Weather, weather, weather. Mother Nature plays the dominant role during winter natural gas trading, and the volatility we are seeing in January contracts is an illustration of that.

Jan Henry Hub contracts are down ~20% for the week, and for those tempted to buy the dip, I come with some words of caution. Unless you have a very strong view that the weather models are about to turn bullish, I suggest you exercise patience. Natural gas traders often push prices to extremes, and this is no exception.

In our Dec 1 natural gas article titled, “Here’s How I’m Looking At The Natural Gas Market.” I said that a warmer-than-normal January would bring $3.75/MMBtu into play, while a bullish outlook would bring $6/MMBtu into play.

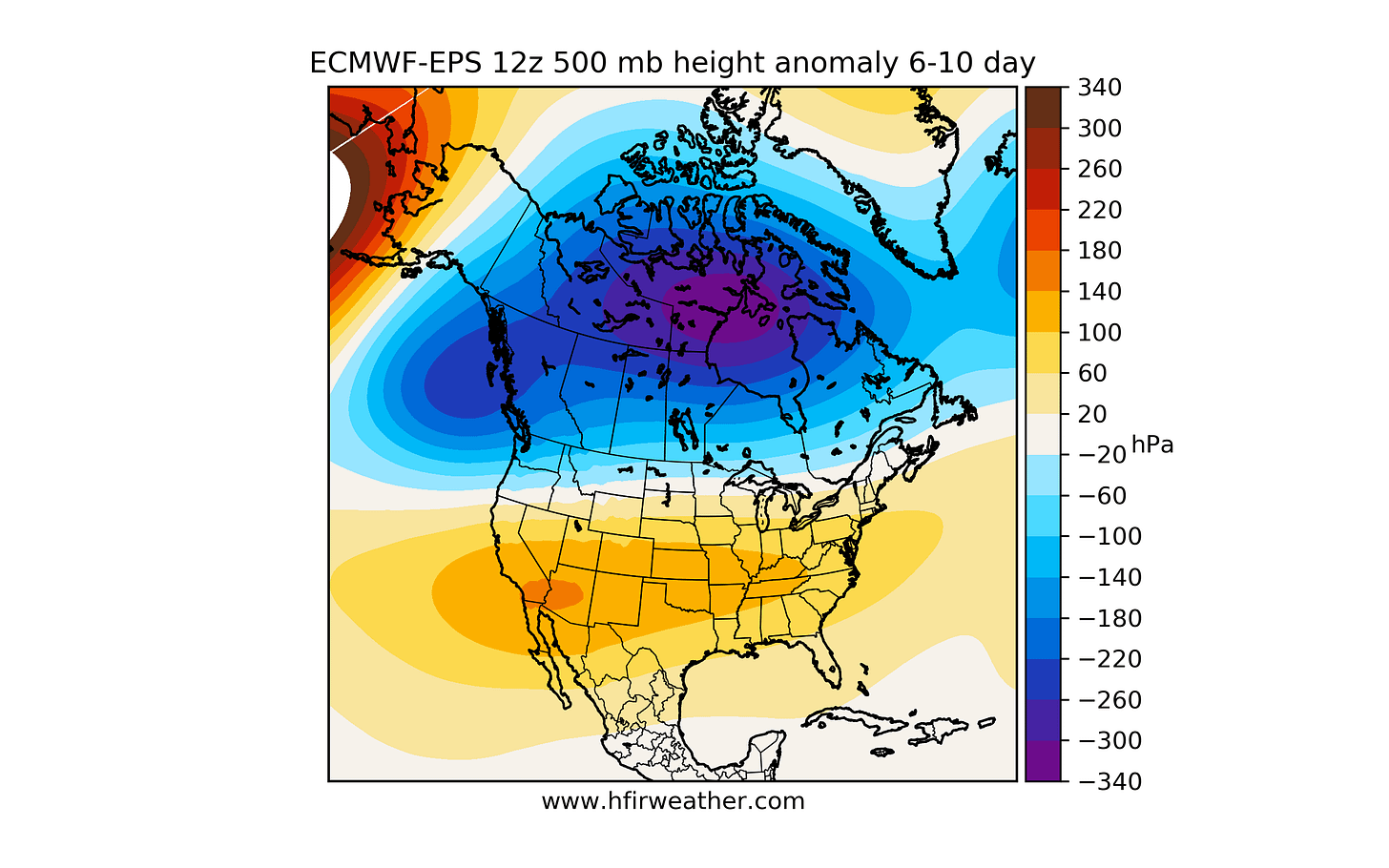

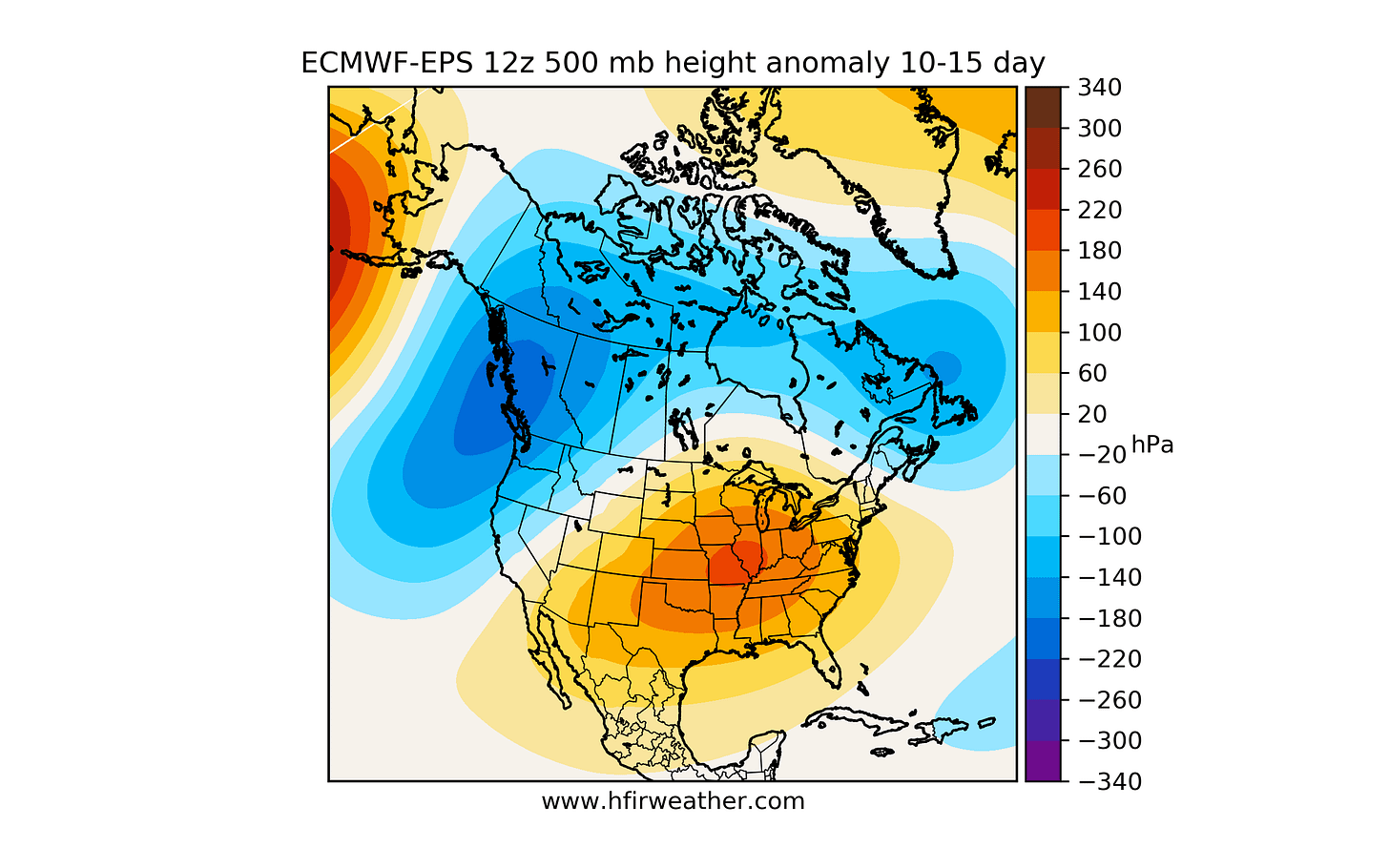

Following this week’s weather model updates, ECMWF-EPS appears to suggest that the 6-15 day outlook will be firmly bearish.

