The Natural Gas Market Is At A Major Turning Point

The natural gas market is finally turning the corner just as we approarch the start of winter. Lower 48 gas production, which has been a key factor on why prices are so low, is finally starting to turn the corner.

While the expectations are that Lower 48 gas production will grow a bit more from ~100 Bcf/d to ~102 Bcf/d by year-end, it's obvious by now that there won't be any meaningful growth over the winter of 2023/2024.

This is an important point to understand because it plays directly into gas balances.

If you look at total gas demand over the past year, we are structurally higher, but the growth trailed that of the supply growth. In essence, the moment the supply side stops growing, the natural gas market will quickly flip back into a deficit.

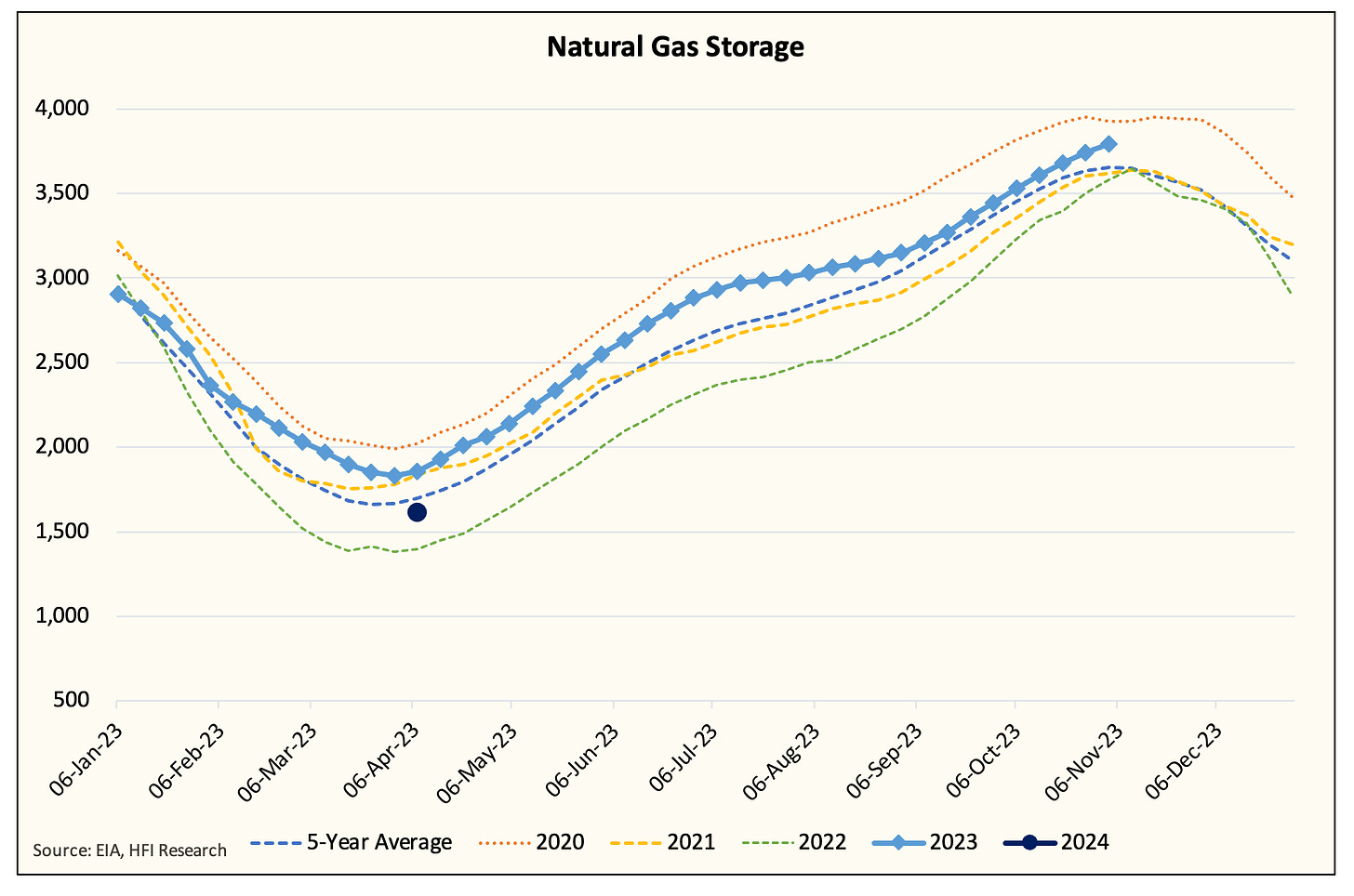

According to the latest ICE report for "end of draw index future", the market is currently expecting 1.475 Tcf for April 2024. This is lower than our estimate of 1.615 Tcf and lower than PointLogic's 1.8 Tcf.

At 1.475 Tcf, this would put US gas storage near the 5-year low. The last time storage was that low with no production growth on the horizon, we saw high single-digit natural gas prices. Could we see a return of that?