There's nothing like the natural gas market where you can round-trip 15% up and down in the matter of days. Sorry oil, you only do that when it's driven by geopolitics. Natural gas is the widowmaker for a reason and the recent turbulence was no different.

After exiting half of our existing long BOIL position exactly a week ago for a profit of ~27%, we re-entered today near the same cost basis.

So the sensible question would be to ask, what changed? What caused August contracts to enter escape velocity and hit our near-term target of $4.25/MMBtu before falling to $3.57/MMBtu again?

Well, the cash market remains weak. A lot of the natural gas traders are pointing to the dismal storage figures in Salt, which is creating the weakness we are seeing in the cash market. It traded an average of $3.25/MMBtu today versus the $3.4/MMBtu July contracts. And as the natural gas bears contend, when prompt contracts get close to expiration, and the cash market is weak, the futures get dragged down with it.

I understand this argument wholeheartedly, but you must remember that this June was a unique month. Why?

If you remember our net gas supply chart, we pointed to the pocket of weakness that took place in early June. This pushed injections to be higher than the 5-year average.

How much?

From the beginning of May to mid-June, natural gas storage saw an injection total of 747 Bcf. This is compared to the +561 Bcf last year and +604 Bcf for the 5-year average.

So yes, the market was materially oversupplied during that 7-week stretch, but that's all coming to an end now.

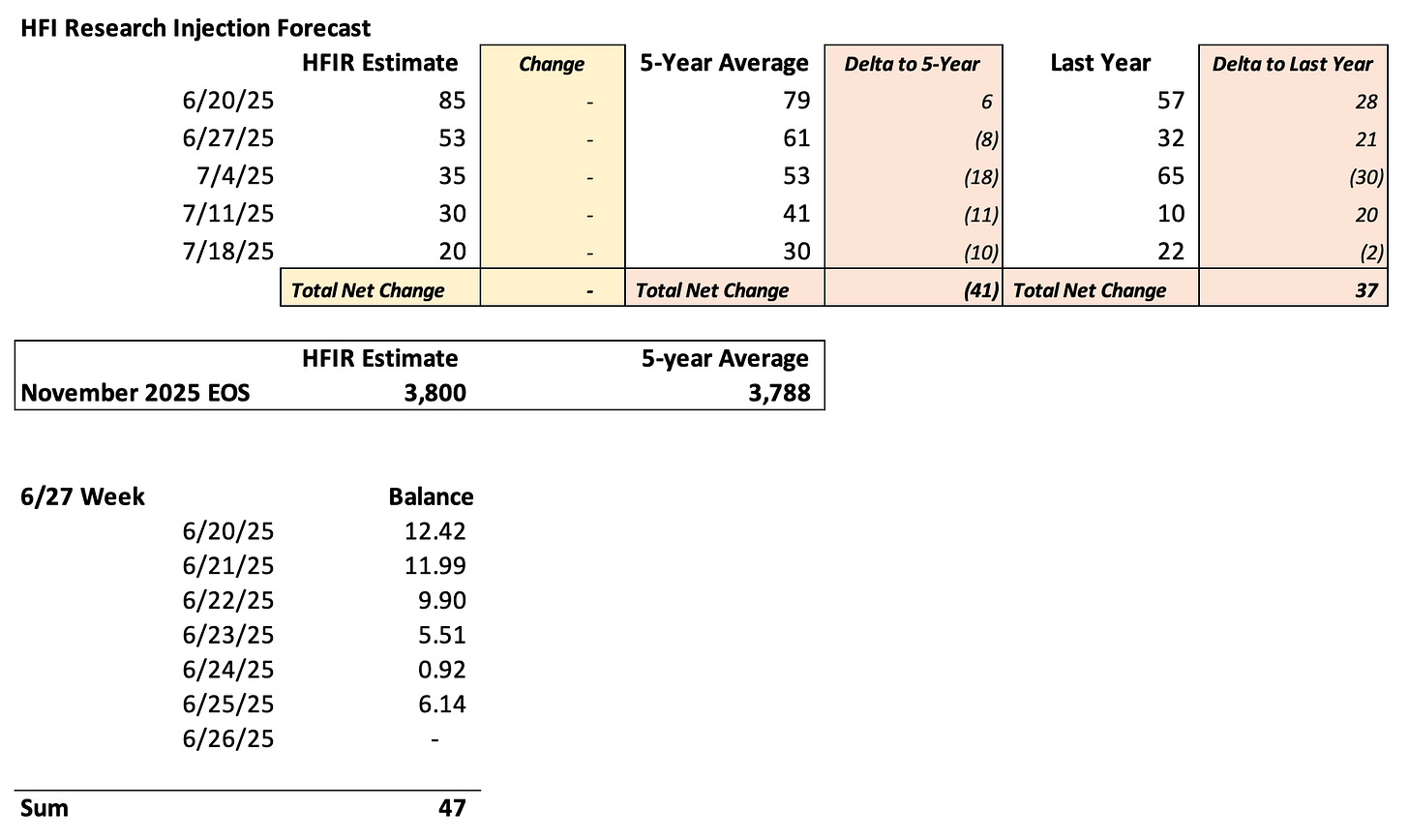

Looking at our storage injection estimates going forward, you can see that the injection total will be 41 Bcf below the 5-year average in the coming weeks. Now keep in mind that balances are probably going to be looser than last year because of lower production and hotter-than-normal weather, but we should see balances tighten going forward.

In addition, power burn demand is looking strong despite strong winds.