The Oil Structural Supply Deficit Thesis Is Underway

Today, I want to show you in charts why we are only in the 2nd inning of the structural oil bull market. The old investment adage, low prices cure low prices, is the foundation of why we stayed invested in energy through all the hard times. We've long said that with the reduction in global upstream capex spending, oil supplies will disappoint, and they will disappoint for years. With ESG now becoming mainstream and energy companies fearing the "demise of oil demand", more and more companies are shunning away from drilling and instead, returning capital back to shareholders.

Without further ado, let me present to you the structural oil bull market via a supply-driven deficit in charts.

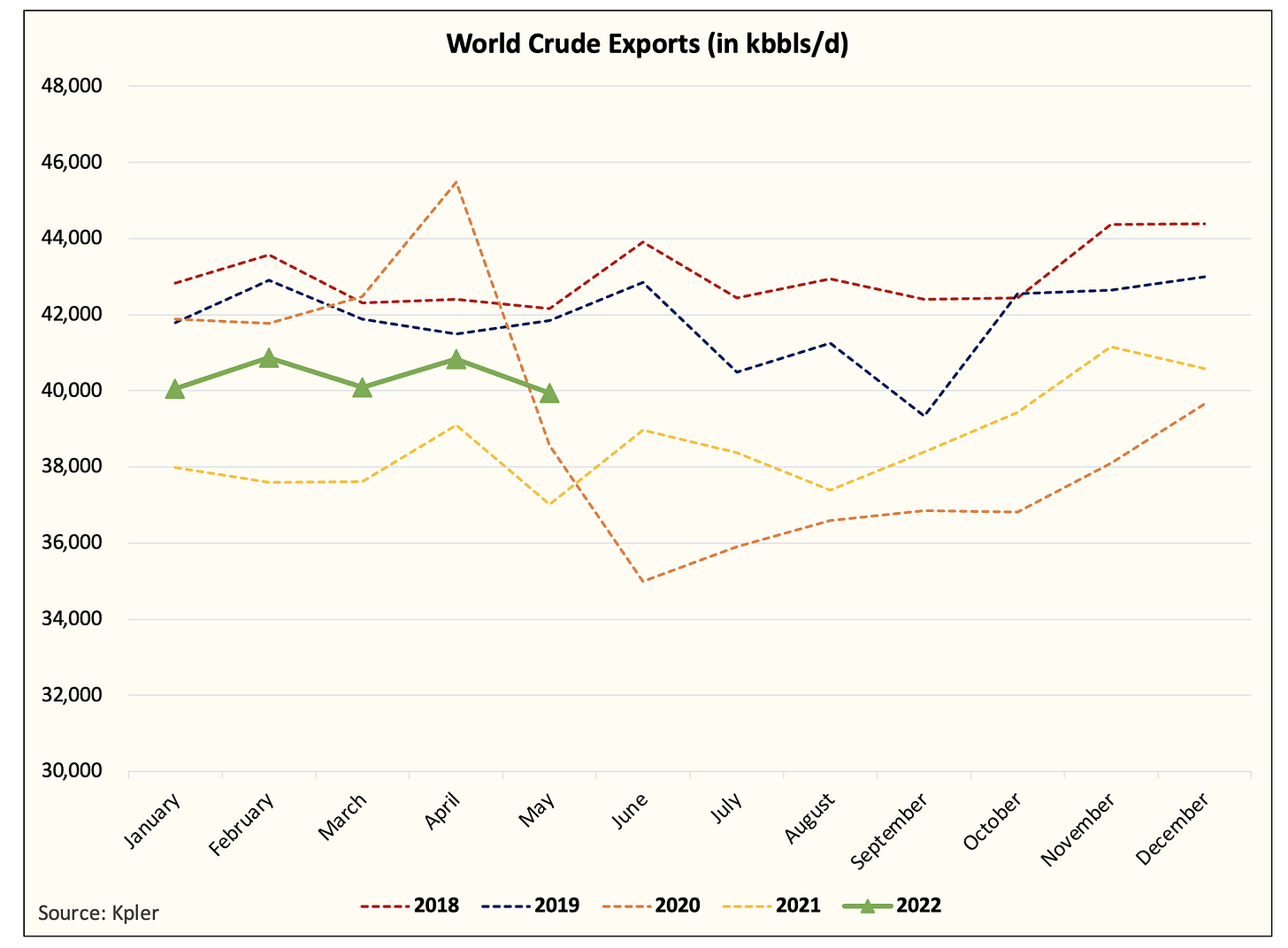

For starters, this is global crude exports.

