The Rangebound Process Continues

As I wrote in a tweet earlier today, this was the first time in over a month that 1) Brent timespreads went up, 2) crack spreads went up, and 3) flat prices went up. Previously, every rally attempt has coincided with speculators short covering. We've seen time and time again where the physical market fails to catch up with the financial price move only to see prices fall back down. And the last rally came at the expense of refining margins, which proved once again to be unsustainable.

3-2-1 Crack Spread

Source: Barchart.com (The actual link to track this)

Note: Please divide the figure above by 3 to arrive at the 3-2-1 crack spread.

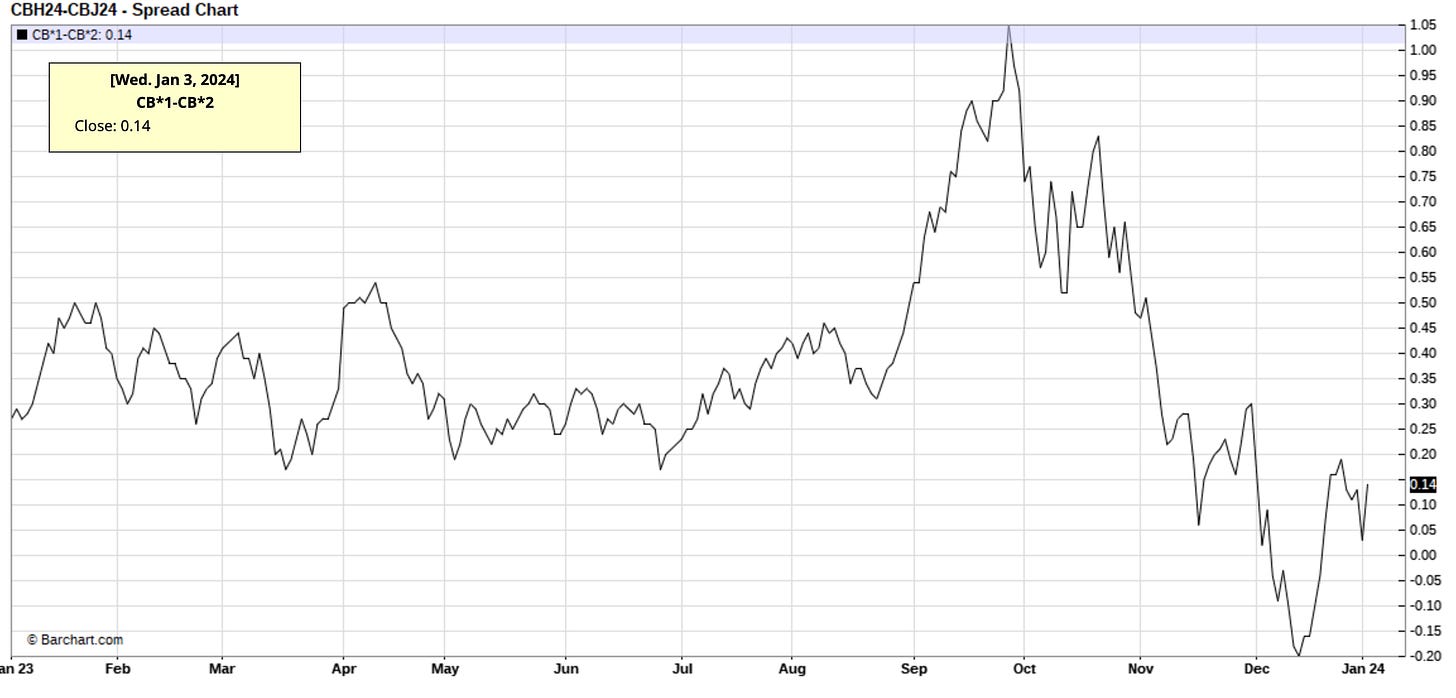

1-2 Brent Timespread

Source: Barchart.com (The actual link to track this)

To me, this is the first step to sustainably higher oil prices. Refining margins have to rally in tandem with flat prices, and backwardation needs to steepen. Without either of these things, any rally in crude will be short-lived as the sentiment remains firmly bearish.

For readers looking for signs of higher oil prices, these two indicators are one of the most straightforward to track, and historically, if timespreads and refining margins rallied in tandem, higher flat prices shortly follow.

For us to be certain that this is not just a gimmick and something of substance, we will need to see this price action continuing. If that is the case, there are important implications arising from this: