The Oil Market Doesn't Believe The OPEC+ Cut

In our WCTW last week, we talked about the surprise OPEC+ cut announcement. In it, we specifically talked about what is really going on with the existing production cut. The conclusion was that Russia is not cutting production at all, while the rest of OPEC+ is complying with the production cuts.

In our view, the additional OPEC+ cut comes down to Saudi, Iraq, UAE, and Kuwait. Everyone else is so marginal that it becomes an optic issue rather than something that impacts supply/demand.

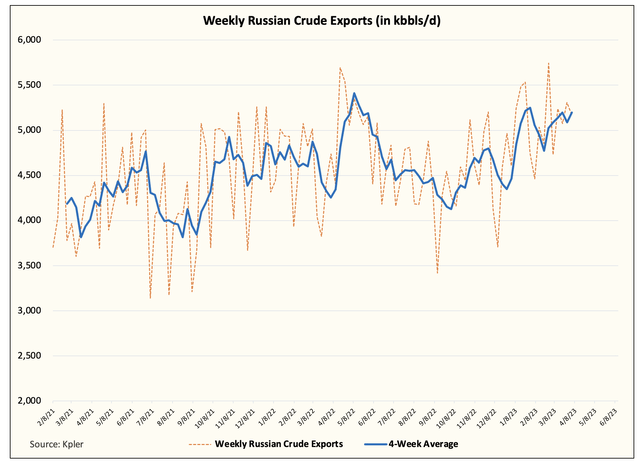

The bigger problem, however, is the assumption surrounding Russia. Despite announcing a voluntary ~500k b/d production cut in March, Russia has not reduced any production by our estimate. All we have to do is watch its seaborne crude exports and the answer is right in front of us.

This is why for some of you who are confused about why oil prices fail to rally further following the announcement, look no further than the chart above. The market simply does not believe this OPEC+ production cut. With Russian crude exports still averaging over ~5 million b/d, that's an increase of ~500k b/d pre-Ukraine invasion. This is in direct contrast to the decline we and the consensus had expected.