As you can see, we are still ~2 million b/d below that of 2018. Now if you start to segment this out into OPEC+ and the rest of the world, this is what you will see:

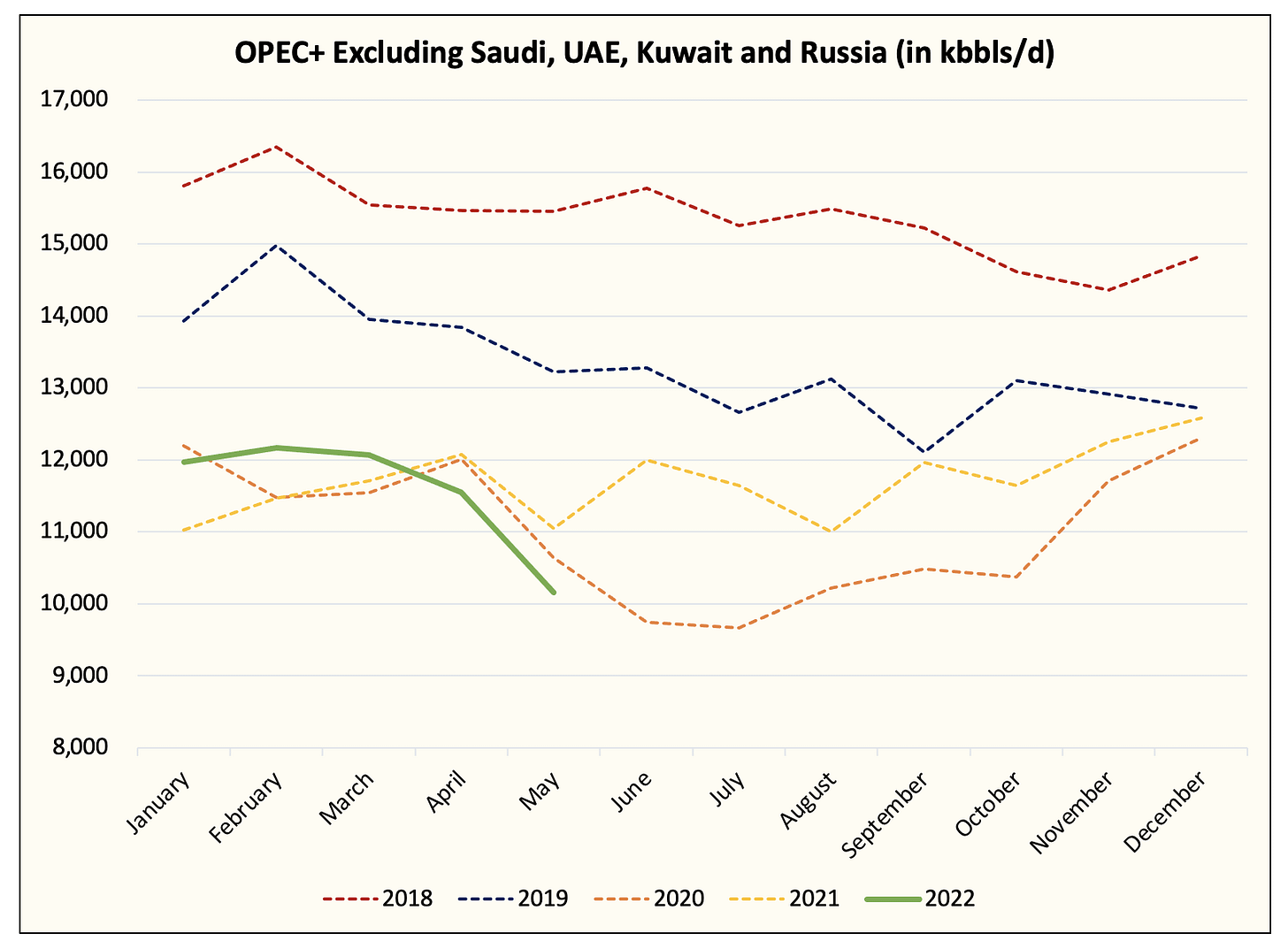

Now from an early glance, you will notice the two following observations:

OPEC+ is the one that's severely disappointing on the supply side.

Global crude exports outside of OPEC+ are back near the highs in recent years.

For those of you that have read our articles for a while, you will remember this pivotal piece we wrote back in 2017 titled, "Understanding History: Why Didn't Saudi Arabia Cut Oil Production In 2014?" If you have not read this article, I highly recommend you do so now. And if you read it, I recommend you revisit it for a refresher.

The key point of that article was that when the oil price war started in 2014, Saudis didn't care that much about US shale, it was the market share within OPEC that it cared about. It didn't want other producers within OPEC to benefit from the supply cut from the Saudis. In particular, this was aimed at Iraq and Iran.

Fast-forwarding to today, Saudi's oil price war back in 2014 is now having a full-blown effect on the rest of OPEC+.

If you break down OPEC+, this is what you will find:

Notice that the severe disappointment in crude exports is coming from the segment titled, "OPEC+ excluding Saudi, UAE, Kuwait, and Russia." This segment including Venezuela, Iraq, Iran, and others has materially disappointed to the downside. Years of underinvestment will continue to hamper their ability to produce and export, and as a result, a structural oil supply deficit is underway.

Irony

Commodity markets go through boom and bust cycles. And like the magic of cycles, history is destined to repeat itself. With years of underinvestment, we are seeing producers now underperform to the downside, and this disappointment is coming from within OPEC+. This is only the beginning. There is no magical cure for oil supplies. This is the key tailwind to the bull thesis and why we are only in the 2nd inning.

It's only just beginning.