The Oil Market Is Stuck Between A Rock And A Hard Place

Many market participants we follow describe the current oil market as either volatile or illiquid. One person noted yesterday that the thin trading is becoming more and more noticeable, especially compared to a year ago.

If you take a step back and compare the trading volume in WTI over the past 5 years, you will notice a pronounced downtrend in trading volume. In addition, if you take a look at the year-to-date trading volume, it has been in a downtrend since the Russia/Ukraine invasion. Margin requirement increase coupled with macro bearish headwinds are likely what's keeping traders on the sidelines, but the thin trading is somewhat of a concern.

While this is not the sole reason why oil has been more volatile than usual, it is a cause, and the thinly traded oil market exacerbates potential volatility to the upside as well as to the downside.

So what's going on with the oil market?

When we are assessing the oil market, there are too many variables to list in the mind at times, so it helps to write them out and then assess from there.

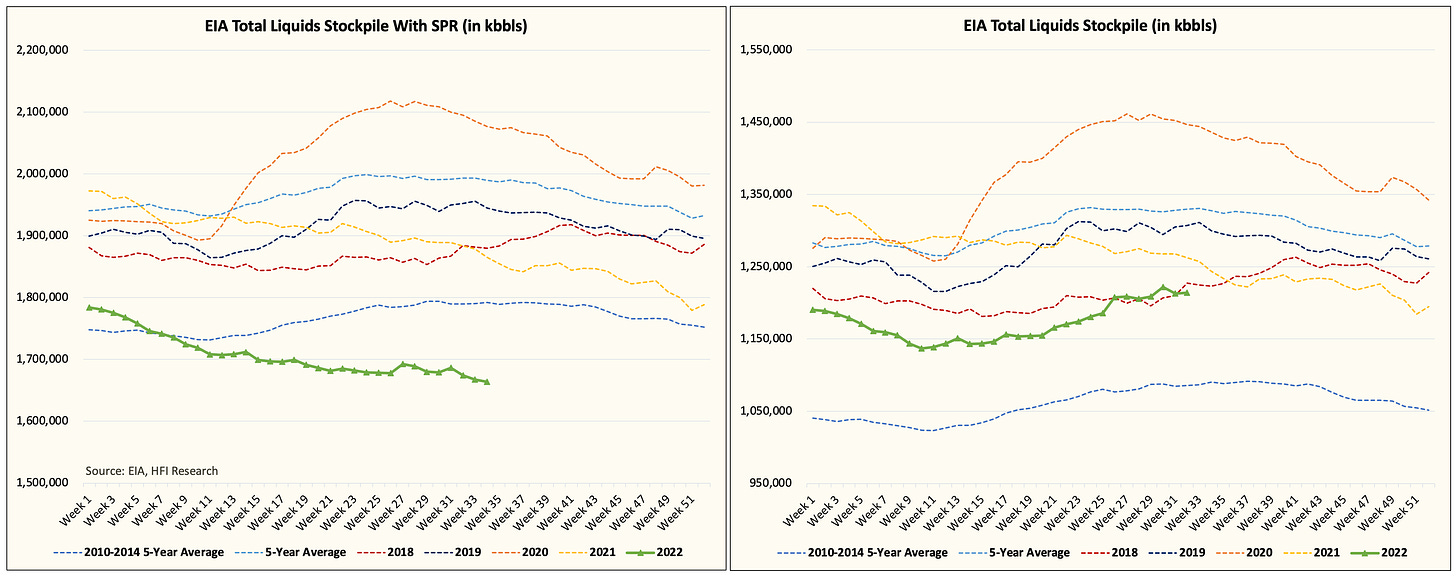

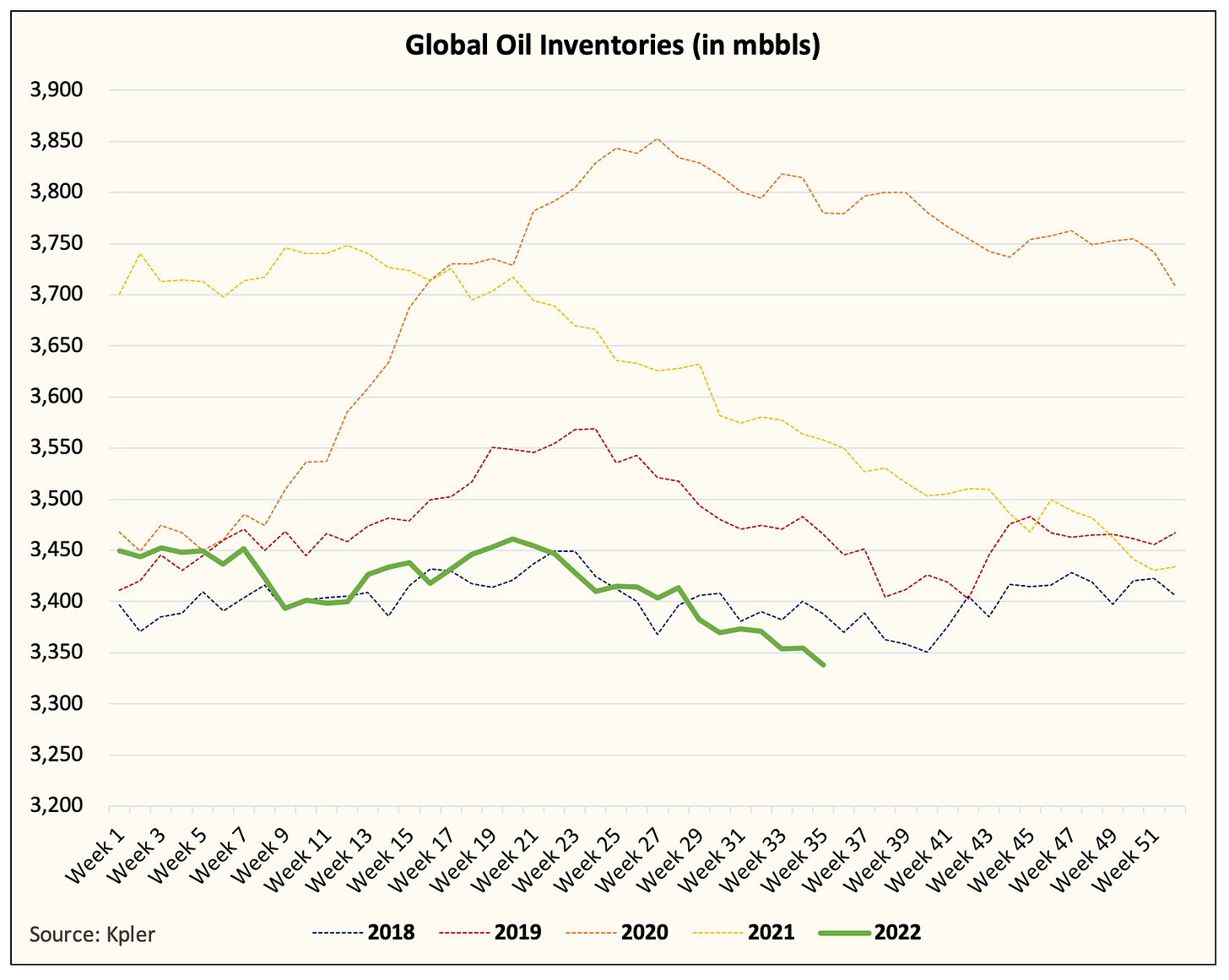

Global oil inventories are still trending lower. The global SPR release is currently keeping commercial storage flat to trending higher. It is important to understand that distinction.

This is a chart from Kpler on global onshore inventories.

