The Physical Oil Market Is So Tight

Oil took a hit last week, but during the sell-off, we wrote a report titled, "Oil Price Sell-Off Won't Last Based On These Signals." In the article, we noted that both the 3-2-1 crack spread and Brent 1-2 timespread were moving higher despite the sell-off. We said:

As you can see in both charts above, despite the crude sell-off we are seeing now, both of the indicators we said to watch for carefully are actually performing well. This indicates to me two things:

The physical oil market tightness remains strong. High refining margin also indicates end-user demand, for now, is fine. Low refining capacity coupled with low product storage will likely keep refining margin elevated. However, we expect +5 million b/d of global refinery throughput in the next 2 months.

Despite the crude sell-off, timespreads are moving higher. This indicates to me physical demand for crude remains strong. As a result, the sell-off in crude appears to be pure financial positioning/hedging.

Since then, oil prices have rebounded nicely with the August contracts now trading at $110/bbl. And looking at all of the updated physical market signals below, the oil market is very tight despite worries over a recession.

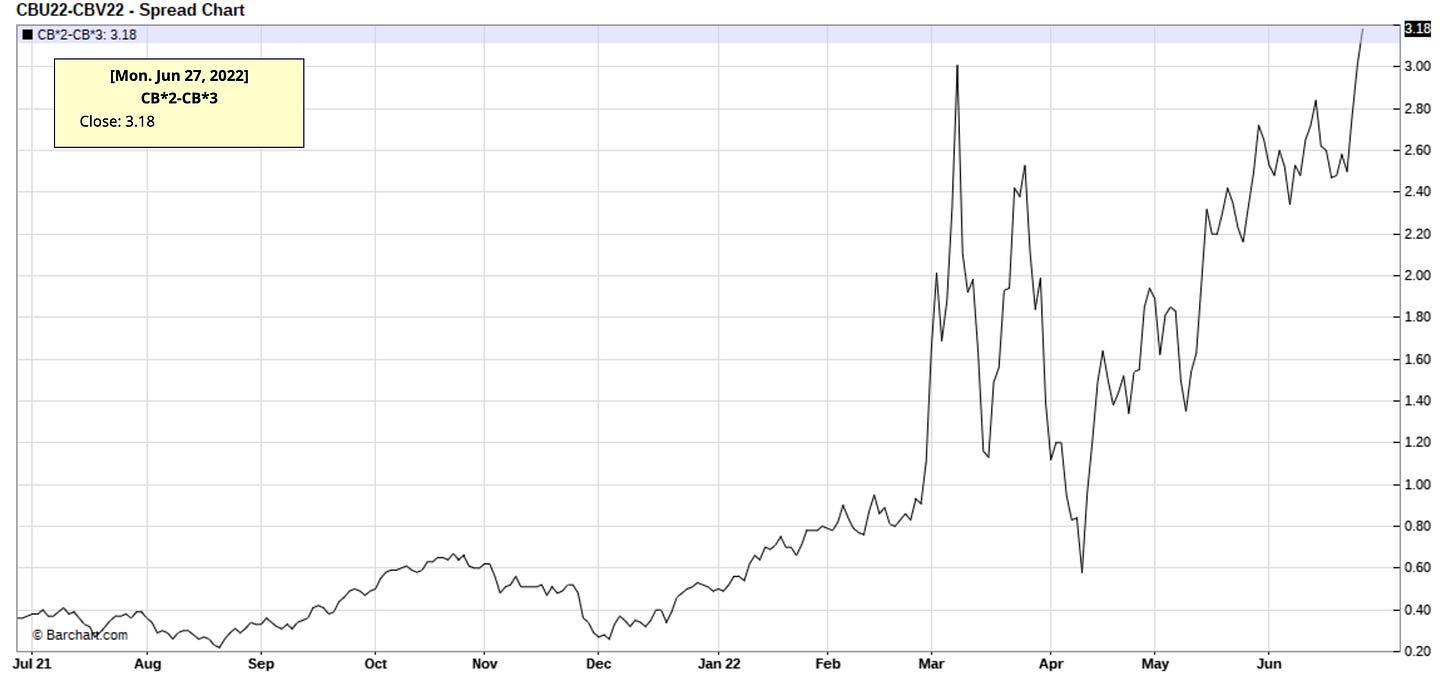

As you can see from the latest Brent 2-3 timespread (not using 1-2 because the front month is about to expire), we are moving higher still. In addition, you can see in the chart below that demand for West African crude grades remain extremely high.