The Oil Market Is Going To Be Rangebound

The oil market is going to be rangebound. Two weeks ago, I had already shared my thoughts on where the oil market is headed. In the article, I wrote:

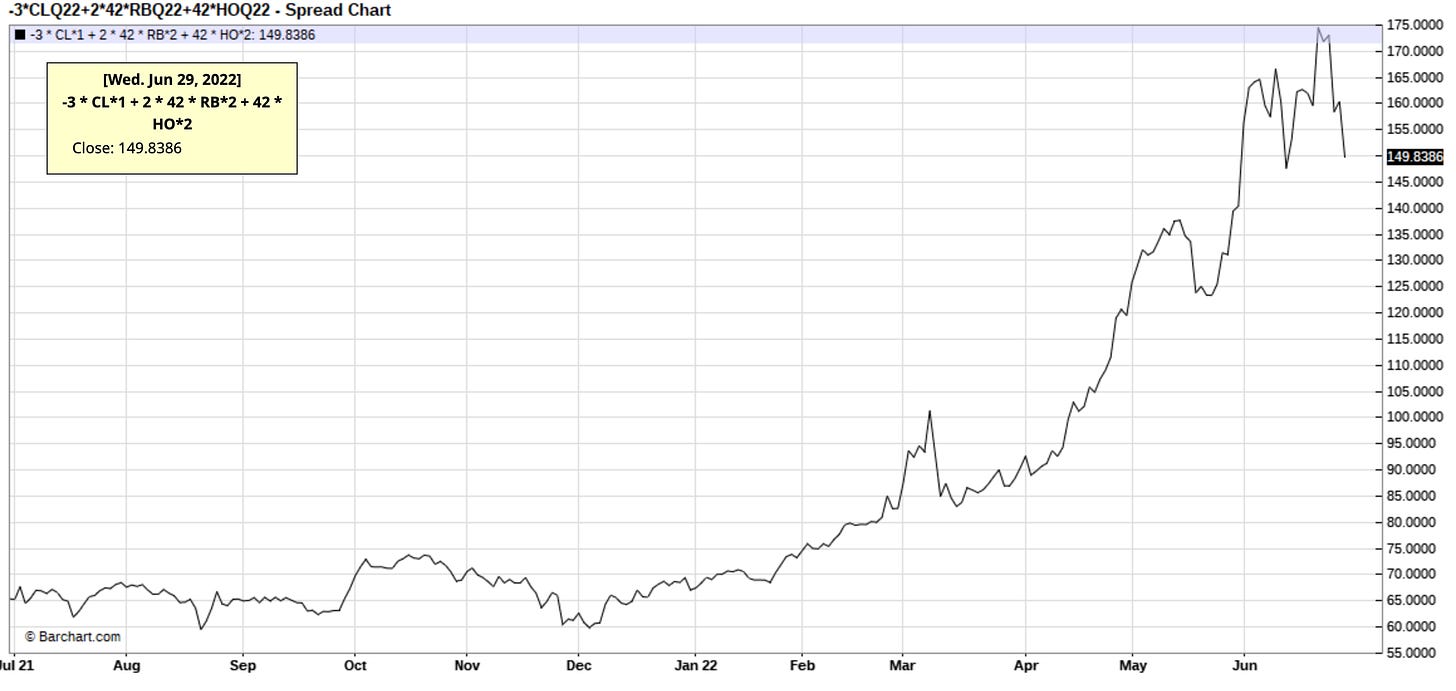

Looking ahead, my thinking is that refining margins will fall. Demand destruction is real and we are seeing some of that take hold now. With the ~5 million b/d of the expected increase in refinery throughput, I think refining margins fall back to $35/bbl or -$18/bbl from today. The end-user price assuming crude stays flat at $120 is then $155/bbl. This should give crude some room to rally. We could see as high as $135/bbl or $170 end-user price if demand holds up, but that's likely the top of the range.

All things considered, this is a great scenario to have for energy stocks. A price band between $115 to $135 is phenomenal for cash flow generation but for those of you long crude futures, the upside may be a bit limited going forward.

Rewinding back to March this year, the upside on the oil market was very evident. We had:

Potential Russian crude export loss (from self-sanctioning).

OECD oil demand was surprising to the upside thanks to gas-to-oil switching.

Global oil inventories drawing at ~2 million b/d or well above the pace we saw in Q1 2021.

The tailwind was clear and the argument for much higher oil prices was strong. But fast-forwarding to today, the arguments are much weaker for much higher oil prices.

US implied oil demand is now below 2021.

In addition, the key 3 components, gasoline, distillate, and jet fuel have turned down when they should be going up seasonally speaking.

US total liquids storage with SPR has started to bottom out versus the significant draws we saw in Q1.

US commercial crude storage is flat largely due to all the SPR being released. On the surface, the commercial crude storage is flat, but SPR is being used to fend off the decline. However, we must acknowledge that at least for the next few months, the SPR release will continue and commercial crude storage will likely be flat/build from here.

Russia has not shown any crude export losses versus pre-invasion levels.

Finally, refining margins are so elevated that end-users are already paying for $160+/bbl oil.

What's the takeaway?

The oil market has successfully tested the "upper bound" of where prices can go. Gauging by the demand indicators, we suspect that $170 to $180 end-user (crude + refining margin) is the level that causes serious demand slowdown. Now the market will want to test the lower bound of this range. Is this range around $140 to $150? We don't know, but with crude back to $110 and refining margins back to $50/bbl, we are currently sitting at $160/bbl.

If the data over the next few weeks continues to show demand disappointment, then the market will push it another notch lower. We will keep going back and forth until the market finds the level where demand starts to move higher.

There are, however, data points that suggest oil demand should rebound given the recent pullback. Gasbuddy data suggests US gasoline demand should be back to the highs for the year. EIA data has not reflected this yet as it's only representing the wholesale level. If the next few weeks show that gasoline demand is higher, we suspect the market will find this encouraging and push higher the "price band".

One thing needs to be cleared up, however. Even if we see some demand improvements over the next few weeks, we think the upper band will hold. If refining margins fall back to $35/bbl, then we could see a scenario where crude goes as high as $130 to $135. But again, we don't think it can go any higher than that.

What does this mean for energy stocks?

Fundamentally, this is the best scenario you can ask for. Energy companies will be able to enjoy a period of stable(ish) prices while not having to worry about "serious" demand destruction.

However, this does not mean energy stock prices will go up. We have already shared why we believe this summer is going to be a slow period.

As a result, readers should remain patient. If you are holding cash, wait for your favorite energy names to test and validate their technical support before adding. Given the macro and sentiment backdrop, being cautiously optimistic continues to be the best way forward.