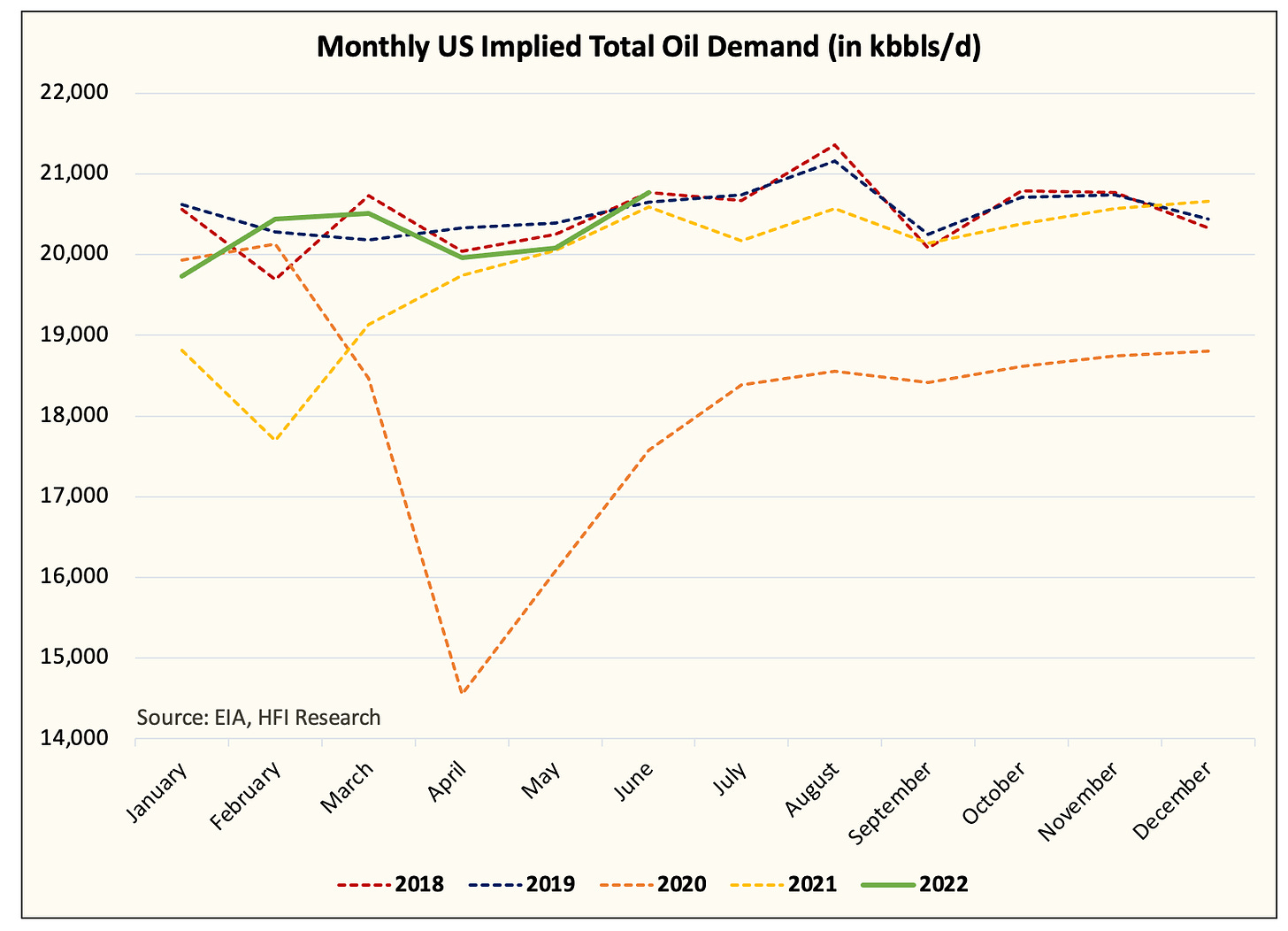

Global oil demand concerns are real, but even for those of us that are excessively worried, the data appears to suggest we are doing okay for the time being. We had the previous assumption that US oil demand was lower y-o-y by 5% due to increasing prices, but the EIA monthly data suggests we are at an all-time high for June.

Gasoline demand, however, is weaker y-o-y likely attributing to the demand weakness concerns. The market is not wrong in assuming potential demand weakness, but the magnitude of the assumption may be exaggerated.

The Iran deal continues to pose a headline risk with traders uncertain about both the timing of the deal and the possibility. When a market is on edge like the one we are seeing today, then you throw in illiquidity, and small herds of traders can materially drive prices up and down. And as it relates to Iran, if there's a group of traders that firmly believe Iran is coming back, then there is no way they would go long. Iran can increase crude exports by 1 to 1.4 million b/d, which would, in essence, replace the SPR release by year-end. The problem is the deal continues to look unlikely, which flies in the face of the recent oil price action.