I firmly believe that everything we will see in the oil market in the coming months will rely solely on this simple thesis: forcing the inevitable.

In a commodity market facing demand uncertainty, the market will react first; in this case, price will force the inevitable: lower supplies.

It won't matter if global oil inventories are drawing or flat.

It won't matter if demand is resilient.

What will ultimately matter for the market to change its tune is if it observes supplies moving lower. And in this case, it will want to see concrete evidence that US crude oil production is moving lower.

This is why I believe that even if global oil inventories trend lower in the coming weeks/months (our view), oil prices will remain subdued in order to keep supplies low. The market is going to force the inevitable, and given that supplies are going to be suppressed lower, the eventual rebound will be that much more cataclysmic.

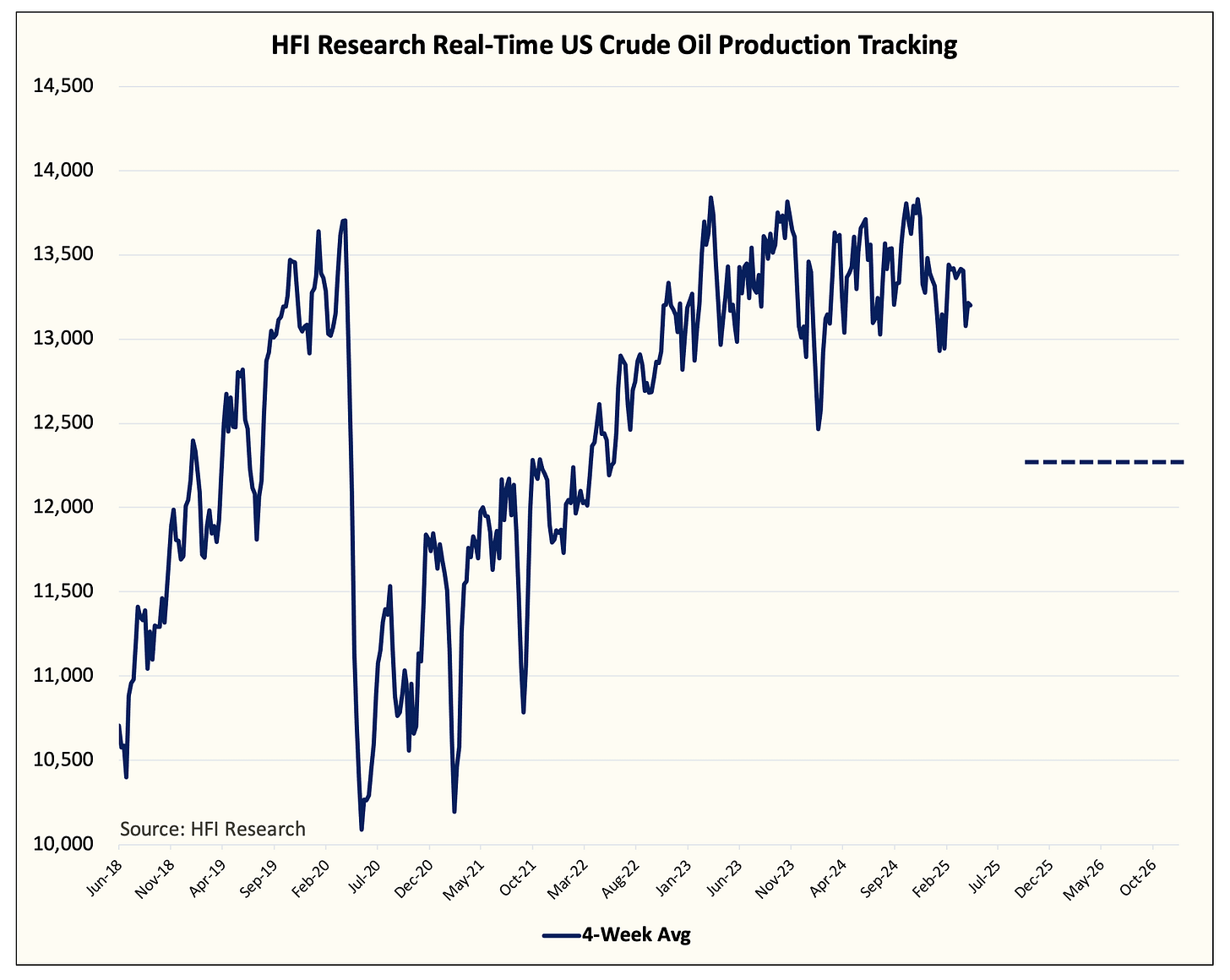

For readers who have paid close attention to our real-time US crude oil production reading, it should have been obvious to you that US shale was rolling over throughout 2024.

We've been hammering this point away for much of the past year, and EIA 914 today reaffirmed the low production estimate. With February production coming in at 13.159 million b/d versus January's 13.13 million b/d, the signs of exhaustion are becoming clear.