Natural Gas

As weather models for January continue to remain favorable.

Weather model updates over the weekend continue to favor a colder-than-normal outlook starting in the 10-15 day period. As we have been updating in the chat, you can see that the heating demand starts to move above the seasonal norm starting in day 12.

ECWMF-EPS TDDs

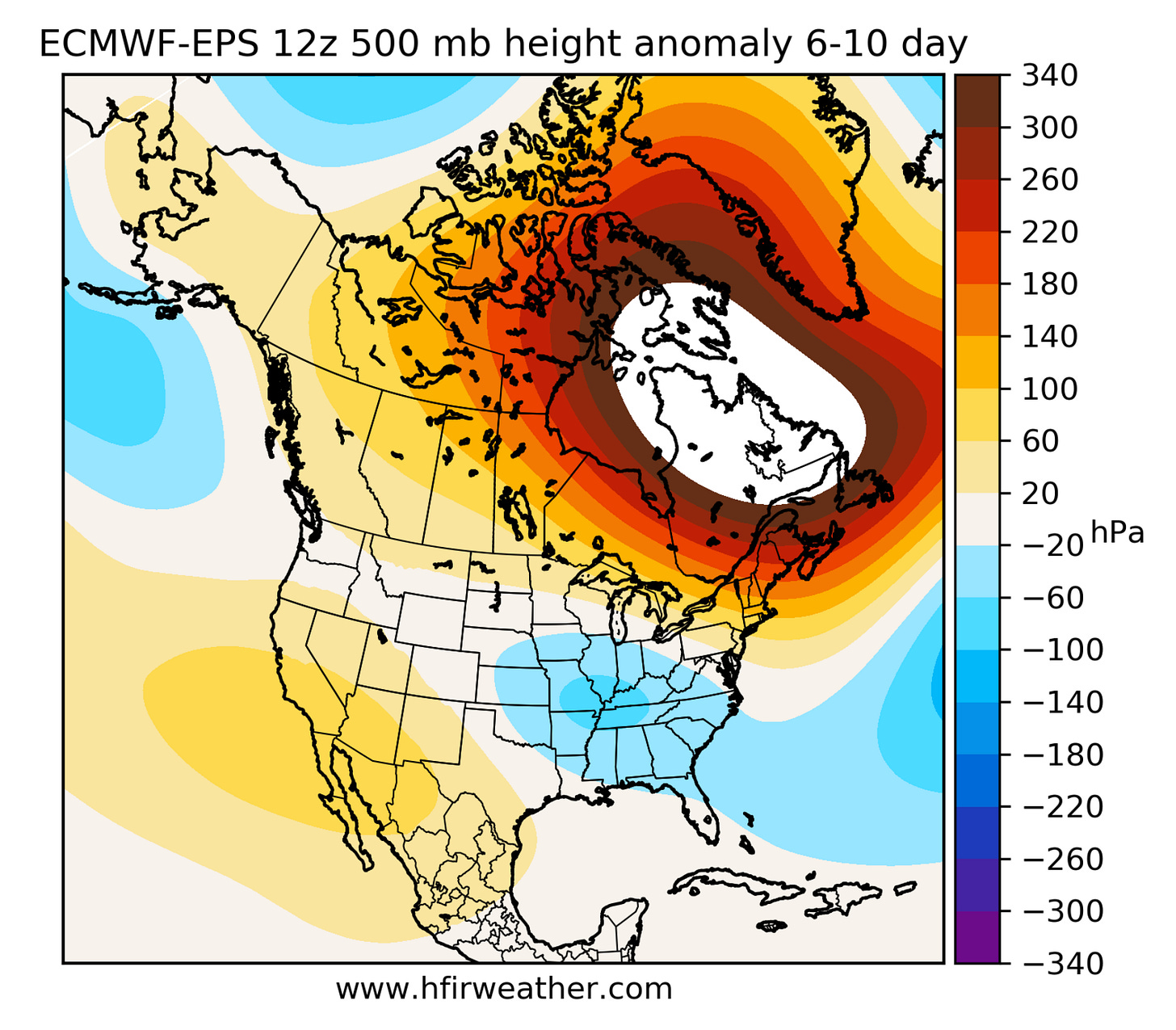

6-10 Day

10-15 Day

15-Day Cluster

For us, the most important indicator when it comes to analyzing weather models is the presence of the "Alaska Ridge". You can see that there's an orange/red blocking pattern in Alaska in the 15-day outlook. This normally foreshadows much colder than normal temperatures on the East Coast.

The more technical term for the Alaska pattern is the East Pacific Oscillation or EPO. When it trends negative, it means it's bullish (because it shows orange to red). When it trends positive, it means it's bearish (because Alaska will show blue).

Source: Weatherbell.com

In this case, you can see that the EPO is trending firmly negative. This is what you call -EPO. And historically speaking, meteorologists can compare this setup to similar events in the past and predict what kind of general pattern we will see.

But as you can see in the chart above, the further out you go in forecasting, the higher the variability of the forecast, so that's why when it comes to weather forecasting or natural gas trading in the winter, it can rug pull those that are not paying attention.