Over the past few months, I've been writing that the disconnect between perception and reality in the oil market is too large to ignore. The notion that non-OPEC supply growth will be ~1.6 to ~1.8 million b/d in 2025 is just utter nonsense. With more data coming to light, the consensus outlook is growing increasingly difficult to come to fruition.

I think my favorite chart amidst all this nonsense is the one published by JP Morgan's team.

Source: JPM

Here's a chart illustrating actual global total oil stocks versus JPM's implied balance. Nevermind the fact that its existing balance is off by a mile, the projection is that much more wild.

But I'm here to tell you that it won't just be the inventory balance the consensus will get wrong. Non-OPEC supply growth will be the biggest miss for the consensus in 2025. US shale and Brazil will contribute nearly ~1 million b/d of delta to the consensus estimate.

A Big Miss

EIA reported its final oil storage report for 2024 this morning. While the data for the report is to the end of January 3rd, readers must be mindful that the data really only captures until January 2nd. The reasoning is that for the EIA weekly oil storage report, companies have to submit the survey data by early Friday morning, so the data captures Friday of the previous week to Thursday.

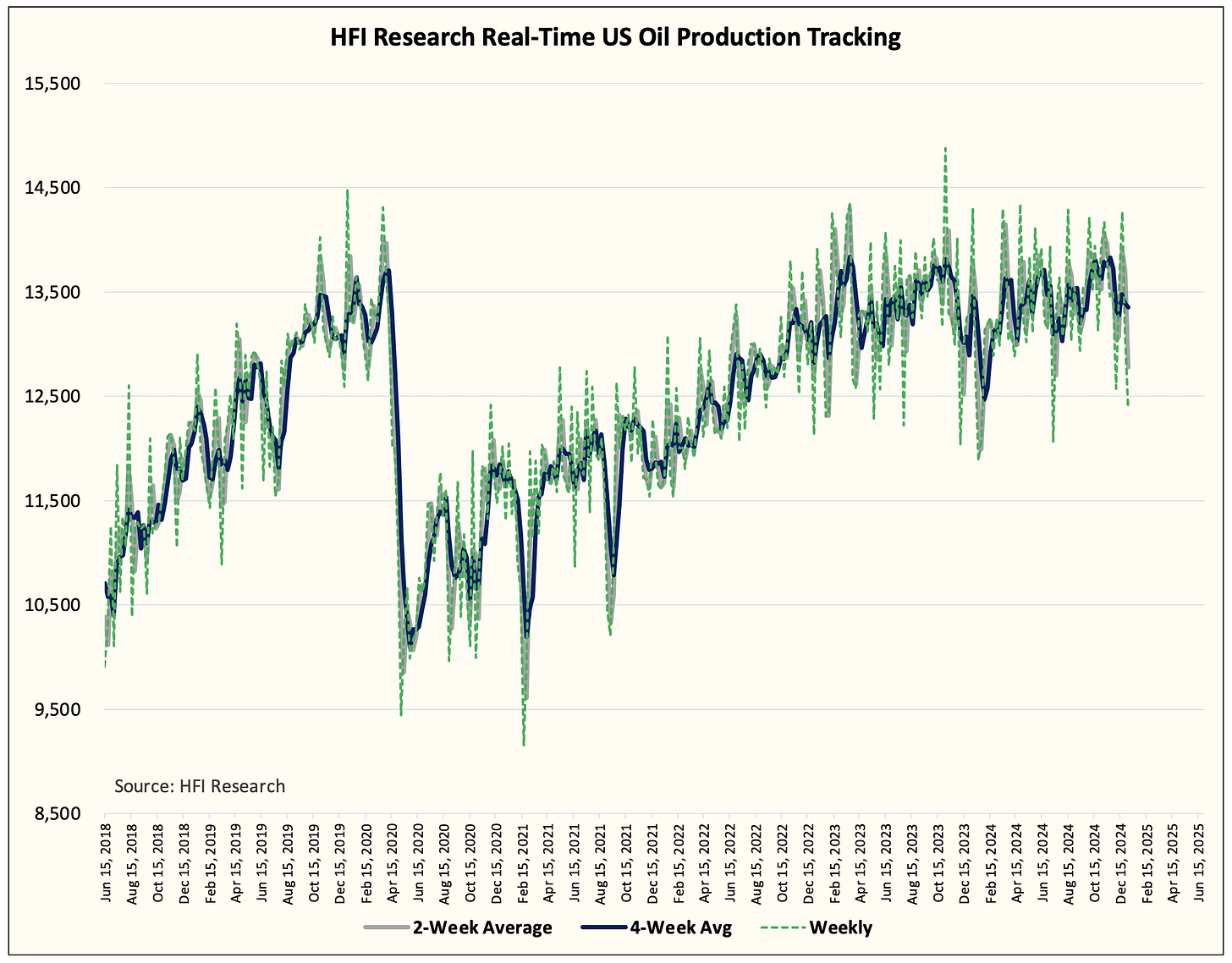

To get a clear picture of the snapshot into the end of 2024, we would use the latest report to finalize December US oil production figures.

And boy, was it a doozy.

According to our real-time US oil production tracker, US oil production is currently producing 12.95 to 13.05 million b/d. There was a steep dropoff observed from the brief spike in October and November.

What's troubling about the latest data point is that this is going to be the weakest exit-to-exit production growth (organic) since the Permian boom started in 2016.

As I've mentioned before, there's a huge significance to exiting December with elevated production levels.