The Importance Of Differentiating Between Near-Term Signals And Long-Term Signals

Following our trade alert yesterday that we were selling from our oil & natural gas trading portfolio yesterday, subscribers were, rightfully, confused. "But HFIR, you just wrote about the bullish implications later this year from your variant perceptions?"

The truth of the matter is that the long-term is made up of many short-term events. And while it is very important to be fixated on the long-term, it helps to have developed short-term signals to help you navigate this treacherous market.

For portfolio management, it's more of an art than a science. Some people are perfectly fine stomaching large drawdowns in the portfolio to avoid any friction cost (trading, tax, opportunity cost, etc). For us, we found the happy medium to be somewhere around holding ~70% to ~80% in core holdings and the rest in trading positions. By actively trading a small subsection of the portfolio, it fulfills the desire to do something while minimizing some volatility associated with energy investing.

So our decision to sell yesterday in our trading portfolio is largely driven by a few bearish headwinds we see over the coming weeks. In addition, our oil market trading signals have all turned bearish with the exception of the macro indicator.

Looking at it another way, if you asked us to take fresh new positions here today, would we still be as long as we were? (150% exposure)

The answer is certainly no. As a result, we thought managing our trading position was the most prudent thing to do.

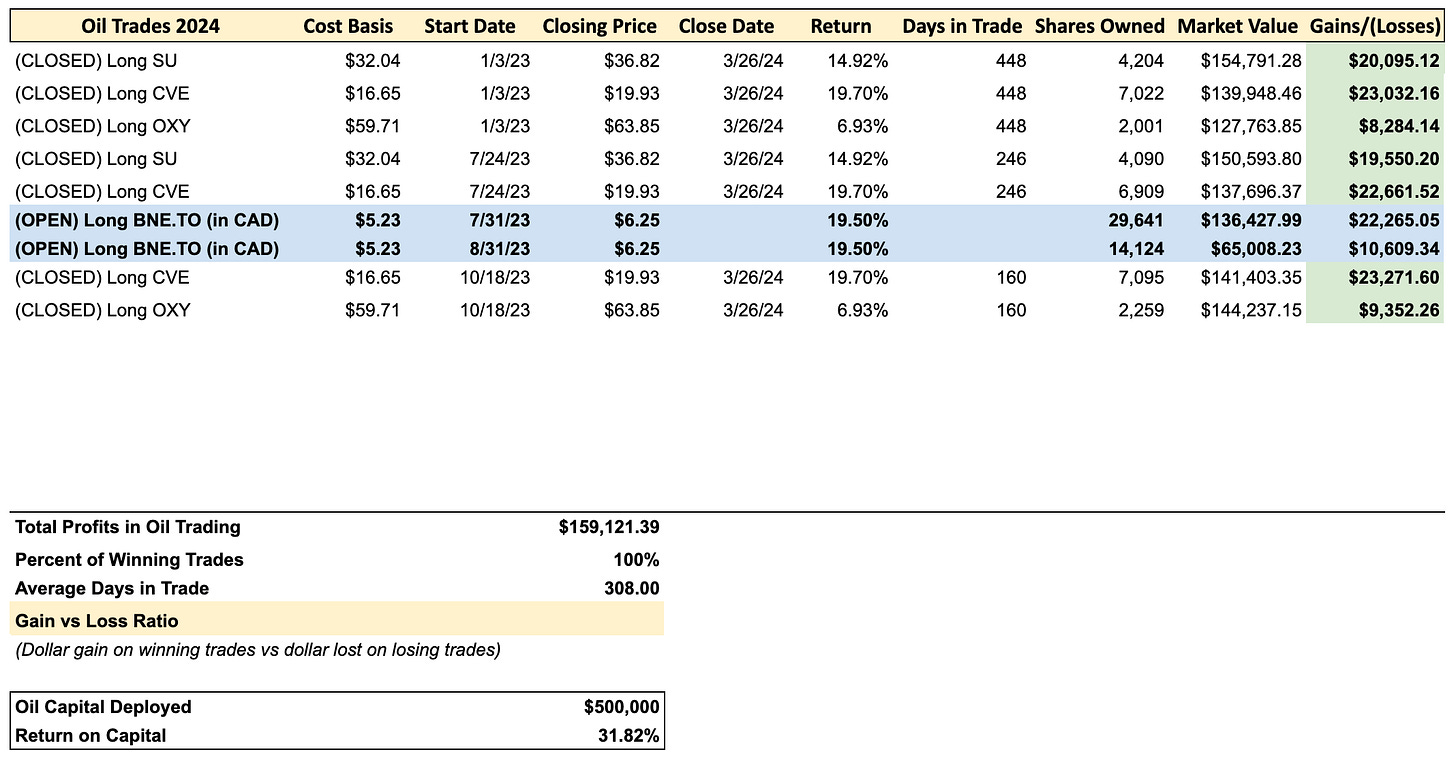

Finally, looking at the gains in both our oil and natural gas trading portfolio, how can you blame us for locking in some profit?

Hope this helps in explaining why we sold down our trading positions.

Let's now dive deeper into what we see as some bearish headwinds near-term.