If I look at the US natural gas market from the 10,000-foot view, these are the most obvious things I see today:

Natural gas storage is exiting the injection season near ~4 Tcf. A storage surplus of ~230 Bcf will cushion some potential spikes in demand.

Europe’s natural gas storage is lower than the 5-year average, likely signaling strong LNG exports from the US.

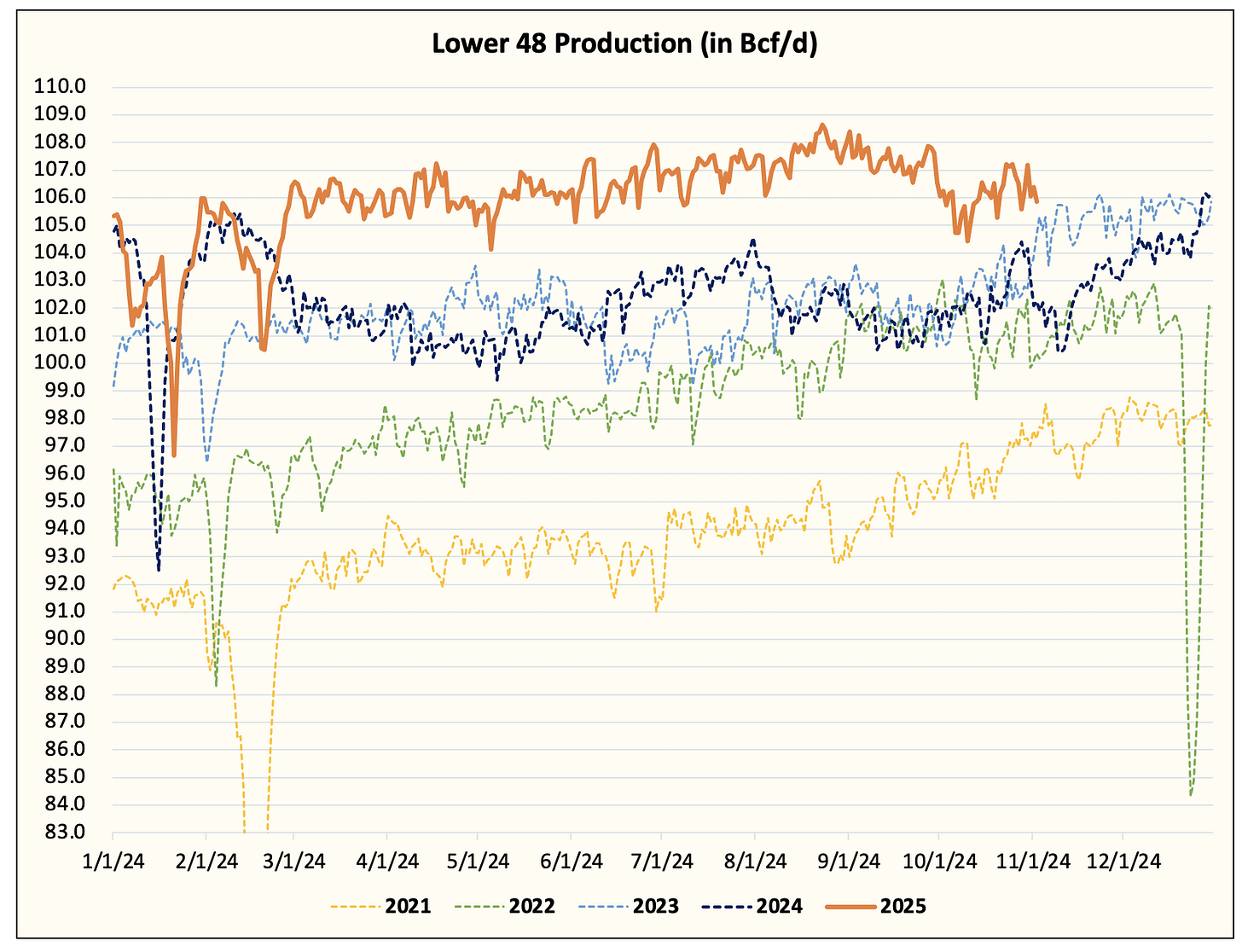

Strong LNG gas exports, coupled with lower-than-expected Lower 48 gas production, will create an imbalance in the market. If the weather cooperates, the incoming tightness will send natural gas prices higher than people expect.

From a fundamental standpoint, the small surplus in storage today should, in theory, be easily eliminated. But as we’ve seen time and time again, Mother Nature could wreak havoc making any bullish bet on natural gas subject to stomach-churning volatility. The best strategy, as we have proposed before, is to remain invested in low-cost producers that can take advantage of the inevitable natural gas price volatility.

An Interesting Setup

Four key fundamental variables will drive the natural gas narrative this winter:

Production

Storage

LNG

Weather

On the production side, we are seeing lower-than-expected natural gas production in Q4.