6-10 Day

10-15 Day

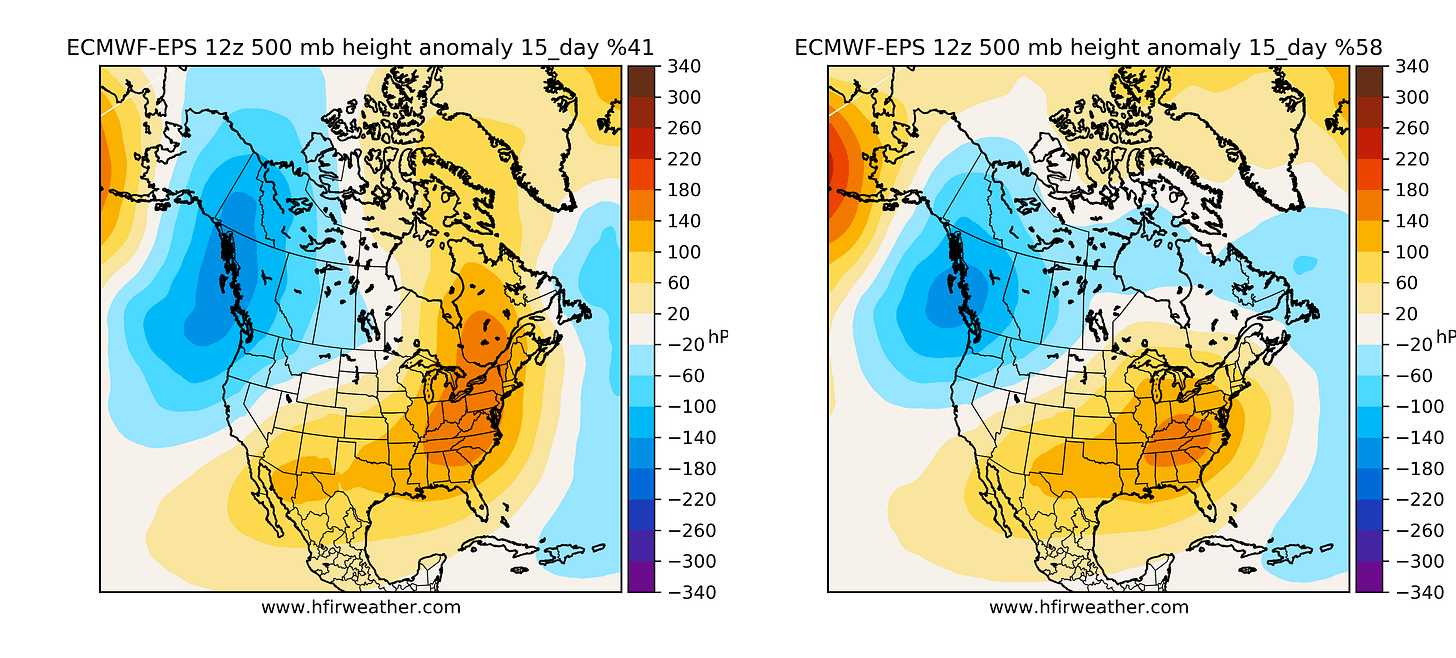

And the issue I’m still seeing with the weather pattern is that the 15-day cluster continues to show no Alaska ridge and a warmer-than-normal outlook in the East.

The market, rightfully so, has sold natural gas prices to a relatively depressed value, but the issue is that if this forecast persists, we could see Jan contracts test $4/MMBtu.

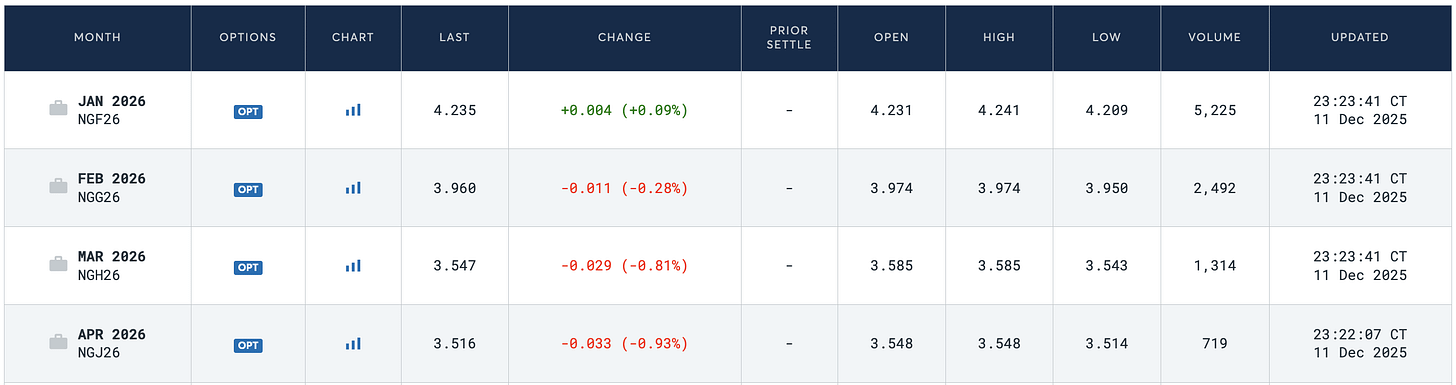

Source: CME

On a side note, for those of you who are looking or are already long BOIL, the 2x levered ETF is long March 2026 contracts. For the first time in a very long time, the bi-monthly contract roll actually worked out in BOIL’s favor. As January contracts surged while March contracts lagged (relatively speaking), BOIL started selling on Monday with the final repositioning taking place today. So anyone long BOIL is actually long March, which is trading at $3.547/MMBtu.

Given the steep backwardation in the natural gas price curve, if the bearish weather projections persist, January contracts will likely continue to pull back, while the forward curve has largely priced in the bearish weather.